Mayfair Gold Corp. (“

Mayfair” or the

“

Company”) (

TSX-V:

MFG; OTCQX:

MFGCF) is pleased to announce an updated mineral

resource estimate at the Company’s 100% controlled Fenn-Gib Gold

Project, located in the Timmins region of Northeast Ontario. Based

on assay results from 61 percent of the Company’s current

110,000-meter (m) infill and expansion drill program, the Fenn-Gib

deposit now hosts a NI 43-101 pit constrained Indicated mineral

resource estimate of 3.06 million (M) ounces (oz) gold (Au) and an

Inferred mineral resource of 0.31M oz Au. The near-surface Fenn-Gib

gold mineralization is broadly disseminated striking east-west on

the Pipestone Fault over more than 1.25 kilometers (km) and is up

to 300m wide at the west end.

Mayfair Gold President and CEO Patrick Evans

commented: “With the expansion of the Fenn-Gib gold zones, the

mineral resources have shown significant improvement over the

previous estimates. Within 18 months of acquiring Fenn-Gib, Mayfair

has increased the Indicated resource size by 47 percent. The

Fenn-Gib mineralization remains open for expansion in most

directions, and we are excited about the near-term potential to

further increase the resources with the ongoing drill program

supported by three drill rigs.”

Mr. Evans added: “A large portion of the

incremental tonnes reported today come from the Expansion Zone in

the center of the Fenn-Gib deposit and to the east of the

higher-grade Main Zone. Previously poorly defined, the Expansion

Zone has been the focus of Mayfair’s drill program, supported by

two of the three drill rigs, and has added significant tonnage to

the Fenn-Gib mineral resources.”

The 30,000m Phase 3 infill and expansion drill

program is ongoing with gold mineralization continuing to be

intersected in all holes reported to date. Based on the continuing

success, Mayfair expects to declare a further resource update in Q2

2023 on completion of the 110,000m drill program. The potential

exists for a further significant increase in the Fenn-Gib

resource.

Highlights of the Updated Fenn-Gib

Mineral Resource Estimate:

- Pit constrained Indicated

resource: 47% increase in Au to 3,061,991 oz from 2,077,661

oz

- Pit constrained Inferred

resource: 315% increase in Au to 311,356 oz from 74,967

oz

- Maiden underground

resource: Inferred underground Au resource of 103,586

oz

Fenn-Gib Gold Project: Summary of

Mineral Resources

Table 1 below contains the updated Fenn-Gib pit

constrained mineral resource estimate; Table 2 is a comparison

between the February 5, 2021 and October 15, 2022 pit-constrained

mineral resource estimates; Table 3 provides the maiden Fenn-Gib

underground resource estimate; and Table 4 details the pit

constrained resource sensitivity by cut-off grades.

Table 1. Fenn-Gib NI 43-101 Open Pit

Mineral Resource Estimate, October 15, 2022

|

Open Pit |

|

|

|

|

|

Class |

Cut-OffGrade |

Tonnes |

Grade (g/t Au) |

Au Ounces (oz) |

|

Indicated |

0.35 |

118,074,000 |

0.81 |

3,062,000 |

|

Inferred |

0.35 |

13,829,000 |

0.70 |

311,000 |

Table 2. Fenn-Gib NI 43-101 Pit

Constrained Mineral Resource Estimate Comparison Between February

5, 2021 and October 15, 2022 at Cut-Off Grade of 0.35 g/t

Au

|

Total Open Pit |

Indicated |

Inferred |

|

|

Tonnes |

Grade (g/t Au) |

Au Ounces (oz) |

Tonnes |

Grade (g/t Au) |

Au Ounces (oz) |

|

February 5, 2021 |

70,204,000 |

0.92 |

2,078,000 |

3,775,000 |

0.62 |

75,000 |

|

October 15, 2022 |

118,074,000 |

0.81 |

3,062,000 |

13,829,000 |

0.70 |

311,000 |

|

Difference |

47,870,000 |

|

984,000 |

10,054,000 |

|

236,000 |

|

Percentage Change |

68% |

|

47% |

266% |

|

315% |

Table 3. Fenn-Gib NI 43-101 Maiden

Underground Mineral Resource Estimate, October 15,

2022

|

Underground |

|

|

|

|

|

Class |

Cut-Off Grade |

Tonnes |

Grade(g/t Au) |

Au Ounces (oz) |

|

Inferred |

2.5 |

1,002,000 |

3.22 |

104,000 |

Notes:

