Osisko Metals Incorporated (the “

Company” or

“

Osisko Metals”) (TSX-V: OM; OTCQX: OMZNF;

FRANKFURT: 0B51) is pleased to announce that it signed, on March 25

2022, a binding term sheet with Glencore Canada Corporation

(“

Glencore” and collectively the

“

Parties”), providing Osisko Metals with an option

(the “

Option”) to acquire a 100% interest in the

past-producing Gaspé Copper Mine (

“Gaspé Copper”)

located near Murdochville, Québec for an up-front payment of US$25

million, to be paid by Osisko Metals by way of a convertible note

issued to Glencore upon the successful closing of the transaction,

and a cash payment of US$20 million, payable upon start of

commercial production. The Company must also incur drilling costs

of C$5 million before June 30, 2022, to test oxidation levels

within the mineralization that surrounds the historical Mount

Copper open pit deposit.

Gaspé Copper Option

Overview

Assuming exercise of the Option, the acquisition

by Osisko Metals of Gaspé Copper could provide the following

benefits to the Company:

- Transformational

acquisition for the Company, providing shareholder exposure to a

significant copper development asset that is located in a safe

jurisdiction with an excellent track record of mine permitting,

especially for metals critical to global decarbonization

objectives;

- Substantial

exploration and resource development potential at Gaspé Copper,

which includes the past-producing Mount Copper open pit mine, the

higher-grade Needle Mountain and E-Zone underground mines, as well

as the undeveloped Porphyry Mountain bulk tonnage deposit;

- Drill program to

start in April 2022 for the purpose of validating an internal

resource model and the oxidation levels of mineralization at the

Mount Copper deposit, which is a critical phase of due diligence on

the project that will lead to a decision on whether to exercise the

Option before June 30 2022, and

- Supportive

infrastructure necessary for mine development is already in place,

including green hydroelectric power with an electrical substation

on the former mine site.

Osisko Metals will host a conference call at

10:00AM ET. Participants are requested to log in 15 minutes prior

to the call using the following numbers:

Participant Toll-Free Dial-In Number:1 (888)

880-5501

Participant Toll Dial-In Number:1 (438)

800-1833

A digital recording of the conference call will

be available for replay two hours after the call's completion until

March 31st 2022. To access the recording, please use the dial-in

number listed below and the following conference ID 3093894.

Toll Free Dial in Number: 1- 800- 770- 2030

Toll Dial in Number: 1- 647- 362- 9199

Robert Wares, Chairman & CEO,

commented: “Gaspé Copper was a significant copper producer

in Eastern Canada for over forty years, and we believe in the

potential to unlock value from this asset through drilling and

re-evaluation of remaining resources. If our internal model is

validated, we expect to close the transaction and release a maiden

Inferred Mineral Resource estimate on the Mount Copper deposit this

year.”

“The successful closing of this transaction will

give Osisko Metals shareholders significant copper exposure and

make Glencore a major shareholder of the Company. We welcome the

new partnership with Glencore and look forward to other

collaborative opportunities that the partnership may bring. In

addition to the ongoing development of our Pine Point zinc-lead

project, we are convinced that this combination of projects will

cement Osisko Metals’ position as one of the premier base metal

development companies in Canada. Our combined expertise will allow

us to rapidly advance both projects and create shareholder value in

safe jurisdictions with a celebrated mining history.”

Transaction Overview

- Glencore has

granted Osisko Metals an exclusive Option to acquire 100% of its

interest in the past-producing Gaspé Copper mine, subject to the

following terms:

- The Company

incurring drilling costs of C$5 million to test oxidation levels

within the mineralization that surrounds the historical Mount

Copper open pit deposit;

- Completion by

the Parties of all necessary due diligence inquiries of the other

Party, and negotiating any outstanding matters by the Parties,

and

- Provide a letter

indicating its intent to exercise the option by June 30,

2022.

- The Parties will

work toward finalizing and signing a Definitive Agreement and all

related documents no later than May 16, 2022,

which will only become effective upon exercise of the Option.

