- M&P’s working interest production in first-half 2022:

25,126 boepd

- In Gabon, oil production of 13,828 bopd for M&P’s working

interest; situation back to normal in June (15,120 bopd for

M&P’s working interest) after disruptions in May following the

incident at the Cap Lopez export terminal

- Steady gas production in Tanzania, with output of 44.4 mmcfd

for M&P’s working interest

- Increase in oil production in Angola, with 3,902 bopd for

M&P’s working interest, up 19% from second-half 2021

- Valued production of $352 million in first-half 2022, driven

by strong crude oil prices

- Average sale price of oil of $105.0/bbl

- Valued production up 63% and 29% respectively versus first- and

second-half 2021

- Consolidated sales of $355 million

- Net debt of $195 million at 30 June 2022, a reduction of

$148 million from 31 December 2021 ($343 million)

- Following the refinancing announced on 12 May, new credit lines

drawn down in early July

- First quarterly repayment due in April 2023, with c.$52 million

being repaid annually for the next five years (excluding the RCF

tranche)

- Dividend of €0.14 per share (for a total amount of $28 million)

paid post closing on 5 July

Regulatory News:

Maurel & Prom (Paris:MAU):

Key indicators for the first half of

2022

Q1

2022

Q2

2022

H1

2022

H1

2021

H2

2021

Change H1 2022 vs.

H1 2021

H2 2021

M&P working interest

production

Gabon (oil)

bopd

14,222

13,439

13,828

15,189

15,886

-9%

-13%

Angola (oil)

bopd

3,856

3,947

3,902

3,561

3,273

+10%

+19%

Tanzania (gas)

mmcfd

47.3

41.5

44.4

38.6

39.8

+15%

+12%

Total

boepd

25,966

24,296

25,126

25,182

25,793

-0%

-3%

Average sale price

Oil

$/bbl

94.2

112.0

105.0

63.0

79.4

+67%

+32%

Gas

$/mmBtu

3.49

3.50

3.50

3.35

3.35

+5%

+4%

Sales

Gabon

$mm

127

136

262

164

205

+60%

+28%

Angola

$mm

26

31

57

28

40

+108%

+43%

Tanzania

$mm

16

16

32

25

27

+30%

+18%

Valued production

$mm

170

182

352

216

272

+63%

+29%

Drilling activities

$mm

1

1

1

1

1

Restatement for lifting imbalances and

inventory revaluation

$mm

-40

41

1

-29

39

Consolidated sales

$mm

130

224

355

188

313

+89%

+13%

M&P’s working interest production in the first half of 2022

was 25,126 boepd. The average sale price of oil during the period

was $105.0/bbl, up 67% from the first half of 2021 ($63.0/bbl) and

32% from the second half of 2021 ($79.4/bbl).

The Group’s valued production (income from production

activities, excluding lifting imbalances and inventory revaluation)

in H1 2022 was $352 million. The restatement for lifting imbalances

net of inventory revaluation had virtually no impact on the period

due to near-exact offsetting between the first quarter (-$40

million) and the second quarter ($40 million). Only one lifting

took place in Gabon in the first quarter, and two in the second

quarter, one in Gabon and the other one in Angola.

Consolidated sales for the first half of 2022 came in at $355

million.

Production activities

M&P’s working interest oil production (80%) on the Ezanga

permit stood at 13,828 bopd (gross production: 17,285 bopd) for the

first half of 2022.

As mentioned previously, production in Q2 2022 was affected by

the interruption to activity at the Cap Lopez terminal, which

forced M&P to reduce production for two weeks. Consequently,

average production in May was 10,701 bopd for M&P’s working

interest (gross production: 13,377 bopd). The export situation

returned to normal in June, with average production of 15,120 bopd

for M&P’s working interest (gross production: 18,900 bopd).

M&P’s working interest gas production (48.06%) on the Mnazi

Bay permit was 44.4 mmcfd (gross production: 92.3 mmcfd) for the

first half of 2022, up 15% from H1 2021 and 12% from H2 2021.

M&P’s working interest production (20%) on Block 3/05 in Q1

2022 was 3,902 bopd (gross production: 19,507 bopd). Production had

been affected by maintenance operations in 2021 but returned to a

higher level once those operations were completed.

