Ackroo releases Q2 2021 Financial Results

August 05 2021 - 7:00AM

Ackroo Inc. (the “

Company” or

“

Ackroo”) (TSX-V: AKR) (OTC: AKRFF), a loyalty

marketing, payments and point-of-sale technology and services

provider, has filed its financial results for the period ended June

30, 2021. The results for the period ended June 30, 2021 reflect

the Company’s 14th consecutive positive adjusted EBITDA quarter and

includes a 2% increase in revenues over the same period the

previous year. The Company has continued to maintain a strong 88%

gross margin and an attractive revenue mix with 85% recurring in

nature. Over the quarter, Ackroo acquired InterActive DMS and

continued its re-investment into sales and marketing to drive

additional organic growth in future quarters.

“We are encouraged with our continued progress

as we finished our 5th quarter since COVID-19 lockdowns began” said

Steve Levely, CEO of Ackroo. “Similar to Q1 we continued to see

lower spend in one time revenue items and saw a higher attrition

rate then previous years due to the various restrictions that still

existed for many of our clients. Despite the challenging

environment we have sustained our business and have continued to

re-invest earnings into sales and marketing to drive much larger

future organic growth. We also acquired InterActive DMS, our 11th

acquisition. This strategic acquisition has doubled the number of

AckrooPOS customers, increased our relevance in automotive, and

expands our geographic reach further into the US. We are in a

strong position to remain active and opportunistic with our M&A

strategy while building a solid foundation for organic growth

leading to great results in the quarters ahead.”

The complete financial results for Ackroo are

available at www.sedar.com. Highlights include:

- Revenue of $1,469,357 for the three-month

period ended June 30, 2021 as compared to $1,440,625 for the

three-month period ended June 30, 2020 (2%

increase);

- Subscription and Service revenue was

$1,250,299 for the three-month period ended June

30, 2021 as compared to $1,220,994 for the three-month period ended

June 30, 2020 (2% increase);

- Positive adjusted EBITDA of $45,026 for the

three-month period ended June 30, 2021, as compared to positive

adjusted EBITDA of $292,631 for the three-month period ended June

30, 2020; (85% decline)

- Gross profit margin of $1,295,369 (88%) for

the three-month period ended June 30, 2021, as compared to

$1,308,610 (90%) for the three-month period ended June 30, 2020

(2% decline).

About Ackroo Through vendor and

industry consolidation, Ackroo provides marketing, payment and

point-of-sale solutions for merchants of all sizes. Ackroo’s

self-serve, data driven, cloud-based marketing platform helps

merchants in-store and online process and manage loyalty, gift card

and promotional transactions at the point of sale in order to

attract, engage and grow their customers while increasing their

revenues and margins. Ackroo’s payment services provide merchants

with low-cost payment processing options through some of the

world’s largest payment technology and service providers. Ackroo’s

hybrid management and point-of-sale solutions help manage and

optimize the general operations for niche industry’s including golf

clubs, automotive dealers and more. All solutions are focused on

helping to consolidate, simplify and improve the merchant

marketing, payments and point-of sale ecosystem for their clients.

Ackroo is headquartered in Hamilton, Ontario, Canada. For more

information, visit: www.ackroo.com.

For information, please contact:

|

Steve Levely Chief Executive Officer | Ackroo Tel:

416-360-5619 x730 Email: slevely@ackroo.com |

|

The TSX Venture Exchange has neither approved

nor disapproved the contents of this press release. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward Looking Statements This

release contains forecasts and forward-looking statements that are

not guarantees of future performance and activities and are subject

to risks and uncertainties. The Company has based these

forward-looking statements on assumptions and assessments made by

its management in light of their experience and their perception of

historical trends, current conditions, expected future developments

and other factors they believe to be appropriate. Important factors

that could cause actual results, developments and business

decisions to differ materially from those anticipated in these

forward-looking statements include, but are not limited to: the

company’s ability to raise enough capital to support the company’s

go forward plans; the overall global economic environment; the

impact of competition and new technologies; general market,

political and economic conditions in the countries in which the

company operates; projected capital expenditures and liquidity;

changes in the company’s strategy; government regulations and

approvals; changes in customers’ budgeting priorities; plus other

factors that may arise. Any forward-looking statements in this

press release are made as of the date hereof, and the company

undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

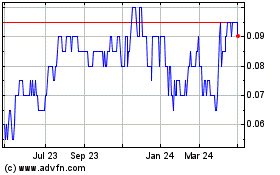

Ackroo (TSXV:AKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

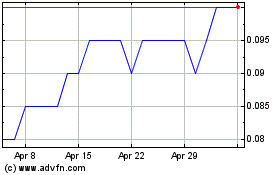

Ackroo (TSXV:AKR)

Historical Stock Chart

From Apr 2023 to Apr 2024