- Once Osisko

Metals has exercised the Option, if at all, and the Definitive

Agreement and all related documents are signed by the Parties, then

the Parties will have three months (on or before September

30, 2022) to close the transaction, including the payment

by Osisko Metals to Glencore of the US$25 million purchase price.

The payment will be paid by way of issuance of a convertible note

to Glencore.

- The note will be

convertible by Glencore into units of Osisko Metals at a price of

$0.40 per unit. Each unit will consist of one share and a

half-warrant. Each whole warrant will entitle Glencore to acquire

one common share of Osisko Metals at a price of $0.46 per share for

a period of 3 years.

- Glencore will

retain a 1% NSR on the Mount Copper sulphide deposit and a 3% NSR

on all other mineral products extracted from the property.

- Osisko Metals

will incur a total of C$55 million in exploration and development

expenditures, including permitting expenditures, over a period of

four years of the date of the Definitive Agreement, with a minimum

of C$20 million to be incurred within the first two years of the

date of the Definitive Agreement.

- Glencore will

retain a commercially reasonable offtake for 100% of concentrates

produced during the renewed life of mine at Gaspé Copper.

- Osisko Metals

will pay to Glencore an additional cash consideration of US$20M

upon commencement of commercial production at Gaspé Copper.

The Option and acquisition by Osisko Metals of a

100% interest in Gaspé Copper remain subject to, among other

things, the approval of (i) the TSX Venture Exchange, and (ii) the

shareholders of Osisko Metals to authorize Glencore to become, upon

and only upon conversion of the note, a "control person" of the

Company.

History of Gaspé Copper

Mines

From the initial discoveries in 1921, Gaspé

Copper (formerly subsidiary of Noranda Inc.) mined the porphyry

copper/skarn complex and produced copper concentrate continuously

from 1955 until the closure of the mine in 1999. Production started

with the Needle Mountain open pit then expanded to operating the

Mount Copper open pit that was supplemented with feed from the

extensive high-grade underground skarn mineralization (B and C Zone

deposits) as well as the massive sulfide skarn and manto deposits

of the underground E Zone.

During its mine life, a total of 150 million

tonnes grading an average of 0.87% Cu with minor gold and silver

credits was extracted (Hussey&Bernard, SME Journal, August

1998), making it one of the largest copper operations in Eastern

Canada.

Location and Infrastructure

Gaspé Copper is located next to the community of

Murdochville, in the Gaspé Peninsula of Eastern Quebec,

approximately 825km east of Montreal. All necessary support

infrastructure for the potential re-opening of Gaspé Copper is

already in place. The former mine site benefits from paved road

access with local highway 198 linking Murdochville with the coastal

community of Gaspé. Green hydroelectric power with an electrical

substation is located on-site.

Qualified Person

Mr. Jeff Hussey, P. Geo., is the Qualified

Person and President/COO for Osisko Metals Incorporated. He is

responsible for the technical data reported in this news release

and he is a Professional Geologist registered in Quebec.

About Osisko Metals

Osisko Metals Incorporated is a Canadian

exploration and development company creating value in the base

metal space. The Company controls one of Canada’s premier

past-producing zinc mining camps, the Pine Point Project, located

in the Northwest Territories for which the 2020 PEA has indicated

an after-tax NPV of $500M and an IRR of 29.6%. The Pine Point

Project PEA is based on current Mineral Resource Estimates that are

amenable to open pit and shallow underground mining and consist of

12.9Mt grading 6.29% ZnEq of Indicated Mineral Resources and 37.6Mt

grading 6.80% ZnEq of Inferred Mineral Resources. Please refer to

the technical report entitled “Preliminary Economic Assessment,

Pine Point Project, Hay River, Northwest Territories, Canada” dated

July 30 2020, which has been filed on SEDAR. The Pine Point Project

is located on the south shore of Great Slave Lake in the Northwest

Territories, near infrastructure, paved highway access, and has an

electrical substation as well as 100 kilometres of viable haulage

roads already in place.

