Xanadu Mines Ltd (

ASX: XAM |

TSX: XAM) (

Xanadu or the

Company) is pleased to announce a significant

expansion to mineralisation at the Company’s Kharmagtai copper and

gold Project, located within the South Gobi, Mongolia. Kharmagtai

is an emerging copper and gold project, within the highly

prospective South Gobi Desert, which the Company believes has the

potential to be a globally significant, gold rich copper project.

Highlights

- Phase 1 program

has completed 17,000 metres out of a 23,000 metre plan, resulting

in significant expansion to the mineralised system at Kharmagtai,

with ~9,800 metres of assays still pending.

- Includes drilling

at the Zaraa Prospect which intersected extensive zones of

anomalous copper and gold mineralisation, more than

doubling the size of the immediate target

zone.

- Also includes

drilling at Stockwork Hill which has identified a potential

structural repeat of mineralisation below the currently defined

Mineral Resource.

- Discovery drilling

nearby at the Pechko target area has also identified a large scale,

potentially mineralised tourmaline breccia system.

- The Kharmagtai

Mineral Resource is currently estimated to contain 1.9 million

tonnes of copper and 4.3 million ounces of gold (as announced to

ASX on 31 October 2018). An updated Mineral Resource Estimate is

planned in H1 CY2021. An updated “Mining Options Study” is also

planned.

- Increased news

flow from Phase 1 drilling results expected through Q1 CY21 to

support a planned Resource Update.

Xanadu’s Chief Executive Officer, Dr

Andrew Stewart, said “Kharmagtai is an emerging, globally

significant, gold rich porphyry copper system. It contains large

zones of relatively higher-grade mineralisation that may represent

opportunities to unlock real value. Our exploration strategy

remains focused on defining these higher grade zones whilst growing

the Mineral Resource through extensions to known deposits such as

Stockwork Hill and discovery of new deposits such as Zaraa and

potentially Pechko.”

Execution – Phase 1

Underway

The Kharmagtai exploration strategy is

constructed in two components, with Phase 1 designed to understand

the scale of the mineralised system through extensional drilling

with several large step-outs from known zones, following broad

geological and geochemical trends. Phase 2 will use the outcomes

from Phase 1 to design and execute a more surgical drill program to

better define higher-grade zones.

Phase 1 commenced in August 2020 as a program of

approximately 23,000 metre diamond core drilling. New geophysical

data (see ASX/TSX announcement dated April 15, 2020) revealed that

the mineral system is disrupted by a series post-mineral faults

that displace higher-grade zones. The resulting structural

interpretation was successfully incorporated into the Phase 1

targeting (Figures 1 to 3). Specific objectives

were to do the following.

- Test

extensions to the known mineralised envelope;

- Find new,

internal high-grade zones within that envelope; and

- Test

other known copper-gold mineralisation and co-incident geophysical

and geochemical anomalies within the Kharmagtai Mining

License.

Figure

1. Kharmagtai

Mining Lease Plan View

with

existing,

current, and target drilling

areas is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/17438e23-a682-45b1-a9f0-10b5428c802b

Figure 2 Kharmagtai Mining Lease Long

Section with existing, current, and target

drilling areas is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f0776109-8658-43cd-8349-f220d369c275

Figure 3

Long Section through Copper Hill, White

Hill & Stockwork Hill showing

target zones is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9f140ce4-80c1-4001-919f-767b2f55f9d2

Since August 2020, approximately 17,000 metres

of the 23,000 metre Phase 1 program have been drilled

(Table 1).

Table 1. Phase 1

Exploration Program Status

|

Prospect |

Objective |

Phase 1 Metres Planned |

Metres Drilled to Date (at 3 Dec 2020) |

Assays Returned |

Assays Pending |

|

Stockwork Hill, Copper Hill and White Hill |

Step Out Extensions |

8,000m |

4,876m |

1,651m |

3,225m |

|

Zaraa Prospect |

Step Out Extensions, Find New High Grade Zones, Test at Depth |

8,000m |

6,468m |

2,918m |

4,475m |

|

Pechko and Camarillo Targets |

Identify New High Grade Zones |

3,118m |

3,118m |

2,234m |

794m |

|

Other Kharmagtai Targets |

Identify New High Grade Zones |

3,989m |

2.542m |

1,211m |

1,330m |

|

Total Phase 1 |

|

23,000m |

17,004m |

8,014m |

9,824m |

Stockwork Hill

Four diamond drill holes have been drilled at

Stockwork Hill totalling 4,100m. Three drill holes have targeted

along strike of the higher grade bornite zone. These holes have

encountered several low angle structures that have offset

mineralisation and have identified the potential offset to the

northern Stockwork Zone at depth. This suggests the higher-grade

zone has been shifted to beneath White Hill. Geological models are

being updated to incorporate these results. Assays for two holes

have been returned (Tables

2 and 3) and

assays for the remaining holes are awaited. Once these results are

returned final models will be developed and additional drill

planned.

Zaraa

Prospect

Recent drilling at the Zaraa prospect has been

designed to test the dimensions and extensions to the large,

mineralised envelope as well as any internal high-grade zones. This

mineralised zone is not currently included in the Kharmagtai

Mineral Resource Estimate and has the potential to add significant

value to the project.

The current drill program has made significant

progress in these objectives, with five holes completed. Zaraa

mineralisation has been expanded 200m to the south, 200m to the

north and 150m to the west. New modelling of these results show

that Zaraa is now 700m long, 300m wide and 650m deep and remains

open along strike and at depth (Figure

4). This has approximately doubled the size of the

Zaraa system. Assay results have been returned for KHDDH534, 534a

(previously reported) and partial results for KHDDH542 and KHDDH543

(Table 2). Assays are pending for

the remaining holes.

