Independence Gold Intersects Gold Mineralization on Boulevard, Yukon

December 18 2017 - 8:00AM

Independence Gold Corp. (TSX.V:IGO)

("Independence" or "the Company") is pleased to announce drill

results from the remaining five diamond drill holes completed this

summer on the Company’s 100% owned Boulevard Project. Boulevard is

contiguous to Goldcorp Inc’s Coffee Gold Deposit in the White Gold

District, Yukon. The best intercept in these five holes is 2.58

grams per tonne (“g/t”) gold over 4.3 metres (“m”) including 5.02

g/t gold over 1.4 m. The 1.4 m sample exhibited a nugget

effect resulting in 42.7 g/t gold in the coarse fraction (30.6 g)

of a 1,040.3 g sample.

A total of 977.5 m of diamond drilling was

completed in 9 holes within the Sunrise/Sunset Zone, located 8.5

kilometres (“km”) southwest of the Coffee deposit. Drilling

focused primarily on the intersection of the Sunrise and Sunset

geochemical trends. Significant intercepts from this year’s

diamond drilling program are presented in the table below. A

table of all 2017 drill results and a map showing the drill hole

locations is posted on the Company’s website.

|

Drill hole |

From (m) |

To (m) |

Length (m) |

Au (g/t) byFire Assay |

Au (g/t) byScreen Metallics(Coarse

Fraction>106 microns) |

Au (g/t) byScreen Metallics(Fine

Fraction<106 microns) |

Au (g/t) byScreen

Metallics(WeightedAverage) |

|

BV17-59 |

52.00 |

60.00 |

8.00 |

0.49 |

- |

- |

- |

|

BV17-63 |

34.00 |

34.68 |

0.68 |

4.43 |

1.7 |

3.81 |

3.8 |

|

BV17-63 |

79.65 |

87.50 |

7.85 |

0.45 |

- |

- |

- |

|

Incl. |

79.65 |

84.25 |

4.60 |

0.62 |

- |

- |

- |

|

BV17-64 |

35.70 |

39.00 |

3.30 |

1.38 |

|

|

|

|

Incl. |

35.70 |

36.85 |

1.15 |

3.30 |

3.3 |

3.35 |

3.4 |

|

BV17-64 |

65.35 |

65.50 |

0.15 |

1.59 |

19.2 |

0.68 |

1.2 |

|

BV17-65 |

14.50 |

20.30 |

4.30 |

2.58 |

- |

- |

- |

|

Incl. |

16.00 |

17.40 |

1.40 |

5.02 |

42.7 |

2.01 |

3.2 |

|

Incl. |

17.90 |

19.20 |

1.30 |

2.35 |

8.1 |

2.66 |

2.3 |

|

BV17-65 |

129.00 |

129.50 |

0.50 |

2.27 |

4.7 |

1.62 |

1.7 |

|

BV17-66 |

77.15 |

77.50 |

0.35 |

2.69 |

1.8 |

2.76 |

2.7 |

|

BV17-67 |

19.25 |

20.85 |

1.60 |

1.39 |

1.0 |

1.26 |

1.2 |

Length represents the apparent thickness of the

mineralization and should not be considered as the true

width

Gold mineralization exhibited a nugget effect

and thus all samples from this program with fire assay results

greater than 1 g/t gold have been further analysed by screen

metallics to determine the amount of gold in the coarse verses fine

(greater or less than 106 microns) fractions of each sample.

Drill hole BV17-59, 64 and 65 were designed to

follow-up reverse circulation (“RC”) drill hole BV15-31 which

intercepted 3.21 g/t gold over 29 m including 7.23 g/t gold over

12.2 m and BV16-53 which intercepted 4.36 g/t gold over 6.1 m and

8.27 g/t gold over 3.1. This series of holes outlines

approximately 130 m of mineralization in a northwesterly direction

and remains open in both directions along strike. This area

is part of a larger anomalous zone identified by elevated gold,

arsenic and antimony in soil.

