Simply Better Brands Corp. ("SBBC" or the "Company") (TSX Venture:

SBBC) (OTCQB: PKANF) is pleased to announce its financial results

for the quarter ended June 30, 2022. All amounts are expressed in

United States dollars unless otherwise noted. Certain metrics,

including those expressed on an adjusted basis, are

non-International Financial Reporting Standards ("IFRS") measures,

see "Non-IFRS Measures" below.

CORPORATE DEVELOPMENTS

On May 19, 2022 the Company announced its entry

into the weight loss category with a PureKana Keto Gummy stretching

the brand beyond CBD. According to Allied Market Research, the

weight loss category currently exceeds $192B with a 2021-2027

estimated CAGR of 7.1% The grape-flavored gummy contains

beta-hydroxybutrate (BHB) salts and is available in both a 20 and

30 ct. offering. Per the National Institute of Health (NIH),

“Supplementing with BHB salts may induce a state of temporary

ketosis without any undesirable side affects, thereby promoting the

benefits of ketosis and minimizing the adherence requirements to a

ketogenic diet.” Since the June 1, 2022 launch, the PureKana Keto

Gummy has delivered $1.5 million in sales.

On June 8, 2022 the Company announced that they

were executing a comprehensive omnichannel strategy on their No

B.S. Skincare (“No B.S.”) brand by launching their award-winning

skincare line in 3,200 CVS stores nationwide beginning July 24th,

2022. Early launch results are exceeding category expectations.

On June 30, 2022, the Company announced two new

flavor profiles under its growing TRUBAR brand. The upcoming

indulgent nutrition flavors are in response to accelerated demand

by both consumers and retailers in the United States and Canadian

markets. The innovation will be available in both brick and mortar

distribution and online sales channels in the third quarter of

2022. Strong sales velocities are driving continued expansion into

Costco in the U.S., and are expected to drive the Company’s

expected expansion to Costco Canada anticipated in Q4 2022.

On July 21, 2022 the Company announced

its PureKana Brand was recognized by Brightfield

Group as one of the fastest growing brands in the category in

their 2022 Mid-year US CBD Report. Brightfield Group is one of

the leading research firms for emerging categories including CBD,

cannabis, and wellness. In the roughly $5B CBD category of over

3,000 brands, PureKana’s Q1 2022 performance places it within the

Top 10 brand performers.

On July 21, 2022, the Company announced its

intention to complete a convertible debenture non-brokered private

placement of up to CA$9.1 million. The convertible debentures have

an exercise price of CA$0.39 per share. On July 26, 2022 the

Company announced that it was restructuring its convertible

debenture non-brokered private placement. The Company announced

that it was reducing the amount to be raised from CA$9.1 million to

CA$ 2.0 million to reduce potential share dilution and eliminate

the general security agreement associated with the original

convertible debenture offering. The new offering consists of

unsecured convertible debentures, which have a maturity date 24

months from closing, and an interest rate of 10% from the original

8%. Under the new offering, each convertible debenture is

convertible at the election of the holder into common shares of the

Company (“Common Shares”) and a conversion price of $0.39 per

Common Share and will receive one-half common share purchase

warrant for each Common Share exercisable at $0.59.

On August 10, 2022 the Company announced that it

had closed the convertible debenture non brokered private placement

offering with CA$850,000 being placed. The total number of Common

Shares to be issued under the offering is 2,719,487. If all

warrants are exercised, a total of 1,089,744 Common Shares would

also be issuable upon conversion.

On August 10, 2022 the Company also announced

that the Company entered into a loan agreement with an amount of

$1,000,000. The loan bears 15% interest per annum and will be

repaid over 42-months.

