Record $8.3M Q1 Revenue and Gross Profits

Increase 24% to $4M

VIQ Solutions Inc. (“VIQ” or the “Company”) (TSX: VQS and OTCQX:

VQSLF), a global provider of secure, AI-driven, digital voice and

video capture technology and transcription services, today reported

unaudited financial results for the first quarter 2021. Results are

reported in US dollars and are prepared in accordance with

International Financial Reporting Standards ("IFRS").

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20210513006087/en/

“VIQ Solutions delivered strong first-quarter results driven by

substantial gross margin improvement, steady increase in our total

revenue, and exponential growth in Australia. The positive response

to our unique industry transforming approach to AI-powered

solutions has been invigorating. Our product portfolio is gaining

momentum and we’re keenly focused on strategy and execution,” said

Sebastien Paré, Chief Executive Officer. “This is a pivotal year

for VIQ as we increase our investment in infrastructure to propel

VIQ 3.0 to greater heights using our technology to broaden our

portfolio and support the transformation and monetization of the

vast amount of digital content recorded within our expanding global

markets.”

“We continue to see tangible results from our comprehensive

strategy flow through our financial statements. We have started to

recapture and recognize the backlog revenue as we enter a

post-pandemic environment. We experienced positive proof in

Australia, where revenues increased 22.5% in the quarter to $2.4

million versus the prior year,” said Mr. Paré.

President and Chief Operating Officer, Susan Sumner reported,

“As we emerge from the Covid-19 slumber, and experience the U.S.

become fully operational, we expect U.S. revenues to return to

growth. In Q1 we saw US revenues decline 8.6% versus the prior

year. However, we saw volumes begin to increase in March, and we

expect steady expansion through Q2 as our clients return to

pre-pandemic operational levels. By witnessing the reopening

improvements in Australia first, we’re confident we’ll also see it

in the U.S.”

“Our clients clearly see the value in our ability to implement

our integrated solutions and services offerings – powered by cloud

and AI - to transform and analyze digital content and securely

generate accurate, actionable information. Our FirstDraft™ launch,

following the completion of our Beta test with a number of

strategic clients in the first half of the year will provide

efficient, cost-effective digitizing of billions of recordings

captured each year and significantly expand our total addressable

market,” concluded Ms. Sumner.

First Quarter 2021 Financial Highlights:

- Revenue of $8.3 million increased 9.4% compared to $7.5 million

in the same quarter of 2020. Revenues increased by 22.5% in

Australia versus the prior year while U.S. revenues decreased 8.6%

due to the impacts of the pandemic mainly in Insurance;

- SaaS, technology and related sales began influencing the gross

margin profile with $1.4 million in sales;

- Gross profit of $4.0 million represented 48.7% of revenue

compared to $3.2 million, or 42.8% of revenue, in the same quarter

of 2020. The increase in gross profit is primarily due to higher

software license and support sales as well as productivity gains

from the conversion of the Company’s Technology Services clients to

the NetScribe™, powered by aiAssist™, platform. This was partially

offset by expensed R&D costs associated with the onboarding the

Company's new and larger contract in Australia, which is expected

to be operational in the second half of 2021;

- Adjusted EBITDA was $0.3 million versus the same period of the

prior year Adjusted EBITDA of $0.6 million. The decrease in

Adjusted EBITDA was driven primarily by professional service fees

and TSX uplisting fees;

- Net loss in the first quarter was $1.7 million, or loss of

$0.07 per diluted share. These results were versus a net loss of

$6.7 million, or loss of $0.44 per diluted share, in the same

quarter of 2020. Note the prior year period included $5.7 million

in one-time, non-cash expenses related to the conversion of Notes

to equity during the quarter. The approximate impact on net

earnings per share was $0.38. Excluding the impact of this one-time

non-cash interest charge, inducement charge and notes revaluation

expense related to the convertible note, the net loss per share in

the first quarter of 2020 was approximately $0.06;

- Generated 59% of revenue in the United States, 29% in

Australia, and 12% in EMEA and Canada;

- During the quarter, the Company graduated to TSX Exchange from

the TSX Venture Exchange.

