Quisitive Technology Solutions Inc.

(“Quisitive” or the “Company”) (TSXV: QUIS, OTCQX:

QUISF), a premier Microsoft solutions and payment

solutions provider, today reported financial results for the second

quarter ended June 30, 2022.

Management Commentary"We’ve

successfully achieved another record mark for top line revenue and

Adjusted EBITDA with strong contributions from both our payments

and cloud solutions segments, highlighting the efficacy of our dual

business model," said Quisitive CEO Mike Reinhart. "The continued

success of the cloud business was centered on ramping up cross-sell

and upsell opportunities since the Catapult acquisition to build

upon our momentum in capturing significant share in the growing

global cloud market. In parallel, we experienced and took advantage

of high payments volumes in our merchant services group, topping

out at approximately $1.1 billion in transaction volume, and

delivered on achieving Visa certification for our LedgerPay

platform. As we progress towards full commercialization aligned to

our roadmap, strong transaction volumes and strengthening

partnerships within our payments business validate our trajectory

and vision. We continue to remain well diversified from a customer,

industry, and platform perspective, helping us remain resilient

during the fluctuating macroeconomic environment.”

Second Quarter 2022 Financial

ResultsThe Company’s condensed consolidated interim

financial statements for three months ended June 30, 2022 and

related management’s discussion and analysis can be found on the

Company’s website and on the Company’s issuer profile on SEDAR

at www.sedar.com. All figures are expressed in United States

dollars unless otherwise stated.

- Revenue increased 107% to $47.6 million compared to $23.0

million for the quarter ended June 30, 2021.

- Gross profit increased 133% to $19.3 million compared to $8.3

million for the quarter ended June 30, 2021.

- Adjusted EBITDA increased to $6.9 million compared to $3.6

million for the quarter ended June 30, 2021.

- Global Payment Solutions revenue increased to $12.4 million

compared to approximately $6.0 million for the quarter ended June

30, 2021.

- Global Cloud Solutions revenue increased to $35.3 million

compared to approximately $17.0 million for the quarter ended June

30, 2021.

- As of June 30, 2022, the Company

had $9.2 million in cash.

Second Quarter 2022 and Recent

Operational Highlights

- Announced amendment to increase

credit facility providing for a new US$9.5 million non-revolving,

five-year term loan. The proceeds from the loan are expected to be

used to fund earn-out obligations on previously completed

acquisitions and for general corporate purposes.

- Announced election of Amy Brandt to

board of directors, bringing over 20 years of experience as an

accomplished entrepreneur and senior executive in institutional

finance, and corporate and financial technology development.

- Recognized as Microsoft United

States Health and Life Sciences Partner of the Year; an award given

to Microsoft partners demonstrating excellence in innovation and

implementation of customer solutions based on Microsoft

technology.

- Received Visa certification to

process credit and debit payments through the LedgerPay

platform.

- Achieved the Microsoft Cloud

Security Advanced Specialization; the Company now holds 12 Advanced

Specializations.

Conference CallQuisitive

management will hold a conference call today (August 18, 2022) at

4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these

results.

Company CEO Mike Reinhart and CFO Scott Meriwether will host the

call, followed by a question-and-answer period.

Toll Free dial-in: 1-877-704-4453International dial-in:

1-201-389-0920Webcast Link: Here

Please call the conference telephone number 10 minutes prior to

the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at

949-574-3860.

A telephonic replay of the conference call will be available

after 7:30 p.m. Eastern time, and will expire after September 1,

2022.

Toll-free replay number: 1-844-512-2921 International

replay number: 1-412-317-6671Replay ID: 13731806

For additional information, please visit the Investor Relations

section of Quisitive’s website

at: https://quisitive.com/investor-relations/.

