Prospera Energy Inc (TSX.V: PEI, OTC: GXRFF, FRA: OF6B) (“PEI”) is

pleased to provide its shareholders with the following corporate

update summarizing the significant milestones achieved over the

past 1.3 years. Prospera has now positioned itself to develop three

large heavy oil fields (>42,000 acres) with significant OOIP

(390 mmbbl) that have had no modern drilling or recovery methods

applied. Historical production has accounted for only 30 mmbbl.

PEI Restructure 2021

Commencing 2021, PEI was restructured to be

compliant and profitable. PEI restructuring efforts were

coordinated throughout 2021 and accomplished the following:

- Structured

Equity and Convertible Debenture Private Placement financing that

raised 7.6 million Cdn$. These proceeds were used to:

- Settle both the

secured and unsecured creditors through a combination of monthly

payments and share debt settlement arrangements

- Settle

historical liabilities to surface landowners, local municipalities

and trades of more than $7.1 million (58%), which is reflected in

the December 31, 2020, financial statements

- Address all 400+

outstanding environmental and regulatory non-compliances

- Perform facility

& pipeline maintenance to ensure safe operating conditions

- Deploy working

capital to optimize production to the current 600 boepd resulting

in over $2.0 million in peak monthly revenue

- Increased PEI

ownership from an average of 40% - 80%+ in all core properties

- Restructured the

Board of Directors with diverse business and technical backgrounds

and formed an experienced management team focused on technical

delineation and financial discipline to optimize oil recovery in a

safe and cost-effective manner. The board is focused on

development, expansion, and growth whilst being ESG friendly.

- Licensed and

ready to spud re-entry horizontal drilling program in Summer 2022:

- The incremental

production is expected to increase total gross production to 1,500+

bpd

- Secured a letter

of intent (LOI) for an adjacent (strategic fit) heavy oil property

similar to the current three Saskatchewan assets

- Executed a

commitment letter to acquire a proximal light oil play with a

development plan to increase production by 1,000+bpd

Core Assets Background

PEI’s core assets are medium to heavy oil

properties (12-17 API) located along the Alberta-Saskatchewan

border: Cuthbert, Heart Hills, and Luseland.

A photo accompanying this announcement is

available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/708f28c0-468c-4841-8c03-94d77acbed3e

These three assets were initiated by Wascana

Energy in the late 1980s and developed by multinational Nexen

(CanOxy) in the 2000s and attained peak rates of 10,000 bpd through

vertical wells at reduced spacing.

Nexen built all the infrastructure to transport

emulsion to a central battery that was controlled and monitored by

state-of-the-art automated systems. Nexen also initiated 3D seismic

program over the entire pool of all three assets.

In 2010, industry economics dictated the

transfer of these three assets to an intermediate company, Cona

Resources (Northern Blizzard Resources), whom applied further

vertical drilling to increase heavy oil recoveries, however, were

focused on other prioritized assets.

Consequently, production from these three assets

declined to less than 1,500 bpd due to the lack of reservoir

management and pressure maintenance required to offset the primary

depletion. The low production rates were unable to support the high

fixed operating costs (surface lease and property tax) stemming

from the numerous reduced spacing vertical locations. In 2018,

these three assets were divested to a junior company, Prospera

Energy (Georox Resources), and various joint venture partners.

Towards the end of 2020, PEI found itself in a

challenging position. It had become difficult to continue

operations due to high and long-term liabilities. These

circumstances were further amplified by the pandemic and drastic

reduction in produced volumes (less than 200 bpd).

In December 2020, Mr. Samuel David was appointed

as President & CEO and to the Board of Directors of PEI. Mr.

David recognized that there was considerable oil remaining in the

ground. The properties were older and mature, but only an average

of 8 percent (~30 mmbbl) had been recovered up to this point of the

original oil place (390 mmbbl).

Furthermore, the recovery was almost exclusively

with vertical wells. Vertical wells have smaller drainage areas

with as low as 20-30 meters of effective radius from the vertical

well. This means that, with heavy oil that doesn’t move

efficiently, a lot of the remaining oil is left in the ground.

Horizontal well technology was a tough option 20

years ago because geosteering was still evolving. Getting a

horizontal well across a 3-meter net pay without dipping into the

oil-water contact was a challenging task.

With today’s downhole guide systems and

directional drill bits, the challenges are no longer a problem. PEI

can easily draw out a 500-meter horizontal lateral from an existing

wellbore and stay in the “sweet spot”. Instead of a vertical

well exposed to a couple meters of net pay, you get a horizontal

well accessing two hundred times that amount. Tapping more

reservoir means more oil to the wellbore and more recovery from the

reservoir.

These assets attained peak rates of 10,000 bpd

of heavy oil with just vertical wells. Working in PEI’s favor is

that, while the oil is heavy, the assets are very high permeability

reservoirs. Permeability is a measure of how well the oil flows in

the reservoir. The bigger the number, the better it moves. These

formations are porous (~30%) and permeable (3 -5 Darcies).

Current recoveries at these three properties are

6 - 10%. PEI believes that they can raise recoveries to at least

20%, and as high as 40%, using horizontal wells and well-designed

polymer floods.