“This quarter’s results indicate we are following through with

our strategy,” said Alexie Edwards, VIQ Chief Financial Officer. We

continue improving revenue quality by moving towards recurring SaaS

accounts, supporting acquisitions through lowest cost liquidity,

and improving productivity by migrating our clients onto our

NetScribe platform, powered by aiAssist. Additionally, we continue

improving our balance sheet and capitalization as we progress

towards an uplisting to a senior exchange in the United

States.”

2021 Priorities

The Company reiterates its focus on several 2021 initiatives to

drive growth in revenue, profitability, and defensibility,

including:

- Driving organic revenue growth through stepped-up investments

in infrastructure including AI, sales, marketing, finance and

operations;

- Integrating prior acquisitions and driving productivity gains

through a technology enabled workforce;

- Migrating clients to the full AI-powered tech stack;

- Further global expansion through net new clients, contracts,

and acquisitions;

- Continued development of AI-driven solutions for clients;

- Mitigating impact of COVID-19 on results and process customer

backlog;

- Complete and begin to integrate at least two acquisitions.

A core aspect of the Company’s plan is doubling down on AI

Machine Learning investments, operational infrastructure, and

organic growth driving capabilities. Over time, this is expected to

result in high top-line and bottom-line growth driving continued

increases in shareholder value.

“We are incredibly pleased that the shareholders overwhelmingly

approved the Company’s Omnibus compensation plan, which modernizes

our employee compensation structure, makes VIQ competitive for

acquiring and retaining talent and enables rewarding performance

for key employees. This is increasingly important as we scale the

Company globally,” Mr. Paré concluded.

Conference Call Details

VIQ will host a conference call to discuss its first quarter

2021 results on Friday, May 14 at 11:00 AM Eastern Time. The call

will consist of a brief update by VIQ’s CEO, Sebastien Paré, Alexie

Edwards, VIQ's CFO, and Susan Sumner, VIQ's President and COO,

followed by a question-and-answer period.

Investors may access a live webcast of the call on the Company’s

website at www.viqsolutions.com/investors or by dialing

1-833-378-1030 (North America toll-free) or +1-236-712-2544

(international) to be connected to the call by an operator using

conference ID number 9416367. Participants should dial in at least

10 minutes prior to the start of the call. A replay of the webcast

will be available on the Company’s website through the same link

approximately one hour after the conference call concludes.

For more information about VIQ, please visit

viqsolutions.com.

About VIQ Solutions Inc.

VIQ Solutions is a global provider of secure, AI-driven, digital

voice and video capture technology and transcription services. VIQ

offers a seamless, comprehensive solution suite that delivers

intelligent automation, enhanced with human review, to drive

transformation in the way content is captured, secured, and

repurposed into actionable information. The cyber-secure, AI

technology and services platform are implemented in the most rigid

security environments including criminal justice, legal, insurance,

media, government, corporate finance, media, and transcription

service provider markets, enabling them to improve the quality and

accessibility of evidence, to easily identify predictive insights

and to achieve digital transformation faster and at a lower

cost.

Forward-looking Statements

Certain statements included in this news release constitute

forward-looking statements or forward-looking information under

applicable securities legislation, including without limitation,

all statements in the “2021 Outlook” and “2021 Priorities” section

of this news release. Such forward-looking statements or

information are provided for the purpose of providing information

about management's current expectations and plans relating to the

future, which are considered reasonable by management. Readers are

cautioned that reliance on such information may not be appropriate

for other purposes.

Forward-looking statements or information typically contain

statements with words such as "anticipate", "believe", "expect",

"plan", "intend", "estimate", "propose", "project" or similar words

suggesting future outcomes or statements regarding an outlook.

Forward-looking statements or information in this news release

include, but are not limited to, the Company’s ability to scale

consistently, accelerate its organic growth, expand its global

footprint and strengthen its market leadership in the industries in

which it operates; the Company’s ability to complete future

strategic acquisitions; expectations regarding the Company’s

development and launch of future product and service offerings,

including without limitation, VIQ 3.0 and the benefits that

customers will realize as a result of such offerings; the

anticipated benefits of the Company’s consolidation of its global

operations and expectations regarding cost savings related thereto;

the benefits that the Company anticipates will be realized as a

result of its continued migration of clients, including, without

limitation, the effect that the continued migration of clients will

have on productivity and gross margin; the strategic initiatives

that the Company intends to focus on in 2021, the effect that such

initiatives will have on the Company’s revenue, profitability,

defensibility , top-line and bottom-line growth and shareholder

value; the Company’s intention to continue investing in its

AI-driven solutions, to scale sales and marketing and to continue

acquiring strategic assets globally, and the effect that such

actions will have on gross margin and Adjusted EBITDA.