The following table summarizes results for the second quarter

ended June 30, 2022 and 2021:

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, 2022 |

June 30, 2021 |

June 30, 2022 |

June 30, 2021 |

|

Revenue |

$ |

47,619 |

|

|

$ |

22,994 |

|

|

$ |

92,547 |

|

|

$ |

35,622 |

|

| Cost of

Revenue |

|

28,297 |

|

|

|

14,695 |

|

|

|

55,317 |

|

|

|

23,033 |

|

| Gross

Margin |

|

19,322 |

|

|

|

8,299 |

|

|

|

37,230 |

|

|

|

12,589 |

|

| Operating

Expenses |

|

|

|

|

|

|

|

| Sales and

marketing expense |

|

3,789 |

|

|

|

1,452 |

|

|

|

7,302 |

|

|

|

2,480 |

|

| General and

administrative |

|

8,686 |

|

|

|

3,247 |

|

|

|

16,699 |

|

|

|

5,324 |

|

|

Development |

|

106 |

|

|

|

92 |

|

|

|

206 |

|

|

|

403 |

|

| Share-based

compensation |

|

819 |

|

|

|

73 |

|

|

|

1,241 |

|

|

|

462 |

|

| Interest

expense |

|

930 |

|

|

|

1,196 |

|

|

|

1,893 |

|

|

|

1,475 |

|

| Grant

Income |

|

- |

|

|

|

(19 |

) |

|

|

- |

|

|

|

- |

|

|

Amortization |

|

4,311 |

|

|

|

2,612 |

|

|

|

8,581 |

|

|

|

3,490 |

|

| Earn-out

settlement loss |

|

- |

|

|

|

- |

|

|

|

72 |

|

|

|

- |

|

| Acquisition

related compensation |

|

725 |

|

|

|

253 |

|

|

|

1,490 |

|

|

|

253 |

|

|

Depreciation |

|

509 |

|

|

|

328 |

|

|

|

1,021 |

|

|

|

581 |

|

| Foreign

exchange loss (gain) |

|

(201 |

) |

|

|

48 |

|

|

|

109 |

|

|

|

326 |

|

|

Acquisition-related, transaction and other expenses |

|

197 |

|

|

|

3,222 |

|

|

|

559 |

|

|

|

3,678 |

|

| Loss

Before Income Taxes |

|

(549 |

) |

|

|

(4,205 |

) |

|

|

(1,943 |

) |

|

|

(5,883 |

) |

| Income tax

expense — current |

|

1,083 |

|

|

|

461 |

|

|

|

2,320 |

|

|

|

891 |

|

| Deferred

income tax expense (recovery) |

|

(1,052 |

) |

|

|

(1,731 |

) |

|

|

(2,233 |

) |

|

|

(1,892 |

) |

| Net

Loss for the Period |

$ |

(580 |

) |

|

$ |

(2,935 |

) |

|

$ |

(2,030 |

) |

|

$ |

(4,882 |

) |

| |

|

|

|

|

|

|

|

About Quisitive:Quisitive (TSXV: QUIS, OTCQX:

QUISF) is a premier, global Microsoft partner that harnesses the

Microsoft platform and complementary technologies, including custom

solutions and first-party offerings, to generate transformational

impact for enterprise customers. Our Cloud Solutions business

focuses on helping enterprises move, operate, and innovate in the

three Microsoft clouds. Centering on our LedgerPay product suite,

our Payments Solutions business leverages the Microsoft Azure cloud

to transform the payment processing industry into an entirely new

source of customer engagement and consumer value. Quisitive serves

clients globally from seventeen employee hubs across the world. For

more information, visit www.Quisitive.com and follow

@BeQuisitive.

Quisitive Investor ContactMatt Glover and John

YiGateway Investor RelationsQUIS@gatewayir.com 949-574-3860

Tami AndersChief of Stafftami.anders@quisitive.com

Reconciliation of Non-GAAP Financial Measures - Adjusted

EBITDA and Adjusted EBITDA as a percentage of revenue

Financial Measures and Adjusted EBITDA

There are measures included in this news release

that do not have a standardized meaning under generally accepted

accounting principles (GAAP) and therefore may not be comparable to

similarly titled measures and metrics presented by other publicly

traded companies. The Company includes these measures because it

believes certain investors use these measures and metrics as a

means of assessing financial performance. EBITDA (earnings before

interest, taxes, depreciation and amortization is calculated as net

earnings before finance costs (net of finance income), income tax

expense, and depreciation and amortization of intangibles) is a

non-GAAP financial measure that does not have any standardized

meaning prescribed by IFRS and may not be comparable to similar

measures presented by other companies.

We prepare and release quarterly unaudited and

annual audited financial statements prepared in accordance with

IFRS. We also disclose and discuss certain non-GAAP financial

information, used to evaluate our performance, in this and other

earnings releases and investor conference calls as a complement to

results provided in accordance with IFRS. We believe that current

shareholders and potential investors in the Company use non-GAAP

financial measures, such as Adjusted EBITDA and Adjusted EBITDA as

a percentage of revenues, in making investment decisions about the

Company and measuring our operational results.

