Anfield Energy Inc. (TSX.V: AEC; OTCQB: ANLDF; FRANKFURT:

0AD) (“Anfield” or “the Company”) is pleased to

provide a corporate update with regard to its operations.

Despite the continuing challenges created by

COVID-19, Anfield remains committed to achieving its goal of

uranium production with its solid asset portfolio providing a clear

and compelling path forward.

During 2021, Anfield has advanced its plans to

improve its market position, as outlined below:

• Raised approximately $4.8 million in

equity and received $7.5 million through warrant

exercises

Anfield raised approximately $4.8 million in

equity in 2021 and received approximately $7.5 million through

warrant exercises. Not only has this allowed Anfield to complete

additional work associated with its Charlie project, it has also

allowed the Company to replace the US$2.4 million of surety bonds

for its West Slope properties and fund the required increase to its

US$11.3 million reclamation bond for the Shootaring mill. Anfield

closed the year with $4.9 million on its balance sheet.

• Engaged BRS Engineering to assess

Anfield’s Taylor Ranch ISR project in Wyoming

Anfield engaged BRS Engineering to assess the

potential of the Company’s Taylor Ranch project. Under

consideration by BRS are plans to delineate a resource and

determine economics from historical work done on the property by

previous owners, along with the potential of resource confirmation

and expansion through a drill program.

Corey Dias, Anfield’s CEO commented: "2021 began

as a challenging year in the uranium sector; however, as the year

progressed there was positive movement in the commodity price and

overall sentiment. Further, nuclear energy is being increasingly

seen as essential to providing baseload electricity and providing a

critical part of the clean energy mix in both North America and

Europe. New generation small modular reactors (SMRs) with shorter

lead times and lower capital requirements are reducing investment

constraints. Moreover, the entry into the market by the Sprott

Physical Uranium Trust – following ongoing spot market purchases by

both large uranium-producing incumbents, Cameco and Kazatomprom -

brought a new dimension to the strategic importance of the uranium

spot market and highlighted the potential vulnerability of spot

market dependence by utilities. Finally, the recent unrest in

Kazakhstan and heightened tension between Russia and the West serve

as a reminder of the importance of stable mining jurisdictions and

assured uranium supplies. Given favorable trends in both the

uranium market and the nuclear sector and given increasing focus on

supply stability, we are confident of a continued upswing in

uranium prices.

We believe that recent market events provide

Anfield with an opportunity to further position itself as a

strategic player in the U.S. uranium market. Anfield’s asset

portfolio, consisting of both near-term and longer-term

opportunities, underscores its significant unrealized value. This

portfolio includes, among other assets, the outstanding Charlie ISR

project and the conventional uranium asset portfolio underpinned by

the Shootaring mill. We feel we are well positioned to thrive in

the upcoming uranium bull market.”

About AnfieldAnfield is a uranium and vanadium

development and near-term production company that is committed to

becoming a top-tier U.S. energy-related fuels supplier by creating

value through sustainable, efficient growth in its assets. Anfield

is a publicly-traded corporation listed on the TSX-Venture Exchange

(AEC-V), the OTCQB Marketplace (ANLDF) and the Frankfurt Stock

Exchange (0AD). Anfield is focused on two asset centers, as

summarized below:

Wyoming – Irigaray ISR Processing Plant (Resin Capture

and Processing Agreement)Anfield has signed a Resin

Capture and Processing Agreement with Uranium One whereby Anfield

would process up to 500,000 pounds per annum of its mined material

at Uranium One’s Irigaray processing plant in Wyoming. In addition,

the Company can both buy and borrow uranium from Uranium One in

order to fulfill some or all of its sales contracts.

Anfield’s 24 ISR mining projects are located in

the Black Hills, Powder River Basin, Great Divide Basin, Laramie

Basin, Shirley Basin and Wind River Basin areas in Wyoming.

Anfield’s three projects in Wyoming for which NI 43-101 resource

reports have been completed are Red Rim, Nine Mile Lake and

Clarkson Hill.

