TSXV: MSR

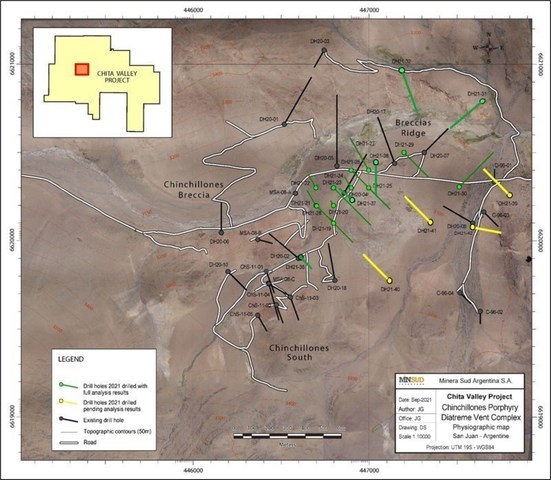

TORONTO, Dec. 13, 2021 /CNW/ - Minsud Resources

Corp. (TSXV: MSR) ("Minsud" or the "Company"), is pleased

to announce receipt of assay results from the additional eight (8)

drillholes completed in the ongoing Phase 3 program over the

Chinchillones area, located at the Chita Valley Project, San Juan

province, Argentina. The Company is completing the largest annual

drilling program over the Chita project area, encompassing

approximately 12,000 meters by the end of December 2021.

A total of twenty-four (24) drillholes are being completed by

the end of this year. Twenty (20) drillholes have been reported

through several previous press releases with remaining four (4)

drillholes awaiting assay results.

Highlights are listed below, along with the accompanying

figures. Scout drillholes CHDH21-33 to CHDH21-35 were drilled

outside of the principal Chinchillones area.

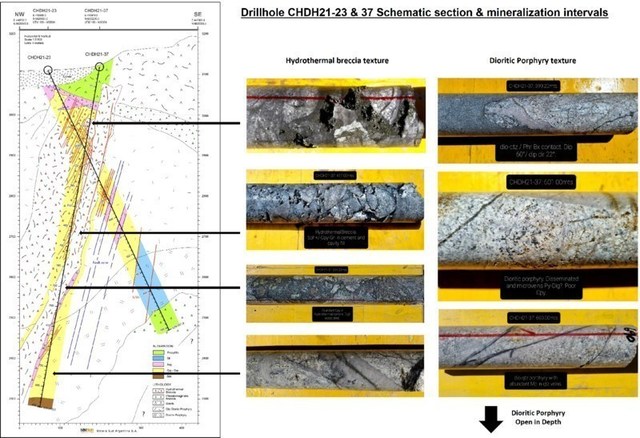

- CHDH21-37 is the deepest drillhole of the project

with 852 m depth. The most

significant intercepts included 448m

with 1.20% CuEq; 3.59% ZnEq, from 404m to 852m EOH

(0.29% Cu, 0.13 g/t Au, 24.08 g/t Ag, 353 ppm Mo, 0.27% Pb, 1.17%

Zn) and a higher-grade zone of 114m

from 490m at 2.67% CuEq; 8.00% ZnEq

(0.52% Cu, 0.34 g/t Au, 67.30 g/t Ag, 0.79% Pb, 3.46% Zn).

This drillhole, with a NNW azimuth, dipping 80°, aimed at

testing the extent of high-grade polymetallic mineralization

intersected at CHDH21-23 (please see press release dated

August 26, 2021). High-grade

intervals are hosted in magmatic-hydrothermal breccias from

409m to 600m, with abundant sulphides in the breccia

matrix. The breccia progresses at depth to a finer-grained dioritic

porphyry containing pervasive Cu-Mo mineralization within type "B"

veins, accompanied by strong sericite-quartz-pyrite alteration,

until the end of the drillhole.

The mineralized diorites intercepted at depth in CHDH21-37,

together with those observed in drillholes CHDH21-23, 28, 04 and

38, confirmed the presence of a porphyry mineralized body, from

around 500m below surface extending

down-dip to at least 850m. From the

drilling conducted so far, the apparent NS-trending porphyry body

is at least 500m-long and

270m-wide.

The higher-grade polymetallic mineralization from 102m occurs in a zone characterized by

well-developed sulphide-cemented hydrothermal breccias and

high-density vein network of sphalerite–

chalcopyrite-galena-pyrargyrite-tennantite-native silver which is

demonstrably superimposed on the Cu-Mo-Ag-Au porphyry body.

- CHDH21-38 intersected 387m at 0.50% CuEq, from 340m to 727m.

(0.25% Cu, 0.06 g/t Au, 9.06 g/t Ag, 111 ppm Mo). This drillhole is

located 250m NE of CHDH21-37, heading

S, dipping 75° with 727m depth. This

drillhole intersected mineralized dacitic and dioritic rocks. The

principal Cu-Mo-Ag-Au mineralization occur as disseminations, and

in thin quartz type "B" and "A" veinlets of pyrite-chalcopyrite and

chalcopyrite-bornite. In conjunction with drillhole CHDH21-37 these

drillholes confirmed the presence of Cu-Mo porphyry at depth and

demonstrate that the porphyry body is open in various directions.

