EverGen Infrastructure Corp. Reports Second Quarter 2021 Results

August 30 2021 - 7:06PM

EverGen Infrastructure Corp. (“EverGen'' or the “Company”) (TSXV:

EVGN), today announced financial results for the second quarter

ended June 30, 2021. For further information on these results

please see the Company’s Consolidated Interim Financial Statements

and Management’s Discussion and Analysis filed on SEDAR

at www.sedar.com. All amounts are in Canadian dollars unless

otherwise stated and in accordance with IFRS.

Second Quarter Events & Updates

“Our second quarter performance was in line with seasonal

expectations for our existing assets, and included the acquisition

& integration of Fraser Valley Biogas, an existing RNG facility

that we have began to optimize in line with our focused RNG

expansion strategy,” said Chase Edgelow, CEO “We continue to

optimize efficiencies across all of our operating facilities

despite complexities of combining business operations and

unprecedented weather circumstances in the quarter. We are also

pleased to have executed our 20-year offtake agreement underpinning

our RNG expansion project at Net Zero Waste Abbotsford. These

milestones bolster our immediate growth potential and enhance our

competitive positioning enabling us to show leadership in

accelerating build out of renewable gas infrastructure in

Canada”.

-

Grew EverGen’s of production and development projects through the

acquisition of Western Canada’s first renewable natural gas ("RNG")

producing facility, Fraser Valley BioGas Ltd (“FVB”) . The FVB

facility currently produces over 80,000 gigajoules of RNG annually

– enough to heat 1,000 homes for a year - and has supplied RNG to

FortisBC Energy Inc. (“Fortis BC”) for the last decade. FVB

combines anaerobic digestion and biogas upgrading to produce RNG,

primarily by converting agricultural waste from local dairy

farms.

- On April 29, 2021 EverGen’s wholly owned subsidiary Net Zero

Waste Abbotsford announced it was entering onto a 20-year offtake

agreement with FortisBC.

Under the agreement, FortisBC will purchase up to 173,000 gigajoules of RNG annually for

injection into its natural gas system, upon completion of an

anaerobic digester project at EverGen’s existing Net Zero Waste

Abbotsford composting and organic processing facility in

Abbotsford, British Columbia. Once constructed this project will

convert municipal and commercial organic waste into enough energy

to meet the needs of more than 1,900 homes.

- Subsequent to the acquisition of Fraser Valley Biogas; we

immediately began optimization activities that have resulted in

increased RNG production at the facility.

- Subsequent to June 30, 2020, EverGen via its wholly owned

subsidiary Sea to Sky Soils entered into a 5 year feedstock

agreement with a local municipal entity for a material tonnage of

organic waste.

- Subsequent to June 30, 2021, EverGen completed an initial

public offering (“IPO”) of 3,080,000 units of the Company at a

price of $6.50 per Offered Unit for aggregate gross proceeds of

$20,020,000 . The Company’s common shares were listed on the TSX

Venture Exchange under the symbol “EVGN” and commenced trading on

August 4, 2021.

Financial Highlights Q2, 2021The consolidated

results of EverGen in the second quarter of 2021 demonstrate a

strong operating performance compared to it’s first year. The

incorporation of the revenues and associated operating costs of the

RNG business at FVB has further boosted the financial results.

Additionally, the impact of the global pandemic on the composting

businesses has been to increase the seasonal demand for residential

and commercial compost and soil products while also increasing the

volumes of organic feedstock from municipal and other sources.

Compared to the first quarter of 2021, operating profits are

significantly increased largely as a result of the seasonal demand

for compost products during the late spring and early summer

months.

-

Reported Revenue $3.3 million in the second

quarter. Revenue increased by $1.8 million, 111% over the

first quarter related to seasonal demand for compost driving an

increase in sales volumes together with the incorporation of RNG

revenues from FVB.

-

Adjusted EBITDA(1) of $1.9m in

the second quarter of 2021, an increase of $1.6m from the first

quarter primarily due to non-recurring professional, legal and

consulting fees relating to the integration of acquisitions,

implementation of processes and in preparation of readying EverGen

as a reporting issuer in Q1.

-

Gross Profit of $2.5m, 74% of revenue. Gross

Profit in Q1 was $1m and 62% of revenue, the increase being further

reflective of the strong seasonal performance of consolidated

composting operations and the addition of RNG sales.

Three months ended:

|

In millions of Canadian Dollars |

June 30, 2021(unaudited) |

March 31, 2021 |

|

Revenue |

3.35 |

|

1.59 |

|

|

Gross Profit |

2.48 |

|

0.99 |

|

|

Gross Profit % |

74% |

|

62% |

|

|

Operating profit (loss) (1) |

1.62 |

|

(0.48 |

) |

|

Net income (loss) |

(0.18 |

) |

(1.16 |

) |

|

Adjusted EBITDA(1) |

1.86 |

|

0.20 |

|

Statement of Financial

Position

|

In millions of Canadian Dollars |

June 30, 2021(unaudited) |

Dec 31, 2021 |

|

Total Assets |

64.96 |

50.51 |

|

|

Total Liabilities |

22.50 |

18.60 |

|

|

Equity |

42.47 |

31.91 |

|

|

Working Capital Surplus(1) |

2.31 |

(2.84 |

) |

About EverGen Infrastructure Corp.Based

in British Columbia, EverGen is focused on combating climate change

and helping communities contribute to a sustainable future through

its strategy to develop a Renewable Natural Gas Infrastructure

Platform, starting on the West Coast of Canada in British Columbia.

