Tricon Residential Plans Dual Listing, $395 Million Stock Sale

October 05 2021 - 7:13AM

Dow Jones News

By Robb M. Stewart

Tricon Residential Inc. is seeking a second listing New York

Stock Exchange and plans to sell roughly $395 million of its shares

in the U.S. and Canada.

The owner and operator of single-family rental homes and

multi-family rental apartments in both countries said Tuesday it

has applied to list on the NYSE and expects trading to begin after

its stock offering prices. It would continue to trade on the

Toronto Stock Exchange, though it said it intends to change the

denomination of the quarterly dividends paid on shares to U.S.

dollars from the Canadian currency.

Tricon said it launched a marketed public offering of its shares

and a concurrent private placement of stock to Blackstone Real

Estate Investment Trust Inc., which has agreed to buy about $45

million in shares that would result in an ownership interest of

about 12%.

The underwriters would have an overallotment option to buy up to

$52.5 million of shares, it said.

In August 2020, Blackstone agreed to lead a syndicate of

investors in a $300 million investment in Tricon, with the

real-estate investment trust buying $240 million of the preferred

equity in Tricon.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

October 05, 2021 07:58 ET (11:58 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

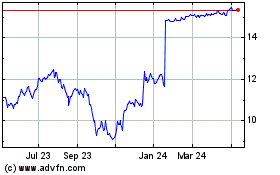

Tricon Residential (TSX:TCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

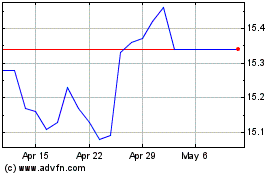

Tricon Residential (TSX:TCN)

Historical Stock Chart

From Apr 2023 to Apr 2024