Detailed structural observations made during

this program have provided a structural framework which indicates

additional extensions may be found (Figure

4). When this structural framework is layered with

the existing 3D IP data, a clear offset target is

identified. The current drilling identified two large

structures. The offset on these structures can be clearly seen in

the geology and geochemistry and when the 3D Induced Polarization

data is shown a significant target to expand Zaraa is observed.

Additional drilling is currently being planned

for Zaraa and will target the offset IP chargeability anomaly in

Figure 4 to confirm the location of the large offset zone of

interpreted mineralisation.

Figure

4 The Zaraa region

showing Zaraa, Sandstorm, Zephyr and Golden Eagle is

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ab514b3c-3bc8-43b3-a90a-04f481eeec27

Discovery

Drilling

Pechko

Four diamond drill holes have been drilled at

Pechko for a total of 1,900m of drilling. Drill hole KHDDH537 was

collared targeting a surface geochemical and sub-surface

geophysical target and encountered over 225m of sulphide bearing

tourmaline breccia. A 150m step back hole KHDDH538 was drilled to

test for higher grade copper beneath KHDDH537 and showed a zonation

of increasing copper down plunge. A scissor hole was drilled

(KHDDH540) to test the depth continuity of mineralisation. Partial

assays have been returned for KHDDH537 and KHDDH538

(Tables 2

and 3), remaining assays are

awaited. These results will be combined, and collated and

geological models created to vector towards a possible higher-grade

core of the tourmaline breccia system.

Camarillo

Two diamond drill holes totalling 1,700m have

been collared at Camarillo targeting a new porphyry centre. Drill

hole KHDDH539 encountered over 200m of porphyry style veining

towards the end of the hole and represents a near miss to a

porphyry system. Assay results have been returned for KHDDH539

(Tables 2

and 3) and assays are pending for

the second drill hole KHDDH546.

Copper Hill

Two diamond drill holes totalling 770m have been

collared at Copper Hill targeting offset extensions. Both holes

encountered porphyry veining but only weak mineralisation. Assays

are pending for both holes.

Target 10

Two diamond drill holes totalling 800m have been

collared at Target 10 targeting a Copper Hill style magnetic

feature associated with surface copper and gold anomalism. Both

holes encountered porphyry veining but only weak mineralisation.

Assays have been returned for KHDDH533 and are pending for KHDDH548

(Tables 2

and 3).

Geological Modelling

The drilling results are continually used to

update the >0.2g/t eCu cut-off model. This indicates a there are

two large clusters of mineralisation, one (western) surrounding

Stockwork Hill, White Hill and Copper HiIl and one (eastern)

surrounding Zaraa, Sandstorm, Zephyr and Golden Eagle

(Figure 1). The Western Cluster displays

copper-gold mineralisation of over 2,000m north-south strike

length, 2,000m wide and more than 800m vertically. The Eastern

Cluster displays copper-gold mineralisation of over 1,000m

north-south strike length, 1,000m wide and more than 800m

vertically Drilling continues to expand the footprint of Kharmagtai

and remains open to the northwest, south and at depth and confirms

Kharmagtai is shaping up to be a large, tier one gold-copper

porphyry project.

Red Mountain

Two diamond drill holes have been started at Red

Mountain in the past month totalling 193m. The program has been

temporarily suspended due a small cluster of COVID-19 cases in a

nearby town. Drilling is anticipated to recommence in early January

2021.

Upcoming News Flow

The Company plans to provide several drilling

and operational updates over the coming weeks following strong

advancement across multiple work streams at Kharmagtai, including

the following:

- Drilling

Program Phase 1 Results (Q1 CY21)

-

Exploration Target Review and Mining Concepts Study (Q1 CY21)

- Resource

Update (H1 CY21)

- Drilling

Program Phase 2 Results (Q1 to Q3 CY21)

- Updated

Concept Study and Gating Decision (Q4 CY21 to Q1 CY22)

COVID in Mongolia

On 11 November 2020, the Government of Mongolia

announced measures to halt community transmission of COVID-19,

following positive tests outside of quarantine in Ulaanbaatar. This

includes an initial lockdown across the country, currently

scheduled to finish on 11 December 2020.

The Government of Mongolia has taken a

conservative approach to managing COVID-19, closing its borders

early in the year, and to date the Mongolian economy has remained

largely open. The action announced by the Government is consistent

with this conservative approach.

Mining and exploration facilities have been able

to continue operation through this period, however a temporary

reduction in assay lab capacity in Ulaanbaatar will likely delay

drilling results and news flow. The Kharmagtai operation continues

its exploration activities, currently operating two diamond drill

rigs. The Red Mountain exploration program is anticipated to

commence in the January quarter.

Extraordinary General

Meeting

Xanadu has scheduled an Extraordinary General

Meeting (EGM) on 23 December 2020 to request

shareholder approval to add a share price vesting condition to

option grants for Executive Directors. Please refer to the Notice

of Meeting available on the Xanadu website. These share price

vesting conditions will also apply to Executives under the Employee

Share Option Plan. Xanadu recognises the timing of this EGM just

prior to the holiday break and encourages all shareholders to vote

their proxies prior to the meeting.

About Xanadu Mines

Xanadu is an ASX and TSX listed Exploration

company that discovers and defines globally significant porphyry

copper-gold assets in Mongolia. We give investors exposure to large

scale copper-gold discoveries and low-cost inventory growth, and we

create liquidity events for shareholders at peak value points in

the mining life cycle. Xanadu maintains a portfolio of exploration

projects and remains one of the few junior explorers on the ASX or

TSX who control an emerging Tier 1 copper-gold deposit in our

flagship Kharmagtai project. For information on Xanadu visit:

www.xanadumines.com.

