Sprott Inc. (TSX: SII) (“Sprott” or the “Company”) today announced

its financial results for the year ended December 31, 2019.

Financial Overview (12 months

results)

- Assets Under Management (“AUM”)

were $12.1 billion as at December 31, 2019, up $1.5 billion (14%)

from December 31, 2018

- Total net revenues (net of

commission expenses, trailer fees and sub-advisor fees, carried

interest and performance fee payouts) were $84 million, reflecting

a decrease of $12.7 million (13%) from the year ended December 31,

2018. Last year's net revenues contained $4.2 million of proceeds

from the sale of our non-core diversified assets

- Total expenses (excluding

commission expenses, trailer fees and sub-advisor fees, carried

interest and performance fee payouts) were $66.8 million,

reflecting an increase of $2.8 million (4%) from the year ended

December 31, 2018

- Net income was $13.5 million ($0.06

per share), reflecting a decrease of $17.8 million from the year

ended December 31, 2018. Last year's net income contained $4.2

million of proceeds from the sale of our non-core diversified

assets

- Adjusted base EBITDA was $38.5

million ($0.16 per share), a decrease of $2 million (5%) from the

year ended December 31, 2018

Significant Events:

- As of February 27, 2020, Sprott's

AUM increased to approximately $15.4 billion due to the acquisition

of Tocqueville Asset Management's gold strategies, stronger

precious metal prices and inflows into the company's

Exchange-Listed Products and Lending funds

- The Company renewed its Normal

Course Issuer Bid on November 15, 2019 and as of December 31, 2019,

had repurchased 740,600 shares for cancellation

"In 2019, stronger precious metals prices

contributed to Sprott’s Assets Under Management (“AUM”) increasing

by 14% to $12.1 billion," said Peter Grosskopf, CEO of Sprott.

"This momentum has carried through into the early months of 2020

and our AUM has now surpassed $15 billion, a new high for the

Company. This growth has been driven by a number of factors,

including the acquisition of the Tocqueville gold strategies,

inflows into our physical trusts and lending strategies, as well as

continued strong performance from gold, silver and their related

equities. With a global platform, an industry-leading investment

team, and the ability to offer clients access to the full spectrum

of precious metal investment strategies, Sprott is well positioned

to benefit from a new uptrend in the sector."

Assets Under Management (12 months

results)

|

(In millions $) |

AUM Dec. 31, 2018 |

Net Inflows (1) |

MarketValueChanges |

Other (2) |

AUMDec. 31, 2019 |

| Exchange Listed

Products |

|

|

|

|

|

|

|

|

|

| - Physical Trusts |

7,927 |

(177) |

842 |

— |

8,592 |

|

| - ETFs |

237 |

11 |

82 |

— |

330 |

|

|

|

8,164 |

(166) |

924 |

— |

8,922 |

|

| |

|

|

|

|

|

|

|

|

|

| Lending |

498 |

858 |

(55) |

(282) |

1,019 |

(3) |

| |

|

|

|

|

|

|

|

|

|

| Managed

Equities |

|

|

|

|

|

|

|

|

|

| - In-house |

538 |

66 |

52 |

— |

656 |

|

| - Sub-advised |

505 |

3 |

79 |

— |

587 |

|

|

|

1,043 |

69 |

131 |

— |

1,243 |

|

| |

|

|

|

|

|

|

|

|

|

| Other |

873 |

68 |

(43) |

— |

898 |

|

| |

|

|

|

|

|

|

|

|

|

|

Total |

10,578 |

829 |

957 |

(282) |

12,082 |

|

(1) See 'Net Inflows' in the key performance indicators

(non-IFRS financial measures) section of the MD&A

(2) Includes new AUM from fund acquisitions and lost AUM

from fund divestitures and capital distributions of our lending

LPs.

(3) $1.7 billion (US$1.3 billion) of committed capital

remains uncalled, of which $697 million (US$536 million) earns a

commitment fee (AUM), and $980 million (US$754 million) does not

(future AUM).

DividendsOn February 27, 2020, a dividend of

$0.03 per common share was declared for the quarter ended

December 31, 2019.