The Charlie Project, Anfield’s flagship ISR

uranium project, is located in the Pumpkin Buttes Uranium District

in Johnson County, Wyoming. The Charlie Project consists of a

720-acre Wyoming State uranium lease which has been in development

since 1969. A NI 43-101 Preliminary Economic Assessment has been

completed for the Charlie Project.

Arizona/Utah/Colorado – Shootaring Canyon MillA

key asset in Anfield’s portfolio is the Shootaring Canyon Mill in

Garfield County, Utah. The Shootaring Canyon Mill is strategically

located within one of the historically most prolific uranium

production areas in the United States, and is one of only three

licensed, permitted and constructed conventional uranium mills in

the United States.

Anfield’s conventional uranium assets consist of

mining claims and state leases in southeastern Utah, Colorado and

Arizona, targeting areas where past uranium mining or prospecting

occurred. Anfield’s conventional uranium assets include the

Velvet-Wood Project, the Frank M Uranium Project, the West Slope

Project as well as the Findlay Tank breccia pipe. A NI 43-101

Preliminary Economic Assessment has been completed for the

Velvet-Wood Project. The PEA is preliminary in nature and includes

inferred mineral resources that are considered too speculative

geologically to have economic considerations applied to them that

would enable them to be categorized as mineral reserves, and there

is no certainty that the preliminary economic assessment would be

realized. All conventional uranium assets are situated within a

200-mile radius of the Shootaring Mill.

On behalf of the Board of DirectorsANFIELD

ENERGY INC.Corey Dias, Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.Contact:Anfield Energy, Inc.Clive

MostertCorporate

Communications780-920-5044contact@anfieldenergy.comwww.anfieldenergy.com

Safe Harbor StatementTHIS NEWS RELEASE CONTAINS “FORWARD-LOOKING

STATEMENTS”. STATEMENTS IN THIS NEWS RELEASE THAT ARE NOT PURELY

HISTORICAL ARE FORWARD-LOOKING STATEMENTS AND INCLUDE ANY

STATEMENTS REGARDING BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS

REGARDING THE FUTURE.

EXCEPT FOR THE HISTORICAL INFORMATION PRESENTED

HEREIN, MATTERS DISCUSSED IN THIS NEWS RELEASE CONTAIN

FORWARD-LOOKING STATEMENTS THAT ARE SUBJECT TO CERTAIN RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR

IMPLIED BY SUCH STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL

FACTS, INCLUDING STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR

THAT INCLUDE SUCH WORDS AS “ESTIMATE,” “ANTICIPATE,” “BELIEVE,”

“PLAN” OR “EXPECT” OR SIMILAR STATEMENTS ARE FORWARD-LOOKING

STATEMENTS. RISKS AND UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT

ARE NOT LIMITED TO, THE RISKS ASSOCIATED WITH MINERAL EXPLORATION

AND FUNDING AS WELL AS THE RISKS SHOWN IN THE COMPANY’S MOST RECENT

ANNUAL AND QUARTERLY REPORTS AND FROM TIME-TO-TIME IN OTHER

PUBLICLY AVAILABLE INFORMATION REGARDING THE COMPANY. OTHER RISKS

INCLUDE RISKS ASSOCIATED FUTURE CAPITAL REQUIREMENTS AND THE

COMPANY’S ABILITY AND LEVEL OF SUPPORT FOR ITS EXPLORATION AND

DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE THAT THE

COMPANY’S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY WILL

ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING

STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE

COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING

STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD

DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS

AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE

CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR

INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL

OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE

RISK FACTORS DISCLOSED IN THE COMPANY’S PERIODIC REPORTS FILED FROM

TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY

MANAGEMENT OF THE COMPANY WHO TAKES FULL RESPONSIBILITY FOR ITS

CONTENTS.

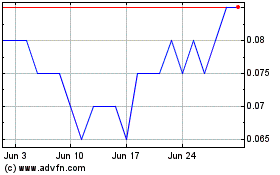

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Apr 2023 to Apr 2024