Andrew StewartCEO Xanadu Mines Ltd

Andrew.stewart@xanadumines.com+61 409 819 922

This Announcement was authorised for release by

Xanadu’s Board of Directors.

Appendix 1:

Drilling Results

Table 2:

Recent Drill hole details (KH prefix =

Kharmagtai, OU prefix = Red Mountain)

|

Hole ID |

Prospect |

East |

North |

RL |

Azimuth (°) |

Inc (°) |

Depth (m) |

|

KHDDH541 |

Pechko |

597689 |

4877039 |

1267 |

140 |

-60 |

402.7 |

|

KHDDH542 |

Zaraa |

594259 |

4877549 |

1273 |

135 |

-60 |

1264.2 |

|

KHDDH543 |

Zaraa |

594500 |

4877000 |

1273 |

95 |

-60 |

771.2 |

|

KHDDH544 |

Stockwork Hill |

592368 |

4877377 |

1295 |

0 |

-70 |

1182.7 |

|

KHDDH545 |

Pechko |

598581 |

4877446 |

1265 |

140 |

-60 |

339.7 |

|

KHDDH546 |

Camarillo |

596148 |

4877090 |

1268 |

115 |

-60 |

454.7 |

|

KHDDH547 |

Zaraa |

594604 |

4877715 |

1267 |

150 |

-65 |

1156.2 |

|

KHDDH548 |

Target 10 |

594332 |

4874850 |

1290 |

140 |

-60 |

303.2 |

|

KHDDH549 |

Zesen Uul |

592271 |

4876331 |

1311 |

0 |

-65 |

297.1 |

|

KHDDH550 |

Stockwork Hill |

592032 |

4877741 |

1295 |

0 |

-60 |

414.7 |

|

KHDDH551 |

Stockwork Hill |

592830 |

4877363 |

1290 |

0 |

-70 |

1078.5 |

|

KHDDH552 |

Zesen Uul |

592272 |

4876153 |

1311 |

0 |

-65 |

477.1 |

|

KHDDH553 |

Zaraa |

594395 |

4877199 |

1273 |

130 |

-67 |

1093.2 |

|

KHDDH554 |

Zephyr |

595660 |

4877587 |

1260 |

0 |

-60 |

343.0 |

|

KHDDH555 |

Zephyr |

595389 |

4877519 |

1261 |

0 |

-60 |

420.1 |

|

KHDDH556 |

Zephyr |

595503 |

4877598 |

1260 |

0 |

-65 |

513.0 |

|

KHDDH557 |

Zaraa |

594174 |

4877088 |

1277 |

130 |

-67 |

1000.0 |

|

KHDDH558 |

Zephyr |

595846 |

4877566 |

1260 |

0 |

-65 |

600.0 |

|

OUDDH098 |

Bavuu |

376100 |

4938900 |

1088 |

0 |

-75 |

374.7 |

|

OUDDH099 |

Vein 10 |

377250 |

4940400 |

1088 |

0 |

-75 |

18.0 |

Table 3: Kharmagtai

significant drill results

|

Hole ID |

Prospect |

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Cu (%) |

CuEq (%) |

AuEq (g/t) |

|

KHDDH541 |

Pechko |

155 |

256 |

101 |

0.11 |

0.06 |

0.12 |

0.23 |

|

and |

|

272 |

277.7 |

5.7 |

0.08 |

0.06 |

0.11 |

0.21 |

|

and |

|

288 |

296 |

8 |

0.11 |

0.06 |

0.12 |

0.23 |

|

and |

|

318 |

362 |

44 |

0.07 |

0.11 |

0.14 |

0.28 |

|

KHDDH542 |

Zaraa |

30 |

54 |

24 |

0.26 |

0.03 |

0.16 |

0.32 |

|

including |

|

34 |

38 |

4 |

0.65 |

0.04 |

0.37 |

0.72 |

|

and |

|

64 |

75 |

11 |

0.11 |

0.09 |

0.14 |

0.28 |

|

and |

|

85 |

107 |

22 |

0.07 |

0.09 |

0.12 |

0.24 |

|

and |

|

119 |

131.2 |

12.2 |

0.19 |

0.09 |

0.19 |

0.37 |

|

and |

|

161 |

285.1 |

124.1 |

0.09 |

0.12 |

0.17 |

0.33 |

|

including |

|

277 |

285.1 |

8.1 |

0.18 |

0.26 |

0.35 |

0.69 |

|

and |

|

314.6 |

327 |

12.4 |

0.10 |

0.11 |

0.16 |

0.32 |

|

Assays pending |

|

KHDDH543 |

Zaraa |

46 |

50 |

4 |

0.24 |

0.04 |

0.16 |

0.32 |

|

and |

|

166 |

170 |

4 |

0.09 |

0.11 |

0.15 |

0.30 |

|

Assays pending |

|

and |

|

427 |

771.2 |

344.2 |

0.09 |

0.15 |

0.19 |

0.37 |

|

including |

|

502 |

539.2 |

37.2 |

0.17 |

0.23 |

0.32 |

0.62 |

|

including |

|

551 |

557 |

6 |

0.13 |

0.22 |

0.29 |

0.56 |

|

including |

|

646 |

654 |

8 |

0.16 |

0.25 |

0.33 |

0.64 |

|

KHDDH544 |

Stockwork Hill |

3.7 |

225 |

221.3 |

0.11 |

0.20 |

0.26 |

0.50 |

|

including |

|

6 |

10 |

4 |

0.18 |

0.30 |

0.39 |

0.76 |

|

including |

|

68 |

80 |

12 |

0.11 |

0.22 |

0.27 |

0.53 |

|

including |

|

96 |

102 |

6 |

0.16 |

0.27 |

0.35 |

0.69 |

|

including |

|

112 |

146 |

34 |

0.31 |

0.41 |

0.57 |

1.11 |

|

including |

|

112 |

136 |

24 |

0.38 |

0.48 |

0.67 |

1.32 |

|

including |

|

126 |

134 |

8 |

0.62 |

0.70 |

1.02 |

1.99 |

|

Assays pending |

|

KHDDH545 |

Pechko |

67 |

109 |

42 |

0.07 |

0.08 |

0.12 |

0.23 |

|

Assays pending |

|

KHDDH546 |

Camarillo |

Assays pending |

|

KHDDH547 |

Zaraa |

Assays pending |

|

KHDDH548 |

Target 10 |

Assays pending |

|

KHDDH549 |

Zesen Uul |

Assays pending |

|

KHDDH550 |

Stockwork Hill |

Assays pending |

|

KHDDH551 |

Stockwork Hill |

Assays pending |

|

KHDDH552 |

Zesen Uul |

Assays pending |

|

KHDDH553 |

Zaraa |

Assays pending |

|

KHDDH554 |

Zephyr |

Assays pending |

|

KHDDH555 |

Zephyr |

Assays pending |

|

KHDDH556 |

Zephyr |

Assays pending |

|

KHDDH557 |

Zaraa |

Assays pending |

|

KHDDH558 |

Zephyr |

Assays pending |

|

OUDDH098 |

Bavuu |

Assays pending |

|

