TFI International Inc. (NYSE and TSX: TFII), a North American

leader in the transportation and logistics industry, today

announced its results for the second quarter ended June 30, 2022.

All amounts are shown in U.S. dollars.

“TFI International produced exceptionally strong

results despite volatile macro conditions, with strong

across-the-board performance and robust free cash flow that

demonstrates the strength of our operating principles, a wealth of

internal levers to drive efficiencies, and the growing diversity of

our end markets,” said Alain Bédard, Chairman, President and Chief

Executive Officer. “Our adjusted net income grew 76% over the

year-ago quarter and our free cash flow expanded another 16% above

already strong levels. In addition to double-digit top line growth

generated by LTL, TL and Logistics, our operating ratios were

remarkably strong, including 69% for Canadian LTL, underscoring the

untapped potential across much of our network. Strategically, in

addition to several attractive bolt-on acquisitions, we sold an

underutilized terminal in Southern California acquired from UPS

with no need to leaseback capacity. We also continued to repurchase

shares given the attractive value we see in our own stock, and this

week received Board approval to further expand our buyback

authorization. As always, our balance sheet remains a pillar of our

strength as we continue to seek attractive growth opportunities

while returning capital to shareholders whenever possible in our

drive to create long-term value.”

|

Financial highlights |

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

(in millions of U.S. dollars, except per share

data) |

2022 |

|

2021* |

|

|

2022 |

|

2021* |

|

|

Total revenue |

|

2,422.3 |

|

|

1,836.7 |

|

|

|

4,613.8 |

|

|

2,985.5 |

|

|

Revenue before fuel surcharge |

|

1,989.5 |

|

|

1,651.0 |

|

|

|

3,883.3 |

|

|

2,710.1 |

|

|

Adjusted EBITDA1 |

|

441.9 |

|

|

285.4 |

|

|

|

771.9 |

|

|

461.6 |

|

|

Operating income |

|

391.0 |

|

|

470.9 |

|

|

|

610.7 |

|

|

572.7 |

|

|

Net cash from operating activities |

|

247.8 |

|

|

298.7 |

|

|

|

385.5 |

|

|

453.9 |

|

|

Net income |

|

276.8 |

|

|

411.8 |

|

|

|

424.5 |

|

|

478.7 |

|

|

EPS - diluted ($) |

|

3.00 |

|

|

4.32 |

|

|

|

4.56 |

|

|

5.01 |

|

|

Adjusted net income1 |

|

241.1 |

|

|

137.2 |

|

|

|

398.7 |

|

|

210.9 |

|

|

Adjusted EPS - diluted1 ($) |

|

2.61 |

|

|

1.44 |

|

|

|

4.28 |

|

|

2.21 |

|

|

Weighted average number of shares ('000s) |

|

90,647 |

|

|

93,192 |

|

|

|

91,304 |

|

|

93,287 |

|

|

* Recasted for adjustments to provisional amounts of UPS Freight

prior year business

combination |

|

1 This is a non-IFRS measure. For a reconciliation, please refer to

the “Non-IFRS Financial Measures” section

below. |

SECOND QUARTER RESULTS

Total revenue of $2.42 billion was up 32% and,

net of fuel surcharge, revenue of $1.99 billion was up 21% compared

to the prior year period.

Operating income of $391.0 million compared to

$470.9 million the prior year period, which included a bargain

purchase gain of $283. 6 million. Excluding the impact from the

bargain purchase gain the increase was driven by business

acquisitions and organic growth across the company.

Net income of $276.8 million compared to $411.8

million in the prior year period, which included a bargain purchase

gain of $283.6 million, and net income of $3.00 per diluted share

compared to $4.32 in the prior year period. Adjusted net income, a

non-IFRS measure, was $241.1 million, or $2.61 per diluted share,

up 76% from $137.2 million, or $1.44 per diluted share, the prior

year period.

For the Package and Courier segment, revenue

before fuel surcharge decreased 14% to $125.1 million and operating

income increased 25% to $36.8 million.