These forward-looking statements or information are based on

several factors and assumptions which have been used to develop

such statements and information, but which may prove to be

incorrect. Although VIQ believes that the expectations reflected in

such forward-looking statements or information are reasonable,

undue reliance should not be placed on forward-looking statements

because VIQ can give no assurance that such expectations will prove

to be correct. In addition to other factors and assumptions which

may be identified in this news release, assumptions have been made

regarding, among other things; the Company’s ability to execute its

business plan as currently contemplated; the Company’s ability to

migrate its customers to the NetScribe platform in accordance with

projected timelines; the Company’s ability to maintain its existing

customer contracts in good standing; the Company’s ability to

successfully recover revenues delayed to 2021; the Company’s

ability to identify and acquire suitable acquisition targets; the

accuracy of the Company’s financial projections; and the Company’s

ability to continue to grow its customer base in accordance with

current projections. Readers are cautioned that the foregoing list

is not exhaustive of all factors and assumptions that have been

used.

Forward-looking statements or information is based on current

expectations, estimates and projections that involve several risks

and uncertainties which could cause actual results to differ

materially from those anticipated by VIQ, including but not limited

to; the risk that delayed revenues will be unrecoverable; the risk

that Company will be unable to successfully migrate its customers

to its NetScribe platform as anticipated or at all; the risk that

certain of the Company’s customer contracts will be terminated; the

risk that the Company’s projections are not accurate; the risk that

the Company will be unable to identify or acquire suitable

acquisition targets; the risk that the Company will be unable to

integrate future acquisitions into its existing operations and the

risks and uncertainties described under the heading “Risk Factors”

in VIQ’s Annual Information Form for the year ended December 31,

2020, filed with the Canadian securities regulatory authorities

under VIQ’s SEDAR profile at www.sedar.com.

These risks and uncertainties may cause actual results to differ

materially from the forward-looking statements or information.

Readers are cautioned that the foregoing list is not exhaustive of

all possible risks and uncertainties. The forward-looking

statements contained in this release are made as of the date of

this release and, except as required by applicable law, VIQ

undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

VIQ Solutions Inc. Interim Condensed Consolidated Statements of

Financial Position (Expressed in United States dollars,

unaudited)

March 31, 2021

December 31, 2020

Assets

Current assets

Cash

$

16,020,297

$

16,835,671

Trade and other receivables, net of

allowance for doubtful accounts

5,717,315

4,475,751

Inventories

58,732

49,381

Prepaid expenses and deposits

442,761

254,230

22,239,105

21,615,033

Non-current assets

Restricted cash

93,672

42,835

Property and equipment

208,283

215,835

Right of use assets

268,611

309,566

Intangible assets

11,508,816

12,118,352

Goodwill

6,969,329

6,976,096

Deferred tax assets

1,657,957

1,441,942

Total assets

$

42,945,773

$

42,719,659

Liabilities

Current liabilities

Trade and other payables and accrued

liabilities

$

5,236,134

$

5,305,600

Income tax payable

157,486

201,592

Share appreciation rights plan

obligations

36,836

126,503

Current portion of long-term debt

1,320,313

1,486,136

Current portion of lease obligations

81,483

113,218

Current portion of contract

liabilities

1,367,006

1,252,957

8,199,258

8,486,006

Non-current liabilities

Deferred tax liability

60,183

60,587

Long-term debt

12,199,414

12,138,799

Long-term contingent consideration

1,247,351

1,575,528

Long-term lease obligations

228,009

240,981

Long-term contract liabilities

10,012

70,834

Other long-term liabilities

334,743

360,525

Total liabilities

22,278,970

22,933,260

Shareholders’ equity

Capital stock

53,305,477

50,234,551

Contributed surplus

4,282,820

4,970,945

Accumulated other comprehensive income

(loss)

