Osisko Metals Incorporated (the "

Corporation" or

"

Osisko Metals") (TSX-V: OM; OTCQX: OMZNF;

FRANKFURT: OB51) is pleased to announce that it has entered into an

agreement with a syndicate of underwriters led by Eight Capital

(collectively, the “

Underwriters”) who, as lead

underwriter has agreed to purchase, on a bought deal private

placement basis (the "

Offering"):

- No less than

14,815,000 flow-through units of the Corporation ("FT

Units") at a price of $0.54 per FT Unit (the "FT

Unit Issue Price"), for gross proceeds of approximately $8

million, with each FT Unit comprised of (i) one common share of the

Corporation that will qualify as "flow-through shares" (within the

meaning of subsection 66 (15) of the Income Tax Act (Canada))

("FT Shares"), and (ii) one-half-of-one common

share purchase warrant of the Corporation (each whole warrant, a

"FT Warrant"); and

- Up to 4,000,000

FT Shares at a price of $0.50 per FT Share (the "FT Share

Issue Price"), for gross proceeds of approximately $2

million.

Each whole FT Warrant will entitle the holder

thereof to purchase one common share of the Corporation at a price

of $0.57 per share until the close of business on the date which is

60 months from the closing date of the Offering.

The Corporation has also granted to the

Underwriters an option, exercisable, in whole or in part, up to 48

hours prior to the closing of the Offering, to purchase up to an

additional aggregate amount of 2.22 million FT Units at the issue

price and 600,000 FT shares at the issue price for additional gross

proceeds of up to $1,500,000.

The gross proceeds from the Offering will be

used by the Corporation to incur eligible "Canadian exploration

expenses" that will qualify as "flow-through mining expenditures"

(as such terms are defined in the Income Tax Act (Canada)) (the

"Qualifying Expenditures") related to the

Corporation's Pine Point Zinc Project and Gaspé Copper Project. All

Qualifying Expenditures will be renounced in favour of the

subscribers of the FT Shares effective December 31, 2022.

The Corporation has agreed to pay the

Underwriters a cash commission equal to a maximum of 6.5% of the

gross proceeds of the Offering and a number of broker warrants

equal to a maximum of 6.5% of the FT Units and FT Shares purchased

pursuant to the Offering. Each broker warrant will entitle the

holder thereof to purchase one common share of the Corporation at a

price of $0.54 per share until the close of business on the date

which is 24 months from the closing date of The Offering.

The Offering is expected to close on or about

June 16, 2022 and is subject to certain closing conditions

including, but not limited to, the receipt of all necessary

approvals including the conditional listing approval of the TSX

Venture Exchange and the applicable securities regulatory

authorities. The Offering is being made by way of private placement

in Canada. The securities issued under the Offering will be subject

to a hold period in Canada expiring four months and one day from

the closing date of the Offering.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This news

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any State in which such offer, solicitation or sale would be

unlawful.

About Osisko Metals

Osisko Metals Incorporated is a Canadian

exploration and development company focused on creating value in

the critical metal space. The Corporation owns one of Canada's

premier past-producing zinc mining camps, the Pine Point Project,

located in the Northwest Territories for which the Pine Point

Project PEA (2020) (as defined herein) has indicated an after-tax

NPV of $500 million and an IRR of 29.6%. The Pine Point Project PEA

(2020) is based on current Mineral Resource Estimates that are

amenable to open pit and shallow underground mining and consist of

12.9Mt grading 6.29% ZnEq of Indicated Mineral Resources and 37.6Mt

grading 6.80% ZnEq of Inferred Mineral Resources. Please refer to

the technical report entitled "Preliminary Economic Assessment,

Pine Point Project, Hay River, Northwest Territories, Canada" dated

July 30, 2020 (with an effective date of June 11, 2020) (the

"Pine Point Project PEA (2020)"), prepared by BBA

Inc. and WSP Canada Inc., for Osisko Metals and Pine Point Mining

Limited, a copy of which is available on SEDAR (www.sedar.com)

under Osisko Metals' issuer profile. The Pine Point Project is

located on the south shore of Great Slave Lake in the Northwest

Territories, near infrastructure, paved highway access, and has an

electrical substation as well as 100 kilometres of viable haulage

roads already in place.

