Facebook, Alphabet, Tesla: Stocks That Defined the Week

January 08 2021 - 7:43PM

Dow Jones News

By Francesca Fontana

Facebook, Alphabet, Tesla: Stocks That Defined the Week

Facebook Inc.

Facebook is putting its foot down. On Thursday, the social-media

giant banned President Trump from its platforms indefinitely in the

wake of Wednesday's attack on the U.S. Capitol by a pro-Trump mob.

Facebook and Twitter Inc. initially removed posts by the president

Wednesday and temporarily locked the accounts that had helped

propel him to power, citing the risk of violence. Facebook shares

rose 2.1% Thursday.

Slack Technologies Inc.

Slack had a tense start to the New Year. The workplace messaging

platform suffered a widespread service disruption for several hours

on Monday, as many employees returned to work for their first full

workday of the year. The company said customers experienced

problems loading channels and connecting to Slack, a service that

many employees depend upon while working from home during the

pandemic. On Dec. 14, more than a dozen of Alphabet Inc.'s Google

services, including its popular email client Gmail and YouTube,

also suffered disruptions, causing issues for workers. Slack shares

fell 0.6% Monday.

Alphabet Inc.

Organized labor now has a beachhead in Silicon Valley. In a rare

move inside America's tech epicenter, a group of employees at

Google parent Alphabet announced Monday that they had formed the

Alphabet Workers Union. The union, which will be affiliated with

Communications Workers of America Local 1400, is the first one open

to employees and contractors at any Alphabet company. Around 200

workers are backing the union, a small fraction of the tech

company's more than 132,000 employees. Members said the union's

immediate goal isn't collective bargaining or formal recognition by

Alphabet, but to allow employees to be able to speak out about the

company without facing career repercussions. Alphabet shares fell

1.4% Monday.

Tesla Inc.

Meet the new richest person in the world: Elon Musk. In claiming

the title this past week, the Tesla chief executive overtook

Amazon.com Inc. leader Jeff Bezos, thanks to a meteoric rise in the

value of the electric-car maker. His net worth totaled around $195

billion Thursday, up from roughly $30 billion a year ago and

exceeding Mr. Bezos' wealth by about $10 billion, according to the

Bloomberg Billionaires Index. Both men have seen the shares in

their companies rise sharply during the pandemic, even as the

global economy took a hit. The value of Tesla's shares added 7.9%

Thursday, enough for Mr. Musk to overtake Mr. Bezos in the wealth

ranking.

Walgreens Boots Alliance Inc.

Covid-19 fears didn't stop Walgreens customers from getting

their prescriptions near the end of 2020. The drugstore chain on

Thursday reported stronger-than-expected pharmaceutical sales in

the quarter ended Nov. 30, even as the pandemic continued to make

some consumers hesitant to visit its stores. Pharmacy foot traffic

is down as Covid-19 precautions keep seasonal flu cases down and

people skip routine medical care and in-person shopping. Walgreens

expects any gains it generates from providing Covid-19 vaccinations

to likely be offset by the effects of pandemic-related lockdowns

and restrictions. The company's quarterly results also came a day

after Walgreens agreed to sell most of its pharmacy wholesale unit

for $6.5 billion. Walgreens shares rose 5.2% Thursday.

Bed Bath & Beyond Inc.

Bed Bath & Beyond's housecleaning efforts aren't yet enough

to make it shine during the pandemic. On Thursday, the home-goods

retailer reported a drop in revenue in the most recent quarter

compared with the year-earlier period. The retailer attributed the

decline in part to permanent store closures and divestitures of

some of its brands, all part of the company's reorganization that

the pandemic accelerated. Also part of the plan is a greater

emphasis on digital sales, which surged during the quarter as

customers continue to shop from home to prevent the spread of

Covid-19. Bed Bath & Beyond shares dropped 10% Thursday.

Shopify Inc.

Looking for TrumpStore.com? You'll get an error message. Online

stores run by the Trump Organization and Trump campaign were taken

offline on Thursday by the Canadian e-commerce company Shopify

after Wednesday's riot at the U.S. Capitol. The company said that

it terminated stores affiliated with President Trump because his

comments on Wednesday violated the company's policy, which

prohibits retailers on the platform from promoting or supporting

organizations or people that promote violence. The sites sold

official Trump branded apparel, "Make America Great Again" hats and

other merchandise. Shopify shares gained 6.6% Thursday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

January 08, 2021 20:28 ET (01:28 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

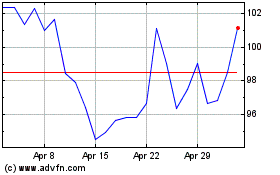

Shopify (TSX:SHOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shopify (TSX:SHOP)

Historical Stock Chart

From Apr 2023 to Apr 2024