Digihost Announces Record Results for the First Quarter of 2021

May 19 2021 - 6:30AM

Digihost Technology Inc. (“

Digihost” or the

“

Company”) (TSXV: DGHI; OTCQB: HSSHF) announces

its financial results as of and for the three months ended March

31, 2021 (all amounts in U.S. dollars, unless otherwise indicated).

The Company’s unaudited consolidated financial statements and

management’s discussion and analysis (“

MD&A”)

for periods ended March 31, 2021 and 2020 have been filed and made

accessible under the Company’s continuous disclosure profile on

SEDAR at www.sedar.com.

Michel Amar, CEO of Digihost, stated: “We are

extremely pleased by the record financial results achieved by

Digihost for the first quarter of 2021, reporting $5,910,974 of

total comprehensive income for the period, an increase of 872% over

the same period of last year. We are looking forward to building on

these results through our commitment to expand our business in an

environmentally and socially responsible way, thereby creating the

momentum to continue our success during the remainder of 2021 and

beyond.”

First Quarter 2021 Financial

Highlights

The following information compares the financial

results of the Company for the three months ended March 31, 2021

(“2021”) and the three months ended March 31, 2020

(“2020”):

- Record high total comprehensive

income of $5.9 million reported in 2021, compared to a total

comprehensive loss of $0.76 million in 2020, an increase of

872%;

- Revenue from digital currency

mining increased by 469% to $4.8 million in 2021 compared to $0.8

million in 2020;

- Gross profit margin increased to

44% in 2021 compared to a gross loss margin of 13% in 2020, an

increase in gross margin of 57%;

- The weighted average shares

outstanding in 2021 were 44,313,754 compared to 20,257,016 in

2020.

The following information compares the financial

position of the Company as at March 31, 2021

(“2021”) and as at December 31, 2020

(“2020”):

- Cash balance of $13.19 million in

2021 compared to $0.03 million in 2020, an increase of $13.16

million;

- Digital currencies balance of

$15.16 million in 2021, comprised of 260 Bitcoins, compared to

$4.51 million in 2020, comprised of 154 Bitcoins, an increase of

$10.65 million and 106 Bitcoins;

- Total assets of $43.54 million in

2021 compared to $16.52 million in 2020, an increase of $27.02

million;

- Total liabilities of $4.40 million

in 2021 compared to $6.08 million in 2020, a decrease of $1.68

million; and

- Total shareholders’ equity of

$39.14 million in 2021 compared to $10.44 million in 2020, an

increase of $28.70 million.

Recent Highlights

- On April 13, 2021, the Company

announced the closing of a private placement of shares and warrants

for gross proceeds of CA$25 million;

- On April 14, 2021, the Company

appointed international audit firm, Raymond Chabot Grant Thornton

LLP;

- On May 10, 2021, the Company

announced the status of its Nasdaq listing application and

diversification of cryptocurrency business model to include

Ethereum technology;

- On May 14, 2021, the Company

announced the acquisition of 9,900 Bitcoin Miners to increase its

hashrate by 925PH, and hosting agreement with Northern Data

AG;

- On May 17, 2021, the Company

reported on green energy consumption, stating that 90% of the

energy consumed by Digihost in its Bitcoin mining operations is

from sources that create zero carbon emissions and more than 50% of

the energy consumed by the Company is generated from renewable

sources; and

- The Company’s current cryptocurrency

holdings are comprised of: 564 Ethereum and 299 Bitcoin.

Michel Amar commented: “Our long-term vision and

business strategy is to expand our operations and evolve as a

leader in the blockchain technology sector. While cryptocurrency

mining is one application of blockchain technology, the blockchain

sector as a whole is a monumental leap forward in information

transparency, security, and decentralization. We are committed to

pursue every opportunity in this sector that allows us to create

significant shareholder value in an environmentally conscious

manner, with the goal of eventually eliminating the Company’s

already very low carbon footprint.”

