Digihost Announces First Quarter Results With a 77% Increase in Coins Mined During Q1 2022 Compared to Q1 2021

May 17 2022 - 5:00AM

Digihost Technology Inc. (“

Digihost” or the

“

Company”) (Nasdaq: DGHI; TSXV: DGHI), an

innovative U.S. based Bitcoin (“

BTC”) mining

company, announces unaudited financial results for the first

quarter ended March 31, 2022 (all amounts in U.S. dollars, unless

otherwise indicated).

“The Company is pleased to present its first

quarter financial results, highlighted by a 77% increase in

Bitcoins mined on a year over year basis,” said Michel Amar,

Chairman and CEO of Digihost. “The Company’s previous investments

in infrastructure along with securing access to clean and renewable

energy sources led to revenue generation from mining of $7.3M, an

increase of 53% over the preceding year. Despite challenging market

conditions, Digihost is committed to its goal of being a leading

blockchain technology company. With approximately $31 million of

cash and cash equivalents currently on hand, valued at today’s BTC

price, and a mining operation with breakeven costs of approximately

$12,000 per BTC, based on current hashing difficulty and cost of

power, the Company is more than capable of sustaining its existing

operations, Digihost is clearly here to stay. Based upon the number

of BTC mined so far this quarter, the Company anticipates that it

will mine more BTC in Q2 than it mined during Q1 of this year.”

First Quarter 2022 Financial

Highlights

- Revenue from digital currency

mining of $7.3 million reported for the three-month period ended

March 31, 2022, compared to $4.8 million for the three-month period

ended March 31, 2021, an increase of 53%;

- For the three-month period ended

March 31, 2022, the Company mined a total of 186.53 BTC compared to

105.26 BTC for the three-month period ended March 31, 2021;

- Operating income for the

three-month period ended March 31, 2022 of $513 thousand, an

increase of 125% over the same period for the prior year;

- Realized net income of $59 thousand

for the three-month period ended March 31, 2022, compared to

realized net income of $73 thousand over the same period for the

prior year;

- EBITDA* of $2.0 million for the

three-month period ended March 31, 2022, compared to $1.3 million

over the same period for the prior year, an increase of 53%;

- Total assets of $97.4 million, an

increase of 22% compared to December 31, 2021;

- Cash and cash equivalents of $47.72

million as at March 31, 2022, an increase of 39% compared to

December 31, 2021;

- Working capital of $35.47 million

as at March 31, 2022, an increase of 34% compared to December 31,

2021;

- Property, plant and equipment

consisting primarily of the Company’s BTC miners (64%) and mining

infrastructure (36%) of $41.47 million;

- Raised CAD$13,300,000 of

institutional equity financing in a private placement at a premium

to market price; and

- Closed a $10,000,000 committed,

collateralized revolving credit facility.

* EBITDA is a non-IFRS financial measure and

should be read in conjunction with, and should not be viewed as an

alternative to or replacement of, measures of operating results and

liquidity presented in accordance with IFRS and refer readers to

reconciliations of non-IFRS measures included in the Company’s

MD&A.

|

(U.S.$ except per share data) |

Three Months Ended |

|

|

March 312022 |

March 312021 |

|

Revenue from digital currency mining |

7,312,342 |

|

4,767,075 |

|

|

Cost of power and production costs |

(2,143,327 |

) |

(1,549,144 |

) |

|

Miner lease agreement |

(3,056,125 |

) |

- |

|

|

Depreciation and amortization |

(1,531,598 |

) |

(1,109,796 |

) |

|

Gross profit |

581,292 |

|

2,108,135 |

|

|

General and administrative and other expenses |

(1,337,992 |

) |

(439,442 |

) |

|

Gain on sale of property, plant and equipment |

2,340,658 |

|

- |

|

|

Loss on settlement of debt |

- |

|

(274,882 |

) |

|

Foreign exchange |

(770,196 |

) |

- |

|

|

Other Income |

84,207 |

|

- |

|

|

Change in fair value - Miner Lease Agreement |

379,065 |

|

- |

|

|

Share based compensation |

(764,390 |

) |

(1,165,542 |

) |

|

|

|

|

|

Operating income |

512,644 |

|

228,269 |

|

|

Net financial expenses |

(84,375 |

) |

(155,312 |

) |

|

Net income before taxes |

428,269 |

|

72,957 |

|

|

Deferred tax expense |

(368,771 |

) |

- |

|

|

Net income for the period |

59,498 |

|

72,957 |

|

|

Foreign currency translation adjustment |

947,199 |

|

1,456 |

|

|

Revaluation of digital currency, net of tax |

(620,761 |

) |

5,836,561 |

|

|

Total comprehensive income for the period |

385,936 |

|

5,910,974 |

|

|

Basic and diluted income per shareWeighted average number of

subordinate voting shares outstanding – diluted |

0.0027,685,913 |

|

0.0014,771,251 |

|

At-the-Market Financing

Update

On March 4, 2022, the Company entered into an

offering agreement with H.C. Wainwright & Co., LLC as agent,

pursuant to which the Company established an at-the-market equity

program (the “ATM Program”). From the commencement of the ATM

Program through to the date hereof, the Company has not issued any

securities pursuant to the ATM Program.