For the Less-Than-Truckload segment, revenue

before fuel surcharge increased 39% to $870.2 million and operating

income decreased 47% to $187.3 million. The decrease includes a

bargain purchase gain of $271.6 million included in the prior year

period and an offset gain on the sale of property of $54.6 million

in the second quarter of 2022.

For the Truckload segment, revenue before fuel

surcharge increased 16% to $556.9 million and operating income

increased 103% to $127.4 million, including a $22.9 million gain

($5.6 million gain in the prior year period) on the sale of rolling

stock and equipment.

For the Logistics segment, revenue before fuel

surcharge increased 12% to $453.7 million and operating income

decreased 11% to $42.4 million, as the prior year period includes a

$12.0 million bargain purchase gain.

SIX-MONTH RESULTS

For the first six months of 2022, total revenue

of $4.61 billion was up 55% and, net of fuel surcharge, revenue of

$3.88 billion was up 43% compared to the prior year period.

Net income was $424.5 million, or $4.56 per

diluted share, compared to $478.7 million, or $5.01 per diluted

share a year ago, which included a $283.6 million bargain purchase

gain. Adjusted net income was $398.7 million compared to $210.9

million, an 89% increase.

During the first half of 2022, revenue grew 125%

for Less-Than-Truckload, 18% for Truckload, 13% for Logistics and

declined 10% for Package and Courier. Operating income was higher

across all segments in Q2 in comparison to the prior year , after

the impacts from the bargain purchase gain recognized in 2021 have

been excluded.

|

SEGMENTED RESULTS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions of U.S. dollars) |

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

|

2022 |

|

2021* |

|

|

2022 |

|

2021* |

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

Revenue1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Package and Courier |

|

125.1 |

|

|

|

|

|

145.2 |

|

|

|

|

|

|

249.7 |

|

|

|

|

|

276.8 |

|

|

|

|

|

Less-Than-Truckload |

|

870.2 |

|

|

|

|

|

625.3 |

|

|

|

|

|

|

1,705.6 |

|

|

|

|

|

756.9 |

|

|

|

|

|

Truckload |

|

556.9 |

|

|

|

|

|

481.5 |

|

|

|

|

|

|

1,072.8 |

|

|

|

|

|

906.1 |

|

|

|

|

|

Logistics |

|

453.7 |

|

|

|

|

|

406.9 |

|

|

|

|

|

|

889.1 |

|

|

|

|

|

785.3 |

|

|

|

|

|

Eliminations |

|

(16.4 |

) |

|

|

|

|

(8.0 |

) |

|

|

|

|

|

(33.8 |

) |

|

|

|

|

(14.9 |

) |

|

|

|

|

|

|

1,989.5 |

|

|

|

|

|

1,651.0 |

|

|

|

|

|

|

3,883.3 |

|

|

|

|

|

2,710.1 |

|

|

|

|

|

|

$ |

|

% of Rev.1 |

|

$ |

|

% of Rev.1 |

|

|

$ |

|

% of Rev.1 |

|

$ |

|

% of Rev.1 |

|

|

Operating income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Package and Courier |

