Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG)

reports Q4 2020 gold production of 130,640 ounces and full year

production of 430,480 ounces. Annual output at El Limón Guajes

(ELG) beat the upper end of revised production guidance (390,000 to

420,000 ounces) and exceeded the lower end of original guidance

(420,000 to 480,000 ounces). In August, annual production guidance

was lowered following a partial quarter of operations in Q2, which

was a direct result of a mandated shutdown by the Government of

Mexico to combat COVID-19 within the country.

During Q4 2020, Torex sold 133,060 ounces of gold

at an average realized price of $1,845 per ounce. For the full year

2020, the Company sold 437,310 ounces of gold at an average

realized price of $1,770 per ounce.

Q4 & Full YEAR 2020 OPERATIONAL

Highlights

|

|

Q4 2020 |

FY 2020 |

|

Gold Produced |

oz |

130,640 |

430,480 |

|

Average Plant Throughput |

tpd |

12,560 |

11,370 |

|

Average Underground Ore Mined |

tpd |

1,300 |

990 |

|

Average Open Pit Ore Mined |

tpd |

18,360 |

15,020 |

|

Strip Ratio |

w:o |

6.2 |

6.7 |

Gold grades mined, gold grades processed, and gold

recoveries will be reported with full year 2020 financial results

after reconciliations have been completed. Average rates quoted are

based on calendar days.

Jody Kuzenko, President & CEO of Torex,

stated:

“We delivered another solid operational result to

close out 2020, a guidance beat which follows a strong pattern of

delivering on our commitments. We expect this operational

consistency to continue, which, combined with robust margins,

positions us well to continue to generate strong operating cash

flow. During Q4 2020, we reduced debt by a further $116 million

dollars, exiting the year with debt of $40 million and a strong

cash balance.

“With solid fundamentals in place, we are well

positioned to build a future that will deliver increasing value to

shareholders. Reinvesting in our business is a core aspect of this

value creation, as we extend the life of ELG underground and

potentially the El Limon open pit; de-risk and advance Media Luna;

field test our proprietary Muckahi Mining System; and invest in

exploration at ELG, Media Luna and other high priority targets

within the broader under-explored Morelos land package.

“After achieving 10 million hours worked without a

lost time injury in November, we incurred one in December due to a

finger injury sustained by a contractor. Our excellence in safety

and operational discipline continues – both key to the reliable and

consistent results that people have come to expect of Torex.”

Torex expects to release 2021 production and cost

guidance within the coming week.

About Torex Gold Resources

Inc.Torex is an intermediate gold producer based in

Canada, engaged in the mining, developing and exploring of its 100%

owned Morelos Gold Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal assets are the El

Limón Guajes mining complex (“ELG” or the “ELG Mine Complex”),

comprising the El Limón, Guajes and El Limón Sur open pits, the El

Limón Guajes underground mine including zones referred to as

Sub-Sill and ELD, and the processing plant and related

infrastructure, which commenced commercial production as of April

1, 2016, and the Media Luna deposit, which is an early stage

development project, and for which the Company issued an updated

preliminary economic assessment in September 2018 (the “Technical

Report”). The property remains 75% unexplored.

For further information, please

contact:

TOREX GOLD RESOURCES INC.

| Jody Kuzenko |

Dan Rollins |

| President and CEO |

Vice President, Corporate Development & Investor

Relations |

| Direct: (647) 725-9982 |

Direct: (647) 260-1503 |

| jody.kuzenko@torexgold.com |

dan.rollins@torexgold.com |

CAUTIONARY NOTESNon-IFRS Performance

MeasuresAverage realized price is a financial performance

measure with no standard meaning under International Financial

Reporting Standards (“IFRS”). Please refer to the “Non-IFRS

Financial Performance Measures” section in the Company’s management

discussion and analysis for the year ended December 31, 2019 (“Q4

2019”) dated February 19, 2020, and quarter ended September 30,

2020, dated November 2, 2020 (“Q3 2020”) and available on the

Company’s SEDAR profile at www.sedar.com for further information

with respect to average realized price and a detailed

reconciliation of this non-IFRS financial performance measure for

Q4 2019 and Q2 2020 to the most directly comparable measures under

IFRS.

