Anfield Energy Inc. (TSX.V: AEC; OTCQB: ANLDF; FRANKFURT:

0AD) (“Anfield” or “the Company”) is pleased to

announce that Anfield has engaged BRS Engineering (“BRS”) to

complete a mineral resource report for four of the nine West Slope

uranium/vanadium properties held by the Company (“West Slope”). The

West Slope properties are located in the prolific Uravan region of

Colorado.

The targeted West Slope properties are known as

JD-6, JD-7, JD-8 and JD-9, and represent a historical uranium and

vanadium resource of approximately 7Mlbs and 33Mlbs, respectively,

at the grades described below.

Corey Dias, Anfield CEO, states: “Given the

strengthening global sentiment related to the uranium market, we

are pleased to update and determine the potential economics for

four of our West Slope properties in Colorado. We believe that

these projects could serve as a critical portion of Anfield’s

long-term viable conventional uranium production – underpinned by

the Shootaring Canyon mill in Utah – as a part of its portfolio of

U.S. uranium assets.”

About The West Slope

Project

The West Slope Project, located in Montrose and

San Miguel Counties of southwestern Colorado, consist of nine

Department of Energy (DOE) leases, associated with adjacent lode

mining claims and leases, covering 6,913 acres on which past

uranium production has taken place. Between 1977 and 2006,

approximately 1.3Mlbs of uranium and 6.6Mlbs of vanadium were

produced from these mines. In 2007, Behre Dolbear was commissioned

by Cotter to produce a Technical Report for the West Slope Project

(Technical Report on Nine Properties Held by Cotter Corporation in

Montrose and San Miguel Counties, Colorado, USA, August 16, 2007).

Using available data and using a cut-off of 0.05% uranium, Behre

Dolbear estimated an in-place Measured Resource of 2.1Mt of uranium

at an average grade of 0.25% for a total of 11Mlbs of uranium and

an in-place Measured resource of 1.2Mt of vanadium at an average

grade of 1.2% for a total of 53Mlbs of vanadium.

|

|

Historical Resources - West Slope |

|

|

Intercepts greater than 0.05% U3O8 |

|

|

U3O8 |

V205 |

|

Property |

Tons (millions) |

% |

|

Pounds (millions) |

% |

|

Pounds (millions) |

|

JD-6 |

0.16 |

0.15 |

|

0.48 |

0.75 |

|

2.4 |

|

JD-7 |

0.77 |

0.26 |

|

4.0 |

1.1 |

|

17 |

|

JD-8 |

0.31 |

0.24 |

|

1.5 |

1.3 |

|

7.9 |

|

JD-9 |

0.23 |

0.24 |

|

1.1 |

1.2 |

|

5.7 |

|

SR-11 |

0.17 |

0.29 |

|

0.99 |

1.9 |

|

6.6 |

|

SR-13A |

0.01 |

0.22 |

|

0.26 |

1.4 |

|

1.7 |

|

SM-18N |

0.097 |

0.23 |

|

0.45 |

1.1 |

|

2.1 |

|

SM-18S |

0.047 |

0.26 |

|

0.24 |

1.5 |

|

1.3 |

|

LP-21 |

0.19 |

0.23 |

|

0.87 |

1.2 |

|

4.6 |

|

CM-25 |

0.092 |

0.36 |

|

0.66 |

1.7 |

|

3.2 |

|

Total |

2.1 |

0.25 |

|

11 |

1.2 |

|

53 |

|

|

|

|

|

|

|

|

|

Anfield considers these estimates to be

historical in nature and cautions that a qualified person has not

done sufficient work to classify the historical estimate as current

mineral resources or mineral reserves and Anfield is not treating

the historical estimate as a current mineral resource or mineral

reserves. A qualified person will need to conduct an analysis of

data from previous exploration activities to delineate an updated

uranium/vanadium resource estimate.

About BRS

BRS, Inc. is an engineering and geology

consulting corporation with expertise in mining and mineral

exploration. Of particular note, it specializes in uranium

exploration, mineral resource evaluation, mine design, feasibility,

mine operations, and reclamation. It has completed numerous uranium

projects including technical reports and feasibility studies for

underground, open pit, ISR, and conventional uranium mills.

Representative projects include technical reports and due diligence

for project financing for conventional uranium projects including

the Sheep Mountain Project in Wyoming, the Marquez/Juan Tafoya

Project in New Mexico, the Coles Hill Project in Virginia, and

numerous ISR uranium projects in Wyoming, Texas and Paraguay.

Douglas L. Beahm, P.E., P.G., the principal

engineer at BRS, is a Qualified Person as defined in NI 43-101 with

more than 45 years of professional and managerial experience. Mr.

Beahm has a proven track record in a variety of mining and mine

reclamation projects including surface and underground mining, heap

leach recovery, ISR, and uranium mill tailings projects. Mr.

Beahm’s experience includes coal, precious metals, and industrial

minerals, but his emphasis throughout his career has been on

uranium. Mr. Beahm has reviewed and approved the technical content

of this news release.

