UNISYNC Reports Fiscal 2021 Financial Results

December 29 2021 - 7:30AM

Unisync Corp. (“Unisync") (TSX:"UNI")

(OTCQX:“USYNF”) announces its audited financial results for the

fourth quarter and fiscal year ended September 30, 2021. Unisync

operates through two business units: Unisync Group Limited (“UGL”)

with operations throughout Canada and the USA and 90% owned

Peerless Garments LP (“Peerless”), a domestic manufacturing

operation based in Winnipeg, Manitoba. UGL is a leading

customer-focused provider of corporate apparel, serving many

leading Canadian and American iconic brands. Peerless specializes

in the production and distribution of highly technical protective

garments, military operational clothing and accessories for a broad

spectrum of Federal, Provincial and Municipal government

departments and agencies.

Results for Fiscal 2021 versus Fiscal

2020

Revenue for the year ended September 30, 2021 of

$86.3 million decreased by $6.8 million or 7% from the prior year

on a $4.6 million decline in revenue in the UGL segment to $68.9

million and a $2.2 million revenue reduction to $18.5 million in

the Peerless segment. UGL segment revenue decreased by 6% over the

prior year as a result of the segment’s transportation revenues

falling $11.1 million from a year ago due to massive employee

layoffs caused by COVID-19 pandemic travel restrictions. These

sales declines, mainly within the UGL segment’s airline accounts,

were partially offset by a $4.7 million increase in personal

protective equipment (“PPE”) sales which Unisync began distributing

for the first time during the third quarter of fiscal 2020. The

Peerless segment’s revenue fell 11% over the prior year, despite a

$2.7 million increase in PPE sales, with a decline in the release

of new contracts and the exercise of outstanding options on

existing contracts by the Department of National Defence (“DND”),

the segment’s largest customer.

Gross profit of $15.8 million slipped to 18.3%

of revenue from 18.9% of revenue in the prior year due to less

absorption of fixed costs. The UGL segment recorded gross profit of

$12.2 million while the segment’s gross profit margin dropped to

18% of revenue from 19% of revenue due to lower economies of

scale. Stimulus subsidies in an amount of $0.3 million

(2020 - $1.0 million) received from the Federal Governments of

Canada under the Canada Emergency Wage Subsidy (“CEWS”) and from

the United States under the Paycheck Protection Program ("PPP") to

help offset the negative impact of the COVID-19 pandemic reduced

direct payroll costs in the UGL segment and minimized layoffs for

employees that would have been otherwise affected. The Peerless

segment’s gross profit margin rose from 20% of revenue to 22% of

revenue on account of the product mix of sales.

Depreciation and amortization expense rose by

$0.6 million from fiscal 2020 to $3.8 million in the current year

primarily on account of a full year’s amortization of the Company’s

new Enterprise Resource Planning (“ERP”) software.

General and administrative expenses increased by

less than 1% to $16.5 million for the year ended September 30, 2021

after receipt of CEWS and PPP amounts of $0.1 million (2020- $0.8

million). Total interest expense of $2.2 million for the year ended

September 30, 2021 decreased by $0.4 million from the prior year on

account of lower utilization on the Company’s operating lines of

credit and lower interest rates following the onset of the COVID-19

pandemic in March 2020. The share-based payment expense rose to

$0.4 million in the current year from $0.1 million in the previous

year with the grant of 1,250,000 (2020 – nil) stock options in

October 2020.

The Company reported a net loss attributable to

Unisync shareholders of $2.8 million, ($0.15 per share) for the

year ended September 30, 2021 compared to a loss of $1.3 million

($0.07 per share) in the year before. Adjusted EBITDA

(comprehensive income before interest expense, income taxes,

depreciation and amortization, share-based payment, and acquisition

related costs) was $3.1 million for fiscal 2021 compared to $4.5

million for fiscal 2020.

Adjusted EBITDA does not have a standardized

meaning prescribed by IFRS and is therefore unlikely to be

comparable to similar measures presented by other issuers and

should not be considered in isolation nor as a substitute for

financial information reported under IFRS. Unisync uses non-IFRS

measures, including adjusted EBITDA, to provide shareholders with

supplemental measures of its operating performance. Unisync

believes adjusted EBITDA is a widely accepted indicator of an

entity’s ability to incur and service debt and commonly used by the

investing community to value businesses.

