Firm Capital Apartment REIT Announces Completion of Previously Announced $26.8 Million Houston Property Joint Venture Buy-Out and $3.5 Million, 12% Preferred Capital Investment

May 02 2022 - 4:01PM

Firm Capital Apartment REIT (the “

Trust”), (TSXV:

FCA.U), (TSXV: FCA) is pleased to announce the closing of the

previously announced (see press release dated April 18, 2022)

acquisitions of a 50% interest in another of the Trust’s Equity

Accounted Investments located in Houston, Texas based on a $26.8

million valuation (the “

Houston Transaction”

and/or “

Houston Property”) and previously

announced (see press release dated April 18, 2022) $3.5 million,

12% Preferred Capital Investment. In addition, the Trust has

completed the full draw of the previously announced (see press

releases dated April 18, 2022 and April 21, 2022) CAD$13 million

bridge loan (the “

Bridge Loan”):

- $26.8 Million Houston

Property Joint Venture Buy-Out: The Trust is pleased to

announce the closing of the acquisition from its unrelated

partner of their 50% interest in another of the Trust’s Houston,

Texas Equity Accounted Investments. The buy-out price of the 50%

interest from the unrelated partner is based on a $26.8 million

valuation for 100% of the Houston Property that was received by way

of an unsolicited offer from an unrelated third party. Based on the

existing $11.1 million first mortgage and the Trust’s $4.7 million

current common and preferred investment, the Trust bought out the

unrelated partner for approximately $5.3 million (including closing

costs). Based on the $26.8 million valuation, the Trust is

acquiring the controlling interest at a forecasted five year Return

on Equity or ROE of approximately 7.4% and a weighted average

capitalization rate of 6.6%. The Trust now controls 100% of the

Houston Property and will report it going forward as an Investment

Property on the Trust’s financial statements;

- $3.5 Million, 12% Preferred

Capital Investment: The Trust has completed the previously

announced $3.5 million investment in the form of Preferred Capital

to an unrelated third party for the recapitalization of a

multi-residential portfolio located in Sioux Falls, South Dakota.

Terms of the three year Preferred Capital Investment were as

follows: (i) 12% interest per annum throughout the entire three

year term, of which 7% per annum is current pay, with the remaining

5% per annum to accrue and compound monthly for the first year;

(ii) 8% per annum with the remaining 4% per annum to accrue and

compound monthly for the second year; (iii) 9% per annum with the

remaining 3% per annum to accrue and compound monthly for the third

year;

- CAD$13 Million Bridge

Loan: In order to complete the above referenced

transactions, the Trust drew down the remaining CAD$8 million under

the Bridge Loan. The borrower under the Bridge Loan is FCARP

Limited Partnership, a wholly owned subsidiary of the Trust. The

Bridge Loan was provided by a related party of the Trust, and

thereafter transferred to, among others, certain trustees of the

Trust (who together have a total commitment of CAD$4.65 million of

the total CAD$13 million), As noted in the Trust's April 18, 2022

press release, the Trust has agreed to guarantee the payment and

performance of the Bridge Loan. As such, the provision of the

Bridge Loan and the guarantee by the Trust constitutes a "related

party transaction" as defined in Multilateral Instrument 61- 101 –

Protection of Minority Securityholders in Special Transactions

("MI 61-101"), but is exempt from the valuation

requirement and the minority approval requirement pursuant to

subsections 5.5(a) and 5.7(a) of MI 61-101, respectively, as the

value of the Bridge Loan and associated guarantee does not

represent more than 25% of the Trust's market capitalization, as

determined in accordance with MI 61-101.

The Bridge Loan and guarantee provided by the

Trust in connection therewith was approved by the trustees of the

Trust who were independent in respect of the transactions. The

material change report in respect of the transaction will be filed

less than 21 days before the closing of the transaction as the

Trust would like to proceed with the transaction in a timely

manner.

ABOUT FIRM CAPITAL APARTMENT REAL ESTATE

INVESTMENT TRUST Firm Capital Apartment Real Estate

Investment Trust is a U.S. focused real estate investment trust

that pursues multi-residential income producing real estate and

related debt investments on both a wholly owned and joint venture

basis. The Trust has ownership interests in a total of 1,846

apartment units diversely located in Florida, Connecticut, Texas,

New York, New Jersey, Georgia and Maryland.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

Certain information in this news release

constitutes forward-looking statements under applicable securities

law. Any statements that are contained in this news release that

are not statements of historical fact may be deemed to be

forward-looking statements. Forward-looking statements are often

identified by terms such as "may", "should", "anticipate",

"expect", "intend" and similar expressions.

Forward-looking statements necessarily involve

known and unknown risks, including, without limitation, risks

associated with general economic conditions; adverse factors

affecting the U.S. real estate market generally or those specific

markets in which the Trust holds properties; volatility of real

estate prices; inability to access sufficient capital from internal

and external sources, and/or inability to access sufficient capital

on favourable terms; industry and government regulation; changes in

legislation, income tax and regulatory matters; the ability of the

Trust to implement its business strategies; competition; currency

and interest rate fluctuations and other risks. Additional risk

factors that may impact the Trust or cause actual results and

performance to differ from the forward looking statements contained

herein are set forth in the Trust's Annual Information Form under

the heading Risk Factors (a copy of which can be obtained under the

Trust's profile on www.sedar.com).

Readers are cautioned that the foregoing list is

not exhaustive. Readers are further cautioned not to place undue

reliance on forward-looking statements as there can be no assurance

that the plans, intentions or expectations upon which they are

placed will occur. Such information, although considered reasonable

by management at the time of preparation, may prove to be incorrect

and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are

expressly qualified by this cautionary statement. Except as

required by applicable law, the Trust undertakes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise.

Neither the Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For further information, please contact:

| Sandy Poklar |

|

Mark Goldreich |

| President & Chief Executive Officer |

|

Chief Financial Officer |

| (416) 635-0221 |

|

(416) 635-0221 |

| |

|

|

| For Investor Relations information, please

contact: |

| |

|

|

| Victoria Moayedi |

|

|

| Director, Investor Relations |

|

|

| (416) 635-0221 |

|

|

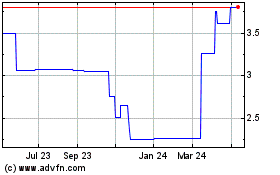

Firm Capital Apartment R... (TSXV:FCA.U)

Historical Stock Chart

From Mar 2024 to Apr 2024

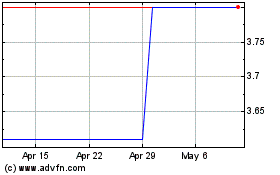

Firm Capital Apartment R... (TSXV:FCA.U)

Historical Stock Chart

From Apr 2023 to Apr 2024