|

(U.S.$ except per share data) |

Three Months Ended March 31 |

|

For the periods ended as indicated |

2021 |

|

2020 |

|

|

Revenue from digital currency mining |

4,767,075 |

|

838,310 |

|

|

Operating and maintenance costs |

(1,549,144 |

) |

(586,336 |

) |

|

Depreciation |

(1,109,796 |

) |

(363,290 |

) |

|

Gross profit (loss) |

2,108,135 |

|

(111,316 |

) |

|

General and administrative and other expenses |

(1,879,866 |

) |

(579,069 |

) |

|

Change in fair value of warrant liability |

- |

|

40,436 |

|

|

Gain on disposition of cryptocurrencies |

- |

|

28,590 |

|

|

|

|

|

|

Operating profit (loss) |

228,269 |

|

(621,359 |

) |

|

Net financial expenses |

(155,312 |

) |

(7,451 |

) |

|

Net income (loss) for the period |

72,957 |

|

(628,810 |

) |

|

|

|

|

|

Other comprehensive income |

|

|

|

Foreign currency translation adjustment |

1,456 |

|

- |

|

|

Revaluation of digital currency |

5,836,561 |

|

(137,014 |

) |

|

Total comprehensive income (loss) |

5,910,974 |

|

(765,824 |

) |

|

Basic and diluted loss per share – dilutedWeighted average number

of subordinate voting shares outstanding – basic and diluted |

(0.0044,313,754 |

) |

(0.0320,257,016 |

) |

About Digihost Technology

Inc.

Digihost Technology Inc. is a growth-oriented

blockchain technology company primarily focused on Bitcoin mining.

The Company's mining facilities are located in Upstate New

York, and are equipped with 78.7 MW of low-cost power with the

option to expand to 102MW. The Company is currently hashing at a

rate of 200PH with potential to expand to a rate of 3EH upon the

completion of the previously announced acquisition of a 60MW power

plant.

For further information, please contact:

Digihost Technology

Inc.www.digihost.caMichel Amar, Chief Executive

Officer T: 1-818-280-9758Email: michel@digihost.ca

Cautionary Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Except for the statements of historical fact,

this news release contains “forward-looking information” and

“forward-looking statements” (collectively, “forward-looking

information”) that is based on expectations, estimates and

projections as at the date of this news release. Forward-looking

information in this news release includes information about listing

on Nasdaq, hashrate expansion, diversification of operations to

include Ethereum technology, potential further improvements to

profitability and efficiency across mining operations, potential

for the Company’s long-term growth, and the business goals and

objectives of the Company. Factors that could cause actual results,

performance or achievements to differ materially from those

described in such forward-looking information include, but are not

limited to: risks relating to completion of the Nasdaq listing

process, continued effects of the COVID19 pandemic may have a

material adverse effect on the Company’s performance as supply

chains are disrupted and prevent the Company from operating its

assets; a decrease in cryptocurrency pricing, volume of transaction

activity or generally, the profitability of cryptocurrency mining;

further improvements to profitability and efficiency may not be

realized; the digital currency market; the Company’s ability to

successfully mine digital currency on the cloud; the Company may

not be able to profitably liquidate its current digital currency

inventory, or at all; a decline in digital currency prices may have

a significant negative impact on the Company’s operations; the

volatility of digital currency prices; and other related risks as

more fully set out in the Annual Information Form of the Company

and other documents disclosed under the Company’s filings at

www.sedar.com. The forward-looking information in this news release

reflects the current expectations, assumptions and/or beliefs of

the Company based on information currently available to the

Company. In connection with the forward-looking information

contained in this news release, the Company has made assumptions

about: the current profitability in mining cryptocurrency

(including pricing and volume of current transaction activity);

profitable use of the Company’s assets going forward; the Company’s

ability to profitably liquidate its digital currency inventory as

required; historical prices of digital currencies and the ability

of the Company to mine digital currencies on the cloud will be

consistent with historical prices; and there will be no regulation

or law that will prevent the Company from operating its business.

The Company has also assumed that no significant events occur

outside of the Company's normal course of business. Although the

Company believes that the assumptions inherent in the

forward-looking information are reasonable, forward-looking

information is not a guarantee of future performance and

accordingly undue reliance should not be put on such information

due to the inherent uncertainty therein.

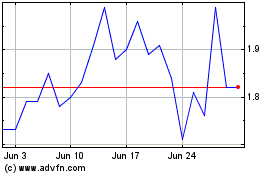

Digihost Technology (TSXV:DGHI)

Historical Stock Chart

From Mar 2024 to Apr 2024

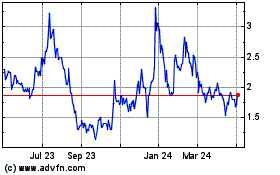

Digihost Technology (TSXV:DGHI)

Historical Stock Chart

From Apr 2023 to Apr 2024