Production in Q1 2022 was revalued to 3,947 bopd for M&P’s

working interest, rather than the 3,536 bopd initially announced

when the quarterly results were published in April. This adjustment

also resulted in a $5 million increase in Q1 2022 valued

production.

Exploration activities

M&P received approval from the National Hydrocarbons Agency

(ANH) to extend the COR-15 permit until July 2023. Drilling of the

first exploration well is expected to start by October 2022.

Financial position

The cash position as at 30 June 2022 was $250 million. Gross

debt stood at $445 million ($363 million for the term loan and $82

million for the shareholder loan), meaning net debt fell by $148

million during the period from $343 million at 31 December 2021 to

$195 million at 30 June 2022.

In early July, M&P refinanced its debt in accordance with

the terms announced on 12 May. It drew down the full amount of the

$255 million new bank loan ($67 million being the RCF tranche) and

repaid the $363 million outstanding on the former term loan,

reducing gross debt by $108 million. In view of the favourable cash

position, M&P decided to keep the shareholder loan at its

current level of $82 million and not to draw down the second

tranche of $100 million. That $100 million therefore remains

available to M&P until the shareholder loan’s final

maturity.

The refinancing completed in early July resulted in a cash

outflow of $108 million. Upon closing of the transaction, the

Group’s proforma cash position was $143 million (vs. $250 million

as at 30 June 2022), before the dividend payment of €0.14 per share

on 5 July, for a total amount of $28 million.

Drawn-debt repayment profile at 21 July

2022 ($337 million):

Object omitted.

Key terms of the debt

facilities:

Bank loan

Amortising portion

Bank loan

Revolving portion

Shareholder loan

Amount drawn

$188mm

$67mm

$82mm

(+ $100mm available)

Interest rate

SOFR + 2.00%

SOFR + 2.25%

(0.675% on the undrawn

portion)

SOFR + 2.10%

Repayments

18 quarterly instalments

At maturity

22 quarterly instalments

First instalment

Q2 2023

–

Q2 2023

Last instalment

Q3 2027

Q3 2027

Q3 2028

Français

Anglais

pieds cubes

pc

cf

cubic feet

millions de pieds cubes par

jour

Mpc/j

mmcfd

million cubic feet per day

milliards de pieds cubes

Gpc

bcf

billion cubic feet

baril

B

bbl

barrel

barils d’huile par jour

b/j

bopd

barrels of oil per day

millions de barils

Mb

mmbbls

million barrels

barils équivalent pétrole

bep

boe

barrels of oil equivalent

barils équivalent pétrole par

jour

bep/j

boepd

barrels of oil equivalent per day

millions de barils équivalent

pétrole

Mbep

mmboe

million barrels of oil equivalent

For more information, visit www.maureletprom.fr/en/

This document may contain forward-looking

statements regarding the financial position, results, business

activities and industrial strategy of Maurel & Prom. By nature,

forward-looking statements contain risks and uncertainties to the

extent that they are based on events or circumstances that may or

may not happen in the future. These projections are based on

assumptions we believe to be reasonable, but which may prove to be

incorrect and which depend on a number of risk factors, such as

fluctuations in crude oil prices, changes in exchange rates,

uncertainties related to the valuation of our oil reserves, actual

rates of oil production and the related costs, operational

problems, political stability, legislative or regulatory reforms,

or even wars, terrorism and sabotage.

Maurel & Prom is listed for trading on

Euronext Paris CAC All-Tradable – CAC Small – CAC Mid & Small –

Eligible PEA-PME and SRD Isin FR0000051070/Bloomberg MAU.FP/Reuters

MAUP.PA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220720005798/en/

Maurel & Prom Press, shareholder and investor

relations Tel: +33 (0)1 53 83 16 45 ir@maureletprom.fr

NewCap Financial communications and investor

relations/Media relations Louis-Victor Delouvrier/Nicolas Merigeau

Tel: +33 (0)1 44 71 98 53/+33 (0)1 44 71 94 98

maureletprom@newcap.eu

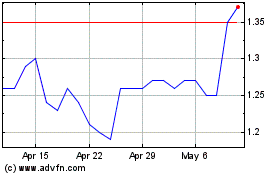

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Apr 2023 to Apr 2024