Furthermore, the Corporation has an option to

purchase, from Glencore Canada, a 100% interest in the

past-producing Gaspé Copper property located near Murdochville in

the Gaspé peninsula of Quebec (see news release of Osisko Metals

dated March 28, 2022 for additional details).

For further information on this news

release, visit www.osiskometals.com

or contact:

|

Robert Wares, CEOOsisko Metals Incorporated Email:

info@osiskometals.com www.osiskometals.com |

|

Cautionary Statement on Forward-Looking

Information

This news release contains "forward‐looking

information" within the meaning of the applicable Canadian

securities legislation that is based on expectations, estimates,

projections and interpretations as at the date of this news

release. The information in this news release about the Offering;

the use of the proceeds from the Offering; the timing and ability

of the Corporation to obtain final approval of the Offering from

the TSX Venture Exchange, if at all; the tax treatment of the

Flow-Through Shares; the timing of the renouncement of the

Qualifying Expenditures in favor of the subscribers, if at all; the

prospects of the Pine Point Mining Camp; and any other information

herein that is not a historical fact may be "forward-looking

information". Any statement that involves discussions with respect

to predictions, expectations, interpretations, beliefs, plans,

projections, objectives, assumptions, future events or performance

(often but not always using phrases such as "expects", or "does not

expect", "is expected", "interpreted", "management's view",

"anticipates" or "does not anticipate", "plans", "budget",

"scheduled", "forecasts", "estimates", "believes" or "intends" or

variations of such words and phrases or stating that certain

actions, events or results "may" or "could", "would", "might" or

"will" be taken to occur or be achieved) are not statements of

historical fact and may be forward-looking information and are

intended to identify forward-looking information. This

forward-looking information is based on reasonable assumptions and

estimates of management of the Corporation, at the time such

assumptions and estimates were made, and involves known and unknown

risks, uncertainties or other factors which may cause the actual

results, performance or achievements of the Corporation to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

information. Such factors include, among others, risks relating to

the Offering; volatility in the trading price of common shares of

the Corporation; risks relating to the ability of the Corporation

to obtain required approvals; ability of Osisko Metals to complete

further exploration activities; property interests; the results of

exploration activities; risks relating to mining activities; the

global economic climate; metal prices; dilution; environmental

risks changes in the tax and regulatory regime; community and

non-governmental actions; and those risks set out in the

Corporation's public documents filed on SEDAR (www.sedar.com) under

Osisko Metals' issuer profile. Although the forward-looking

information contained in this news release is based upon what

management believes, or believed at the time, to be reasonable

assumptions, the Corporation cannot guarantee shareholders and

purchasers of securities of the Corporation that actual results

will be consistent with such forward-looking information, as there

may be other factors that cause results not to be as anticipated,

estimated or intended, and neither Corporation nor any other person

assumes responsibility for the accuracy and completeness of any

such forward looking information. The Corporation does not

undertake, and assumes no obligation, to update or revise any such

forward looking statements or forward-looking information contained

herein to reflect new events or circumstances, except as may be

required by law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

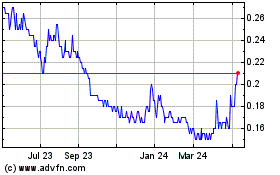

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Mar 2024 to Apr 2024

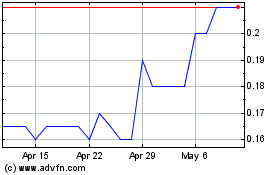

Osisko Metals (TSXV:OM)

Historical Stock Chart

From Apr 2023 to Apr 2024