Highland Copper Company Inc. (TSXV: HI, OTCQB: HDRSF) (the

“

Company” or “

Highland”) is

pleased to announce that it has entered today into a share purchase

agreement with Sweetwater Royalties

(“

Sweetwater”), a privately held company owned by

Orion Mine Finance (“

Orion”), pursuant to which

the Company has agreed to sell to Sweetwater its UPX properties

located in the Upper Peninsula of the State of Michigan, U.S.A. for

cash consideration of US$3 million, the assumption by Sweetwater of

the US$15 million principal amount owing under a promissory note,

and other terms and conditions described below (the

“

Transaction”).

The Company also announces that it intends to

complete a non-brokered private placement of approximately

260,000,000 units (the “Units”) at C$0.10 per

Unit, to raise up to C$26 million (the

“Offering”). Orion, a 30% shareholder of the

Company, has agreed to subscribe for approximately 62,310,000 Units

under the Offering for an aggregate cash consideration of US$5

million (the “Orion Subscription”).

Denis Miville-Deschênes, the Company’s CEO

stated: “We are extremely pleased with the announcement of the

proposed Transaction and Offering. Their completion should result

in the elimination of all cash indebtedness from the Company’s

balance sheet and will allow the Company to focus its efforts on

plans required to develop both the fully-permitted Copperwood

Project and the White Pine North Project.”

Sale of UPX Minerals Inc.

The Company and its 100%-owned subsidiary Upper

Peninsula Copper Holdings Inc. (“UPCH”) have

entered into a share purchase agreement with Sweetwater dated

August 3, 2021, pursuant to which Sweetwater has agreed to purchase

from UPCH all of the issued and outstanding shares of UPX Minerals

Inc. (“UPX Minerals”), for US$3 million in cash

and the assumption of amounts owing under the Note (as defined

below).

UPX Minerals holds a land package comprised of

mineral rights and real properties (the “UPX

Properties”) acquired from Rio Tinto Nickel Company and

Kennecott Exploration Company (collectively,

“RTX”) in 2017. The Transaction will result in

Sweetwater controlling approximately 447,842 mineral acres in the

Upper Michigan area near the Eagle Mine. As part of the

consideration for the acquisition of the UPX Properties in 2017,

UPX Minerals had issued a secured promissory note (the

“Note”) in favor of RTX in the amount of US$16

million of which US$15 million remains unpaid. Sweetwater will

assume the remaining payments and interest due by UPX Minerals

under the Note and Highland will be released from the guaranty it

provided to RTX as security for the repayment of the Note.

Sweetwater, being a wholly-owned subsidiary of

Orion, is considered to be a “related party” of the Company under

Multilateral Instrument 61-101 - Protection of Minority

Security Holders in Special Transactions (“MI

61-101”) and the proposed Transaction is considered to be

a “related party transaction” under the MI 61-101. However, the

Transaction will be exempt from the formal valuation and minority

shareholder approval requirements of MI 61-101.

C$26 Million Private Placement of

Units

The Company intends to complete a non-brokered

private placement of approximately 260,000,000 Units at C$0.10 per

Unit, to raise up to C$26 million. Each Unit will consist of one

common share of the Company and one half of one common share

purchase warrant (each whole warrant, a

"Warrant"), with each Warrant exercisable to

acquire one common share at C$0.18 for a period of 24 months from

the closing date of the Offering.

Certain insiders of the Company intend to

acquire Units in the Offering, including Orion. Orion’s

participation in the Offering is conditional on the completion of

the Transaction. The Company anticipates that, assuming the

Offering is fully subscribed, Orion’s shareholding in Highland will

be approximately 28%. Any participation by insiders in the Offering

constitutes a “related party transaction” as defined under MI

61-101. However, such participation, including by Orion, will be

exempt from the formal valuation and minority shareholder approval

requirements of MI 61-101.

Restructuring of Board of Directors and

Management

The Company has agreed with Orion that the

Company will take steps to add qualified independent directors to

its Board of Directors. The Company anticipates ultimately

increasing its Board to seven members, of whom a majority are

expected to be “independent”, as defined by National Instrument

52-110 – Audit Committees. In addition, the Company anticipates

expanding its management team to address increased activity levels

at the Copperwood and White Pine North Projects. The Company

anticipates announcing management hires and new Board members,

before its annual general meeting, currently anticipated to be held

before the end of December, 2021.

Closings

The closing of the Transaction with Sweetwater

and the closing of the Offering are subject to various customary

conditions and receipt of all necessary corporate and regulatory

approvals, including but not limited to the approval of the TSX

Venture Exchange. The closing of the Transaction is also

conditional on the Company having raised not less than US$12.5

million in the Offering, inclusive of the Orion Subscription in the

amount of US$5 million. Both closings are expected to occur during

the third quarter of 2021.

The Company intends to use the proceeds of the

Transaction and the Offering to settle all of the Company’s

liabilities including the loan due to Osisko Gold Royalties Ltd and

Greenstone Resources LP, to advance the development of the

Copperwood and White Pine North projects and for general working

capital purposes.

Cautionary Statement

The Offering will be conducted in reliance upon

certain prospectus and private placement exemptions. The securities

issuable under the private placement will be subject to a hold

period expiring four months and one day after the closing date. The

securities have not been and will not be registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold

in the United States absent registration or an applicable exemption

from the registration requirements. This press release does not

constitute an offer to sell or the solicitation of an offer to buy

nor shall there be any sale of the securities in any jurisdiction

in which such offer, solicitation or sale would be

unlawful.

Certain statements contained in this news

release constitute forward looking information under the provisions

of Canadian securities laws, including statements about plans to

complete and timing of the Transaction and the Offering,

anticipated changes to the board of directors and management of the

Company, regulatory approvals, the use of funds, the settling of

all of the Company’s liabilities and the anticipated effect on the

Company’s ability to advance its Copperwood and White Pine

projects. The information contained herein reflects Highland's

views as of the date of this news release. Forward looking

information is based on assumptions, and by its nature is subject

to risks and uncertainties that may cause actual future events to

differ materially from those anticipated in it. There can be no

assurance that the Transaction and the Offering will be completed

on the terms announced or at all, and that the use of proceeds will

be as contemplated. The Company does not intend, and does not

assume any obligation, to update forward-looking information,

except as required by law. Accordingly, readers are advised not to

place undue reliance on forward-looking information.

About Highland

Highland Copper Company Inc. is a Canadian

company focused on exploring and developing copper projects in the

Upper Peninsula of Michigan, U.S.A. Information about the Company

is available on SEDAR at www.sedar.com and on the Company’s website

at www.highlandcopper.com.

About Sweetwater

Sweetwater is a base metals and industrial

minerals royalty company holding significant surface and mineral

acreage in Wyoming, Utah and Colorado with multiple avenues for

organic growth. Sweetwater provides its partners with

opportunities to develop natural resources as well as access to

grazing and the renewable energy sector. In addition to its

cornerstone Trona royalties and internal growth opportunities,

Sweetwater is focused on capturing new base metal, industrial

mineral and renewable energy royalties in stable mining

jurisdictions.

Further information about Sweetwater is

available at www.sweetwaterroyalties.com.

Neither the

TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

For further information, please

contact: Denis

Miville-Deschênes, President & CEO Tel: +1.450.677.2455Email:

info@highlandcopper.com

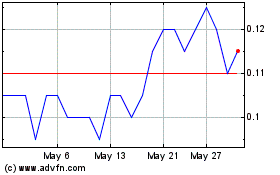

Highland Copper (TSXV:HI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Highland Copper (TSXV:HI)

Historical Stock Chart

From Feb 2024 to Feb 2025