- Effective date of this updated

mineral resource estimate is October 15, 2022. The effective date

for the drill-hole database used to produce this updated mineral

resource estimate is July 31, 2022.

- All mineral resources have been

estimated in accordance with Canadian Institute of Mining and

Metallurgy and Petroleum (“CIM”) definitions, as required under NI

43-101. Mineral Resource Statement prepared by Garth Kirkham, P.

Geo (Kirkham Geosystems Ltd.) in accordance with NI 43-101.

- Mineral Resources reported

demonstrate reasonable prospect of eventual economic extraction, as

required under NI 43-101. Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability. The

Mineral Resources may be materially affected by environmental,

permitting, legal, marketing and other relevant issues.

- Mineral Resources are reported at a

cut-off grade of 0.35 g/t Au for an open-pit mining scenario.

Cut-off grades are based on a price of US$1,750/oz gold, and a

number of operating cost and recovery assumptions, including a

reasonable contingency factor. Metallurgical recoveries of 94% were

used. Densities were assigned based on physical measurements.

- Ounce (troy) = metric tonnes x

grade / 31.10348. All numbers have been rounded to reflect the

relative accuracy of the estimate.

- The quantity and grade of reported

Inferred Resources are uncertain in nature and there has not been

sufficient work to define these Inferred Resources as Indicated or

Measured Resources. It is reasonably expected that most of the

Inferred Mineral Resources could be upgraded to Indicated Mineral

Resources with continued exploration.

- Tonnages and ounces in the tables

are rounded to the nearest thousand and hundred, respectively.

Numbers may not total due to rounding.

Based on Mayfair’s drilling costs, the

incremental gold ounces reported have been added at an average cost

of approx. C$6.00 per ounce. Despite a modest increase in drilling

costs to account for increased fuel prices, Mayfair expects to

continue adding to the Fenn-Gib resource at industry-leading

costs.

Table 4 below presents the current resource

estimates at varying cut-off grades.

