Pulse Oil Corp. Provides Operations Update

April 28 2021 - 1:51PM

Pulse Oil Corp., (“Pulse” or the "Company”) (TSXV: PUL and PUL.RT)

announced today that Pulse has been busy working on reactivating

previously shut-in wells at its Queenstown and Bigoray properties,

supported by stronger commodity prices over recent months, and

creditor and shareholder arrangements.

Bigoray:

During the summer of 2020, a third party owned

production facility Pulse was sending its Bigoray oil and gas

production to, closed its doors. As part of its reactivation

program and rights issue, Pulse has approved an operational plan to

build its own oil processing and water injection facility,

including separators, water injection/disposal, sufficient oil

tankage and road work, allowing Pulse to reactivate three oil and

gas wells in Q2/Q3, and, subject to Board approval and sufficient

or additional cash reserves, another two Bigoray well reactivations

later in the year.

Pulse is happy to report that as part of this

infrastructure build, Pulse has inspected and acquired the

necessary infrastructure at attractive prices and we expect to take

the final steps to commission the plant in the next couple of

weeks.

With vendor and shareholder support, Pulse has

been able to reactivate one of its shut-in wells by adding

compression that enabled Pulse access to a pipeline to another

third party facility. This step has increased production and

cashflow.

Queenstown:

Pulse has come to arrangement with a vendor that

has allowed it to reactivate four wells at our production area. As

a result of the arrangement with this creditor, Pulse is receiving

25% of the net revenue attributable to this production with Pulse

anticipating returning to 100% of net revenue by late May 2021.

As of the date of this release, Pulse is also

building a technical plan with the goal of supporting new workovers

at the two Pulse Oil horizontal wells drilled in 2018. Subject to

Board approval of the technical planning work and sufficient or

additional cash resources, the Pulse team will look to execute

similar “clean-out” workovers that have been conducted by third

party operators in the area.

Overall Pulse production at Bigoray and

Queenstown over the last two weeks averaged 240 BOE/d (37% Oil and

NGL’s).

Pulse CEO, Garth Johnson commented, “Pulse is

making good progress on its well reactivation plan. The Pulse team

is happy to be back working in the field to build our production

and cash flow while also proceeding towards the close of our

announced $1.5 million Rights Offering as well. With the additional

revenues generated from the re-activated production, the company

anticipates becoming profitable from operations within the 3 months

following the completion of the Rights Offering.”

About Pulse

Pulse is a Canadian company incorporated under

the Business Corporations Act (Alberta) that is primarily focused

on a 100% Working Interest Enhanced Oil Project Located in West

Central Alberta, Canada. The project includes two established Nisku

pinnacle reef reservoirs that have been producing sweet light crude

oil for over 40 years. The Company plans to institute a proven

recovery methodology (NGL solvent injection) to further enhance the

ultimate oil recovery from these two proven pools. With under 10

million barrels of oil recovered to date, and representing just 35%

recovery factor from the pools, Pulse is moving forward to execute

the EOR project and unlock significant value for shareholders.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information contact:

Pulse Oil Corp.

Garth

JohnsonCEO604-306-4421garth@pulseoilcorp.com

Drew CadenheadPresident and

COO604-909-1152drew@pulseoilcorp.com

Barrels of oil equivalent (boe) is calculated

using the conversion factor of 6 mcf (thousand cubic feet) of

natural gas being equivalent to one barrel of oil. Boe’s may

be misleading, particularly if used in isolation. A boe

conversion ratio of 6 mcf:1 bbl (barrel) is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the

wellhead. Given that the value ratio based on the current

price of crude oil as compared to natural gas is significantly

different from the energy equivalency of 6:1, utilizing a

conversion on a 6:1 basis.

Forward Looking Statements:

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. All statements, other than statements of historical

fact, included herein are forward-looking information. In

particular, this news release contains forward-looking information

regarding: the reactivation operations, the potential production

and cash flow increases, profitability and the potential timing of

operations. There can be no assurance that such forward-looking

information will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such forward-looking information. This forward-looking information

reflects Pulse’s current beliefs and is based on information

currently available to Pulse and on assumptions Pulse believes are

reasonable. These assumptions include, but are not limited to: oil

and gas prices, timing and success of operations, weather, well

productivity and the Rights Offering currently underway.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of Pulse to be

materially different from those expressed or implied by such

forward-looking information. Such risks and other factors may

include, but are not limited to: general business, economic,

competitive, political and social uncertainties; general capital

market conditions and market prices for securities; the actual

results of future operations; competition; changes in legislation,

including environmental legislation, affecting Pulse; the timing

and availability of external financing on acceptable terms; and

loss of key individuals. A description of additional risk factors

that may cause actual results to differ materially from

forward-looking information can be found in Pulse’s disclosure

documents on the SEDAR website at www.sedar.com. Although Pulse

has attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. Readers

are cautioned that the foregoing list of factors is not exhaustive.

Readers are further cautioned not to place undue reliance on

forward-looking information as there can be no assurance that the

plans, intentions or expectations upon which they are placed will

occur. Forward-looking information contained in this news release

is expressly qualified by this cautionary statement. The

forward-looking information contained in this news release

represents the expectations of Pulse as of the date of this news

release and, accordingly, is subject to change after such date.

However, Pulse expressly disclaims any intention or obligation to

update or revise any forward-looking information, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable securities law.

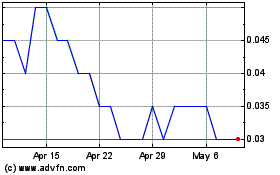

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Jan 2025 to Feb 2025

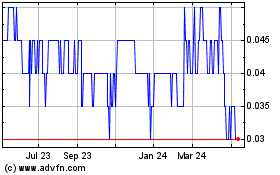

Pulse Oil (TSXV:PUL)

Historical Stock Chart

From Feb 2024 to Feb 2025