Sherritt International Corporation (TSX:S):

NOT FOR DISTRIBUTION TO UNITED STATES

NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Sherritt International Corporation (“Sherritt”)

(TSX:S) today announced the results of its modified Dutch auction

tender offer to purchase for cash its outstanding 8.0% Senior

Unsecured Debentures due 2021, 7.5% Senior Unsecured Debentures due

in 2023 and 7.875% Senior Unsecured Notes due in 2025

(collectively, the “Notes”). In accordance with the terms of the

Offers (collectively, the “Offers”), Sherritt has elected to

purchase an aggregate total of $121,223,000 principal amount of

Notes at an aggregate cost of $110,331,090 plus accrued

interest.

“The successful conclusion of our Dutch auction

completes the process that we commenced with our unit offering

principally aimed at de-leveraging and strengthening our balance

sheet,” said David Pathe, President and CEO of Sherritt

International. “Through this process, we have reduced the principal

amount outstanding of our Notes by more than 15%. This transaction

saves the Company approximately $10 million annually in interest

expense, and brings the total amount of indebtedness eliminated

from our balance sheet over the past four years to more than $2

billion.”

The following table sets out the Purchase

Price, together with the Clearing Price and Corresponding

Principal, for each series of Notes to be purchased under the

Offers.

Title of Security CUSIP

Purchase Price

ClearingPrice

CorrespondingPrincipal

Amount

Outstanding DebenturesAt

Closing

8.00% SeniorUnsecuredDebentures due

2021

823901AH6

$47,312,850

$950

$49,803,000

$170,197,000

7.50% SeniorUnsecuredDebentures due

2023

823901AK9

$39,286,380

$890

$44,142,000

$205,858,000

7.875% SeniorUnsecuredNotes due 2025

823901AL7

$23,731,860

$870

$27,278,000

$222,722,000 Totals

$110,331,090

N/A

$121,223,000

$598.777,000

The complete terms and conditions of the Offers

to purchase each series of Notes were set forth in the Offers to

Purchase dated January 16, 2018. All Notes validly tendered at or

below the Clearing Price will be accepted for purchase by Sherritt

subject to the conditions set forth in the Offer to Purchase.

Payment for Notes accepted for purchase will be made by Sherritt on

the settlement date, which is expected to be on or about February

16, 2018.

Following the settlement of the Offers, any

Notes that are purchased in the Offers will be retired and

cancelled and no longer remain outstanding. All Notes not accepted

for purchase by Sherritt will be returned to the Tendering Holder.

Following completion of the Offers, Sherritt will have an aggregate

total of $598,777,000 of Notes outstanding.

National Bank Financial Markets acted as dealer

manager for the Offers and Computershare Investor Services Inc. is

acting as depositary for the Offers.

This notice to the market does not represent an

offer to sell securities or a solicitation to buy securities in the

United States or in any other country.

About Sherritt

Sherritt is a world leader in the mining and

refining of nickel and cobalt from lateritic ores with projects and

operations in Canada, Cuba and Madagascar. The Corporation is

the largest independent energy producer in Cuba, with extensive oil

and power operations across the island. Sherritt licenses its

proprietary technologies and provides metallurgical services to

mining and refining operations worldwide. The Corporation’s common

shares are listed on the Toronto Stock Exchange under the symbol

“S”.

Forward-Looking Statements

This press release contains certain

forward-looking statements. Forward-looking statements can

generally be identified by the use of statements that include such

words as “believe”, “expect”, “anticipate”, “intend”, “plan”,

“forecast”, “likely”, “may”, “will”, “could”, “should”, “suspect”,

“outlook”, “projected”, “continue” or other similar words or

phrases.

Forward-looking statements are not based on

historic facts, but rather on current expectations, assumptions and

projections about future events, including matters relating to the

transaction disclosed herein. By their nature, forward-looking

statements require the Corporation to make assumptions and are

subject to inherent risks and uncertainties. There is significant

risk that predictions, forecasts, conclusions or projections will

not prove to be accurate, that those assumptions may not be correct

and that actual results may differ materially from such

predictions, forecasts, conclusions or projections.

The Corporation cautions readers of this press

release not to place undue reliance on any forward-looking

statement as a number of factors could cause actual future results,

conditions, actions or events to differ materially from the

targets, expectations, estimates or intentions expressed in the

forward-looking statements. These risks, uncertainties and other

factors include, but are not limited to the risks and uncertainties

set out in the Management’s Discussion & Analysis of the

Corporation for the period ending December 31, 2017 and the

Corporation’s Prospectus Supplement dated January 17, 2018, each of

which are available on SEDAR at www.sedar.com. Readers are

cautioned that the foregoing list of factors is not exhaustive and

should be considered in conjunction with the risk factors described

in this press release and in the Corporation’s other documents

filed with the Canadian securities authorities.

The Corporation may, from time to time, make

oral forward-looking statements. The Corporation advises that the

above paragraph and the risk factors described in this press

release and in the Corporation’s other documents filed with the

Canadian securities authorities should be read for a description of

certain factors that could cause the actual results of the

Corporation to differ materially from those in the oral

forward-looking statements. The forward-looking information and

statements contained in this press release are made as of the date

hereof and the Corporation undertakes no obligation to update

publicly or revise any oral or written forward-looking information

or statements, whether as a result of new information, future

events or otherwise, except as required by applicable securities

laws. The forward-looking information and statements contained

herein are expressly qualified in their entirety by this cautionary

statement.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180214005506/en/

Sherritt International CorporationJoe Racanelli,

416-935-2457Director of Investor RelationsToll-Free:

1-800-704-6698investor@sherritt.comwww.sherritt.com

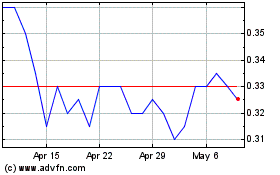

Sherritt (TSX:S)

Historical Stock Chart

From Oct 2024 to Nov 2024

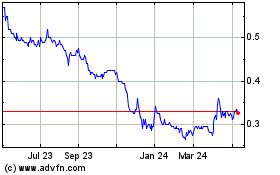

Sherritt (TSX:S)

Historical Stock Chart

From Nov 2023 to Nov 2024