|

36.8 |

|

|

29.4 |

% |

|

29.5 |

|

|

20.3 |

% |

|

|

62.9 |

|

|

25.2 |

% |

|

47.9 |

|

|

17.3 |

% |

|

Less-Than-Truckload |

|

187.3 |

|

|

21.5 |

% |

|

351.3 |

|

|

56.2 |

% |

|

|

282.1 |

|

|

16.5 |

% |

|

373.4 |

|

|

49.3 |

% |

|

Truckload |

|

127.4 |

|

|

22.9 |

% |

|

62.6 |

|

|

13.0 |

% |

|

|

198.4 |

|

|

18.5 |

% |

|

112.6 |

|

|

12.4 |

% |

|

Logistics |

|

42.4 |

|

|

9.3 |

% |

|

47.6 |

|

|

11.7 |

% |

|

|

77.3 |

|

|

8.7 |

% |

|

76.6 |

|

|

9.8 |

% |

|

Corporate |

|

(2.9 |

) |

|

|

|

|

(20.1 |

) |

|

|

|

|

|

(9.9 |

) |

|

|

|

|

(37.9 |

) |

|

|

|

|

|

|

391.0 |

|

|

19.7 |

% |

|

470.9 |

|

|

28.5 |

% |

|

|

610.7 |

|

|

15.7 |

% |

|

572.7 |

|

|

21.1 |

% |

|

* Recasted for adjustments to provisional amounts of UPS Freight

prior year business combination |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: due to rounding, totals may differ slightly from the

sum. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Revenue before fuel surcharge. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOW Net cash from

operating activities was $247.8 million during Q2 compared to

$298.7 million the prior year period. The decrease was due to

working capital requirements primarily related to increased revenue

of $131.8 million offset by increased contributions from net

income. The Company returned $235.9 million to shareholders during

the quarter, of which $24.2 million was through dividends and

$211.7 million was through share repurchases.

Net cash used for capital expenditures decreased

by $92.5 million as compared to Q2 2021. The decrease is due to

proceeds recognized on the sale of excess property of $91.9

million.

On June 15, 2022, the Board of Directors of TFI

International declared a quarterly dividend of $0.27 per

outstanding common share paid on July 15, 2022, representing a 17%

increase over the $0.23 quarterly dividend declared in Q2 2021.

PROPOSED AMENDMENT TO NORMAL COURSE

ISSUER BIDTFI International also announces that it will

apply to the Toronto Stock Exchange for approval of an amendment to

TFI International’s normal course issuer bid (“NCIB”). If the

amendment is approved by the TSX, TFI International will be

entitled to repurchase for cancellation up to 8,798,283 common

shares until the expiry of the NCIB on November 1, 2022,

representing 10% of TFI International’s “public float” of

87,982,839 common shares as of October 22, 2021. The

current maximum under the NCIB is 7,000,000 common shares. All

other terms and conditions of the NCIB will remain the same.

As of June 30, 2022, TFI International had

repurchased a total of 4,365,041 shares pursuant to its NCIB

at a weighted average price of CDN $114.63 per share. As at

June 30, 2022, there were 89,094,521 common shares of

TFI International issued and outstanding.

If the TSX approves the amendment to the NCIB,

TFI International will amend its previously-announced automatic

share purchase plan entered into with RBC Dominion Securities Inc.,

acting as TFI International’s agent for the NCIB, in order to

reflect the increase in the maximum number of shares that TFI

International may repurchase under the NCIB. Under the automatic

share purchase plan, RBC Dominion Securities Inc may acquire, at

its discretion, shares on TFI International’s behalf during its

“black-out” periods, as permitted by the TSX Company Manual

and the Securities Act (Québec), subject to certain parameters as

to price and number of shares.

CONFERENCE CALLTFI

International will host a conference call on July 29, 2022, at 8:30

a.m. Eastern Time to discuss these results.Interested parties can

join the call by dialing 877-704-4453. A recording of the call will

be available until midnight, August 12, 2022, by dialing

844-512-2921 or 412-317-6671 and entering passcode 13730125.

ABOUT TFI INTERNATIONALTFI

International Inc. is a North American leader in the transportation

and logistics industry, operating across the United States, Canada

and Mexico through its subsidiaries. TFI International creates

value for shareholders by identifying strategic acquisitions and

managing a growing network of wholly-owned operating subsidiaries.

Under the TFI International umbrella, companies benefit from

financial and operational resources to build their businesses and

increase their efficiency. TFI International companies service the

following segments:

- Package and

Courier;

- Less-Than-Truckload;

- Truckload;

- Logistics.

TFI International Inc. is publicly traded on the

New York Stock Exchange and the Toronto Stock Exchange under symbol

TFII. For more information, visit www.tfiintl.com.