Conference Call and WebcastA

conference call and webcast will be held today, February 28, 2020

at 10:00 am ET to discuss the Company's financial results. To

participate in the call, please dial (855) 458-4215 ten minutes

prior to the scheduled start of the call and provide conference

ID8819354. A taped replay of the conference call will be

available until Friday, March 6, 2020 by calling (855) 859-2056,

reference number 8819354. The conference call will be webcast live

at www.sprott.com and

https://edge.media-server.com/mmc/p/hwjy6zyh

*Non-IFRS Financial Measures

This press release includes financial terms

(including AUM, investable capital, net revenues, expenses,

adjusted base EBITDA and net sales) that the Company utilizes to

assess the financial performance of its business that are not

measures recognized under International Financial Reporting

Standards (“IFRS”). These non-IFRS measures should not be

considered alternatives to performance measures determined in

accordance with IFRS and may not be comparable to similar measures

presented by other issuers. For additional information regarding

the Company's use of non-IFRS measures, including the calculation

of these measures, please refer to the “Non-IFRS Financial

Measures” section of the Company's Management's Discussion and

Analysis and its annual financial statements available on the

Company's website at www.sprottinc.com and on SEDAR at

www.sedar.com.

A reconciliation from net income to adjusted

base EBITDA is shown below:

|

|

12 months ended |

| (in

thousands $) |

Dec. 31, 2019 |

Dec. 31, 2018 |

| |

|

|

| Net income (loss) for

the periods |

13,532 |

|

31,379 |

|

| Adjustments: |

|

|

|

Interest expense |

1,373 |

|

419 |

|

|

Provision (recovery) for income taxes |

3,619 |

|

1,278 |

|

|

Depreciation and amortization |

5,033 |

|

2,199 |

|

| EBITDA |

23,557 |

|

35,275 |

|

| |

|

|

| Other adjustments: |

|

|

|

(Gains) losses on net investments (1) |

1,401 |

|

5,782 |

|

|

(Gains) losses on foreign exchange |

1,960 |

|

(2,310 |

) |

|

Non-cash stock-based compensation |

5,120 |

|

5,199 |

|

|

Net proceeds from sale transaction |

— |

|

(4,200 |

) |

|

Unamortized placement fees (2) |

— |

|

(1,093 |

) |

|

Other expenses(3) |

7,509 |

|

2,746 |

|

| Adjusted

EBITDA |

39,547 |

|

41,399 |

|

| |

|

|

| Other adjustments: |

|

|

|

Carried interest and performance fees |

(2,391 |

) |

(1,802 |

) |

|

Carried interest and performance fee related expenses |

1,310 |

|

915 |

|

|

Adjusted base EBITDA |

38,466 |

|

40,512 |

|

(1) This adjustment removes the income effects

of certain gains or losses on proprietary and long-term investments

to ensure the reporting objectives of our EBITDA metric are

met.

(2) The prior period comparative figures

contained a placement fee amortization adjustment to ensure the

2018 results were comparable to 2017 in light of the 2018 adoption

of IFRS 15

(3) See Other expenses in Note 7 of the annual

financial statements. In addition to the items outlined in Note 7,

Other expenses also includes severance and new hire accruals of

$1.4 million for the 12 months ended (12 months ended December 31,

2018 - $0.5 million)

Forward Looking

StatementsCertain statements in this press release contain

forward-looking information (collectively referred to herein as the

"Forward-Looking Statements") within the meaning of applicable

securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" and similar expressions are

intended to identify Forward-Looking Statements. In particular, but

without limiting the forgoing, this press release contains

Forward-Looking Statements pertaining to: (i) market outlook and

future metal prices; (ii) Sprott’s positioning to benefit from a

new uptrend in gold, silver and related equities; (iii) future

purchases by Sprott of the Shares pursuant to the normal course

issuer bid; and (iv) the declaration, payment and designation of

dividends.

