Osisko Metals Incorporated (the “

Company” or

“

Osisko Metals”) (TSX-V: OM; OTCQX: OMZNF;

FRANKFURT: 0B51) is pleased to announce that drilling at Gaspé

Copper will begin this week. The drill program will focus on

re-evaluation of copper mineralization near the past-producing

Mount Copper open pit, with Phase 1 (10,000 metres) primarily

designed to evaluate extent of near-surface oxide mineralization,

and a subsequent Phase 2 program (20,000 metres) for infill

drilling in order to update the currently modelled in-pit resource.

The company anticipates issuing the maiden,

NI43-101 compliant, in-pit Inferred Mineral Resource Estimate for

the Mount Copper deposit before the end of April, which will be

based on historical drilling results from Noranda (until 1998), and

more recently from Xstrata and Glencore Canada (2011 to 2019).

Robert Wares, Chairman & CEO, commented: “We

are excited to take this first step in re-evaluating the historic

Gaspé Copper mine located near the community of Murdochville. Our

initial drilling will be focused on completing our due diligence

requirements, including further testing of the surface oxide zone.

Should Osisko Metals acquire this asset from Glencore Canada, the

objective this year will be to complete the 30,000 metre drill

program and launch a Preliminary Economic Assessment of the

project. Additional drilling may be completed this year in order to

upgrade the forthcoming Inferred Mineral Resource Estimate to the

Measured and Indicated categories so that we can rapidly move

forward to a Feasibility Study.”

The expansion of the Mount Copper open pit was

evaluated by Noranda in the 1980’s but did not proceed due to the

presence of the copper smelter located on the pit perimeter. Mining

operations ceased in 1999 and the smelter closed in 2002. Since

then, the entire mine, mill and smelter complex was dismantled and

the site has been on care and maintenance. With the smelter gone,

potential expansion of the Mount Copper pit is now possible and

this will be the focus of the Company’s resource evaluation in the

context of rising copper prices.

Pine Point Update

The winter drill program at Pine Point is

finishing and drilling will be suspended during spring break-up.

Drilling will resume in June 2022 and remaining drilling, which

will extend into winter 2023, will allow conversion of the Inferred

Mineral Resources to the Measure and Indicated categories, which

will be included in the 2023 feasibility study.

The site-wide hydrogeological study is near

completion and results are being incorporated into the 2022 PEA

Update. The study will integrate significantly lower dewatering

costs and increased commodity prices.

The PEA Update is now scheduled for release in

mid-May. The delay in issuing the PEA from the end of the first

quarter was to fully calibrate the hydrogeological model and to

further optimize the Life-of-Mine Plan. Following this we will

continue with trade off studies in preparation of the 2023

feasibility study. The study will also include an estimate of the

further reduction in greenhouse gas emissions.

The 2020 PEA already included the reduction of

energy associated to material sorting reducing the throughput of

the concentrator by approximately forty percent. That combined with

the use of natural gas generators to generate power that was not

available on the Taltson grid. The 2022 PEA Update should have less

power needs due the reduced de-watering volume estimates.

Qualified Person

Mr. Jeff Hussey, P. Geo., is the Qualified

Person and President/COO for Osisko Metals Incorporated. He is

responsible for the technical data reported in this news release

and he is a Professional Geologist registered in Quebec.

About Osisko Metals

Osisko Metals Incorporated is a Canadian

exploration and development company creating value in the base

metal space. The Company controls one of Canada’s premier

past-producing zinc mining camps, the Pine Point Project, located

in the Northwest Territories for which the 2020 PEA has indicated

an after-tax NPV of $500M and an IRR of 29.6%. The Pine Point

Project PEA is based on current Mineral Resource Estimates that are

amenable to open pit and shallow underground mining and consist of

12.9Mt grading 6.29% ZnEq of Indicated Mineral Resources and 37.6Mt

grading 6.80% ZnEq of Inferred Mineral Resources. Please refer to

the technical report entitled “Preliminary Economic Assessment,

Pine Point Project, Hay River, Northwest Territories, Canada” dated

July 30 2020, which has been filed on SEDAR. The Pine Point Project

is located on the south shore of Great Slave Lake in the Northwest

Territories, near infrastructure, paved highway access, and has an

electrical substation as well as 100 kilometres of viable haulage

roads already in place.