About Anfield

Anfield is a uranium and vanadium development

and near-term production company that is committed to becoming a

top-tier energy-related fuels supplier by creating value through

sustainable, efficient growth in its assets. Anfield is a

publicly-traded corporation listed on the TSX Venture Exchange

(AEC-V), the OTCQB Marketplace (ANLDF) and the Frankfurt Stock

Exchange (0AD). Anfield is focused on two asset centers, as

summarized below:

Wyoming – Resin Capture and Processing

AgreementAnfield has signed a Resin Capture and Processing

Agreement with Uranium One whereby Anfield would process up to

500,000 pounds per annum of its mined material at Uranium One’s

Irigaray processing plant in Wyoming.

The Charlie Project, Anfield’s flagship uranium

project, is located in the Pumpkin Buttes Uranium District in

Johnson County, Wyoming. The Charlie Project consists of a 720-acre

Wyoming State uranium lease which has been in development since

1969. An NI 43-101 Preliminary Economic Assessment has been

completed for the Charlie Project.

Anfield’s 24 ISR mining projects are located in

the Black Hills, Powder River Basin, Great Divide Basin, Laramie

Basin, Shirley Basin and Wind River Basin areas in Wyoming.

Anfield’s three projects in Wyoming for which NI 43-101 resource

reports have been completed are Red Rim, Nine Mile Lake and

Clarkson Hill.

Arizona/Utah/Colorado – Shootaring Canyon

MillAnother asset in Anfield’s portfolio is the Shootaring

Canyon Mill in Garfield County, Utah. The Shootaring Canyon Mill is

strategically located within one of the historically most prolific

uranium production areas in the United States, and is one of only

three licensed, permitted and constructed conventional uranium

mills in the United States.

Anfield’s conventional uranium assets consist of

mining claims and state leases in southeastern Utah, Colorado and

Arizona, targeting areas where past uranium mining or prospecting

occurred. Anfield’s conventional uranium assets include the

Velvet-Wood Project, the Frank M Uranium Project, the West Slope

Project as well as the Findlay Tank breccia pipe. An NI 43-101

Preliminary Economic Assessment has been completed for the

Velvet-Wood Project. The PEA is preliminary in nature, and includes

inferred mineral resources that are considered too speculative

geologically to have economic considerations applied to them that

would enable them to be categorized as mineral reserves, and there

is no certainty that the preliminary economic assessment would be

realized. All conventional uranium assets are situated within a

200-mile radius of the Shootaring Mill.

On behalf of the Board of DirectorsANFIELD

ENERGY INC.Corey Dias, Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.Contact:Anfield Energy, Inc.Clive

MostertCorporate

Communications780-920-5044contact@anfieldenergy.comwww.anfieldenergy.com

Safe Harbor Statement

THIS NEWS RELEASE CONTAINS “FORWARD-LOOKING

STATEMENTS”. STATEMENTS IN THIS NEWS RELEASE THAT ARE NOT PURELY

HISTORICAL ARE FORWARD-LOOKING STATEMENTS AND INCLUDE ANY

STATEMENTS REGARDING BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS

REGARDING THE FUTURE.

EXCEPT FOR THE HISTORICAL INFORMATION PRESENTED

HEREIN, MATTERS DISCUSSED IN THIS NEWS RELEASE CONTAIN

FORWARD-LOOKING STATEMENTS THAT ARE SUBJECT TO CERTAIN RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR

IMPLIED BY SUCH STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL

FACTS, INCLUDING STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR

THAT INCLUDE SUCH WORDS AS “ESTIMATE,” “ANTICIPATE,” “BELIEVE,”

“PLAN” OR “EXPECT” OR SIMILAR STATEMENTS ARE FORWARD-LOOKING

STATEMENTS. RISKS AND UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT

ARE NOT LIMITED TO, THE RISKS ASSOCIATED WITH MINERAL EXPLORATION

AND FUNDING AS WELL AS THE RISKS SHOWN IN THE COMPANY’S MOST RECENT

ANNUAL AND QUARTERLY REPORTS AND FROM TIME-TO-TIME IN OTHER

PUBLICLY AVAILABLE INFORMATION REGARDING THE COMPANY. OTHER RISKS

INCLUDE RISKS ASSOCIATED FUTURE CAPITAL REQUIREMENTS AND THE

COMPANY’S ABILITY AND LEVEL OF SUPPORT FOR ITS EXPLORATION AND

DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE THAT THE

COMPANY’S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY WILL

ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING

STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE

COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING

STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD

DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS

AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE

CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR

INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL

OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE

RISK FACTORS DISCLOSED IN THE COMPANY’S PERIODIC REPORTS FILED FROM

TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY

MANAGEMENT OF THE COMPANY WHO TAKES FULL RESPONSIBILITY FOR ITS

CONTENTS.

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

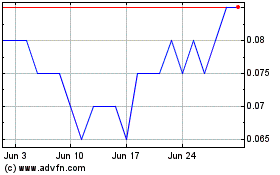

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Apr 2023 to Apr 2024