Results for Q4 2021 versus Q4

2020

Revenue for the three months ended September 30,

2021 of $19.4 million decreased by $1.7 million or 8% over the

three months ended September 30, 2020. Excluding PPE revenue, Q4

2021 revenues increased 15% over the corresponding quarter last

year, while PPE related revenue decreased from $6.7 million in Q4

2020 to $2.8 million in Q4 2021.

Gross profit for the three months ended

September 30, 2021 of $2.7 million or 14% of revenue was down from

19% of revenue in the same period last year on account of reduced

operating leverage on the lower volume of sales and a swing in

foreign exchange rates as the Canadian dollar weakened by 3%

against the US dollar in the current period compared to a

strengthening of 2% in the 4th quarter of fiscal 2020. The UGL

segment recorded gross profit of $1.9 million or 12% of segment

revenue compared to $2.5 million or 16% of segment revenue in the

same quarter of the prior fiscal year as an exchange loss of $0.3

million was included in direct expenses in the current period

compared to an exchange gain of $0.2 million in the same period of

the prior year. The Peerless segment recorded gross profit of $0.8

million or 22% of segment revenue in the fourth quarter of fiscal

2021 against $1.5 million or 24% of segment revenue in the same

quarter of the prior fiscal year.

At $3.8 million, total general and

administrative expenses for the three months ended September 30,

2021 were up $0.1 million from the three months ended September 30,

2020.

Interest expense of $0.7 million for the current

quarter was up $0.1 million from the same period last year due to

interest incurred on the extension of long-term lease obligations

at the Company’s Guelph, Ontario distribution facility in the

current quarter.

The Company reported a net loss of $1.5 million

in the quarter ended September 30, 2021 compared to a net loss of

$0.3 million in the same quarter last year for the reasons cited

above. Adjusted EBITDA was a loss of $0.4 million for the three

months ended September 30, 2021 versus $0.8 million for the

three-month period ended September 30, 2020.

More detailed information is contained in the

Company’s Consolidated Financial Statements for the fiscal year

ended September 30, 2021 and Management Discussion and Analysis

dated December 23, 2021 which may be accessed at www.sedar.com.

Business Trends

The Company began seeing a build-up in orders in

the transportation and hospitality sectors during the latter part

of Q4 2021 and, notwithstanding the recent surge in COVID cases

caused by the Omicron variant, continues to experience a strong

increase in uniform orders from these sectors to pre-pandemic

levels. With a resulting 50% increase in deferred revenue to $12.4

million at the end of fiscal 2021 complimented by recent new

account additions, management expects an improving revenue and

profitability picture as we move through fiscal 2022.

On Behalf of the Board of Directors

Matthew Graham CEO

Investor relations

contact:Douglas F Good, Executive Chairman at 778-370-1725

Email: dgood@unisyncgroup.com

Forward Looking StatementsThis

news release may contain forward-looking statements that involve

known and unknown risk and uncertainties that may cause the

Company’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied in these forward-looking

statements. Any forward-looking statements contained herein are

made as of the date of this news release and are expressly

qualified in their entirety by this cautionary statement. Except as

required by law, the Company undertakes no obligation to publicly

update or revise any such forward-looking statements to reflect any

change in its expectations or in events, conditions or

circumstances on which any such forward-looking statements may be

based, or that may affect the likelihood that actual results will

differ from those set forth in the forward-looking statements.

Neither the TSX nor its Regulation Services Provider (as that term

is defined in the policies of the TSX) accepts responsibility for

the adequacy or accuracy of this release.

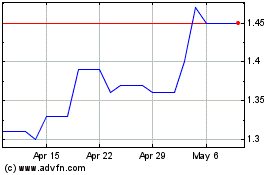

Unisync (TSX:UNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unisync (TSX:UNI)

Historical Stock Chart

From Apr 2023 to Apr 2024