FORWARD-LOOKING STATEMENTSThe

Company may make statements in this report that reflect its current

expectations regarding future results of operations, performance

and achievements. These are “forward-looking” statements and

reflect management’s current beliefs. They are based on information

currently available to management. Words such as “may”, “might”,

“expect”, “intend”, “estimate”, “anticipate”, “plan”, “foresee”,

“believe”, “to its knowledge”, “could”, “design”, “forecast”,

“goal”, “hope”, “intend”, “likely”, “predict”, “project”, “seek”,

“should”, “target”, “will”, “would” or “continue” and words and

expressions of similar import are intended to identify these

forward-looking statements. Such forward-looking statements are

subject to certain risks and uncertainties that could cause actual

results to differ materially from historical results and those

presently anticipated or projected.

The Company wishes to caution readers not to

place undue reliance on any forward-looking statements which

reference issues only as of the date made. The following important

factors could cause the Company’s actual financial performance to

differ materially from that expressed in any forward-looking

statement: the highly competitive market conditions, the Company’s

ability to recruit, train and retain qualified drivers, fuel price

variations and the Company’s ability to recover these costs from

its customers, foreign currency fluctuations, the impact of

environmental standards and regulations, changes in governmental

regulations applicable to the Company’s operations, adverse weather

conditions, accidents, the market for used equipment, changes in

interest rates, cost of liability insurance coverage, downturns in

general economic conditions affecting the Company and its

customers, credit market liquidity, and the Company’s ability to

identify, negotiate, consummate, and successfully integrate

acquisitions.

The foregoing list should not be construed as

exhaustive, and the Company disclaims any subsequent obligation to

revise or update any previously made forward-looking statements

unless required to do so by applicable securities laws.

Unanticipated events are likely to occur. Readers should also refer

to the section “Risks and Uncertainties” at the end of the 2022 Q2

MD&A for additional information on risk factors and other

events that are not within the Company’s control. The Company’s

future financial and operating results may fluctuate as a result of

these and other risk factors.

NON-IFRS FINANCIAL MEASURESThis

press release includes references to certain non-IFRS financial

measures as described below. These non-IFRS measures do not have

any standardized meanings prescribed by International Financial

Reporting Standards (IFRS) as issued by the International

Accounting Standards Board (IASB) and are therefore unlikely to be

comparable to similar measures presented by other companies.

Accordingly, they should not be considered in isolation, in

addition to, not as a substitute for or superior to, measures of

financial performance prepared in accordance with IFRS. The terms

and definitions of the non-IFRS measures used in this press release

and a reconciliation of each non-IFRS measure to the most directly

comparable IFRS measure are provided below.

Adjusted EBITDA: Adjusted EBITDA is calculated

as net income before finance income and costs, income tax expense,

depreciation, amortization, bargain purchase gain, and gain or loss

on sale of land and buildings and assets held for sale. Management

believes adjusted EBITDA to be a useful supplemental measure.

Adjusted EBITDA is provided to assist in determining the ability of

the Company to assess its performance.