On July 21, 2022, the Company announced its

intention to complete a non-brokered private placement of Common

Shares (the “Common Share Offering”) of up to 11,016,949 Common

Shares and a price of CA$0.295 per Common Share, for aggregate

gross proceeds of up to CA$3,250,000. The Company further announced

on July 25, 2022 that it had completed the first tranche of this

Common Share Offering. In this first tranche, the Company issued a

total of 4,718,203 Common Shares for aggregate proceeds of

$1,391,869.69

On August 17, 2022, the Company further

announced the closing of the second tranche of the Common Share

Offering. In this second tranche, the Company issued a total of

3,454,236 Common Shares for aggregate proceeds of $1,018,999.62

Today, the Company is announcing the closing of

the third tranche of the Common Share Offering (the “Third

Tranche”) and issued a total of 2,474,490 Common Shares

for aggregate proceeds of CA$729,974.61 in the Third Tranche. The

shares issued pursuant to the Third Tranche are subject to a

four-month hold. The proceeds from the Third Tranche will be used

to reduce debt and for general working capital purposes. No new

insiders were created, nor has any change of control occurred, as a

result of the Third Tranche. There were no finder’s fees or

finder’s warrants paid by the Company in connection with the Third

Tranche.

The Company also announces today that its has

awarded the milestone shares related to the acquisition of Herve

Edibles Limited for a total of 213,219 Common Shares as further

described in the Company’s news release dated March 18, 2022. These

Common Shares are subject to a four-month hold.

As of August 29, 2022 there are 41,620,551

Common Shares issued and outstanding.

“Due to the strong growth of our PureKana, No

B.S. Skincare, and TRUBAR brands, our 2022 outlook is $50-55

million or over 300% growth vs. one year-ago. Our anticipated gross

margins are expected to be 63-65% up from 62% in the prior year,

while achieving positive adjusted EBITDA. Finalizing this capital

raise is critical to fuel sustainable growth with strong balance

sheet governance. We have paid special attention to secure the

fuel we need while minimizing dilution to our shareholders. Our

operational fundamentals remain strong and we look forward to the

momentum this investment will unlock,” says Kathy Casey, CEO of

Simply Better Brands Corp.

FINANCIAL HIGHLIGHTS FOR QUARTER ENDED

JUNE 30, 2022 AND SIX MONTHS ENDED JUNE 30, 2022

For the three months ended June 30, 2022, the

Company generated revenue of $16.9 million with a gross profit of

$11.7 million (69%) compared to $3.1 million with a gross profit of

$1.8 million (58%) during the three months ended June 30, 2021.

Second quarter 2022 revenue was up 445% over the same period in

2021 and second quarter 2022 gross profit was up 550% over the same

period for 2021. All amounts are expressed in United States dollars

unless otherwise noted.

| |

For the three months ended |

|

|

| |

June 30, 2022 |

June 30, 2021 |

Change in |

|

expressed in millions * |

$ |

|

|

% |

$ |

|

|

% |

$ |

|

|

% |

|

REVENUE |

16.9 |

|

100 |

% |

3.1 |

|

100 |

% |

13.8 |

|

445 |

% |

|

COST OF GOODS SOLD |

(5.2 |

) |

-31 |

% |

(1.3 |

) |

-42 |

% |

(3.9 |

) |

300 |

% |

|

GROSS MARGIN |

11.7 |

|

69 |

% |

1.8 |

|

58 |

% |

9.9 |

|

550 |

% |

| |

For the six months ended |

|

|

| |

June 30, 2022 |

June 30, 2021 |

Change in |

|

expressed in millions * |

$ |

|

|

% |

$ |

|

|

% |

$ |

|

|

% |

|

REVENUE |

29.0 |

|

100 |

% |

5.6 |

|

100 |

% |

23.4 |

|

418 |

% |

|

COST OF GOODS SOLD |

(9.3 |

) |

-32 |

% |

(2.2 |

) |

-39 |

% |

(7.1 |

) |

323 |

% |

|

GROSS MARGIN |

19.7 |

|

68 |

% |

3.4 |

|

61 |

% |

16.3 |

|

479 |

% |

Operating costs for three months ended June 30,

2022, were $13.5 million, an increase of $10.6 million (or 366%),

compared to $2.9 million in the second quarter of 2021.

Most of the operating costs increase incurred in

the three months ended June 30, 2022, was related to marketing

expenses ($8.2 million for Q2 or 66% of $10.6 million increase).