The current Mineral Resources mentioned in this

press release conform to NI43-101 standards and were prepared by

independent qualified persons, as defined by NI43-101 guidelines.

The abovementioned Mineral Resources are not Mineral Reserves as

they do not have demonstrated economic viability. The quantity and

grade of the reported Inferred Mineral Resources are conceptual in

nature and are estimated based on limited geological evidence and

sampling. Geological evidence is sufficient to imply but not verify

geological grade and/or quality of continuity. Zinc equivalency

percentages are calculated using metal prices, forecasted metal

recoveries, concentrate grades, transport costs, smelter payable

metals and charges (see respective technical reports for

details).

For further information on this press

release, visit www.osiskometals.com

or contact:

Robert Wares, CEO, Osisko Metals, tel.

514-940-0670 ext. 111

Email: info@osiskometals.com

www.osiskometals.com

Cautionary Statement Regarding

Forward-Looking Information

This news release contains "forward‐looking

information" within the meaning of the applicable Canadian

securities legislation that is based on expectations, estimates,

projections and interpretations as at the date of this news

release. The information in this news release about the potential

acquisition of Gaspé Copper; the timing and ability of the Company

to exercise the option to acquire Gaspé Copper(if at all); the

results of exploration and economic evaluation work completed by

Osisko Metals on Gaspé Copper ad Pine Point; the significance (if

any) of Gaspé Copper and Pine Point being past producers and the

results of such past production; the timing and ability of the

Company to obtain regulatory approvals, including the approval of

the TSX Venture Exchange, for any transaction and any other

information herein that is not a historical fact may be

"forward-looking information".

Any statement that involves discussions with

respect to predictions, expectations, interpretations, beliefs,

plans, projections, objectives, assumptions, future events or

performance (often but not always using phrases such as "expects",

or "does not expect", "is expected", "interpreted", "management's

view", "anticipates" or "does not anticipate", "plans", "budget",

"scheduled", "forecasts", "estimates", "believes" or "intends" or

variations of such words and phrases or stating that certain

actions, events or results "may" or "could", "would", "might" or

"will" be taken to occur or be achieved) are not statements of

historical fact and may be forward-looking information and are

intended to identify forward-looking information.

This forward-looking information is based on

reasonable assumptions and estimates of management of the Company,

at the time such assumptions and estimates were made, and involves

known and unknown risks, uncertainties or other factors which may

cause the actual results, performance or achievements of the

Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

risks relating to the ability of the Company and other parties to

negotiate and execute agreements; volatility in the trading price

of common shares of the Company; risks relating to the ability of

the Company to obtain regulatory and shareholder approvals, as

required; ability of Osisko Metals to complete further exploration

activities; property interests; the results of exploration

activities; risks relating to mining activities; the global

economic climate; long-term metal price assumptions; dilution;

environmental risks; changes in the tax and regulatory regime;

community and non-governmental actions; and those risks set out in

the Company's public documents filed on SEDAR (www.sedar.com) under

Osisko Metals' issuer profile. Although the forward-looking

information contained in this news release is based upon what

management believes, or believed at the time, to be reasonable

assumptions, the Company cannot guarantee shareholders and

purchasers of securities of the Company that actual results will be

consistent with such forward-looking information, as there may be

other factors that cause results not to be as anticipated,

estimated or intended, and neither Company nor any other person

assumes responsibility for the accuracy and completeness of any

such forward looking information. The Company does not undertake,

and assumes no obligation, to update or revise any such forward

looking statements or forward-looking information contained herein

to reflect new events or circumstances, except as may be required

by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

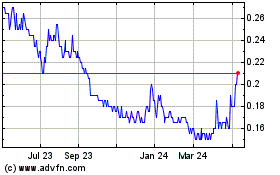

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Mar 2024 to Apr 2024

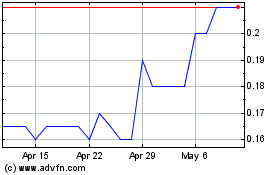

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Apr 2023 to Apr 2024