OUDDH099 |

Vein 10 |

Assays pending |

Appendix 2:

Statements and Disclaimers

Mineral Resources and

Ore Reserves Reporting Requirements

The 2012 Edition of the Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves (the JORC Code 2012) sets out minimum

standards, recommendations and guidelines for Public Reporting in

Australasia of Exploration Results, Mineral Resources and Ore

Reserves. The Information contained in this Announcement has been

presented in accordance with the JORC Code 2012.

Competent Person

Statement

The information in this announcement that

relates to exploration results is based on information compiled by

Dr Andrew Stewart, who is responsible for the exploration data,

comments on exploration target sizes, QA/QC and geological

interpretation and information. Dr Stewart, who is an employee of

Xanadu and is a Member of the Australasian Institute of

Geoscientists, has sufficient experience relevant to the style of

mineralisation and type of deposit under consideration and to the

activity he is undertaking to qualify as the “Competent Person” as

defined in the 2012 Edition of the Australasian Code for Reporting

Exploration Results, Mineral Resources and Ore Reserves and the

National Instrument 43-101. Dr Stewart consents to the inclusion in

the report of the matters based on this information in the form and

context in which it appears.

Copper Equivalent

Calculations

The copper equivalent (eCu) calculation

represents the total metal value for each metal, multiplied by the

conversion factor, summed and expressed in equivalent copper

percentage with a metallurgical recovery factor applied. The copper

equivalent calculation used is based off the eCu calculation

defined by CSA in the 2018 Mineral Resource Upgrade.

Copper equivalent (eCu) grade values were

calculated using the following formula:

|

eCu = Cu + Au * 0.62097 * 0.8235,Where Cu = copper grade

(%); Au = gold grade (gold per tonne

(g/t)); 0.62097 = conversion factor (gold to

copper); and 0.8235 = relative recovery of gold to copper

(82.35%).The copper equivalent formula was based on the following

parameters (prices are in USD): Copper price = 3.1 $/lb (or 6,834 $

per tonne ($/t)); Gold price = 1,320 $ per ounce

($/oz); Copper recovery = 85%; Gold recovery =

70%; and Relative recovery of gold to copper = 70% / 85% =

82.35%. |

Forward-Looking Statements

Certain statements contained in this

Announcement, including information as to the future financial or

operating performance of Xanadu and its projects may also include

statements which are ‘forward‐looking statements’ that may include,

amongst other things, statements regarding targets, estimates and

assumptions in respect of mineral reserves and mineral resources

and anticipated grades and recovery rates, production and prices,

recovery costs and results, capital expenditures and are or may be

based on assumptions and estimates related to future technical,

economic, market, political, social and other conditions. These

‘forward-looking statements’ are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by

Xanadu, are inherently subject to significant technical, business,

economic, competitive, political and social uncertainties and

contingencies and involve known and unknown risks and uncertainties

that could cause actual events or results to differ materially from

estimated or anticipated events or results reflected in such

forward‐looking statements.

Xanadu disclaims any intent or obligation to

update publicly or release any revisions to any forward‐looking

statements, whether as a result of new information, future events,

circumstances or results or otherwise after the date of this

Announcement or to reflect the occurrence of unanticipated events,

other than required by the Corporations Act 2001 (Cth) and the

Listing Rules of the Australian Securities Exchange

(ASX) and Toronto Stock Exchange

(TSX). The words ‘believe’, ‘expect’,

‘anticipate’, ‘indicate’, ‘contemplate’, ‘target’, ‘plan’,

‘intends’, ‘continue’, ‘budget’, ‘estimate’, ‘may’, ‘will’,

‘schedule’ and similar expressions identify forward‐looking

statements.

All ‘forward‐looking statements’ made in this

Announcement are qualified by the foregoing cautionary statements.

Investors are cautioned that ‘forward‐looking statements’ are not

guarantee of future performance and accordingly investors are

cautioned not to put undue reliance on ‘forward‐looking statements’

due to the inherent uncertainty therein.

For further information please visit the Xanadu

Mines’ Website at www.xanadumines.com.

