Plateau Energy Metals Inc. (“

Plateau” or the

“

Company”) (TSX-V: PLU | OTCQB: PLUUF) announces

that the Special Meeting (the “

Special Meeting”)

of its security holders in connection with its previously announced

business combination (“

Arrangement”) with American

Lithium Corp. (“

American Lithium”) is scheduled to

be held on May 3, 2021. Materials for the Special Meeting will be

mailed to shareholders and optionholders of record as of the close

of business on March 26, 2021. Further details about the

Arrangement are set out in the news release of February 9, 2021 and

in the information circular to be filed on SEDAR and mailed to

shareholders and optionholders of Plateau at the beginning of

April. All shareholders and optionholders of Plateau are urged to

read the information circular once available, as it will contain

important additional information concerning the Arrangement.

The Arrangement will be carried out by way of a

court-approved plan of arrangement under the Business Corporations

Act (Ontario) and will require the approval of: (i) at least 66

2/3% of the votes cast by all Plateau shareholders; (ii) at least

66 2/3% of the votes cast by all Plateau shareholders and all

holders of Plateau stock options voting together as a single class;

and (iii) and a simple majority of the votes cast by all Plateau

shareholders excluding certain interested or related parties as

required by Multilateral Instrument 61-101, in each case by

securityholders present in person or represented by proxy at the

securityholder meeting.

Closing of the Arrangement is subject to the

receipt of applicable regulatory approvals and the satisfaction of

certain other closing conditions customary in transactions of this

nature, including, without limitation, approval of the Ontario

Superior Court of Justice and the TSX Venture Exchange. Closing of

the Arrangement is anticipated to occur in May 2021.

Immediately following the completion of the

Arrangement, Plateau will become a wholly owned subsidiary of

American Lithium, while former Plateau shareholders will own

approximately 21% of American Lithium’s shares on an outstanding

undiluted basis upon completion of the Arrangement.

The Arrangement has been unanimously approved by

the board of directors of both American Lithium and Plateau, and

the directors of Plateau, based on the recommendation of a special

committee of independent directors of Plateau, recommend that

Plateau shareholders and optionholders vote in favour of the

Arrangement. Directors and officers of Plateau and certain

shareholders have entered into customary voting support agreements,

representing in aggregate approximately 17% of Plateau’s

outstanding common shares, to vote in favour of the Agreement.

About Plateau Energy

Metals

Plateau Energy Metals Inc., a Canadian

exploration and development company, is enabling the new energy

paradigm through exploring and developing its Falchani lithium

project and Macusani uranium project in southeastern Peru, both of

which are situated near significant infrastructure.

About American LithiumAmerican

Lithium (TSXV:LI | OTCQB:LIACF | Frankfurt:5LA1) is actively

engaged in the acquisition, exploration and development lithium

deposits within mining-friendly jurisdictions throughout the

Americas. The company is currently exploring and developing the TLC

lithium project located in the highly prospective Esmeralda lithium

district in Nevada. TLC is close to infrastructure, 3.5 hours south

of the Tesla Gigafactory, and in the same basinal environment as

Albemarle’s Silver Peak lithium mine, and several advancing

deposits and resources, including Ioneer Ltd.’s (formerly Global

Geoscience) Rhyolite Ridge and Cypress Development Corp.’s Clayton

Valley Project.

|

For further information, please

contact:Plateau Energy Metals Inc. |

|

|

|

Laurence Stefan, Director,President &

Interim-CEO+1-416-628-9600IR@PlateauEnergyMetals.com |

|

Facebook: www.facebook.com/pluenergy/Twitter: www.twitter.com/pluenergy/Website: www.PlateauEnergyMetals.com |

|

|

|

|

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward Looking StatementsThis

news release contains certain forward-looking information and

forward-looking statements (collectively “forward-looking

statements”) within the meaning of applicable securities

legislation. All statements, other than statements of historical

fact, are forward-looking statements. These include statements

regarding the intent of American Lithium and Plateau (the

“Companies”), or the beliefs or current expectations of the

officers and directors of the Companies post-closing of the

Arrangement. Forward-looking statements in this news release

include, but are not limited to, statements regarding anticipated

benefits of the Arrangement, the closing of the Arrangement, TLC

and Falchani (the “Projects”) and any statements regarding the

business plans, expectations and objectives of the Companies.