Table 4. Fenn-Gib Pit Constrained Resource Sensitivity

by Cut-Off Grades

|

Resources Category |

Cut-Off Grade |

Tonnes |

Grade (Au g/t) |

Au Ounces (oz) |

|

Pit-Constrained Resources |

|

Indicated |

0.70 |

53,287,000 |

1.17 |

2,012,000 |

|

0.60 |

67,570,000 |

1.06 |

2,309,000 |

|

0.55 |

75,810,000 |

1.01 |

2,461,000 |

|

0.50 |

84,833,000 |

0.96 |

2,613,000 |

|

0.45 |

94,611,000 |

0.91 |

2,763,000 |

|

0.40 |

105,593,000 |

0.86 |

2,912,000 |

|

0.35 |

118,074,000 |

0.81 |

3,062,000 |

|

0.30 |

133,487,000 |

0.75 |

3,222,000 |

|

|

0.25 |

154,908,000 |

0.68 |

3,410,000 |

|

|

0.20 |

187,450,000 |

0.60 |

3,643,000 |

|

|

|

|

|

|

|

Inferred |

0.70 |

5,007,000 |

1.07 |

172,000 |

|

0.60 |

6,524,000 |

0.97 |

203,000 |

|

0.55 |

7,610,000 |

0.91 |

224,000 |

|

0.50 |

8,802,000 |

0.86 |

244,000 |

|

0.45 |

10,208,000 |

0.81 |

265,000 |

|

0.40 |

11,964,000 |

0.75 |

289,000 |

|

0.35 |

13,829,000 |

0.70 |

311,000 |

|

|

0.30 |

16,404,000 |

0.64 |

338,000 |

|

|

0.25 |

20,447,000 |

0.57 |

373,000 |

|

|

0.20 |

27,751,000 |

0.48 |

426,000 |

Figure 1 below shows the location of the

Fenn-Gib Project; Figure 2 shows views of the Fenn-Gib drill holes

and solids; Figure 3 shows plan and section views of the Fenn-Gib

block model; and Figure 4 shows a grade/tonnage sensitivity graph

for the Fenn-Gib Indicated resource.

Figure 1. Fenn-Gib Project Location

Figures 2. Fenn-Gib Drill Holes and Solids

Figures 3. Fenn-Gib Deposit Plan and Section

Maps

Figure 4. Fenn-Gib Deposit: Indicated Resource

Grade/Tonnage Sensitivity Graph

Mayfair Gold will be hosting a webinar to

discuss the updated mineral resource estimate on Tuesday,

October 18, 2022, at 12 noon EST. Participants can join

the webinar through the following link or dial-in numbers:

Video call link: https://meet.google.com/fux-rhfz-qnmOr

dial: Canada +1 437-781-4585 PIN: 796 894 283 7884# US +1

302-314-6925 PIN: 200 394 972#More phone numbers:

https://tel.meet/fux-rhfz-qnm?pin=7968942837884

Qualified Person Statement

The disclosure of technical and scientific

information in this news release has been reviewed and approved by

Garth Kirkham, P. Geo., of Kirkham Geosystems Ltd., who is deemed a

qualified person as defined by NI 43-101 and was responsible for

the completion of the updated mineral resource estimation. Mayfair

Gold’s disclosure regarding the technical drilling program

information in this news release has been reviewed and approved by

Howard Bird, P Geo., Vice President Exploration for the Company,

who oversaw the Mayfair Gold drill program and serves as a

Qualified Person under the definition of National Instrument

43-101.

February 5, 2021 Fenn-Gib Mineral Resource

Estimate

A pit-constrained NI 43-101 resource estimate

was completed entitled “NI 43-101 Technical Report Fenn-Gib

Project, Ontario, Canada” dated February 5, 2021, by JDS Energy and

Mining Inc. and prepared by Garth Kirkham, P. Geo., an Independent

Qualified Person as defined by NI 43-101, from Kirkham Geosystems

Ltd.

QA/QC Controls

Mayfair Gold employs a QA/QC program consistent

with NI 43-101 and industry best practices. Surface drilling was

conducted by Major/Norex Drilling of Timmins, Ontario and was

supervised by the Mayfair exploration team. Mayfair’s drill

program includes descriptive logging and sampling of the drill core

for analysis at Mayfair’s secure facility located in Matheson,

Ontario. Sampled drill core intervals were sawn in half with a

diamond blade saw. Half of the sampled core was left in the core

box and the remaining half was bagged and sealed. Mayfair utilizes

accredited laboratories that include, Activation Laboratories Ltd.

(Actlabs) and AGAT Laboratories Ltd. (AGAT) both located in

Timmins, Ontario, and Swastika Laboratories Ltd located in

Swastika, Ontario. Mayfair personnel transport the samples directly

and deliver to Actlabs, and samples are collected by both AGAT and

Swastika personnel directly from Mayfair’s secure core logging

facility in Matheson, Ontario. Gold was analyzed by 30-gram fire

assay with AA-finish. Certified reference material (CRM) standards

and coarse blank material are inserted every twenty samples.

Mayfair completes routine third-party check assays.

Drill intercepts cited do not necessarily represent true

widths, unless otherwise noted.