Appendix 3: Kharmagtai Table 1 (JORC 2012)

Set out below is Section 1 and Section 2 of

Table 1 under the JORC Code, 2012 Edition for the Kharmagtai

project. Data provided by Xanadu. This Table 1 updates the JORC

Table 1 disclosure dated 11 April 2019.

JORC TABLE 1 - SECTION 1

- SAMPLING TECHNIQUES AND

DATA

|

Criteria |

Commentary |

|

Samplingtechniques |

- The CSAMT Survey at Kharmagtai was

conducted by OGC LLC, an external Geophysical Contractor.

- The transmitter system used was a

Zonge GGT-30 transmitter and GDP-32 receiver.

- Transmitter was set up +10km for

the survey grid and receiver stations were spaced at 200m along

oblique lines roughly perpendicular to the geological trend. Line

locations and lengths can be seen in the text of the document.

- The relevant QAQC was conducted to

ensure measurements give a representative sample for this type of

survey.

- Representative 2 metre samples were

taken from ½ HQ diamond core for assay.

- Only assay result results from

recognised, independent assay laboratories were used after QAQC was

verified.

- The IP Survey at Red Mountain was

conducted by OGC LLC, an external Geophysical Contractor.

- The IP transmitter system used was

a Zonge GGT-30 transmitter and GDP-32 receiver.

- Transmitter and receiver stations

were spaced at 200m along north south lines. Line locations and

lengths can be seen in the text of the document.

- The relevant QAQC was conducted to

ensure measurements give a representative sample for this type of

survey.

|

|

Drilling techniques |

- Diamond Drill Hole

(DDH) drilling has been the primary drilling

method. Some RC (reverse circulation) is conducted. RC holes are

denoted by the KHRC prefix. Diamond Drill Holes are denoted by the

KHDDH prefix.

|

|

Drillsamplerecovery |

- DDH core recoveries have been very

good, averaging between 95% and 99% for all of the deposits. In

localised areas of faulting and/or fracturing the recoveries

decrease; however, this is a very small percentage of the overall

mineralised zones.

- Recovery measurements were

collected during all DDH and RC programs. The methodology used for

measuring recovery is standard industry practice.

- Analysis of recovery results vs.

grade indicates no significant trends. Indicating bias of grades

due to diminished recovery and / or wetness of samples.

|

|

Logging |

- Drill and trench samples are logged

for lithology, mineralisation and alteration and geotechnical

aspects using a standardised logging system, including the

recording of visually estimated volume percentages of major

minerals.

- Drill core was photographed after

being logged by a geologist.

- The entire interval drilled and

trenched has been logged by a geologist.

|

|

Sub-sampling techniques and sample

preparation |

- DDH Core is cut in half with a

diamond saw, following the line marked by the geologist. The rock

saw is regularly flushed with fresh water.

- Sample intervals are generally a

constant 2m interval down-hole in length unless subdivided at

geological contacts.

- Routine sample preparation and

analyses of DDH samples were carried out by ALS Mongolia LLC

(ALS Mongolia), who operates an independent sample

preparation and analytical laboratory in Ulaanbaatar.

- All samples were prepared to meet

standard quality control procedures as follows: crushed to 90%

passing 3.54 mm, split to 1kg, pulverised to 90% - 95% passing 200

mesh (75 microns) and split to 150g.

- Certified reference materials

(CRMs), blanks and pulp duplicate were randomly

inserted to manage the quality of data.

- Sample sizes are well in excess of

standard industry requirements.

|

|

Quality ofassay

dataandlaboratorytests |

- All samples were routinely assayed

by ALS Mongolia for gold

- Au is determined using a 25g fire

assay fusion, cupelled to obtain a bead, and digested with Aqua

Regia, followed by an atomic absorption spectroscopy

(AAS) finish, with a lower detection limit

(LDL) of 0.01 ppm.

- All samples were submitted to ALS

Mongolia for the package ME-ICP61 using a four acid digest. Where

copper is over-range (>1% Cu), it is analysed by a second

analytical technique (Cu-OG62), which has a higher upper detection

limit (UDL) of 5% copper.

- Quality assurance was provided by

introduction of known certified standards, blanks and duplicate

samples on a routine basis.

- Assay results outside the optimal

range for methods were re-analysed by appropriate methods.

- Ore Research Pty Ltd certified

copper and gold standards have been implemented as a part of QA/QC

procedures, as well as coarse and pulp blanks, and certified matrix

matched copper-gold standards.

- QAQC monitoring is an active and

ongoing processes on batch by batch basis by which unacceptable

results are re-assayed as soon as practicable.

|

|

Verificationof

samplingandassaying |

- All assay data QA/QC is checked

prior to loading into the Geobank data base.

- The data is managed by Xanadu

geologists.

- The database and geological

interpretation is collectively managed by Xanadu.

|

|

Location ofdata points |

- CSAMT transmitter and receivers

were located using a handheld GPS

- Diamond drill holes have been

surveyed with a differential global positioning system

(DGPS) to within 10cm accuracy.

- All diamond drill holes have been

down hole surveyed to collect the azimuth and inclination at

specific depths. Two principal types of survey method have been

used over the duration of the drilling programs including Eastman

Kodak and Flexit.

- UTM WGS84 48N grid.

- The digital terrain model

(DTM) is based on 1m contours with an accuracy of

±0.01m.

|

|

Dataspacinganddistribution |

- CSAMT receiver nodes were place at

200m spacings to allow a potential maximum depth penetration of

1000m.

- Holes spacings range from 50m

spacings within the core of mineralization to +500m spacings for

exploration drilling. Hole spacings can be determined using the

sections and drill plans provided

- Holes range from vertical to an

inclination of -60 degrees depending on the attitude of the target

and the drilling method.

