TFI International Inc. (NYSE and TSX: TFII), a North American

leader in the transportation and logistics industry, today

announced its results for the third quarter ended September 30,

2020.

“TFI International had an outstanding quarter as

we continue to navigate through an unprecedented year. Relentless

focus on our proven operating principles helped generate a 18%

year-over-year increase in operating income and a robust 27%

increase in free cash flow, all while continuing to protect our

customers and employees,” said Alain Bédard, Chairman, President

and Chief Executive Officer. “Regardless of fluctuating macro

conditions, we have the experience and financial strength to create

shareholder value through disciplined execution of our asset-light

business plan, and are pleased to announce today a 12% increase in

our quarterly dividend. We also acquired or agreed to acquire an

additional five businesses during the quarter that are each an

outstanding fit with our proven operating philosophy, and add to my

confidence in TFI’s continued success going forward.”

|

Financial highlights(in millions of

dollars, except per share data) |

Quarters ended September

30 |

|

Nine months

endedSeptember

30 |

|

|

2020 |

2019* |

|

2020 |

2019* |

| Total revenue |

1,247.2 |

1,304.8 |

|

3,593.9 |

3,873.4 |

| Revenue before fuel

surcharge |

1,155.0 |

1,165.8 |

|

3,293.0 |

3,447.2 |

| Adjusted EBITDA1 |

252.3 |

221.6 |

|

685.0 |

645.5 |

| Operating income from

continuing operations |

156.0 |

131.9 |

|

405.9 |

385.9 |

| Net cash from continuing

operating activities |

189.6 |

187.1 |

|

609.2 |

489.1 |

| Adjusted net income1 |

115.8 |

88.1 |

|

278.0 |

257.2 |

| Adjusted EPS - diluted1

($) |

1.25 |

1.04 |

|

3.11 |

2.99 |

| Net income from continuing

operations |

110.7 |

82.6 |

|

256.1 |

247.9 |

| EPS from continuing operations

- diluted ($) |

1.19 |

0.98 |

|

2.87 |

2.88 |

|

Weighted average number of shares ('000s) |

90,954 |

82,707 |

|

87,693 |

84,013 |

|

* Recasted for changes in presentation, see note 20 in the

unaudited condensed consolidated interim financial statements.1

This is a non-IFRS measure. For a reconciliation, please refer to

the “Non-IFRS Financial Measures” section below. |

THIRD QUARTER

RESULTSTotal revenue of $1.25 billion was down 4% and, net

of fuel surcharge, revenue of $1.16 billion was down 1% compared to

the prior year period.

Operating income from continuing operations

increased by 18% to $156.0 million from $131.9 million the prior

year period, primarily driven by strong execution across the

organization, an asset-light approach, cost efficiencies,

contributions from business acquisitions, and contributions from

the Canadian Emergency Wage Subsidy of $22.4 million.

Net income from continuing operations was $110.7

million, an increase of 34% compared to $82.6 million the prior

year period, due to improved contributions from operations and a

reduction in interest expense as a result of lower debt. Net income

from continuing operations of $1.19 per diluted share increased

relative to $0.98 the prior year period. Adjusted net income, a

non-IFRS measure, was $115.8 million, or $1.25 per diluted share,

up from $88.1 million, or $1.04 per diluted share, the prior year

period.

Total revenue grew 7% for Logistics, driven by

business acquisitions and e-commerce, and 1% for Package and

Courier, declined 6% for Truckload and 17% for Less-Than-Truckload,

relative to the prior year.

The operating income in all segments improved

from the prior year period except for the Truckload segment, where

the comparative period benefited from $6.4 million of higher gains

on the sale of real estate relative to this year.

TFI acquired four companies in Q3 and two post

Q3. Additionally, TFI has agreed to purchase DLS Worldwide which is

expected to close in the fourth quarter, and terminated the

previously announced agreement to acquire APPS Transport.