Muckahi Mining System

The Technical Report includes information on

Muckahi. It is important to note that Muckahi is experimental in

nature and has not been tested in an operating mine. Many aspects

of the system are conceptual, and proof of concept has not been

demonstrated. Drill and blast fundamentals, standards and best

practices for underground hard rock mining are applied in the

Muckahi, where applicable. The proposed application of a monorail

system for underground transportation for mine development and

production mining is unique to underground hard rock mining. There

are existing underground hard rock mines that use a monorail system

for transportation of materials and equipment, however not in the

capacity described in the Technical Report. Aspects of Muckahi

mining equipment are currently in the design and test stage. The

mine design, equipment performance and cost estimations are

conceptual in nature, and do not demonstrate technical or economic

viability. Aspects of Muckahi mining equipment are currently in the

design stage. The Company has completed the development and the

first phase of testing the concept for the mine development and

production activities in 2019 (including the system’s elements to

break rock) and in 2020 the focus is on optimization to further

verify the viability of Muckahi (including the system’s elements to

move rock as an integrated system).

Forward Looking Statements

This press release contains "forward-looking

statements" and "forward-looking information" within the meaning of

applicable Canadian securities legislation. Forward-looking

information also includes, but is not limited to, statements that:

we expect this operational consistency to continue, which, combined

with robust margins, positions us well to continue to generate

strong operating cash flow; with solid fundamentals in place, we

are well positioned to build a future that will deliver increasing

value to shareholders; reinvesting in our business is a core aspect

of this value creation, as we extend the life of ELG underground

and potentially the El Limon open pit, de-risk and advance Media

Luna, field test our proprietary Muckahi Mining System, and invest

in exploration at ELG, Media Luna and other high priority targets

within the broader under-explored Morelos land package; our

excellence in safety and operational discipline carries on, both

key to the reliable and consistent results that people have come to

expect of Torex. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects", "believes", “future”, “intends” or variations

of such words and phrases or state that certain actions, events or

results “can”, "may", "could", "would" or "might". Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including, without limitation, the

inability of the Company’s mining and exploration operations to

operate as intended due to shortage of skilled employees, shortages

in supply chains, inability of employees to access sufficient

healthcare, significant social upheavals, government or regulatory

actions or inactions, decreased demand or the inability to sell

precious metals or declines in the price of precious metals,

capital market volatility, uncertainty involving skarns deposits

and the management of soluble iron and those risk factors

identified in the Technical Report and the Company’s annual

information form and management’s discussion and analysis or other

unknown but potentially significant impacts. Notwithstanding the

Company's efforts, there can be no guarantee that the Company’s

measures to protect employees and surrounding communities from

COVID-19 during this period will be effective. Forward-looking

information are based on the assumptions discussed in the Technical

Report and such other reasonable assumptions, estimates, analysis

and opinions of management made in light of its experience and

perception of trends, current conditions and expected developments,

and other factors that management believes are relevant and

reasonable in the circumstances at the date such statements are

made. Although the Company has attempted to identify important

factors that could cause actual results to differ materially from

those contained in the forward-looking information, there may be

other factors that cause results not to be as anticipated. There

can be no assurance that such information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information. Accordingly,

readers should not place undue reliance on forward-looking

information. The Company does not undertake to update any

forward-looking information, whether as a result of new information

or future events or otherwise, except as may be required by

applicable securities laws.

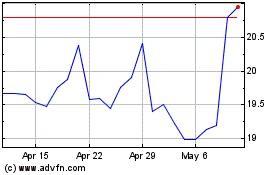

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Mar 2024 to Apr 2024

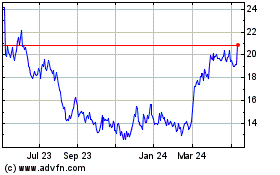

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Apr 2023 to Apr 2024