Molybdenum values remarkably increased through to the end of the

drillhole, indicating further potential at depth.

The substantial and high-grade Zn-Pb-Ag-Cu-Au and Cu-Mo-Ag-Au

mineralization at CHDH21-37 and CHDH21-38 confirm the potential of

Chinchillones to host high-grade polymetallic mineralization

transitioning to prospective cluster of porphyry Cu centres.

Ramiro Massa, Minsud's President

& CEO, commented: "We continue to be excited and encouraged

by results from our ongoing Phase 3 drilling program. This year we

discovered a new porphyry center at Chinchillones area with Cu-Mo

mineralization overprinted by a hydrothermal system Zn-Pb-Cu-Ag-Au.

Our exploration program has expanded our understanding of the

project and dramatically increased its potential. We continue our

ongoing exploration program and anticipate further encouraging

results with support from our partner South32".

|

PHASE III:

Chinchillones Diamond Drilling Program – Summary of Analytical

Results

|

%

|

|

Hole

ID

|

From

|

To

|

Length

|

Au

|

Ag

|

Cu

|

Mo

|

Pb

|

Zn

|

Zn Eq

(**)

|

Cu Eq

(***)

|

|

(mt)

|

(mt)

|

(mts)

(*)

|

g/t

|

g/t

|

%

|

ppm

|

ppm

|

ppm

|

|

CHDH21-31

|

300

|

322

|

22

|

0.05

|

8.27

|

0.06%

|

7

|

1829

|

4679

|

1.09%

|

0.36%

|

|

376

|

422

|

46

|

0.04

|

13.94

|

0.08%

|

10

|

902

|

6809

|

1.42%

|

0.47%

|

|

CHDH21-32

|

6

|

16

|

10

|

0.08

|

3.98

|

0.17%

|

215

|

709

|

356

|

1.17%

|

0.39%

|

|

288

|

334

|

46

|

0.05

|

2.88

|

0.17%

|

80

|

21

|

223

|

0.83%

|

0.28%

|

|

CHDH21-33

|

112

|

135

|

23

|

0.16

|

14.10

|

0.03%

|

3

|

1266

|

4422

|

1.31%

|

0.44%

|

|

CHDH21-34

|

18

|

46

|

28

|

0.06

|

5.80

|

0.11%

|

90

|

29

|

25

|

0.73%

|

0.24%

|

|

148

|

276

|

128

|

0.05

|

1.96

|

0.10%

|

98

|

90

|

223

|

0.60%

|

0.20%

|

|

CHDH21-35

|

206

|

224

|

18

|

0.25

|

2.01

|

0.04%

|

39

|

112

|

1048

|

0.86%

|

0.29%

|

|

CHDH21-36

|

48

|

78

|

30

|

0.06

|

14.66

|

0.11%

|

1

|

1013

|

4527

|

1.34%

|

0.45%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHDH21-37

|

102

|

240

|

138

|

0.17

|

25.14

|

0.20%

|

30

|

1016

|

8053

|

2.50%

|

0.83%

|

|

Inc

|

128

|

184

|

56

|

0.27

|

41.33

|

0.31%

|

26

|

1052

|

17584

|

4.39%

|

1.47%

|

|

404

|

852

|

448

|

0.13

|

24.08

|

0.29%

|

353

|

2699

|

11678

|

3.59%

|

1.20%

|

|

Inc

|

490

|

604

|

114

|

0.34

|

67.30

|

0.52%

|

31

|

7883

|

34555

|

8.00%

|

2.67%

|

|

CHDH21-38

|

340

|

727

|

387

|

0.06

|

9.06

|

0.25%

|

111

|

514

|

1888

|

1.49%

|

0.50%

|

|

Inc

|

586

|

589

|

3

|

0.11

|

69.13

|

1.68%

|

294

|

67

|

1009

|

7.52%

|

2.51%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

References:

|

|

|

|

|

|

|

|

|

|

|

|

|

(*) Intervals

reported in the above table are not true thicknesses

|

|

(**) ZnEq% formula

is defined as: Zn(%)+[Cu(%)*Cu price (lb)/Zn price (lb)]+[Ag(%)*Ag

price (lb)/Zn price (lb)]+[Au(%)*Au price (lb)/Zn price

(lb)]+[Pb(%)*Pb price (lb)/Zn price (lb)]+[Mo(%)*Mo price (lb)/Zn

price (lb)]

|

|

(***) CuEq%

formula is defined as: Cu(%)+[Zn(%)*Zn price (lb)/Cu price

(lb)]+[Ag(%)*Ag price (lb)/Cu price (lb)]+[Au(%)*Au price (lb)/Cu

price (lb)]+[Pb(%)*Pb price (lb)/Cu price (lb)]+[Mo(%)*Mo price

(lb)/Cu price (lb)]

|

|

Copper equivalent

(CuEq) and Zinc equivalent (ZnEq) grades are for comparative

purposes only. Calculations are uncut and recovery is assumed to be

100% as no metallurgical data is available.

|

Quality Assurance/Quality Control

All core samples were submitted to the ALS Global Laboratories

in Mendoza, Argentina for preparation and analysis. All samples

were analyzed for Au by fire assay/ AA finish 50g, plus a

48-element ultra-trace four acid digest with ICP-MS and ICP-AES

finish. Minsud followed industry standard procedures for the work

with a quality assurance/quality control (QA/QC) program. Field

duplicates, standards and blanks were included with all sample

shipments to the principal laboratory. Minsud detected no

significant QA/QC issues during review of the data.