- The data spacing and distribution

is sufficient to establish anomalism and targeting for both

porphyry, tourmaline breccia and epithermal target types.

|

|

Orientationof data

inrelation

togeologicalstructure |

- Drilling is conducted in a

predominantly regular grid to allow unbiased interpretation and

targeting.

- Sample lines for the CSAMT survey

were conducted roughly perpendicular to the gross geological

trend

|

|

Sample security |

- Samples are dispatched from site

through via company employees and secure company vehicles to the

Laboratories.

- Samples are signed for at the

Laboratory with confirmation of receipt emailed through.

- Samples are then stored at the lab

and returned to a locked storage site.

|

|

Audits or reviews |

- CSAMT data from the survey was

reviewed and audited by Barry de Wet, an external consultant.

- Internal audits of sampling

techniques and data management on a regular basis, to ensure

industry best practice is employed at all times.

|

JORC TABLE 1 - SECTION 2 - REPORTING OF

EXPLORATION RESULTS

(Criteria in this section apply to all succeeding sections).

|

Criteria |

Commentary |

|

Mineraltenementand

landtenurestatus |

- The Project comprises 2 Mining

Licences (MV-17129A Oyut Ulaan and (MV-17387A Kharmagtai):

- Xanadu now owns 90% of Vantage LLC,

the 100% owner of the Oyut Ulaan mining licence.

- The Kharmagtai mining license

MV-17387A is 100% owned by Oyut Ulaan LLC. Xanadu has an 85%

interest in Mongol Metals LLC, which has 90% interest in Oyut Ulaan

LLC. The remaining 10% in Oyut Ulaan LLC is owned by Quincunx (BVI)

Ltd (“Quincunx”).

- The Mongolian Minerals Law (2006)

and Mongolian Land Law (2002) govern exploration, mining and land

use rights for the project.

|

|

Explorationdone

byotherparties |

- Previous exploration at Kharmagtai

was conducted by Quincunx Ltd, Ivanhoe Mines Ltd and Turquoise Hill

Resources Ltd including extensive drilling, surface geochemistry,

geophysics, mapping.

- Previous exploration at Red

Mountain (Oyut Ulaan) was conducted by Ivanhoe Mines.

|

|

Geology |

- The mineralisation is characterised

as porphyry copper-gold type.

- Porphyry copper-gold deposits are

formed from magmatic hydrothermal fluids typically associated with

felsic intrusive stocks that have deposited metals as sulphides

both within the intrusive and the intruded host rocks. Quartz

stockwork veining is typically associated with sulphides occurring

both within the quartz veinlets and disseminated thought out the

wall rock. Porphyry deposits are typically large tonnage deposits

ranging from low to high grade and are generally mined by large

scale open pit or underground bulk mining methods. The deposits at

Kharmagtai are atypical in that they are associated with

intermediate intrusions of diorite to quartz diorite composition;

however the deposits are in terms of contained gold significant,

and similar gold-rich porphyry deposits.

|

|

Drill holeInformation |

- Diamond drill holes are the

principal source of geological and grade data for the Project.

- See figures in this ASX/TSX

Announcement.

|

|

DataAggregation methods |

- The CSAMT data was converted into

2D line data using the Zonge CSAMT processing software and then

converted into 3D space using a UBC inversion process. Inversion

fit was acceptable, and error was generally low.

- A nominal cut-off of 0.1% eCu is

used in copper dominant systems for identification of potentially

significant intercepts for reporting purposes. Higher grade

cut-offs are 0.3%, 0.6% and 1% eCu.

- A nominal cut-off of 0.1g/t eAu is

used in gold dominant systems like Golden Eagle for identification

of potentially significant intercepts for reporting purposes.

Higher grade cut-offs are 0.3g/t, 0.6g/t and 1g/t eAu.

- Maximum contiguous dilution within

each intercept is 9m for 0.1%, 0.3%, 0.6% and 1% eCu.

- Most of the reported intercepts are

shown in sufficient detail, including maxima and subintervals, to

allow the reader to make an assessment of the balance of high and

low grades in the intercept.

- Informing samples have been

composited to two metre lengths honouring the geological domains

and adjusted where necessary to ensure that no residual sample

lengths have been excluded (best fit).

The copper equivalent (eCu) calculation represents

the total metal value for each metal, multiplied by the conversion

factor, summed and expressed in equivalent copper percentage with a

metallurgical recovery factor applied. The copper equivalent

calculation used is based off the eCu calculation defined by CSA in

the 2018 Mineral Resource Upgrade.Copper equivalent

(CuEq or eCu) grade values were

calculated using the following formula:

eCu or CuEq = Cu + Au * 0.62097 *

0.8235,Gold Equivalent (eAu) grade values were

calculated using the following formula:

eAu = Au + Cu / 0.62097 *

0.8235.Where:Cu - copper grade (%)Au - gold grade (g/t)0.62097 -

conversion factor (gold to copper)0.8235 - relative recovery of

gold to copper (82.35%)The copper equivalent formula was based on

the following parameters (prices are in USD):

- Copper price - 3.1 $/lb (or 6834

$/t)

- Gold

price - 1320

$/oz

- Copper recovery - 85%

- Gold recovery - 70%

- Relative recovery of gold to copper

= 70% / 85% = 82.35%.

|

|

Relationship between mineralisationon

widthsand

interceptlengths |

- Mineralised structures are variable

in orientation, and therefore drill orientations have been adjusted

from place to place in order to allow intersection angles as close

as possible to true widths.