Forward-looking statements are frequently

identified by such words as "may", "will", "plan", "expect",

"anticipate", "estimate", "intend", “indicate”, “scheduled”,

“target”, “goal”, “potential”, “subject”, “efforts”, “option” and

similar words, or the negative connotations thereof, referring to

future events and results. Forward-looking statements are based on

the current opinions and expectations of management are not, and

cannot be, a guarantee of future results or events. Although the

Companies believe that the current opinions and expectations

reflected in such forward-looking statements are reasonable based

on information available at the time, undue reliance should not be

placed on forward-looking statements since the Companies can

provide no assurance that such opinions and expectations will prove

to be correct.

All forward-looking statements are inherently

uncertain and subject to a variety of assumptions, risks and

uncertainties, including risks, uncertainties and assumptions

related to: the Companies' ability to complete the Arrangement; the

Companies' ability to secure the necessary security holder and

regulatory approvals required to complete the Arrangement; risks

related to the satisfaction or waiver of certain conditions to the

closing of the Arrangement; the Companies' ability to achieve their

stated goals as a result of the Arrangement; the estimated costs

associated with the advancement of the Projects; risks and

uncertainties relating to the COVID-19 pandemic and the extent and

manner to which measures taken by governments and their agencies,

the Companies or others to attempt to reduce the spread of COVID-19

could affect the Companies, which could have a material adverse

impact on many aspects of the Companies’ businesses including but

not limited to: the ability to access mineral properties for

indeterminate amounts of time, the health of the employees or

consultants resulting in delays or diminished capacity, social or

political instability in Peru which in turn could impact Plateau’s

ability to maintain the continuity of its business operating

requirements, may result in the reduced availability or failures of

various local administration and critical infrastructure, reduced

demand for the Companies’ potential products, availability of

materials, global travel restrictions, and the availability of

insurance and the associated costs; risks related to the certainty

of title to the properties of the Companies, including the status

of the “Precautionary Measures” filed by Plateau’s subsidiary

Macusani Yellowcake S.A.C. (“Macusani”), the outcome of the

administrative process, the judicial process, and any and all

future remedies pursued by Plateau and its subsidiary Macusani to

resolve the title for 32 of its concessions; the ongoing ability to

work cooperatively with stakeholders, including but not limited to

local communities and all levels of government; the potential for

delays in exploration or development activities due to the COVID-19

pandemic; the interpretation of drill results, the geology, grade

and continuity of mineral deposits; the possibility that any future

exploration, development or mining results will not be consistent

with our expectations; mining and development risks, including

risks related to accidents, equipment breakdowns, labour disputes

(including work stoppages, strikes and loss of personnel) or other

unanticipated difficulties with or interruptions in exploration and

development; risks related to commodity price and foreign exchange

rate fluctuations; risks related to foreign operations; the

cyclical nature of the industry in which the Companies operate;

risks related to failure to obtain adequate financing on a timely

basis and on acceptable terms or delays in obtaining governmental

approvals; risks related to environmental regulation and liability;

political and regulatory risks associated with mining and

exploration; risks related to the uncertain global economic

environment and the effects upon the global market generally, and

due to the COVID-19 pandemic measures taken to reduce the spread of

COVID-19, any of which could continue to negatively affect global

financial markets, including the trading price of the Companies’

shares and could negatively affect the Companies’ ability to raise

capital and may also result in additional and unknown risks or

liabilities to the Companies. Other risks and uncertainties related

to prospects, properties and business strategy of Plateau and

American Lithium are identified, respectively, in the “Risks and

Uncertainties” section of Plateau’s Management’s Discussion and

Analysis filed on January 19, 2021, in the “Risk Factors” section

of American Lithium’s Management’s Discussion and Analysis filed on

January 29, 2021, and in recent securities filings available at

www.sedar.com. Actual events or results may differ materially from

those projected in the forward-looking statements. Neither of the

Companies undertakes any obligation to update forward-looking

statements except as required by applicable securities laws.

Investors should not place undue reliance on forward-looking

statements.

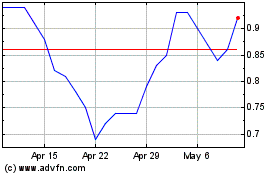

American Lithium (TSXV:LI)

Historical Stock Chart

From Mar 2024 to Apr 2024

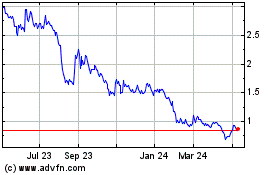

American Lithium (TSXV:LI)

Historical Stock Chart

From Apr 2023 to Apr 2024