Incorporated in 2020, EverGen has been established to acquire,

develop, build, own and operate a portfolio of renewable natural

gas, waste to energy, and related infrastructure projects. EverGen

has acquired three facilities and has the intention to grow its

platform into other regions in North America in the future.

For more information, visit: https://www.evergeninfra.com/

| (1) |

Non-IFRS

Measures |

| |

EverGen uses certain financial measures referred to in this

press release to quantify its results that are not prescribed by

International Financial Report Standards (“IFRS”). The terms

“adjusted EBITDA”, “operating profit” and “working capital” are not

recognized measures under IFRS and may not be comparable to that

reported by other companies. EverGen believes that, in addition to

measures prepared in accordance with IFRS, the non-GAAP

measurements provide useful information to evaluate the Company’s

performance and ability to generate cash, profitability and meet

financial commitments. |

| |

These non-GAAP measures ae intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. |

| |

“Adjusted EBITDA” is defined as net earnings before finance

costs, taxes and depreciation and amortization adjusted for

one-time or non-recurring items, stock-based compensation expense,

litigation and other claims settlements, gains and losses resulting

from changes in certain balance sheet valuations, acquisition costs

and costs related to our initial public offering, including

estimated incremental auditing and professional services costs

incurred in connection with our initial public offering. |

| |

“Operating profit” is measured as gross profit, less operating

costs and general and administrative expenses. |

| |

“Working capital” for EverGen is calculated as current assets

less current liabilities |

Forward Looking StatementsThis news release

contains forward-looking statements and/or forward-looking

information (collectively, “forward looking statements”) within the

meaning of applicable securities laws. When used in this release,

such words as “would”, “will”, “anticipates”, believes”, “explores”

and similar expressions, as they relate to EverGen, or its

management, are intended to identify such forward-looking

statements. Such forward-looking statements reflect the current

views of EverGen with respect to future events, and are subject to

certain risks, uncertainties and assumptions. Many factors could

cause EverGen's actual results, performance or achievements to be

materially different from any expected future results, performance

or achievement that may be expressed or implied by such

forward-looking statements. These forward-looking statements are

subject to numerous risks and uncertainties, including but not

limited to: the impact of general economic conditions in Canada,

including the ongoing COVID19 pandemic; industry conditions

including changes in laws and regulations and/or adoption of new

environmental laws and regulations and changes in how they are

interpreted and enforced, in Canada; volatility of prices for

energy commodities; change in demand for clean energy to be offered

by EverGen; competition; lack of availability of qualified

personnel; obtaining required approvals of regulatory authorities,

in Canada; ability to access sufficient capital from internal and

external sources; optimization and expansion of organic waste

processing facilities and RNG feedstock; the realization of cost

savings through synergies and efficiencies expected to be realized

from the acquisitions of NZWA, SSS and FVB; the sufficiency of

EverGen’s liquidity to fund operations and to comply with covenants

under its credit facility; continued growth through strategic

acquisitions and consolidation opportunities; continued growth of

the feedstock opportunity from municipal and commercial sources,

many of which are beyond the control of EverGen. Forward-looking

statements included in this news release should not be read as

guarantees of future performance or results. Such statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results, performance or achievements to be

materially different from those implied by such forward looking

statements.

Readers are encouraged to review and carefully consider the risk

factors pertaining to EverGen described in EverGen’s final

prospectus dated May 17, 2021, which is accessible on EverGen's

SEDAR issuer profile at www.sedar.com. The forward-looking

statements contained in this release are made as of the date of

this release, and except as may be expressly be required by law,

EverGen disclaims any intent, obligation or undertaking to publicly

release any updates or revisions to any forward-looking statements

contained herein whether as a result of new information, future

events or results or otherwise, other than as required by

applicable securities laws.

Management of EverGen has included the above summary of

assumptions and risks related to forward-looking statements

provided in this release in order to provide shareholders with a

more complete perspective on EverGen's current and future

operations and such information may not be appropriate for other

purposes. EverGen's actual results, performance or achievement

could differ materially from those expressed in, or implied by,

these forward-looking statements and, accordingly, no assurance can

be given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits EverGen will derive therefrom.

This news release shall not constitute an offer to sell or the

solicitation of an offer to buy the securities in any

jurisdiction.

Contact:

Alison Gallagher778-837-5623alison@talkshopmedia.com

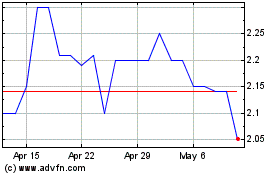

Evergen Infrastructure (TSXV:EVGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Evergen Infrastructure (TSXV:EVGN)

Historical Stock Chart

From Apr 2023 to Apr 2024