Bullion Gold Announces Option Agreement to Acquire Up to 100% of the Bousquet Property, Cadillac Break, Abitibi

March 08 2021 - 6:00AM

Bullion Gold Resources Corp. (TSX-V: BGD)

(“

Bullion Gold” or the

“

Corporation”) is pleased to announce that it has

entered into an Option Agreement (the “Agreement”) with Vantex

Resources Ltd. (“Vantex”) to acquire up to 100% of the Bousquet

Property (the “Property”) located on the historical Cadillac Break.

The Property consists of two claim blocks totalling 70 claims

covering 1515.55 ha. The Bousquet property is in the Abitibi Region

of the Province of Québec, about 30 kilometers west of

Rouyn-Noranda.

The Bousquet Property is underlain by

meta-sedimentary rocks of the Cadillac, Timiskaming and Pontiac

Groups and from volcanic flows and intrusives of the Piche Group.

The Cadillac-Larder Lake Break crosses the property for 2.5 km in

the northern part of the Normar Block. There are several gold mines

found along or adjacent to the Cadillac-Larder Lake Break that cuts

across the Bousquet Lake Property. Between 1926 and 2020, in excess

of twenty (20) mines have produced over 25 million ounces of gold

along the Cadillac Break within the Bousquet-Cadillac district. The

Cadillac mining camp is characterized by three types of

mineralization related to distinct gold-bearing geological

settings: gold-bearing massive sulphide lenses (Bousquet 2 and La

Ronde mines), gold-rich polymetallic veins (Doyon and Mouska mines)

and auriferous veins associated with regional E-W trending faults

(Lapa deposit).

A strong gold mineralized system was discovered

in the southern portion of the Bousquet Lake Property. Three gold

showings, Decoeur, Paquin East and Paquin West and Calder-Bousquet,

were discovered in the early exploration work (1932-1945) on the

property. These showings have probably been formed in the same

mineralizing episode within regional E-W trending faults. On the

Decoeur showing, grades of 8.40 g/t Au over 1.77 m, 4.35 g/t Au

over 4.83 and 4.04 g/t Au over 1.52 m were intersected in

historical drill holes. On the Paquin showings, 3.73 g/t Au over

5.49 m, 5.91 g/t Au over 3.02 m and 6.84 and 6.53 g/t Au over 2.44

m were intersected in historical drilling. An intercept of 8.09 g/t

Au over 2.0 m was also intersected on the Calder-Bousquet gold

occurrence.

The gold mineralization is located in a fold

zone above the 250m level. Strong possibilities exist that other

folds from the same deformation exist laterally or at depth. The

Blackfly group of claims has been little explored in the past due

to the paucity of outcrops but the use of new geophysical methods

can generate good and valid targets from the deposit models of this

high quality location within one of the most prolific world class

gold belt.

Gold mineralization was also found in a 2003

drill program in the felsic intrusion (called tonalite) within the

Cadillac fault zone. The intrusive is found between two

talc-chlorite schist units of the Piche Group. Hole TMN-03-31

intersected 4.75 g/t Au over 1.5 m in quartz veins, veinlets, and

zones of silicification and hole TMN-03-08 intersected 1.42 g/t Au

over 1.5 m and 0.71 g/t Au over 5.7 m gold also in the

tonalite.

“We are incredibly pleased with this option

agreement, which positions us strategically on the Cadillac Fault,

a globally recognized gold producing environment. We were attracted

by the Property due to the interesting historical showings (Paquin

Est, Paquin Ouest and Decoeur) and by the fact that these showings

remain open both laterally and at depth. To our knowledge, no depth

survey (more than 250 meters) has been carried out on the

property.” Said Jonathan Hamel, President and CEO of Bullion Gold

Resources Corp.

Terms of Agreement

Under the terms of the Agreement, the Company

may earn a 100% interest in seventy-eight (78) claims forming The

Property by satisfying the following conditions, subject to TSX

Venture Exchange approval:

I. paying to Vantex a total of

$150,000 as follows:

- $30,000 upon the

TSX Venture Exchange Approval (The “Effective Date”);

- a further

$30,000 on or before the 3th month anniversary of the Effective

Date;

- a further

$30,000 on or before the 6th month anniversary of the Effective

Date;

- a further

$30,000 on or before the 9th month anniversary of the Effective

Date; and

- a final $30,000

on or before the 12th month anniversary of the Effective Date.

II. allotting and issuing to

Vantex, as fully paid and non-assessable, a total of 1,250,000

Shares as follows:

- 500,000 upon

the Effective Date;

- a further

375,000 on or before the 6th month anniversary of the Effective

Date; and

- a final 375,000

on or before the 9th month anniversary of the Effective Date.

Vantex owns a 100% interest in the 52 claims of

the Blackfly block and owns a 60% interest in the Normar block (18

claims), the other 40% belongs to Nyrstar N.V. from Switzerland.

There are various royalty obligations on the mining claims.

Mr. Gilles Laverdière. P.Geo, director and

qualified person under NI 43-101 has read and approved this press

release.

About Bullion Gold

Bullion Gold is involved in the identification,

exploration and development of viable mineral properties in the

Province Quebec and British Columbia. For more information on the

Corporation, visit www.bulliongold.ca

For further information, please

contact:

Jonathan HamelPresident and

CEOjhamel@bulliongold.ca514-531-8129

Other Information

The TSX Venture Exchange and its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts no responsibility for the veracity or

accuracy of its content.

Forward-Looking

Statements: This press release contains

forward-looking statements. Forward-looking statements are

frequently characterized by words such as "plan", "expect",

"project", "intend", "believe", “anticipate", "estimate", "may",

"will", "would", "potential", "proposed" and other similar words,

or statements that certain events or conditions "may" or "will"

occur. The forward-looking statements are based on certain key

expectations and assumptions made by the Corporation. Although

Bullion Gold believes that the expectations and assumptions on

which the forward-looking statements are based are reasonable,

undue reliance should not be placed on the forward-looking

statements because Bullion Gold can give no assurance that they

will prove to be correct. Since forward-looking statements address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. Actual results could differ

materially from those currently anticipated due to a number of

factors and risks. In addition to other risks that may affect the

forward-looking statements in this press release are those set out

in the Corporation’s management discussion and analysis of the

financial condition and results of operations for the year ended

December 31, 2019 and the third quarter ended September 30, 2020,

which are available on the Corporation’s profile

at www.sedar.com. The forward-looking statements contained in

this press release are made as of the date hereof and Warrior Gold

undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

NOT FOR DISSEMINATION IN THE UNITED STATES OR

FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES AND DOES NOT CONSTITUTE

AN OFFER OF THE SECURITIES DESCRIBED HEREIN.

A figure accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/3d7c2fb1-10e3-4feb-9368-57e1af2b6187

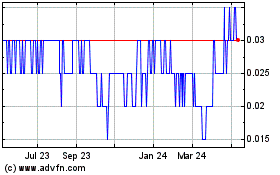

Bullion Gold Resources (TSXV:BGD)

Historical Stock Chart

From Mar 2024 to Apr 2024

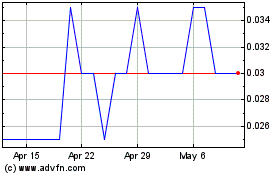

Bullion Gold Resources (TSXV:BGD)

Historical Stock Chart

From Apr 2023 to Apr 2024