AnalytixInsight Inc. (“

AnalytixInsight” or the

“

Company”) (TSXV: ALY) is pleased to announce the

closing of its previously-announced overnight marketed public

offering (the “

Offering”), pursuant to which it

issued 13,225,000 units of AnalytixInsight (the

“

Units”), at a price of $0.70 per Unit

(“

Issue Price”) for aggregate gross proceeds of

$9,257,500, which includes 1,725,000 Units issued at the Issue

Price upon full exercise of the over-allotment option. The Units

were offered by way of a short form prospectus dated June 22, 2021

filed in each of the provinces of Canada (other than Quebec) (the

“

Prospectus”).

Each Unit consists of one common share of

AnalytixInsight (a “Common Share”) and one-half of

a common share purchase warrant (each whole warrant, a

“Warrant”). Each whole Warrant entitles its holder

to purchase one common share of AnalytixInsight at a price of $0.90

for a period of 36 months following closing of the Offering,

provided that if, at any time following the closing of the

Offering, the volume weighted average share price of the Common

Shares on the TSX Venture Exchange is greater than $1.80 per Common

Share for a period of 10 consecutive trading days, AnalytixInsight

shall have the right, within 10 business days of the occurrence of

such event, to accelerate the expiry date of the warrant by giving

notice to the holders of the Warrants, and issuing a concurrent

press release, of the acceleration of the expiry date to a date

that is at least 30 trading days following the date of written

notice to warrantholders.

The net proceeds from the Offering are expected

to be used for digital stock trading platform development and North

American deployment of MarketWall products, acquiring servers and

data for the implementation of real time stock quotations,

administrative expenses and for general working capital purposes,

as further described in the Prospectus, which is available on the

Company’s SEDAR profile at www.sedar.com.

The Offering was led by Canaccord Genuity Corp.

(“Canaccord”) and Cantor Fitzgerald Canada

Corporation, acting as the co-lead underwriters and joint

bookrunners, and including Roth Canada, ULC (collectively, the

“Underwriters”). In connection with the Offering,

the Underwriters received an aggregate cash commission of $648,025

and were granted 925,750 compensation warrants

(“Compensation Warrants”), with each Compensation

Warrant entitling the holder to purchase one unit at the Issue

Price until June 28, 2024, with each unit consisting of one Common

Share and one-half of one Common Share purchase warrant, which

entitles the holder of a whole warrant to acquire an additional

Common Share on the same terms as the Warrants. Additionally,

Canaccord received a corporate finance fee payable through the

issuance of 176,642 units, with each unit consisting of one Common

Share and one-half of one Common Share purchase warrant, which

entitles the holder of a whole warrant to acquire an additional

Common Share on the same terms as the Warrants.

The securities described herein have not been,

nor will they be, registered under the United States Securities Act

of 1933, as amended, or any state securities laws and may not be

offered or sold in the United States or to U.S. persons absent

registration or an applicable exemption from the registration

requirements. This press release shall not constitute an offer to

sell or the solicitation of an offer to buy nor shall there be any

sale of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

ABOUT ANALYTIXINSIGHT INC.

AnalytixInsight Inc. is an Artificial

Intelligence, machine-learning company. AnalytixInsight’s financial

analytics platform CapitalCube.com algorithmically analyzes market

price data and regulatory filings to create insightful actionable

narratives and research on approximately 50,000 global companies

and ETFs, providing high-quality financial research and content for

investors, information providers, finance portals and media.

AnalytixInsight also designs and implements Workforce Optimization

solutions for large global enterprises. AnalytixInsight holds a 49%

interest in MarketWall, a developer of FinTech solutions for

financial institutions. For more information, visit

AnalytixInsight.com.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Scott UrquhartVP Corporate

DevelopmentScott.Urquhart@AnalytixInsight.comTel: (416)

522-3975

NOTICE REGARDING FORWARD-LOOKING

STATEMENTS

This press release contains “forward-looking

information” or “forward-looking statements” within the meaning of

applicable securities legislation. Forward-looking information

includes, without limitation, statements regarding the use of

proceeds of the Offering, and the acceleration of the Warrants.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as “plans”, “expects” or “does

not expect”, “is expected”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates” or “does not anticipate”, or

“believes”, or variations of such words and phrases or statements

that certain actions, events or results “may”, “could”, “would”,

“might” or “will be taken”, “occur” or “be achieved”.

We have made certain assumptions about the

forward-looking information and statements, including assumptions

about: the use of proceeds of the Offering. Even though our

management believes that the assumptions made and the expectations

represented by such statements or information are reasonable, there

can be no assurance that the forward-looking information or

statement will prove to be accurate. Many assumptions may be

difficult to predict and are beyond our control.

Forward-looking information and statements are

also subject to known and unknown risks, uncertainties and other

factors that may cause the actual results, level of activity,

performance or achievements of AnalytixInsight, as the case may be,

to be materially different from those expressed or implied by such

forward-looking information, including but not limited to: general

business, economic, competitive, geopolitical and social

uncertainties; the Company’s technology and revenue generation;

risks associated with operation in the technology sector; the

ability to successfully integrate new technologies and employees;

foreign operations risks; and other risks inherent in the

technology industry.

We refer potential investors to the “Risk

Factors” section of the annual information form of AnalytixInsight

dated May 14, 2021 and the Prospectus, which are available under

AnalytixInsight’s profile on SEDAR at www.sedar.com, for additional

risks regarding AnalytixInsight.

Although AnalytixInsight has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information or statements.

AnalytixInsight does not undertake to update any forward-looking

information, except in accordance with applicable securities

laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE.

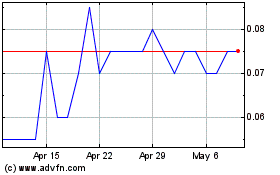

AnalytixInsight (TSXV:ALY)

Historical Stock Chart

From Mar 2024 to Apr 2024

AnalytixInsight (TSXV:ALY)

Historical Stock Chart

From Apr 2023 to Apr 2024