NINE-MONTH

RESULTSFor the first nine months of 2020, total

revenue was $3.59 billion, versus $3.87 billion in the first nine

months of 2019. Net of fuel surcharge, revenue was $3.23 billion,

as compared to $3.45 billion the prior year. Operating income from

continuing operations totalled $405.9 million, or 12.3% of revenue

before fuel surcharge, up from $385.9 million or 11.2% of revenue

before fuel surcharge the prior year.

Net income from continuing operations was $256.1

million, or $2.87 per diluted share, versus $247.9 million, or

$2.88 per diluted share, a year ago. Adjusted net income was $278.0

million up from $257.2 million the prior year.

For the first nine months of 2020, total revenue

grew 11% for Logistics, driven by business acquisitions and

e-commerce, and declined 9% for Truckload, 7% for Package and

Courier and 20% for Less-Than-Truckload, relative to the prior

year.

Operating income was higher for the Truckload,

Logistics and Less-Than-Truckload segments, while operating income

for Package and Courier declined.

|

SEGMENTED RESULTS |

|

(in millions of dollars) |

Quarters ended September

30 |

Nine months

ended September

30 |

|

|

2020 |

|

|

2019* |

|

|

|

2020 |

|

|

|

2019* |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

| Revenue1 |

|

|

|

|

|

|

|

|

|

Package and Courier |

163.2 |

|

|

154.8 |

|

|

442.2 |

|

|

460.3 |

|

|

|

Less-Than-Truckload |

177.4 |

|

|

205.4 |

|

|

516.0 |

|

|

632.5 |

|

|

|

Truckload |

544.7 |

|

|

557.2 |

|

|

1,549.4 |

|

|

1,654.7 |

|

|

|

Logistics |

279.8 |

|

|

256.8 |

|

|

813.5 |

|

|

726.0 |

|

|

|

Eliminations |

(10.1) |

|

|

(8.4) |

|

|

(28.2) |

|

|

(26.3) |

|

|

|

|

1,155.0 |

|

|

1,165.8 |

|

|

3,293.0 |

|

|

3,447.2 |

|

|

| |

$ |

|

% ofRev.1 |

$ |

|

% ofRev.1 |

|

$ |

|

% ofRev.1 |

|

$ |

|

% ofRev.1 |

|

| Operating income (loss) |

|

|

|

|

|

|

|

|

|

Package and Courier |

28.5 |

|

17.5% |

28.2 |

|

18.2% |

|

66.6 |

|

15.1% |

|

79.2 |

|

17.2% |

|

|

Less-Than-Truckload |

35.0 |

|

19.7% |

25.8 |

|

12.6% |

|

86.1 |

|

16.7% |

|

83.7 |

|

13.2% |

|

|

Truckload |

74.6 |

|

13.7% |

75.8 |

|

13.6% |

|

207.1 |

|

13.4% |

|

193.7 |

|

11.7% |

|

|

Logistics |

29.9 |

|

10.7% |

13.8 |

|

5.4% |

|

78.6 |

|

9.7% |

|

57.6 |

|

7.9% |

|

|

Corporate |

(12.0) |

|

|

(11.6) |

|

|

(32.5) |

|

|

(28.4) |

|

|

|

|

156.0 |

|

13.5% |

131.9 |

|

11.3% |

|

405.9 |

|

12.3% |

|

385.9 |

|

11.2% |

|

| Note: due to

rounding, totals may differ slightly from the sum.* Recasted for

changes in presentation, see note 20 in the unaudited condensed

consolidated interim financial statements. |

|

| 1 Revenue before

fuel surcharge. |

|

CASH FLOWNet cash from

continuing operating activities was $189.6 million during Q3 2020

versus $187.1 million the prior year quarter. The Company returned

$119.3 million to shareholders during the year, of which $66.7

million was through dividends and $52.6 million was through share

repurchases. The company also paid down net debt of $495.8 million

during the year from proceeds generated from operations and the

share issuances.

Cash used for the purchases of property and

equipment was $50.5 million during Q3 2020 versus $103.3 million

the prior year quarter. In Q2, management initially suspended all

capital expenditures to which it had not already committed, but

reinstated most capital expenditures at the end of Q2. The lead

time to obtain equipment limited the capital expenditures in

Q3.