About Digihost

Digihost is a growth-oriented blockchain

technology company primarily focused on BTC mining. Through its

self-mining operations and joint venture agreements, the Company is

currently hashing at a rate of approximately 450 PH/s.

For further information, please contact:

Digihost Technology

Inc.www.digihost.caMichel Amar, Chief Executive

Officer T: 1-818-280-9758Email: michel@digihost.ca

Cautionary Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Except for the statements of historical fact,

this news release contains “forward-looking information” and

“forward-looking statements” (collectively, “forward-looking

information”) that are based on expectations, estimates and

projections as at the date of this news release and are covered by

safe harbors under Canadian and United States securities laws.

Forward-looking information in this news release includes

information about potential further improvements to profitability

and efficiency across mining operations including, as a result of

the Company’s expansion efforts, acquisitions of equipment and

infrastructure, potential for the Company’s long-term growth, and

the business goals and objectives of the Company. Factors that

could cause actual results to differ materially from those

described in such forward-looking information include, but are not

limited to: the ability to obtain regulatory approval for and

complete acquisitions of equipment and infrastructure on the terms

as announced or at all; the ability to successfully integrate the

acquisitions of equipment and infrastructure on an economic basis

or at all; future capital needs and uncertainty of additional

financing, including the Company’s ability to utilize the Company’s

at-the-market offering program (the “ATM Program”) and the prices

at which the Company may sell securities in the ATM Program, as

well as capital market conditions in general; share dilution

resulting from the ATM Program and from other equity issuances;

risks relating to the strategy of maintaining and increasing

Bitcoin holdings and the impact of depreciating Bitcoin prices on

working capital; regulatory and other unanticipated issues that

prohibit us from declaring or paying dividends to our shareholders

that are payable in Bitcoin; continued effects of the COVID19

pandemic may have a material adverse effect on the Company’s

performance as supply chains are disrupted and prevent the Company

from operating its assets; approval of the Public Service

Commission or other regulatory or board approvals being received on

a timely basis, or at all; the acquisition of North Tonawanda, New

York facilities closing on timely basis, or at all; ability to

access additional power from the local power grid; a decrease in

cryptocurrency pricing, volume of transaction activity or

generally, the profitability of cryptocurrency mining; further

improvements to profitability and efficiency may not be realized;

the digital currency market; the Company’s ability to successfully

mine digital currency on the cloud; the Company may not be able to

profitably liquidate its current digital currency inventory, or at

all; a decline in digital currency prices may have a significant

negative impact on the Company’s operations; the volatility of

digital currency prices; and other related risks as more fully set

out in the Annual Information Form of the Company and other

documents disclosed under the Company’s filings at www.sedar.com.

The forward-looking information in this news release reflects the

current expectations, assumptions and/or beliefs of the Company

based on information currently available to the Company. In

connection with the forward-looking information contained in this

news release, the Company has made assumptions about: the current

profitability in mining cryptocurrency (including pricing and

volume of current transaction activity); profitable use of the

Company’s assets going forward; the Company’s ability to profitably

liquidate its digital currency inventory as required; historical

prices of digital currencies and the ability of the Company to mine

digital currencies on the cloud will be consistent with historical

prices; the ability to maintain reliable and economical sources of

power to run its cryptocurrency mining assets; the negative impact

of regulatory changes in the energy regimes in the jurisdictions in

which the Company operates; the ability to adhere to Digihost’s

dividend policy and the timing and quantum of dividends based on,

among other things, the Company’s operating results, cash flow and

financial condition, Digihost’s current and anticipated capital

requirements, and general business conditions; and there will be no

regulation or law that will prevent the Company from operating its

business. The Company has also assumed that no significant events

occur outside of the Company's normal course of business. Although

the Company believes that the assumptions inherent in the

forward-looking information are reasonable, forward-looking

information is not a guarantee of future performance and

accordingly undue reliance should not be put on such information

due to the inherent uncertainties therein.

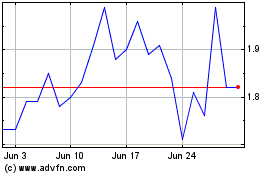

Digihost Technology (TSXV:DGHI)

Historical Stock Chart

From Mar 2024 to Apr 2024

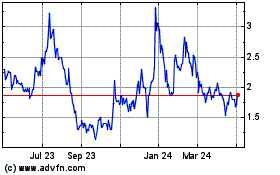

Digihost Technology (TSXV:DGHI)

Historical Stock Chart

From Apr 2023 to Apr 2024