|

Adjusted EBITDA |

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

(unaudited, in millions of U.S. dollars) |

2022 |

|

2021* |

|

|

2022 |

|

2021* |

|

|

Net income |

|

276.8 |

|

|

411.8 |

|

|

|

424.5 |

|

|

478.7 |

|

|

Net finance costs |

|

21.5 |

|

|

16.6 |

|

|

|

41.7 |

|

|

31.0 |

|

|

Income tax expense |

|

92.6 |

|

|

42.5 |

|

|

|

144.5 |

|

|

63.0 |

|

|

Depreciation of property and equipment |

|

66.4 |

|

|

56.2 |

|

|

|

130.8 |

|

|

97.4 |

|

|

Depreciation of right-of-use assets |

|

31.3 |

|

|

28.2 |

|

|

|

62.8 |

|

|

51.0 |

|

|

Amortization of intangible assets |

|

14.1 |

|

|

13.7 |

|

|

|

28.4 |

|

|

28.0 |

|

|

Bargain purchase gain |

|

- |

|

|

(283.6 |

) |

|

|

- |

|

|

(283.6 |

) |

|

Gain on sale of land and buildings and assets held for sale |

|

(60.9 |

) |

|

0.0 |

|

|

|

(60.9 |

) |

|

(3.9 |

) |

|

Adjusted EBITDA |

|

441.9 |

|

|

285.4 |

|

|

|

771.9 |

|

|

461.6 |

|

|

* Recasted for adjustments to provisional amounts of UPS Freight

prior year business combination |

|

Note: due to rounding, totals may differ slightly from the

sum. |

Adjusted net income and adjusted earnings per

share (adjusted “EPS”), basic or dilutedAdjusted net income is

calculated as net income excluding amortization of intangible

assets related to business acquisitions, net change in the fair

value and accretion expense of contingent considerations, net

change in the fair value of derivatives, net foreign exchange gain

or loss, bargain purchase gain, and gain or loss on sale of land

and buildings and assets held for sale. Adjusted earnings per

share, basic or diluted, is calculated as adjusted net income

divided by the weighted average number of common shares, basic or

diluted. The Company uses adjusted net income and adjusted earnings

per share to measure its performance from one period to the next,

without the variation caused by the impact of the items described

above. The Company excludes these items because they affect the

comparability of its financial results and could potentially

distort the analysis of trends in its business performance.

Excluding these items does not imply they are necessarily

non-recurring.

|

Adjusted net income |

Three months ended June 30 |

|

|

Six months ended June 30 |

|

|

(unaudited, in millions of U.S. dollars, except per share

data) |

2022 |

|

2021* |

|

|

2022 |

|

2021* |

|

|

Net income for the period |

|

276.8 |

|

|

411.8 |

|

|

|

424.5 |

|

|

478.7 |

|

|

Amortization of intangible assets related to business

acquisitions |

|

13.0 |

|

|

12.8 |

|

|

|

26.1 |

|

|

26.1 |

|

|

Net change in fair value and accretion expense of contingent

considerations |

|

0.1 |

|

|

(0.1 |

) |

|

|

0.0 |

|

|

0.2 |

|

|

Net foreign exchange loss (gain) |

|

(0.1 |

) |

|

(0.7 |

) |

|

|

0.2 |

|

|

(0.7 |

) |

|

Bargain purchase gain |

|

- |

|

|

(283.6 |

) |

|

|

- |

|

|

(283.6 |

) |

|

(Gain) loss on sale of land and buildings and assets held for

sale |

|

(60.9 |

) |

|

0.1 |

|

|

|

(60.9 |

) |

|

(3.7 |

) |

|

Tax impact of adjustments |

|

12.2 |

|

|

(3.1 |

) |

|

|

8.8 |

|

|

(6.0 |

) |

|

Adjusted net income |

|

241.1 |

|

|

137.2 |

|

|

|

398.7 |

|

|

210.9 |

|

|

Adjusted earnings per share - basic |

|

2.66 |

|

|

1.47 |

|

|

|

4.37 |

|

|

2.26 |

|

|

Adjusted earnings per share - diluted |

|

2.61 |

|

|

1.44 |

|

|

|

4.28 |

|

|

2.21 |

|

|

* Recasted for adjustments to provisional amounts of UPS Freight

prior year business combination |

|

Note: due to rounding, totals may differ slightly from the

sum. |

|

Note to readers: |

Unaudited condensed consolidated interim financial statements and

Management’s Discussion & Analysis are available on TFI

International’s website at www.tfiintl.com. |

For further information:Alain

BédardChairman, President and CEOTFI International

Inc.647-729-4079abedard@tfiintl.com

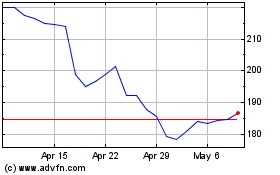

TFI (TSX:TFII)

Historical Stock Chart

From Mar 2024 to Apr 2024

TFI (TSX:TFII)

Historical Stock Chart

From Apr 2023 to Apr 2024