85,486

(78,906

)

Deficit

(37,006,980

)

(35,340,191

)

Total liabilities and shareholders’

equity

$

42,945,773

$

42,719,659

VIQ Solutions Inc. Interim Condensed Consolidated Statements of

Loss and Comprehensive Loss (Expressed in United States dollars,

unaudited)

Three months ended

March 31,

2021

2020

Revenue

$

8,254,222

$

7,548,204

Cost of sales

4,236,387

4,318,312

Gross profit

4,017,835

3,229,892

Expenses

Selling and administrative expenses

3,661,326

2,377,154

Research and development expenses

239,663

252,321

Stock-based compensation

85,995

47,725

Foreign exchange (gain) loss

215,325

(252,249

)

Depreciation

73,555

107,854

Amortization

1,174,808

990,697

5,450,672

3,523,502

Loss before undernoted items

(1,432,837

)

(293,610

)

Interest expense

(331,419

)

(3,695,952

)

Accretion and other financing expense

(264,949

)

(230,548

)

Loss on revaluation of conversion feature

liability

–

(1,118,761

)

Loss on repayment of long-term debt

–

(1,290,147

)

Gain on contingent consideration

95,994

–

Other income

3,453

204

(1,929,758

)

(6,628,814

)

Current income tax recovery (expense)

41,990

(53,444

)

Deferred income tax recovery

220,979

–

Income tax recovery (expense)

262,969

(53,444

)

Net loss for the period

$

(1,666,789

)

$

(6,682,258

)

Exchange gain on translating foreign

operations

164,392

15,939

Comprehensive loss for the

period

$

(1,502,397

)

$

(6,666,319

)

Net loss per share

Basic

$

(0.07

)

$

(0.44

)

Diluted

$

(0.07

)

$

(0.44

)

Weighted average number of common shares

outstanding – basic

24,467,151

15,092,939

Weighted average number of common shares

outstanding – diluted

24,467,151

15,092,939

VIQ Solutions Inc. Interim Condensed Consolidated Statements of

Cash Flows (Expressed in United States dollars, unaudited)

Three months ended March

31,

2021

2020

Cash provided by (used in):

Operating activities

Net loss for the period

$

(1,666,789

)

$

(6,682,258

)

Items not affecting cash:

Depreciation

73,555

107,854

Amortization

1,174,808

990,697

Stock‑based compensation

85,995

47,725

Loss on revaluation of conversion feature

liability

–

1,118,761

Loss on repayment of long-term debt

–

1,290,147

Accretion and other financing expense

264,949

230,548

Interest expense

331,419

3,695,952

Income tax (recovery) expense

(262,969

)

53,444

Gain on contingent consideration

(95,994

)

–

Other income

(3,453

)

(204

)

Foreign exchange (gain) loss

215,325

(252,249

)

Unrealized foreign exchange loss

(gain)

3,094

200,098

Changes in non‑cash operating working

capital

(1,027,370

)

(732,387

)

Cash provided by (used in) operating

activities

(907,430

)

68,128

Investing activities

Purchase of property and equipment

(7,540

)

(26,988

)

Business acquisitions

(4,411,500

)

Earn out payment

(386,827

)

-

Development costs related to internally

generated intangible assets

(532,298

)

(338,362

)

Employee loan advancement

(518,431

)

-

Change in restricted cash

(50,837

)

4,877

Cash used in investing

activities

(1,495,933

)

(4,771,973

)

Financing activities

Issuance costs reimbursement

1,673

–

Proceeds from debt, net of issuance costs

-

4,566,945

Proceeds from exercise of stock

options

202,857

-

Proceeds from exercise of warrants

2,092,276

1,561,039

Repayment of debt

(381,157

)

(254,382

)

Repayment of lease obligations

(45,268

)

(79,842

)

Payment of interest on debt

(311,909

)

(188,330

)

Payment of interest on lease

obligations

(7,777

)

(15,680

)

Cash provided by financing

activities

1,550,695

5,589,750

Net increase (decrease) in cash for the

period

(852,668

)