- Exploration results have been

reported as an interval with 'from' and 'to' stated in tables of

significant economic intercepts. Tables clearly indicate that true

widths will generally be narrower than those reported.

|

|

Diagrams |

- See figures in the body of the

report.

|

|

Balancedreporting |

- Resources have been reported at a

range of cut-off grades, above a minimum suitable for open pit

mining, and above a minimum suitable for underground mining.

|

|

Othersubstantiveexplorationdata |

- Extensive work in this area has

been done and is reported separately.

|

|

FurtherWork |

- The mineralisation is open at depth

and along strike.

- Current estimates are restricted to

those expected to be reasonable for open pit mining. Limited

drilling below this depth (-300m RLl) shows widths and grades

potentially suitable for underground extraction.

- Exploration on going.

|

JORC TABLE 1 -

SECTION 3 - ESTIMATION

AND REPORTING OF MINERAL RESOURCES

(Criteria listed in section 1, and where relevant in section 2,

also apply to this section.)

|

Criteria |

Commentary |

|

Databaseintegrity |

- The database is a Geobank data base

system.

- Data is logged directly into an

Excel spread sheet logging system with drop down field lists.

- Validation checks are written into

the importing program ensures all data is of high quality.

- Digital assay data is obtained from

the Laboratory, QAQC checked and imported

- Geobank exported to Access and

connected directly to the GemcomSurpac Software.

- Data was validated prior to

resource estimation by the reporting of basic statistics for each

of the grade fields, including examination of maximum values, and

visual checks of drill traces and grades on sections and

plans.

|

|

Site visits |

- Andrew Vigar of Mining Associates

Pty Ltd visited the site from 24 and 25 October 2014.

- The site visit included a field

review of the exploration area, an inspection of core, sample

cutting and logging procedures and discussions of geology and

mineralisation with exploration geologists.

|

|

Geologicalinterpretation |

- Mineralisation resulted in the

formation of comprises quartz-chalcopyrite-pyrite-magnetite

stockwork veins and minor breccias.

- The principle ore minerals of

economic interest are chalcopyrite, bornite and gold, which occur

primarily as infill within these veins. Gold is intergrown with

chalcopyrite and bornite.

- The ore mineralised zones at

Stockwork Hill, White HIll and Copper Hill are associated with a

core of quartz veins that were intensely developed in and the

quartz diorite intrusive stocks and/or dykes rocks. These vein

arrays can be described as stockwork, but the veins have strong

developed preferred orientations.

- Sulphide mineralisation is zoned

from a bornite-rich core that zone outwards to chalcopyrite-rich

and then outer pyritic haloes, with gold closely associated with

bornite.

- Drilling indicates that the

supergene profile has been oxidised to depths up to 60 metres below

the surface. The oxide zone comprises fracture controlled copper

and iron oxides; however there is no obvious depletion or

enrichment of gold in the oxide zone.

|

|

Dimensions |

- Stockwork Hill comprises two main

mineralised zones, northern and southern stockwork zones (SH-N and

SH-S) which are approximately 100 metres apart and hosted in

diorite and quartz diorite porphyries.

- The SH-S is at least 550 metres

long, 600 metres deep and contains strong

quartz-chalcopyrite-pyrite stockwork veining and associated high

grade copper-gold mineralisation. The stockwork zone widens

eastward from a 20 to 70 metres wide high-grade zone in the western

and central sections to a 200 metres wide medium-grade zone in the

eastern most sections. Mineralisation remains open at depth and

along strike to the east.

- The SH-N consists of a broad halo

of quartz that is 250 metres long, 150 metres wide long and at

least 350 metres deep.

- WH consists of a broad halo of

quartz veins that is 850 metres long, 550 metres wide long and at

least 500 metres deep, and forms a pipe like geometry.

- CH forms a sub vertical body of

stockwork approximately 350 × 100 metres by at least 200 metres and

plunges to the southeast.

|

|

Estimation

andmodellingtechniques |

- The estimate Estimation Performed

using Ordinary Kriging.

- Variograms are reasonable along

strike.

- Minimum & Maximum Informing

samples is 5 and 20 (1st pass), Second pass is 3 and 20.

- Copper and Gold Interpreted

separately on NS sections and estimated as separate domains.

- Halo mineralisation defined as

0.12% Cu and 0.12g/t Au Grade.

- The mineralised domains were

manually digitised on cross sections defining mineralisation.

Three-dimensional grade shells (wireframes) for each of the metals

to be estimated were created from the sectional interpretation.

Construction of the grade shells took into account prominent

lithological and structural features. For copper, grade shells were

constructed for each deposit at a cut-off of 0.12% and 0.3% Cu. For

gold, wireframes were constructed at a threshold of 0.12g/t and 0.3

g/t. These grade shells took into account known gross geological

controls in addition to broadly adhering to the above mentioned

thresholds.

- Cut off grades applied are

copper-equivalent (CuEq) cut off values of 0.3% for appropriate for

a large bulk mining open pit and 0.5% for bulk block caving

underground.

- A set of plans and cross-sections

that displayed colour coded drill holes were plotted and inspected

to ensure the proper assignment of domains to drill holes.

- The faulting interpreted to have

had considerable movement, for this reason, the fault surface was

used to define two separate structural domains for grade

estimation.

- Six metre down-hole composites were

chosen for statistical analysis and grade estimation of Cu and Au.

Compositing was carried out downhole within the defined

mineralisation halos. Composite files for individual domains were

created by selecting those samples within domain wireframes, using

a fix length and 50% minimum composite length.

- A total of 4,428 measurements for

specific gravity are recorded in the database, all of which were

determined by the water immersion method. The average density of

all samples is 2.74 t/m3. In detail there are some differences in

density between different rock types, but since the model does not

include geological domains a single pass Inverse Distance

(ID2) interpolation was applied.