On September 15, 2020, the Board of Directors of

TFI International declared a quarterly dividend of $0.26 per

outstanding common share payable on October 15, 2020, representing

an 8% increase over the $0.24 quarterly dividend declared in Q3

2019.

The Board of Directors of TFI has approved a

$0.29 quarterly dividend, a 12% increase over its previous

quarterly dividend of $0.26 per share, effective as of the next

regular dividend payment.

REVERSAL OF CERTAIN

COST SAVING MEASURESTFI has rolled back certain

cost saving measures implemented at the onset of the COVID-19

pandemic that had spanned all operating companies and its entire

workforce. In the third quarter TFI has reinstated a full five-day

work week for 486 employees and rehired 176 employees full-time who

had been furloughed.

CONFERENCE CALLTFI

International will host a conference call on Friday, October 23,

2020 at 8:30 a.m. Eastern Time to discuss these results. Interested

parties can join the call by dialing 1-877-223-4471. A recording of

the call will be available until midnight, November 6, 2020, by

dialing 1-800-585-8367 or 416-621-4642 and entering passcode

5794241.

ABOUT TFI INTERNATIONALTFI

International Inc. is a North American leader in the transportation

and logistics industry, operating across the United States, Canada

and Mexico through its subsidiaries. TFI International creates

value for shareholders by identifying strategic acquisitions and

managing a growing network of wholly-owned operating subsidiaries.

Under the TFI International umbrella, companies benefit from

financial and operational resources to build their businesses and

increase their efficiency. TFI International companies service the

following segments:

- Package and

Courier;

- Less-Than-Truckload;

- Truckload;

- Logistics.

TFI International Inc. is publicly traded on the New York Stock

Exchange and the Toronto Stock Exchange under symbol TFII. For more

information, visit www.tfiintl.com.

FORWARD-LOOKING

STATEMENTSExcept for historical information provided

herein, this press release may contain information and statements

of a forward-looking nature concerning the future performance of

TFI International. These statements are based on assumptions and

uncertainties as well as on management's best possible evaluation

of future events. Such factors may include, without excluding other

considerations, fluctuations in quarterly results, evolution in

customer demand for TFI International's products and services, the

impact of price pressures exerted by competitors, and general

market trends or economic changes. As a result, readers are advised

that actual results may differ from expected results.

NON-IFRS FINANCIAL MEASURESThis

press release includes references to certain non-IFRS financial

measures as described below. These non-IFRS measures do not have

any standardized meanings prescribed by International Financial

Reporting Standards (IFRS) and are therefore unlikely to be

comparable to similar measures presented by other companies.

Accordingly, they should not be considered in isolation, in

addition to, not as a substitute for or superior to, measures of

financial performance prepared in accordance with IFRS. The terms

and definitions of the non-IFRS measures used in this press release

and a reconciliation of each non-IFRS measure to the most directly

comparable IFRS measure are provided below.

Adjusted EBITDA Adjusted EBITDA is calculated as

net income or loss from continuing operations before finance income

and costs, income tax expense, depreciation, amortization, bargain

purchase gain, and gain or loss on sale of land and buildings and

assets held for sale. Management believes adjusted EBITDA to be a

useful supplemental measure. Adjusted EBITDA is provided to assist

in determining the ability of the Company to assess its

performance.