Drill hole BV17-63 tested the northwest strike

extension of RC hole BV16-54 which intersected 1.58 g/t gold over

39.6 m including 7.73 g/t gold over 6.1 m. The 2017 program

also included BV17-58, a diamond drill hole designed as a minor

step out to BV16-54, and interested 3.10 g/t gold over 1.5

including 76.2 g/t gold in the coarse fraction of the sample and

drill hole BV17-62 which tested the strike extension to the

southeast.

Drill hole BV17-66 tested the southeast extent

of the Sunset soil trend, while drill hole BV17-67 tested the

northwest extent of the Hollywood soil trend. Both trends are

identified by greater than 75th percentile gold, arsenic and

antimony in soil.

All five holes have azimuths of approximately

080 degrees with dips ranging between -45 to -55 degrees.

All samples were submitted to SGS Minerals

Services in Burnaby, BC for sample preparation by crushing to 75%

less than 2 millimetres, creation of a 250 g split, and then

pulverizing to 85% passing 75 microns. Sample pulps were

submitted for a 52 element analysis using an aqua regia digest and

ICP-AES and ICP–MS analysis (GE-ICM14B) and for gold analysis with

a 30 g fire assay and AAS finish (code GE-FAA313). Samples

resulting in greater than 1 g/t of gold were then re-submitted for

analysis by screen metallics. A 1,000 g sample was taken from

the reject, crushed to 2 mm and split. A representative sample of

approximately 100 g was taken. This sample was pulverized and

screened to 106 microns. The plus 106 micron fraction was submitted

for fire assay, the minus fraction was split and two 30 g aliquots

were submitted for fire assay. Final assays were weight

ratioed back to the representative sample weight (code

FAS51K). Control samples (accredited gold standards and

blanks) were inserted into the sample sequence on a regular basis

to monitor precision of results. No QAQC concerns were

identified.

About IndependenceIndependence

Gold Corp. (TSX.V:IGO) is a mineral exploration company listed on

the TSX Venture Exchange. With a portfolio of projects in the

Yukon and the 3Ts Project in British Columbia, the Company’s

holdings range from early-stage grassroots exploration to

advanced-stage resource expansion. For additional

information, visit the Company's website www.ingold.ca.

Kendra Johnston, P.Geo., the Company’s Qualified

Person as defined by National Instrument 43-101 for the White Gold

District projects, has reviewed the technical information in this

news release.

ON BEHALF OF THE BOARD OF

INDEPENDENCE GOLD CORP.

“Kendra Johnston”

President and Director

For further information please contact Kendra

Johnston at 604-687-3959 or info@ingold.ca

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

All statements in this press release, other than

statements of historical fact, are "forward-looking information"

with respect to Independence within the meaning of applicable

securities laws, including statements with respect to the

Company’s planned drilling and exploration activities. The Company

provides forward-looking statements for the purpose of conveying

information about current expectations and plans relating to the

future and readers are cautioned that such statements may not be

appropriate for other purposes. By its nature, this information is

subject to inherent risks and uncertainties that may be general or

specific and which give rise to the possibility that expectations,

forecasts, predictions, projections or conclusions will not prove

to be accurate, that assumptions may not be correct and that

objectives, strategic goals and priorities will not be achieved.

These risks and uncertainties include but are not limited to those

identified and reported in Independence’s public filings under

Independence Gold Corp.’s SEDAR profile at www.sedar.com.

Although Independence has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward-looking

information, there may be other factors that cause actions, events

or results not to be as anticipated, estimated or intended. There

can be no assurance that such information will prove to be accurate

as actual results and future events could differ materially from

those anticipated in such statements. Independence disclaims

any intention or obligation to update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise unless required by law.

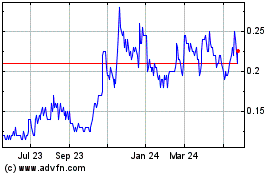

Independence Gold (TSXV:IGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

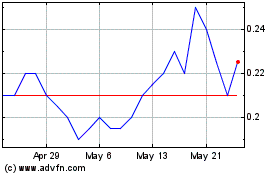

Independence Gold (TSXV:IGO)

Historical Stock Chart

From Dec 2023 to Dec 2024