- Primary grade interpolation for the

two metals was by ordinary kriging of capped 6m composites. A

two-pass search approach was used, whereby a cell failing to

receive a grade estimate in a previous pass would be resubmitted in

a subsequent and larger search pass.

- The Mineral Resource Estimate meets

the requirements of JORC 2012 and has been reported considering

geological characteristics, grade and quantity, prospects for

eventual economic extraction and location and extents. Mineral

Resources are sub-divided, in order of increasing geological

confidence, into Inferred, Indicated and Measured categories using

relevant copper-equivalent cut-off values.

- The copper equivalent

(eCu) calculation represents the total metal value

for each metal, multiplied by the conversion factor, summed and

expressed in equivalent copper percentage with a metallurgical

recovery factor applied. The copper equivalent calculation used is

based off the eCu calculation defined by CSA in the 2018 Mineral

Resource Upgrade.

- Copper equivalent

(CuEq or eCu) grade values were

calculated using the following formula:eCu or CuEq = Cu + Au *

0.62097 * 0.8235,Gold Equivalent (eAu) grade

values were calculated using the following formula:eAu = Au + Cu /

0.62097 * 0.8235.Where:Cu - copper grade (%)Au - gold grade

(g/t)0.62097 - conversion factor (gold to copper)0.8235 - relative

recovery of gold to copper (82.35%)The copper equivalent formula

was based on the following parameters (prices are in USD):Copper

price - 3.1 $/lb (or 6834 $/t)Gold price - 1320 $/ozCopper recovery

- 85%Gold recovery - 70%Relative recovery of gold to copper = 70% /

85% = 82.35%.

|

|

Moisture |

- All tonnages are reported on a dry

basis.

|

|

Cut-offparameters |

- Cut off grades applied are

copper-equivalent (CuEq) cut off values of 0.3%

for possible open pit and 0.5% for underground.

|

|

Miningfactors

orassumptions |

- No mining factors have been applied

to the in-situ grade estimates for mining dilution or loss due to

the grade control or mining process.

- The deposit is amenable to large

scale bulk mining.

- The Mineral Resource is reported

above an optimised pit shell. (Lerch Grossman algorithm),

mineralisation below the pit shell is reported at a higher cut-off

to reflect the increased costs associated with block cave

underground mining

|

|

Metallurgicalfactors

orassumptions |

- No metallurgical factors have been

applied to the in-situ grade estimates.

|

|

Environmentalfactors or

assumptions |

- An environmental baseline study was

completed in 2003 by Eco Trade Co. Ltd. of Mongolia in cooperation

with Sustainability Pty Ltd of Australia. The baseline study report

was produced to meet the requirements for screening under the

Mongolian Environmental Impact Assessment (EIA)

Procedures administered by the Mongolian Ministry for Nature and

Environment (MNE).

|

|

Bulk density |

- A total of 4,428 measurements for

specific gravity are recorded in the database, all of which were

determined by the water immersion method.

- The average density of all samples

is approximately 2.74 t/m3. In detail there are some differences in

density between different rock types, but since the model does not

include geological domain, an ID2 was applied to a density

attribute.

- There is no material impact on

global tonnages, but it should be noted that density is a function

of both lithology and alteration (where intense magnetite/sulphide

is present).

|

|

Classification |

- The Mineral Resource classification

protocols, for drilling and sampling, sample preparation and

analysis, geological logging, database construction, interpolation,

and estimation parameters are described in the ASX/TSX Announcement

above have been used to classify the 2015 resource.

- The Mineral Resource statement

relates to global estimates of in situ tonnes and grade

- The Mineral Resource Estimate has

been classified in accordance with the JORC Code, 2012 Edition

using a qualitative approach. The classifications reflect the

competent person’s view of the Kharmagtai Copper Gold Project.

|

|

Audits orreviews |

- Xanadu’s internal review and audit

of the Mineral Resource Estimate consisted of data analysis and

geological interpretation of individual cross-sections, comparing

drill-hole data with the resource estimate block model.

- Good correlation of geological and

grade boundaries was observed

- 2013 - Mining Associates Ltd. was

engaged to conduct an Independent Technical Report to review

drilling, sampling techniques, QA/QC and previous Resource

estimates. Methods were found to conform to international best

practice.

|

|

Discussion

ofrelativeaccuracy/confidence |

- An approach to the resource

classification was used which combined both confidence in

geological continuity (domain wireframes) and statistical analysis.

The level of accuracy and risk is therefore reflected in the

allocation of the measured, indicated, and inferred resource

categories.

- Resource categories were

constrained by geological understanding, data density and quality,

and estimation parameters. It is expected that further work will

extend this considerably.

- Resources estimates have been made

on a global basis and relates to in situ grades.

- Confidence in the Indicated Mineral

Resources is sufficient to allow application of Modifying Factors

within a technical and economic study. The confidence in Inferred

Mineral Resources is not sufficient to allow the results of the

application of technical and economic parameters.

- The deposits are not currently

being mined.

- There is surface evidence of

historic artisanal workings.

- No production data is

available.

|

JORC TABLE 1 -

SECTION 4 -

ESTIMATION AND REPORTING OF ORE

RESERVES

Ore Reserves are not reported so this is not

applicable to this announcement.

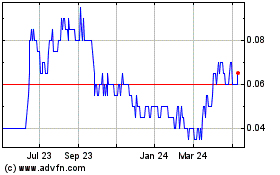

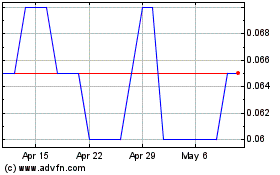

Xanadu Mines (TSX:XAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Xanadu Mines (TSX:XAM)

Historical Stock Chart

From Apr 2023 to Apr 2024