The term "Adjusted EBITDA" refers to a financial

measure that we define as earnings before certain charges that

management considers to be non-operating expenses and which consist

of interest, taxes, depreciation, amortization, stock-based

compensation (for which we include related fees and taxes), changes

in fair value of derivatives, transaction and acquisition-related

expenses, US payroll protection plan loan forgiveness, earn-out

settlement losses and non-recurring development costs associated

with obtaining bank sponsorship and operational certifications

required to complete LedgerPay. Adjusted EBITDA as a percentage of

revenues divides Adjusted EBITDA for a period by the revenues for

the corresponding period and expresses the quotient as a

percentage.

Management considers these non-operating

expenses to be outside the scope of Quisitive's ongoing operations

and the related expenses are not used by management to measure

operations. Accordingly, these expenses are excluded from Adjusted

EBITDA, which we reference to both measure our operations and as a

basis of comparison of our operations from period-to-period.

Management believes that investors and financial

analysts measure our business on the same basis, and we are

providing the Adjusted EBITDA financial metric to assist in this

evaluation and to provide a higher level of transparency into how

we measure our own business. However, Adjusted EBITDA and Adjusted

EBITDA as a percentage of revenues are non-GAAP financial measures

and may not be comparable to similarly titled measures reported by

other companies. Adjusted EBITDA and Adjusted EBITDA as a

percentage of revenues should not be construed as a substitute for

net income determined in accordance with IFRS or other non-GAAP

measures that may be used by other companies, such as EBITDA. The

use of Adjusted EBITDA and Adjusted EBITDA as a percentage of

revenues does have limitations. As these acquisition-related

expenses charges may continue as we pursue our consolidation

strategy, some investors may consider these charges and expenses as

a recurring part of operations rather than expenses that are not

part of operations.

Cautionary Note Regarding Forward Looking

Information

This news release contains certain “forward‐looking information”

and “forward‐looking statements” (collectively, “forward‐ looking

statements”) within the meaning of applicable Canadian securities

legislation regarding Quisitive and its business. Any statement

that involves discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions,

future events or performance (often but not always using phrases

such as “expects”, or “does not expect”, “is expected”,

“anticipates” or “does not anticipate”, “plans”, “budget”,

“scheduled”, “forecasts”, “estimates”, “believes” or “intends” or

variations of such words and phrases or stating that certain

actions, events or results “may” or “could”, “would”, “might” or

“will” be taken to occur or be achieved) are not statements of

historical fact and may be forward‐looking statements. Forward‐

looking statements are necessarily based upon a number of estimates

and assumptions that, while considered reasonable, are subject to

known and unknown risks, uncertainties, and other factors which may

cause the actual results and future events to differ materially

from those expressed or implied by such forward‐looking statements.

These forward-looking statements include, but are not limited to,

statements relating to: internal business integrations, full

commercialization and success of the LedgerPay platform,

expectations regarding go-to-market strategy and growing

partnerships in the payments business, growth prospects, projected

milestones and timelines.

The risks and uncertainties that may affect forward-looking

statements, or the material factors or assumptions used to develop

such forward-looking information, are described under the heading

"Risks Factors" in the Company's annual information form dated June

23 , 2022, which are available under the Company’s issuer profile

on SEDAR at www.sedar.com. There can be no assurance that

forward-looking information, or the material factors or assumptions

used to develop such forward-looking information, will prove to be

accurate. The Company does not undertake any obligations to release

publicly any revisions for updating any voluntary forward-looking

statements, except as required by applicable securities law.

Neither the TSX Venture Exchange nor its Regulation Services

provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

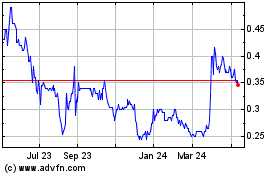

Quisitive Technology Sol... (TSXV:QUIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

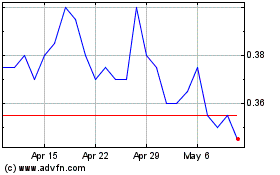

Quisitive Technology Sol... (TSXV:QUIS)

Historical Stock Chart

From Apr 2023 to Apr 2024