Although the Company believes that the

Forward-Looking Statements are reasonable, they are not guarantees

of future results, performance or achievements. A number of factors

or assumptions have been used to develop the Forward-Looking

Statements, including, without limitation: (i) the impact of

increasing competition in each business in which the Company

operates will not be material; (ii) quality management will be

available; (iii) the effects of regulation and tax laws of

governmental agencies will be consistent with the current

environment; and (iv) those assumptions disclosed under the heading

"Significant Accounting Judgments, Estimates and Changes in

Accounting Policies" in the Company’s MD&A for the period ended

December 31, 2019. Actual results, performance or achievements

could vary materially from those expressed or implied by the

Forward-Looking Statements should assumptions underlying the

Forward-Looking Statements prove incorrect or should one or more

risks or other factors materialize, including: (i) difficult market

conditions; (ii) poor investment performance; (iii) failure to

continue to retain and attract quality staff; (iv) employee errors

or misconduct resulting in regulatory sanctions or reputational

harm; (v) performance fee fluctuations; (vi) a business segment or

another counterparty failing to pay its financial obligation; (vii)

failure of the Company to meet its demand for cash or fund

obligations as they come due; (viii) changes in the investment

management industry; (ix) failure to implement effective

information security policies, procedures and capabilities; (x)

lack of investment opportunities; (xi) risks related to regulatory

compliance; (xii) failure to manage risks appropriately; (xiii)

failure to deal appropriately with conflicts of interest; (xiv)

competitive pressures; (xv) corporate growth which may be difficult

to sustain and may place significant demands on existing

administrative, operational and financial resources; (xvi) failure

to comply with privacy laws; (xvii) failure to successfully

implement succession planning; (xviii) foreign exchange risk

relating to the relative value of the U.S. dollar; (xix) litigation

risk; (xx) failure to develop effective business resiliency plans;

(xxi) failure to obtain or maintain sufficient insurance coverage

on favourable economic terms; (xxii) historical financial

information being not necessarily indicative of future performance;

(xxiii) the market price of common shares of the Company may

fluctuate widely and rapidly; (xxiv) risks relating to the

Company’s investment products; (xxv) risks relating to the

Company's proprietary investments; (xxvi) risks relating to the

Company's lending business; (xxvii) risks relating to the Company’s

merchant bank and advisory business; (xxviii) those risks described

under the heading "Risk Factors" in the Company’s annual

information form dated February 27, 2020; and (xxix) those risks

described under the headings "Managing Risk: Financial" and

"Managing Risk: Non-Financial" in the Company’s MD&A for the

period ended December 31, 2019. In addition, the payment of

dividends is not guaranteed and the amount and timing of any

dividends payable by the Company will be at the discretion of the

Board of Directors of the Company and will be established on the

basis of the Company’s earnings, the satisfaction of solvency tests

imposed by applicable corporate law for the declaration and payment

of dividends, and other relevant factors. The Forward-Looking

Statements speak only as of the date hereof, unless otherwise

specifically noted, and the Company does not assume any obligation

to publicly update any Forward-Looking Statements, whether as a

result of new information, future events or otherwise, except as

may be expressly required by applicable Canadian securities

laws.

About SprottSprott is an

alternative asset manager and a global leader in precious metal and

real asset investments. Through its subsidiaries in Canada, the US

and Asia, Sprott is dedicated to providing investors with

specialized investment strategies that include Exchange Listed

Products, Lending, Managed Equities and Brokerage. Sprott’s common

shares are listed on the Toronto Stock Exchange under the symbol

(TSX:SII). For more information, please

visit www.sprott.com.

Investor contact

information:Glen WilliamsManaging DirectorInvestor

Relations and Corporate Communications(416)

943-4394gwilliams@sprott.com

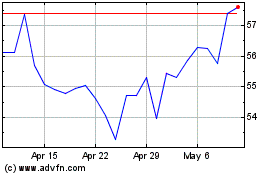

Sprott (TSX:SII)

Historical Stock Chart

From Mar 2024 to Apr 2024

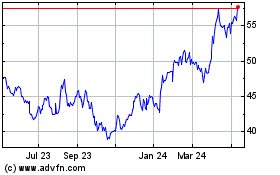

Sprott (TSX:SII)

Historical Stock Chart

From Apr 2023 to Apr 2024