TransAlta Renews Normal Course Issuer Bid

May 27 2024 - 5:15PM

TransAlta Corporation (“TransAlta” or the “Company”) (TSX: TA)

(NYSE: TAC) announced today that the Toronto Stock Exchange (“TSX”)

has accepted the notice filed by the Company to implement a normal

course issuer bid (“NCIB”) for a portion of its common shares

(“Common Shares”).

Pursuant to the NCIB, TransAlta may repurchase

up to a maximum of 14,000,000 Common Shares, representing

approximately 4.6% of the 303,256,652 Common Shares issued and

outstanding as at May 27, 2024. Purchases under the NCIB may be

made through open market transactions on the TSX and any

alternative Canadian trading systems on which the Common Shares are

traded, based on the prevailing market price. Any Common Shares

purchased under the NCIB will be cancelled.

Transactions under the NCIB will depend on

future market conditions. TransAlta will initially retain

discretion whether to make purchases under the NCIB, and to

determine the timing, amount and acceptable price of any such

purchases, subject at all times to applicable TSX and other

regulatory requirements. The period during which TransAlta is

authorized to make purchases under the NCIB commences on May 31,

2024, and ends on May 30, 2025, or such earlier date on which the

maximum number of Common Shares are purchased under the NCIB or the

NCIB is terminated at the Company’s election.

Under TSX rules, not more than 211,262 Common

Shares (being 25% of the average daily trading volume on the TSX of

845,049 Common Shares for the six months ended April 30, 2024) can

be purchased on the TSX on any single trading day under the NCIB,

with the exception that one block purchase in excess of the daily

maximum is permitted per calendar week.

TransAlta has repurchased and cancelled

8,561,800 Common Shares on the open market through the facilities

of the TSX and/or alternative Canadian trading systems at an

average price of $9.50 per share under its prior NCIB approved by

the TSX on May 26, 2023, for the twelve-month period commencing May

31, 2023.

The NCIB provides the Company with a capital

allocation alternative with a view to long-term shareholder value.

TransAlta’s Board of Directors and Management believe that, from

time to time, the market price of the Common Shares does not

reflect their underlying value and purchases of Common Shares for

cancellation under the NCIB may provide an opportunity to enhance

shareholder value.

About TransAlta

Corporation:TransAlta owns, operates and develops a

diverse fleet of electrical power generation assets in Canada, the

United States and Australia with a focus on long-term shareholder

value. TransAlta provides municipalities, medium and large

industries, businesses and utility customers with clean,

affordable, energy efficient and reliable power. Today, TransAlta

is one of Canada’s largest producers of wind power and Alberta’s

largest producer of hydro-electric power. For over 112 years,

TransAlta has been a responsible operator and a proud member of the

communities where we operate and where our employees work and live.

TransAlta aligns its corporate goals with the UN Sustainable

Development Goals and the Future-Fit Business Benchmark, which also

defines sustainable goals for businesses. Our reporting on climate

change management has been guided by the International Financial

Reporting Standards (IFRS) S2 Climate-related Disclosures Standard

and the Task Force on Climate-related Financial Disclosures (TCFD)

recommendations. TransAlta has achieved a 66 per cent reduction in

GHG emissions or 21.3 million tonnes CO2e since 2015 and received

an upgraded MSCI ESG rating of AA.

For more information about TransAlta, visit its

website at transalta.com.

Cautionary Statement Regarding

Forward-looking Information: This news release contains

forward-looking statements and forward-looking information within

the meaning of applicable securities laws. The use of any of the

words “may”, “will”, and similar expressions are intended to

identify forward-looking information or statements. More

particularly, and without limitation, this news release contains

forward-looking statements and information relating to TransAlta’s

intentions with respect to the NCIB, the effects of repurchases of

Common Shares and purchases thereunder, including any enhancement

to shareholder value. These statements are based on TransAlta’s

belief and assumptions based on information available at the time

the assumptions were made. These statements are subject to a number

of risks and uncertainties that may cause actual results to differ

materially from those contemplated by the forward-looking

statements. Some of the factors that could cause such differences

include: the entering into of an automatic securities purchase

plan; legislative or regulatory developments; any significant

changes to Common Share price or trading volume; continued

availability of capital and financing; changes to general economic,

market or business conditions; business opportunities that become

available to, or are pursued by TransAlta; and other risk

factors contained in the Company’s annual information form and

management’s discussion and analysis. Readers are cautioned not to

place undue reliance on these forward-looking statements or

forward-looking information, which reflect TransAlta’s expectations

only as of the date of this news release. TransAlta disclaims any

intention or obligation to update or revise these forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

Note: All financial figures are in Canadian

dollars unless otherwise indicated.

For more information:

|

Investor Inquiries:Phone: 1-800-387-3598 in Canada

and U.S.Email: investor_relations@transalta.com |

Media Inquiries:Toll-free media number:

1-855-255-9184Email: ta_media_relations@transalta.com |

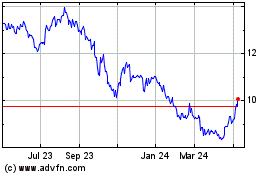

TransAlta (TSX:TA)

Historical Stock Chart

From Oct 2024 to Nov 2024

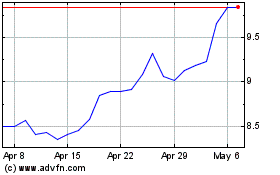

TransAlta (TSX:TA)

Historical Stock Chart

From Nov 2023 to Nov 2024