TransAlta Achieves Commercial Operation of 200 MW Horizon Hill Wind Facility, increasing its United States Renewables Fleet to over 1 GW

May 21 2024 - 3:22PM

TransAlta Corporation (“TransAlta” or the “Company”) (TSX: TA)

(NYSE: TAC) announced today that the 200 MW Horizon Hill Wind

Project ("Horizon Hill"), located in Logan County, Oklahoma, has

achieved commercial operation. The facility is fully contracted to

Meta Platforms Inc. ("Meta"), which is receiving both clean

electricity and environmental attributes from the new facility.

“Since 2020, Meta has supported its global

operations with 100 per cent wind and solar energy. As our

footprint grows, it’s key that we find strong partners who can help

us continue to meet that goal by bringing new renewable energy to

the grid,” said Urvi Parekh, head of renewable energy at Meta. “We

are excited to partner with TransAlta to help power our operations

with clean electricity.”

“We are pleased to bring our 30th wind facility,

Horizon Hill, into service. The completion of the facility also

concludes the significant construction program we started in 2021

through which we have added 800 MW of contracted renewable

electricity to our portfolio. With the completion of Horizon Hill,

over 60 per cent of our fleet is now contracted on a megawatt

basis," said Mr. John Kousinioris, President and Chief Executive

Officer of TransAlta. "Horizon Hill also brings our US renewables

fleet to over one GW, another key milestone for TransAlta, and

provides a clean energy solution to a leading corporate energy

customer.”

On Feb. 22, 2024, the Company entered into a

10-year transfer agreement with an AA- rated customer for the sale

of approximately 80 per cent of the expected production tax credits

("PTCs") to be generated from Horizon Hill. The remaining PTCs are

expected to be sold through spot transactions or contracted at a

later date.

Horizon Hill Highlights

• Long-term contracted revenues with Meta who

will receive 100 per cent of both renewable electricity and

environmental attributes;

• Facility includes 34 Vestas V162 and V136

turbines, of which 33 have 119-metre towers and one has a 105-metre

tower;

• 10-year transfer agreement for approximately

80 per cent of PTCs, which are subject to an annual inflation

adjustment factor, with an AA- rated third-party customer, with

opportunity to contract the remaining 20 per cent;

• Extends TransAlta's weighted-average contract

life of its renewables portfolio1 to over 12 years; and

• Estimated average annual adjusted EBITDA range

between US$31 and US$33 million, including third-party sales of

PTCs.

(1) The weighted-average remaining contract life

does not include our merchant renewables assets. For power

generated under long-term power purchase agreements ("PPAs") and

other long-term contracts, the weighted-average remaining contract

life is based on long-term average gross installed capacity.

About TransAlta Corporation:

TransAlta owns, operates and develops a diverse

fleet of electrical power generation assets in Canada, the United

States and Australia with a focus on long-term shareholder value.

TransAlta provides municipalities, medium and large industries,

businesses and utility customers with clean, affordable, energy

efficient and reliable power. Today, TransAlta is one of Canada’s

largest producers of wind power and Alberta’s largest producer of

hydro-electric power. For over 112 years, TransAlta has been a

responsible operator and a proud member of the communities where we

operate and where our employees work and live. TransAlta aligns its

corporate goals with the UN Sustainable Development Goals and the

Future-Fit Business Benchmark, which also defines sustainable goals

for businesses. Our reporting on climate change management has been

guided by the International Financial Reporting Standards (IFRS) S2

Climate-related Disclosures Standard and the Task Force on

Climate-related Financial Disclosures (TCFD) recommendations.

TransAlta has achieved a 66 per cent reduction in GHG emissions or

21.3 million tonnes CO2e since 2015 and received an upgraded MSCI

ESG rating of AA.

For more information about TransAlta, visit our

web site at transalta.com.

Cautionary Statement Regarding Forward-Looking

Information

This news release contains “forward-looking

information”, within the meaning of applicable Canadian securities

laws, and “forward-looking statements”, within the meaning of

applicable United States securities laws, including the United

States Private Securities Litigation Reform Act of 1995

(collectively referred to herein as “forward-looking statements).

In some cases, forward-looking statements can be identified by

terminology such as “plans”, “expects”, “proposed”, “will”,

“anticipates”, “develop”, “continue”, and similar expressions

suggesting future events or future performance. In particular, this

news release contains, without limitation, statements pertaining to

the anticipated benefits arising from the Horizon Hill facility

(defined above); expected generation of PTCs (defined above) to be

sold through spot transactions or contracted to customers; and the

estimated average annual adjusted EBITDA range for the Horizon Hill

facility. These forward-looking statements are not historical facts

but are based on TransAlta’s belief and assumptions based on

information available at the time the assumptions were made,

including, but not limited to the political and regulatory

environments; and the condition of the financial markets not

changing significantly. These statements are subject to a number of

risks and uncertainties that may cause actual results to differ

materially from those contemplated by the forward-looking

statements. Some of the factors that could cause such differences

include: changes in power prices; supply chain disruptions

impacting major maintenance projects; cybersecurity breaches; the

settlement price of the PPA being greater than the nodal price

received in the market; congestion and curtailment risks and the

potential for negative priced hours; negative impacts to our credit

ratings; legislative or regulatory developments and their impacts;

increasingly stringent environmental requirements and their

impacts; increased competition; global capital markets activity

(including our ability to access financing at a reasonable cost or

at all, including as it pertains to PTCs); changes in prevailing

interest rates, currency exchange rates and inflation levels; armed

hostilities; general economic conditions in the geographic areas in

which TransAlta operates; and other risks and uncertainties

discussed in the TransAlta’s materials filed with the securities

regulatory authorities from time to time and as also set forth in

TransAlta’s most recent MD&A and Annual Information Form for

the year ended Dec. 31, 2023. Readers are cautioned not to place

undue reliance on these forward-looking statements, which reflect

TransAlta’s expectations only as of the date of this news release.

The purpose of the financial outlooks contained in this news

release are to give the reader information about management’s

current expectations and plans and readers are cautioned that such

information may not be appropriate for other purposes and is given

as of the date of this news release. TransAlta disclaims any

intention or obligation to update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

For more information:

| Investor

Inquiries: |

Media

Inquiries: |

| Phone: 1-800-387-3598 in

Canada and US |

Phone: 1-855-255-9184 |

| Email:

investor_relations@transalta.com |

Email:

ta_media_relations@transalta.com |

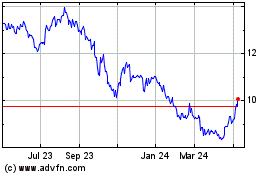

TransAlta (TSX:TA)

Historical Stock Chart

From Oct 2024 to Nov 2024

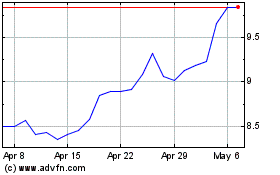

TransAlta (TSX:TA)

Historical Stock Chart

From Nov 2023 to Nov 2024