Look Forward - 2022

PEI is entering the second phase of its

corporate development plan: the re-entry horizontal from existing

vertical wellbores. These new wells will access undrained reserves

and capture the significant remaining reserves within these three

large heavy oil fields. These re-entry wells are low-cost

operations and already tied into the existing infrastructure. High

permeability reservoirs also mean no need for fracks or costly

completions. Along the path of the lateral section, PEI can

eliminate depleted, low-rate, vertical wells, effectively reducing

abandonment liabilities and the associated high (fixed) operating

costs related to the vertical wells. PEI is licensed and poised to

spud in Summer 2022.

Supporting production, flattening the decline

and further cost reduction can be obtained using a polymer flood

application. PEI is planning to pattern the reservoir with

horizontal producer and horizontal injector wells.

The polymer flood is expected to provide

improved reservoir support compared to a traditional water flood.

The polymer is thicker, thereby sweeping the oil more efficiently,

whilst building pressure more effectively. There are proximal

analogue reservoirs where polymer flood has been applied that has

resulted in substantial recovery and incremental production.

Multiple adjacent properties operated by private companies have

completed polymer flood applications resulting in improved

recoveries and cost reductions. PEI is assessing the polymer

technology to enhance the recovery from the three Saskatchewan

fields.

Expansion & Upside:

PEI has signed a letter of intent (LOI) to

acquire an adjacent heavy oil property with similar reservoir

qualities to the current three Saskatchewan assets. This

acquisition will double the size of PEI in terms of reserves and

production. PEI has also signed a commitment letter on a proven

light oil play for a path to an additional 1,000+bpd. These assets

are strategic to expand the core assets and to diversify the

product mix to higher margin light oil. Full details will be

unveiled after the asset transfers to PEI are confirmed.

A few larger peers like Gear Energy (GXE – TSX)

have heavy oil exposure. Gear trades at an EV/Flowing Barrel of

about $70,000. At $0.08/share, PEI has a fully diluted market cap

of $30 million. By executing its development plan, PEI would expect

to be about 1/5th the price of Gear.

Additionally, PEI has the same tailwind that all

the oil producers have today – buoyant oil prices. While the

industry has witnessed a big move up in valuation for producers,

they continue to remain at an attractive price point. A further

sector move could drive PEI market cap up further.

ESG Plans:

Whilst focusing on growing revenue and

profitability and ultimately increasing shareholder value, PEI’s

management team is keen on sustainability and ESG initiatives. PEI

has refurbished three central batteries, infrastructure and

monitoring equipment to code and safe operating conditions to avoid

spills and downtime. PEI is committed to eliminate all emissions

through ESG technologies. Furthermore, PEI development entails

reducing its environmental footprint by eliminating over 160

surface locations through re-entering existing vertical wellbores

and placing laterals from them. This will not require any

additional surface disturbance.

PEI is actively pursuing oil upgrade

technologies that will improve revenue pricing and operating

netbacks. The company has been in active discussions that offer

disruptive technologies that would potentially improve PEI’s

economics and allow for a more ESG-friendly output. PEI hopes to

share further details regarding this in the near future.

PEI is currently producing at a stable rate of

600 boepd and with the development plan expects to exit the year at

1,500 boepd.

About Prospera

Prospera is a public oil and gas exploration,

exploitation and development company focusing on conventional oil

and gas reservoirs in Western Canada. Prospera will use its

experience to develop, acquire and drill assets with potential for

primary and secondary recovery.

For further information:

Samuel David, President & CEO

| Tel: |

|

(403) 454-9010 |

| email: |

|

admin@prosperaenergy.com |

| Website: |

|

www.prosperaenergy.com |

| |

|

|

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking

statements relating to the future operations of the Corporation and

other statements that are not historical facts. Forward-looking

statements are often identified by terms such as “will”, “may”,

“should”, “anticipate”, “expects” and similar expressions. All

statements other than statements of historical fact, included in

this release, including, without limitation, statements regarding

plans and objectives of the Corporation, are forward looking

statements that involve risks and uncertainties. There can be no

assurance that such statements will prove to be accurate and actual

results and future events could differ materially from those

anticipated in such statements.

Although Prospera believes that the expectations

and assumptions on which the forward-looking statements are based

are reasonable, undue reliance should not be placed on the

forward-looking statements because Prospera can give no assurance

that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, risks associated with the oil and gas industry in

general (e.g., operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses, and health, safety and

environmental risks), commodity price and exchange rate

fluctuations and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures.

The reader is cautioned that assumptions used in

the preparation of any forward-looking information may prove to be

incorrect. Events or circumstances may cause actual results to

differ materially from those predicted, as a result of numerous

known and unknown risks, uncertainties, and other factors, many of

which are beyond the control of Prospera. As a result, Prospera

cannot guarantee that any forward-looking statement will

materialize, and the reader is cautioned not to place undue

reliance on any forward- looking information. Such information,

although considered reasonable by management at the time of

preparation, may prove to be incorrect and actual results may

differ materially from those anticipated. Forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement. The forward-looking statements

contained in this news release are made as of the date of this news

release, and Prospera does not undertake any obligation to update

publicly or to revise any of the included forward- looking

statements, whether as a result of new information, future events

or otherwise, except as expressly required by Canadian securities

law.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

release.

SOURCE: Prospera Energy Inc.

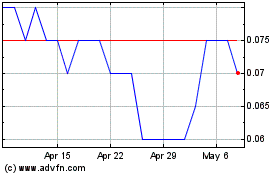

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Apr 2023 to Apr 2024