885,905

Cash, beginning of period

16,835,671

1,707,654

Effect of exchange rate changes on

cash

37,294

(108,218

)

Cash, end of period

$

16,020,297

$

2,485,341

VIQ Solutions Inc. Reconciliation of Non-IFRS Measures

(Expressed in United States dollars, unaudited)

We believe that securities analysts, investors and other

interested parties frequently use non-IFRS measures in the

evaluation of performance. Management also uses non-IFRS measures

in order to facilitate operating performance comparisons from

period to period, prepare annual operating budgets and assess our

ability to meet our capital expenditure and working capital

requirements.

The following is a reconciliation of Net Loss to Adjusted

EBITDA, the most directly comparable IFRS measure for the three

months ended March 31, 2021 and 2020:

Three months ended March

31

2021

2020

Net Loss

(1,666,789)

(6,682,258)

Add:

Depreciation

73,555

107,854

Amortization

1,174,808

990,697

Interest expense

331,419

3,695,952

Current income tax (recovery) expense

(41,990)

53,444

Deferred income tax recovery

(220,979)

-

EBITDA

(349,976)

(1,834,311)

Accretion and other financing expense

264,949

230,548

Loss on revaluation of conversion feature

liability

-

1,118,761

Loss on repayment of long-term debt

-

1,290,147

Restructuring Costs

122,216

-

Other income

(3,453)

(204)

Stock-based compensation

85,995

47,725

Foreign exchange (gain) loss

215,325

(252,249)

Adjusted EBITDA

335,056

600,417

Non-IFRS Measures

The Company prepares its financial statements in accordance with

IFRS. Non-IFRS measures are used by management to provide

additional insight into our performance and financial condition. We

believe non-IFRS measures are an important part of the financial

reporting process and are useful in communicating information that

complements and supplements the consolidated financial statements.

This MD&A also includes certain measures which have not been

prepared in accordance with IFRS such as Adjusted EBITDA. To

evaluate the Company’s operating performance as a complement to

results provided in accordance with IFRS, the term “Adjusted

EBITDA” - as defined by management refers to net income (loss)

before adjusting earnings for stock-based compensation,

depreciation, amortization, interest expense, accretion and other

financing expense, (gain) loss on revaluation of conversion feature

liability, loss on repayment of long-term debt, business

acquisition costs, impairment of goodwill and intangibles, other

expense (income), foreign exchange (gain) loss, current and

deferred income tax expense. We believe that the items excluded

from Adjusted EBITDA are not connected to and do not represent the

operating performance of the Company.

We believe that Adjusted EBITDA is useful supplemental

information as it provides an indication of the results generated

by the Company’s main business activities prior to taking into

consideration how those activities are financed and taxed as well

as expenses related to stock-based compensation, depreciation,

amortization, impairment of goodwill and intangibles, other expense

(income), and foreign exchange (gain) loss. Accordingly, we believe

that this measure may also be useful to investors in enhancing

their understanding of the Company’s operating performance.

Adjusted EBITDA is not a measure which has any standardized

meaning under IFRS and therefore, may not be comparable to similar

measures presented by other issuers. Investors are cautioned that

Adjusted EBITDA should not be construed as an alternative to net

income (loss) as determined in accordance with IFRS.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210513006087/en/

Media Contact: Laura Haggard Chief Marketing Officer VIQ

Solutions Phone: (800) 263-9947 Email:

marketing@viqsolutions.com

Investor Relations Contact: Laura Kiernan High Touch

Investor Relations Phone: 1-914-598-7733 Email: viq@htir.net

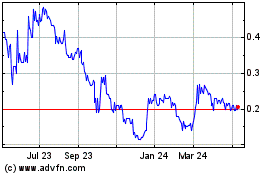

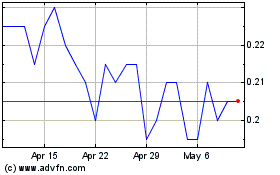

VIQ Solutions (TSX:VQS)

Historical Stock Chart

From Oct 2024 to Nov 2024

VIQ Solutions (TSX:VQS)

Historical Stock Chart

From Nov 2023 to Nov 2024