PureKana accounted for most of the marketing expenses in the second

quarter of 2022 (91%). An increase of share-based payments of $1.6

million for Q2 accounted for 15% of the $10.6 million increase, an

increase in customer services expenses of $0.8 million for Q2

accounted for 8% of the $10.6 million increase and professional

fees of $0.3 million in Q2 accounted for 3% of the $10.6 million

increase. The increase in marketing in the second quarter of 2022

were related to PureKana’s launch of new marketing programs. The

launches drove the increase in second quarter sales and gross

margins. Share-based payments are related to the options and

restricted share units granted. One-time legal fees related to the

Jones Soda transaction ($0.1 million), increases in audit related

fees ($0.1 million), and increases in business consulting services

($0.1 million) drove second quarter 2022 professional fees. During

the three months ended March 31, 2022, the Company recorded net

loss of $3.3 million compared to a net loss of $0.7 million for the

three months ended March 31, 2021. The biggest contributors to the

increase in the net loss of $2.7 million were share-based payments

of $1.1 million, increased consulting and professional fees of $0.4

million, and increased marketing expenses in the first quarter of

2022 of $6.1 million compared to the same period of the prior

year.

For the six months ended June 30, 2022, the

Company generated revenue of $29.0 million with a gross profit of

$19.7 million (68%) compared to $5.6 million with a gross profit of

$3.4 million (58%) during the six months ended June 30, 2021. Six

month 2022 revenue was up 418% over the same period in 2021 and six

month 2022 gross profit was up 479% over the same period for

2021.

Operating costs for the six months ended June

30, 2022, were $24.0 million, an increase of $19.0 million (or

379%), compared to $5.0 million in the second quarter of 2021.

Most of the operating costs increase incurred in

the six months ended June 30, 2022 was related to marketing

expenses ($15.2 million for the 6 months ended June 30, 2022 or 69%

of the $19.0 million increase). PureKana accounted for most of the

marketing expenses in the six months ended June 30, 2022 (92%).

Share-based payments of $2.7 million for the 6 months ended June

30, 2022 accounted for 14% of the $19.0 million increase. Customer

services expenses of $1.0 million for the 6 months ended June 30,

2022 accounted for 5% of the $19.0 million increase. Professional

fees of $1.2 million for the 6 months ended June 30, 2022 accounted

for 4% of the $19.0 million increase. The increase in marketing in

the six months ended June 30, 2022, were related to the new

marketing programs launched by PureKana which drove the significant

increase in six months 2022 sales and gross margins. Share-based

payments are related to the options and restricted share units

granted. The increase in the six months ended June 30, 2022,

professional fees were driven several one-time items including

strategic consulting ($0.2 million) and legal fees related to Jones

Soda binding LOI ($0.1 million), increases in business consulting

($0.1 million) and increased audit related fees ($0.3 million).

The Company had a loss of $2.8 million for the

three months ended June 30, 2022. The net loss for the second

quarter decreased by $0.5 million over the loss in the first

quarter of 2022 with higher revenues and higher gross profits

generated in the second quarter of 2022 compared to the first

quarter of 2022. Loss per share was $0.09 in the second quarter of

2022.

The Company had a loss of $6.0 million for the

six months ended June 30, 2022 compared to 2.2 million in the prior

period in 2021. Loss per share was $0.21 for the six months ended

June 30, 2022.

Non-IFRS Measures (Earnings before

Interest, Taxes, Depreciation, and Amortization ("EBITDA") and

Adjusted EBITDA)

EBITDA and Adjusted EBITDA are non-IFRS measures

used by management that are not defined by IFRS. EBITDA and

Adjusted EBITDA do not have a standardized meaning prescribed by

IFRS and therefore may not be comparable to similar measures

presented by other issuers. Management believes that EBITDA and

Adjusted EBITDA provide meaningful and useful financial information

as these measures demonstrate the operating performance of the

business excluding non-cash charges.

The most directly comparable measure to EBITDA

and Adjusted EBITDA calculated in accordance with IFRS is net loss.