|

Adjusted

EBITDA(unaudited

in millions of dollars) |

Quarters ended September

30 |

|

|

Nine months

ended September

30 |

|

|

|

2020 |

|

2019* |

|

|

2020 |

|

2019* |

|

|

Net income from continuing operations |

110.7 |

|

82.6 |

|

|

256.1 |

|

247.9 |

|

|

Net finance costs |

15.4 |

|

21.2 |

|

|

52.2 |

|

61.8 |

|

|

Income tax expense |

29.9 |

|

28.1 |

|

|

97.7 |

|

76.1 |

|

|

Depreciation of property and equipment |

56.4 |

|

56.6 |

|

|

171.5 |

|

164.8 |

|

|

Depreciation of right-of-use assets |

26.7 |

|

26.4 |

|

|

79.7 |

|

76.8 |

|

|

Amortization of intangible assets |

15.8 |

|

16.8 |

|

|

46.8 |

|

49.1 |

|

|

Bargain purchase gain |

- |

|

- |

|

|

(5.6 |

) |

(10.8 |

) |

|

Gain on sale of land and buildings and assets held for sale |

(2.6 |

) |

(10.1 |

) |

|

(13.4 |

) |

(20.2 |

) |

|

Adjusted EBITDA |

252.3 |

|

221.6 |

|

|

685.0 |

|

645.5 |

|

|

Note: due to rounding, totals may differ slightly from the

sum. |

|

* Recasted for change in presentation, see note 20 in the unaudited

condensed consolidated interim financial statements. |

Adjusted net income and adjusted earnings per

share (adjusted “EPS”), basic or dilutedAdjusted net income is

calculated as net income excluding amortization of intangible

assets related to business acquisitions, net change in the fair

value and accretion expense of contingent considerations, net

change in the fair value of derivatives, net foreign exchange gain

or loss, bargain purchase gain, gain or loss on sale of land and

buildings and assets held for sale, net of tax, net loss from

discontinued operations and U.S Tax Reform. Adjusted earnings per

share, basic or diluted, is calculated as adjusted net income

divided by the weighted average number of common shares, basic or

diluted. The Company uses adjusted net income and adjusted earnings

per share to measure its performance from one period to the next,

without the variation caused by the impact of the items described

above. The Company excludes these items because they affect the

comparability of its financial results and could potentially

distort the analysis of trends in its business performance.

Excluding these items does not imply they are necessarily

non-recurring.

|

Adjusted net income (unaudited, in

millions of dollars, except per share data) |

Quarters ended September

30 |

|

|

Nine months

ended September

30 |

|

|

|

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

|

Net income |

110.7 |

|

82.6 |

|

|

256.1 |

|

235.5 |

|

|

Amortization of intangible assets related to business acquisitions,

net of tax |

11.1 |

|

12.0 |

|

|

33.1 |

|

35.1 |

|

|

Net change in fair value and accretion expense of contingent

considerations, net of tax |

- |

|

- |

|

|

0.1 |

|

0.1 |

|

|

Net change in fair value of derivatives, net of tax |

(0.2 |

) |

- |

|

|

- |

|

- |

|

|

Net foreign exchange (gain) loss, net of tax |

(0.3 |

) |

0.4 |

|

|

(1.5 |

) |

0.6 |

|

|

Bargain purchase gain |

- |

|

- |

|

|

(5.6 |

) |

(10.8 |

) |

|

Gain on sale of land and buildings and assets held for sale, net of

tax |

(2.2 |

) |

(7.0 |

) |

|

(11.7 |

) |

(15.7 |

) |

|

Net loss from discontinued operations |

- |

|

- |

|

|

- |

|

12.5 |

|

|

U.S. Tax Reform |

(3.2 |

) |

- |

|

|

7.5 |

|

- |

|

|

Adjusted net income |

115.8 |

|

88.1 |

|

|

278.0 |

|

257.2 |

|

|

Adjusted earnings per share - basic |

1.27 |

|

1.07 |

|

|

3.17 |

|

3.06 |

|

|

Adjusted earnings per share - diluted |

1.25 |

|

1.04 |

|

|

3.11 |

|

2.99 |

|

| Note: due

to rounding, totals may differ slightly from the

sum. |

| Note to readers: |

Unaudited condensed consolidated interim financial statements and

Management’s Discussion & Analysis are available on TFI

International’s website at www.tfiintl.com. |

For further information:Alain

BédardChairman, President and CEOTFI International Inc.(647)

729-4079abedard@tfiintl.com

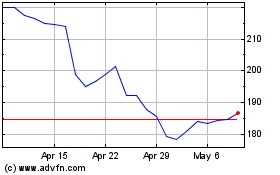

TFI (TSX:TFII)

Historical Stock Chart

From Mar 2024 to Apr 2024

TFI (TSX:TFII)

Historical Stock Chart

From Apr 2023 to Apr 2024