Mr. Mario Alfaro, Professional

Geoscientist, VP-Exploration of the Company, is a qualified person

as defined by Canadian National Instrument 43-101. Mr. Alfaro

visited the property and has read and approved the contents of this

release.

About the Chita Valley Project, San Juan Province:

The Chita Valley Project is a large exploration stage porphyry

system with classic alteration features, widespread porphyry style

Cu-Mo-Au and polymetallic Ag-Pb-Zn mineralization hosted by

Hydrothermal Phreatic Breccias and associated gold and

silver-bearing polymetallic veins of intermediate sulfide

composition that conformed an outcropping porphyry system at Chita

and a lithocap of a porphyry system at Chinchillones. San Juan

Province of Argentina has a robust mining sector and recognizes the

important economic benefits of responsible development of its

substantial Mineral Resource endowment.

Current exploration activities on the Chita Valley Project are

being funded by a subsidiary of South32 in accordance with the

earn-in agreement between the parties entered into on November 1, 2019.

The earn-in agreement grants to South32 the right to acquire a

50.1% direct interest in the Company's Argentinean operating

subsidiary Minera Sud Argentina S.A.

("MSA") at the end of the earn-in period. Under the earn-in

agreement, and having given the Company notice of its intention to

continue funding Chita Valley Project, South32 will provide further

funding to MSA over the next 2 years such that its aggregate

funding is (i) not less than C$10.5

million by December 31, 2022;

and (ii) not less than C$14 million

by December 31, 2023. South32 has the

right to withdraw at the end of each year.

If South32 exercises its earn-in right it may elect to fund a

pre-feasibility study, with a minimum spend of C$41 million, which would entitle it to elect to

increase its 50.1% direct interest in MSA to 70%.

About Minsud Resources Corp.

Minsud is a mineral exploration company focused on exploring its

flagship Chita Valley Cu-Mo- Au-Ag-Pb-Zn Project, in the Province

of San Juan, Argentina. The Company also holds a 100% owned

portfolio of selected early-stage prospects, including 6,000 ha in

Santa Cruz Province,

Argentina.

About South32 Limited

South32 is a globally diversified mining and metals company. The

company's purpose is to make a difference by developing natural

resources, improving people's lives now and for generations to

come. South32 is trusted by its owners and partners to realise the

potential of their resources. South32 produces bauxite, alumina,

aluminium, metallurgical coal, manganese, nickel, silver, lead and

zinc at operations in Australia,

Southern Africa and South America. With a focus on growing its

base metals exposure, South32 also has two development options in

North America and several

partnerships with junior explorers around the world.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION:

This news release includes certain information that may

constitute forward-looking information under applicable Canadian

securities laws. Forward-looking information includes, but is not

limited to, statements about strategic plans, spending commitments,

future operations, results of exploration, anticipated financial

results, future work programs, capital expenditures and objectives.

Forward-looking information is necessarily based upon a number of

estimates and assumptions that, while considered reasonable, are

subject to known and unknown risks, uncertainties, and other

factors which may cause the actual results and future events to

differ materially from those expressed or implied by such

forward-looking information including, but not limited to:

fluctuations in the currency markets (such as the Canadian dollar,

Argentina peso, and the U.S. dollar); changes in national and local

government, legislation, taxation, controls, regulations and

political or economic developments in Canada and Argentina or other countries in

which the Corporation may carry on business in the future;

operating or technical difficulties in connection with exploration

and development activities; risks and hazards associated with the

business of mineral exploration and development (including

environmental hazards or industrial accidents); risks relating to

the credit worthiness or financial condition of suppliers and other

parties with whom the Company does business; presence of laws and

regulations that may impose restrictions on mining, including those

currently enacted in Argentina;

employee relations; relationships with and claims by local

communities; availability and increasing costs associated with

operational inputs and labour; the speculative nature of mineral

exploration and development, including the risks of obtaining

necessary licenses, permits and approvals from government

authorities; business opportunities that may be presented to, or

pursued by, the Company; challenges to, or difficulty in

maintaining, the Company's title to properties; risks relating to

the Company's ability to raise funds; and the factors identified

under "Risk Factors" in the Company's Filing Statement dated

April 27, 2011. There can be no

assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such information. Accordingly, readers should not

place undue reliance on forward-looking information. All

forward-looking-information contained in this news release is given

as of the date hereof and is based upon the opinions and estimates

of management and information available to management as at the

date hereof. The Company disclaims any intention or obligation to

update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, except as

required by law.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

SOURCE Minsud Resources Corp.