The current Mineral Resources mentioned in this

press release conform to NI43-101 standards and were prepared by

independent qualified persons, as defined by NI43-101 guidelines.

The abovementioned Mineral Resources are not Mineral Reserves as

they do not have demonstrated economic viability. The quantity and

grade of the reported Inferred Mineral Resources are conceptual in

nature and are estimated based on limited geological evidence and

sampling. Geological evidence is sufficient to imply but not verify

geological grade and/or quality of continuity. Zinc equivalency

percentages are calculated using metal prices, forecasted metal

recoveries, concentrate grades, transport costs, smelter payable

metals and charges (see respective technical reports for

details).

For further information on this press

release, visit www.osiskometals.com

or contact:

Robert Wares, CEO, Osisko Metals, tel.

514-940-0670 ext. 111

Email: info@osiskometals.com

www.osiskometals.com

Cautionary Statement Regarding

Forward-Looking Information

This news release contains "forward‐looking

information" within the meaning of the applicable Canadian

securities legislation that is based on expectations, estimates,

projections and interpretations as at the date of this news

release. The information in this news release about the Option; the

timing and ability of the Company to exercise the option (if at

all); the timing and ability of the Company and Glencore to execute

the Definitive Agreement (if at all); the results of any

exploration work completed by Osisko Metals on Gaspé Copper; the

significance (if any) of Gaspé Copper being a past producer and the

results of such past production; the ability of Osisko Metals (if

at all) to complete the required expenditures during the periods to

be specified in the Definitive Agreement; the timing and ability of

the Company to obtain regulatory approvals, including the approval

of the TSX Venture Exchange, in respect of the Option and the

acquisition of Gaspé Copper; and any other information herein that

is not a historical fact may be "forward-looking information".

Any statement that involves discussions with

respect to predictions, expectations, interpretations, beliefs,

plans, projections, objectives, assumptions, future events or

performance (often but not always using phrases such as "expects",

or "does not expect", "is expected", "interpreted", "management's

view", "anticipates" or "does not anticipate", "plans", "budget",

"scheduled", "forecasts", "estimates", "believes" or "intends" or

variations of such words and phrases or stating that certain

actions, events or results "may" or "could", "would", "might" or

"will" be taken to occur or be achieved) are not statements of

historical fact and may be forward-looking information and are

intended to identify forward-looking information.

This forward-looking information is based on

reasonable assumptions and estimates of management of the Company,

at the time such assumptions and estimates were made, and involves

known and unknown risks, uncertainties or other factors which may

cause the actual results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

risks relating to the Option; the ability of the Parties to

negotiate and execute the Definitive Agreement; volatility in the

trading price of common shares of the Company; risks relating to

the ability of the Company to obtain required approvals; ability of

Osisko Metals to complete further exploration activities; property

interests; the results of exploration activities; risks relating to

mining activities; the global economic climate; metal prices;

dilution; environmental risks changes in the tax and regulatory

regime; community and non-governmental actions; and those risks set

out in the Company's public documents filed on SEDAR

(www.sedar.com) under Osisko Metals' issuer profile. Although the

forward-looking information contained in this news release is based

upon what management believes, or believed at the time, to be

reasonable assumptions, the Company cannot guarantee shareholders

and purchasers of securities of the Company that actual results

will be consistent with such forward-looking information, as there

may be other factors that cause results not to be as anticipated,

estimated or intended, and neither Company nor any other person

assumes responsibility for the accuracy and completeness of any

such forward looking information. The Company does not undertake,

and assumes no obligation, to update or revise any such forward

looking statements or forward-looking information contained herein

to reflect new events or circumstances, except as may be required

by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

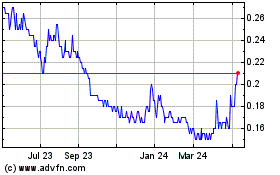

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Mar 2024 to Apr 2024

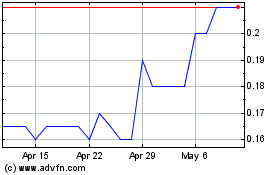

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Apr 2023 to Apr 2024