The following table presents the EBITDA and Adjusted EBITDA for the

three months and six months ended June 30, 2022, and 2021, and a

reconciliation of same to net income (loss):

| |

For the three months ended |

|

|

| |

June 30, |

|

June 30, |

|

|

|

| |

2022 |

|

2021 |

|

Change in |

|

expressed in millions * |

$ |

|

$ |

|

$ |

|

|

% |

|

Loss before income taxes |

(2.8 |

) |

(1.5 |

) |

(1.3 |

) |

87 |

% |

|

Add (less): |

|

|

|

|

|

Amortization expense |

0.6 |

|

0.2 |

|

0.4 |

|

200 |

% |

|

Finance costs |

0.2 |

|

0.6 |

|

(0.4 |

) |

-67 |

% |

|

EBITDA |

(2.0 |

) |

(0.7 |

) |

(1.3 |

) |

186 |

% |

|

Add (less): |

|

|

|

|

|

Share-based payment |

1.6 |

|

- |

|

1.6 |

|

100 |

% |

|

Acquisition-related costs |

0.1 |

|

- |

|

0.1 |

|

100 |

% |

|

Foreign exchange loss |

0.1 |

|

- |

|

0.1 |

|

100 |

% |

|

Gain (loss) on remeasurement of loan payable |

0.5 |

|

- |

|

0.5 |

|

100 |

% |

|

Fair value adjustment of derivative liability |

- |

|

(0.2 |

) |

0.2 |

|

-100 |

% |

|

Write-off of advance payments |

0.4 |

|

- |

|

0.4 |

|

100 |

% |

|

Shares issued for services |

0.3 |

|

- |

|

0.3 |

|

100 |

% |

|

Adjusted EBITDA |

0.7 |

|

(0.9 |

) |

1.6 |

|

-180 |

% |

| |

For the six months ended |

|

|

| |

June 30, |

|

June 30, |

|

|

|

| |

2022 |

|

2021 |

|

Change in |

|

expressed in millions * |

$ |

|

$ |

|

$ |

|

|

% |

|

Loss before income taxes |

(6.0 |

) |

(2.2 |

) |

(3.8 |

) |

173 |

% |

|

Add (less): |

|

|

|

|

|

Amortization expense |

0.8 |

|

0.2 |

|

0.6 |

|

300 |

% |

|

Finance costs |

0.5 |

|

1.2 |

|

(0.7 |

) |

-58 |

% |

|

EBITDA |

(4.7 |

) |

(0.8 |

) |

(3.9 |

) |

488 |

% |

|

Add (less): |

|

|

|

|

|

Share-based payment |

2.7 |

|

- |

|

2.7 |

|

100 |

% |

|

Acquisition-related costs |

0.5 |

|

- |

|

0.5 |

|

100 |

% |

|

Foreign exchange loss |

0.1 |

|

- |

|

0.1 |

|

100 |

% |

|

Gain (loss) on remeasurement of loan payable |

0.6 |

|

- |

|

0.6 |

|

100 |

% |

|

Fair value adjustment of derivative liability |

- |

|

(0.6 |

) |

0.6 |

|

-100 |

% |

|

Grant and other assistance |

(0.4 |

) |

- |

|

(0.4 |

) |

100 |

% |

|

Write-off of advance payments |

0.4 |

|

- |

|

0.4 |

|

100 |

% |

|

Shares issued for services |

0.4 |

|

- |

|

0.4 |

|

100 |

% |

|

Non-recurring expenses |

0.3 |

|

- |

|

0.3 |

|

100 |

% |

|

Adjusted EBITDA |

(0.1 |

) |

(1.4 |

) |

1.3 |

|

-93 |

% |

The Company generated positive adjusted EBITDA

of $0.7 million for the three months ended June 30, 2022, an

increase of $1.6 million over the adjusted EBITDA loss for the

comparable period in 2021. The positive Adjusted EBITDA of $0.7

million incurred during the three months ended June 30, 2022, were

due to (1) positive adjusted EBITDA generated by three of SBBC’s

subsidiaries PureKana ($0.7 million positive adjusted EBITDA), Tru

($0.5 million positive adjusted EBITDA), and No BS ($0.04 million

positive adjusted EBITDA), which were offset by (2) SBBC corporate

($0.1 million adjusted EBITDA loss) and (3) $0.4 million adjusted

EBITDA losses by SBBC’s other subsidiaries. PureKana’s EBITDA

performance in the second quarter reflects the large number of

customers acquired during the first quarter, which drive during the

second quarter. Tru had another strong quarter of generating

positive adjusted EBITDA and No BS generated slightly positive

adjusted EBITDA during the quarter driven by its higher sales. The

Company has developed a plan to significantly reduce the negative

Adjusted EBITDA performance at its other subsidiaries as it

integrates these businesses into its portfolio. The plan being

implemented includes both cost reduction and sales expansion

initiatives to attain positive adjusted EBITDAs for these

subsidiaries.