About Mayfair Gold

Mayfair Gold is a Canadian mineral exploration

company focused on advancing the 100% controlled Fenn-Gib gold

project in the Timmins region of Northern Ontario. The Fenn-Gib

gold deposit is Mayfair’s flagship asset and currently hosts an

updated NI 43-101 resource estimate including a pit constrained

Indicated Resource of 118.07M tonnes containing 3.06M ounces at a

grade of 0.81 g/t Au; a pit constrained Inferred Resource of 13.8M

tonnes containing 0.31M ounces at a grade of 0.70 g/t Au; and an

underground Inferred Resource of 1M tonnes containing 0.104M ounces

at a grade of 3.22 g/t Au. (Source: Garth Kirkham, P. Geo., of

Kirkham Geosystems Ltd., who is deemed a qualified person as

defined by NI 43-101, effective date October 15, 2022). The

Fenn-Gib deposit has a strike length of approx. 1.25km with widths

ranging up to 300m. The gold mineralized zones remain open at depth

and along strike to the east and west. Recently completed

metallurgical tests confirm that the Fen-Gib deposit can deliver

robust gold recoveries of up to 94%.

For further

information contact:

Patrick Evans, President and CEO Email: patrick@mayfairgold.ca

Phone: (480) 747-3032Web: www.mayfairgold.ca

Forward Looking

Statements

This news release contains forward-looking

statements and forward-looking information within the meaning of

Canadian securities legislation (collectively,

"forward-looking statements") that relate to

Mayfair’s current expectations and views of future events. Any

statements that express, or involve discussions as to,

expectations, beliefs, plans, objectives, assumptions or future

events or performance (often, but not always, through the use of

words or phrases such as "will likely result", "are expected to",

"expects", "will continue", "is anticipated", "anticipates",

"believes", "estimated", "intends", "plans", "forecast",

"projection", "strategy", "objective" and "outlook") are not

historical facts and may be forward-looking statements and may

involve estimates, assumptions and uncertainties which could cause

actual results or outcomes to differ materially from those

expressed in such forward-looking statements. No assurance can be

given that these expectations will prove to be correct and such

forward-looking statements included in this news release should not

be unduly relied upon. These statements speak only as of the date

of this news release.

Forward-looking statements are based on a number

of assumptions and are subject to a number of risks and

uncertainties, many of which are beyond Mayfair’s control, which

could cause actual results and events to differ materially from

those that are disclosed in or implied by such forward- looking

statements. Such risks and uncertainties include, but are not

limited to, the impact and progression of the COVID-19 pandemic and

other factors. Mayfair undertakes no obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by law. New factors emerge from time to time, and it is not

possible for Mayfair to predict all of them, or assess the impact

of each such factor or the extent to which any factor, or

combination of factors, may cause results to differ materially from

those contained in any forward-looking statement. Any

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

Photos accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/21a27ade-1187-45da-9d47-c76a2ea78e06

https://www.globenewswire.com/NewsRoom/AttachmentNg/272d6460-a637-48c3-9234-3b7e9b261041

https://www.globenewswire.com/NewsRoom/AttachmentNg/5f8a9a19-08d9-4d3f-a3fc-e3edd6197f04

https://www.globenewswire.com/NewsRoom/AttachmentNg/e26bd718-0dfe-4ea1-9dbc-87ba45183970

https://www.globenewswire.com/NewsRoom/AttachmentNg/391fdda6-661e-4e49-bc6b-061fd11cb181

https://www.globenewswire.com/NewsRoom/AttachmentNg/39f95c25-1280-49cd-9b47-cbf162c84c68

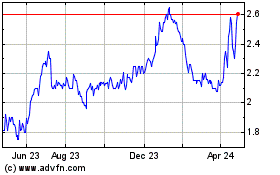

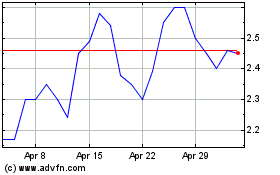

Mayfair Gold (TSXV:MFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mayfair Gold (TSXV:MFG)

Historical Stock Chart

From Apr 2023 to Apr 2024