International Frontier Resources Corporation (“IFR” or the

“Company”) (TSX‐V: IFR) (OTCQB:

IFRTF), today announced that it will be offering

rights (the "

Rights Offering") to holders of

its common shares ("

Common Shares") of record at

the close of business on November 29, 2019 (the “

Record

Date”). Pursuant to the Rights Offering, each holder of

Common Shares (a “

Shareholder”) will receive 0.4

of a transferable right (each, a “

Right”) for each

Common Share held as of the Record Date. One (1) Right will entitle

the holder thereof to subscribe for one Common Share upon payment

of the subscription price of $0.01 per Common Share until 5:00 p.m.

(Toronto time) (the “

Expiry Time”) on January 13,

2020. Assuming the exercise of all Rights, the Rights Offering will

raise gross proceeds of up to C$695,406.

The Rights will be offered to Shareholders

resident in each province and territory of Canada (the

“Eligible Jurisdictions”) and Shareholders who

have satisfied the requirements of the Corporation for those

resident outside of the Eligible Jurisdictions, Accordingly, and

subject to the detailed provisions of the right offering circular

dated November 25, 2019 (the “Circular”), Rights

certificates (“Rights Certificates”) will not be

mailed to Shareholders resident outside of the Eligible

Jurisdictions, unless such Shareholders are able to establish to

the satisfaction of the Corporation, on or before January 3, 2020,

that they are eligible to participate in the Rights Offering.

Shareholders who fully exercise their Rights

will be entitled to subscribe for additional Common Shares, if

available, that were not subscribed for by other holders of Rights

prior to the Expiry Time.

The Company understands that certain directors

and officers of the Company who own Common Shares intend to

exercise their rights to purchase Common Shares under the Rights

Offering.

The Company currently has

173,851,385 Common Shares issued and outstanding. If all

Rights issued under the Rights Offering are validly exercised, an

additional 69,540,554 Common Shares would be issued. A portion of

the net proceeds from the Rights Offering will be applied to the

Company’s existing working capital deficiency. The remainder of the

net proceeds will go towards the exploration of potential

acquisition opportunities in Canada, Mexico and other jurisdictions

and for general corporate purposes. The Rights Offering is subject

to regulatory approval, including the final approval of the TSX

Venture Exchange.

Complete details of the Rights Offering are set

out in the Circular and the rights offering notice (the

“Notice”), which are filed under the

Corporation’s profile at www.sedar.com. Registered

Shareholders who wish to exercise their Rights must complete and

forward the Rights Certificate, together with applicable funds, to

Computershare Investor Services Inc., the depositary for the

Rights Offering, on or before the Expiry Time of the Rights

Offering. Shareholders who own their Common Shares through

an intermediary, such as a bank, trust Corporation, securities

dealer or broker, will receive materials and instructions from

their intermediary.

IFR Strategic Review

IFR is continuing to explore and review a wide

variety of strategic alternatives with the objective of enhancing

shareholder value. Currently IFR is in ongoing discussions

regarding a number of material alternative transactions including

pursuing joint ventures of its projects. While IFR is continuing to

work diligently on these opportunities, it should be noted that IFR

has not entered into any definitive or binding arrangements and

there is no certainty that any of these discussions will lead to

definitive agreements. IFR will continue to provide updates on any

material developments respecting its strategic review. The

Company intends to continue to operate in a manner that will

preserve the value of its assets, manage financial capacity and

maintain cost discipline while sustaining the Company’s efforts to

both pursue current joint venture discussions and also evaluate and

pursue strategic alternatives.

Tonalli Corporate Update -

Tecolutla

TEC-2 and TEC-10 Wells

The TEC-2 and TEC-10 wells continued to produce

through Q3 2019. In October the Tec 2 well was shut in pending

completion of the construction of a flowline between the two wells.

The construction of the approximate 700-meter flowline has

commenced and is expected to be completed before the end of

November at which time the Tec 2 well will be brought back

on-stream. Tonalli is also in the process of procuring the

purchase of certain surface equipment to replace rentals and has

already secured lower cost alternatives for water disposal.

Tonalli is proceeding with various other initiatives to improve

operating costs.

TEC-11 Horizontal Well

Tonalli has finalized the completion and testing

of the TEC-11 well in the uphole Tantoyuca zone. The testing of the

Tantoyuca resulted in oil production during initial swabbing but it

quickly transitioned to a flow of 100% water. Tonalli is further

analyzing the El Abra and the Tantoyuca formation to determine a

better strategy for development of the Tecolutla field in the

future. It is believed that water preferentially flows up

open fractures present in the reservoir. Tonalli will do further

technical work to determine if this can be mitigated.

Tonalli has completed its minimum work

commitment required to earn-in on the Tecolutla Block in its

35-year license agreement.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of securities in the United States or in any province,

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to the registration or qualification under

securities laws of any such province, state or jurisdiction.

The securities referenced herein may not be offered or sold in the

United States except in transaction exempt from or not subject to

the registration requirements of the United States Securities Act

of 1933, as amended, and applicable state securities laws.

About International Frontier

Resources

International Frontier Resources Corporation

(IFR) is a Canadian publicly traded company with a demonstrated

track record of advancing oil and gas projects. Through its Mexican

subsidiary, Petro Frontera S.A.P.I de CV and strategic joint

ventures, it is advancing the development of petroleum and natural

gas assets in Mexico. The Company also has projects in Canada

and the United States, including the Northwest Territories, and

Montana.

The Company’s shares are listed on the TSX

Venture Exchange, trading under the symbol IFR and on the OTCQB

under the symbol IFRTF. For additional information please visit

www.internationalfrontier.com.

| For further information |

|

|

| |

|

|

| Steve Hanson – President and CEO |

or |

Tony Kinnon –

Chairman |

| (403) 215-2780 |

|

(403) 215-2780 |

| shanson@internationalfrontier.com |

|

tkinnon@internationalfrontier.com |

| |

|

|

Forward Looking

Statements This news release contains

“forward-looking information” within the meaning of applicable

Canadian securities legislation. All statements, other than

statements of historical fact, included herein are forward-looking

information. In particular, this news release contains

forward-looking information regarding: the Rights Offering,

including the expiry time of the rights offering, the potential

outstanding Common Shares after the Rights Offering and the

potential use of proceeds. There can be no assurance that such

forward-looking information will prove to be accurate, and actual

results and future events could differ materially from those

anticipated in such forward-looking information. This

forward-looking information reflects IFR’s current beliefs and is

based on information currently available to IFR and on assumptions

IFR believes are reasonable. These assumptions include, but are not

limited to: the underlying value of IFR and its Common Shares

market acceptance of the Rights Offering; TSX Venture Exchange

final approval of the Rights Offering, IFR’s current and initial

understanding and analysis of its projects and the exploration

required for such projects; the costs of exploration and drilling

on IFR’s projects; IFR's general and administrative costs remaining

constant; and the market acceptance of IFR's business strategy.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of IFR to be

materially different from those expressed or implied by such

forward-looking information. Such risks and other factors may

include, but are not limited to: volatility in market prices for

oil and natural gas; liabilities inherent in oil and natural gas

operations; uncertainties associated with estimating oil and

natural gas reserves; geological, technical, drilling and

processing problems; general business, economic, competitive,

political and social uncertainties; general capital market

conditions and market prices for securities; delay or failure to

receive board or regulatory approvals; the actual results of future

operations; competition; changes in legislation, including

environmental legislation, affecting IFR; the timing and

availability of external financing on acceptable terms; and lack

of qualified, skilled labour or loss of key individuals. A

description of additional risk factors that may cause actual

results to differ materially from forward-looking information can

be found in IFR’s disclosure documents on the SEDAR website at

www.sedar.com. Although IFR has attempted to identify important

factors that could cause actual results to differ materially from

those contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. Readers are cautioned that the foregoing list of factors

is not exhaustive. Readers are further cautioned not to place

undue reliance on forward-looking information as there can be no

assurance that the plans, intentions or expectations upon which

they are placed will occur. Forward-looking information contained

in this news release is expressly qualified by this cautionary

statement. The forward-looking information contained in this news

release represents the expectations of IFR as of the date of this

news release and, accordingly, is subject to change after such

date. However, IFR expressly disclaims any intention or obligation

to update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable securities law.

“Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility or

accuracy of this release”. The Company seeks Safe Harbor.

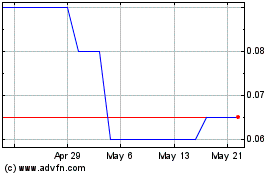

International Frontier R... (TSXV:IFR)

Historical Stock Chart

From Mar 2024 to Apr 2024

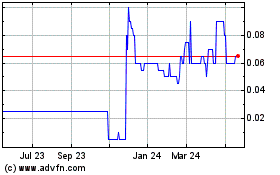

International Frontier R... (TSXV:IFR)

Historical Stock Chart

From Apr 2023 to Apr 2024