The Company lost Adjusted EBITDA of $0.1 million

for the six months ended June 30, 2022, an increase of $1.3 million

over the adjusted EBITDA loss for the comparable period in 2021.

The small adjusted EBITDA loss of $0.1 million, incurred during the

six months ended June 30, 2022, was due to (1) positive adjusted

EBITDA generated by Tru ($0.9 million) which was offset by (2)

PureKana ($0.2 million adjusted EBITDA loss), No BS ($0.1 million

adjusted EBITDA loss), SBBC corporate ($0.3 million adjusted EBITDA

loss) and (3) $0.4 million adjusted EBITDA losses by SBBC’s other

subsidiaries. As discussed in the Q2 EBITDA analysis, three of

SBBC’s subsidiaries had positive adjusted EBITDA for the quarter.

The Company has developed a plan to significantly reduce the

negative Adjusted EBITDA performance at its other subsidiaries as

it integrates these businesses into its portfolio. The plan’s

implementation includes both cost reduction and sales expansion

initiatives get these subsidiaries to positive Adjusted

EBITDAs.

Readers are cautioned that EBITDA and Adjusted

EBITDA should not be construed as an alternative to net income, as

determined under IFRS; nor as an indicator of financial performance

as determined by IFRS; nor a calculation of cash flow from

operating activities as determined under IFRS; nor as a measure of

liquidity and cash flow under IFRS. The Company's method of

calculating EBITDA and Adjusted EBITDA may differ from methods used

by other companies and, accordingly, the Company's EBITDA and

Adjusted EBITDA may not be comparable to similar measures used by

any other company. Except as otherwise indicated, SBBC calculates

and discloses EBITDA and Adjusted EBITDA on a consistent basis from

period to period. Specific adjusting items may only be relevant in

certain periods.

See also Earnings before Interest, Taxes,

Depreciation, and Amortization ("EBITDA") and Adjusted EBITDA

(Non-GAAP Measures) in the Company's management discussion and

analysis for the quarter ended June 30, 2022 available on SEDAR at

www.sedar.com.

DEBT REDUCTION

During the six months ended June 30, 2022, the

Company,

-

Announced a shares for debt agreement in the amount of

$480,000.

- Repaid

$1,254,521 of short-term promissory notes.

-

Converted notes with a principal value of $1,021,820 including

outstanding interest into 283,527 Common Shares

- Repaid a

working loan for one of its subsidiaries in the amount of

$395,000

These initiatives have reduced debt by

$3,151,341 since December 31, 2021.

Subsequent to the quarter ended June 30, 2022,

the Company,

- Repaid

promissory notes for a total of $1,999,252

- Repaid

convertible debenture notes with a face value of $530,100

These initiatives have reduced debt of

$2,529,352 subsequent to the quarter end.

These initiatives subsequent to the quarter plus

the debt reduced during the six months ended June 30, 2022 have

collectively reduced the short-term debt by $5,680,693 since

December 31, 2021.

2022 OUTLOOK

As a result of the second quarter and six month

ended June 30, 2022 interim financial results, the Company

maintains the guidance it released on July 13, 2022.

- Expected

consolidated net sales are between $50 million-55 million

- Expected

gross margin as a percentage of net sales is 63%-65%.

- The

Company expects to achieve positive Adjusted EBITDA for fiscal

2022.

“We consider Q2 2022 as trifecta performance

against our critical metrics: strong topline sales, gross margin

expansion, while delivering positive adjusted EBITDA. It is a proof

point in our ability to build and acquire clean ingredient brands

and expand them into omni-channel environments with solid

operational fundamentals and strong financial governance. Our

strategic growth priorities remain to lead consumer-centric

innovation and relentlessly acquire customers to these emerging

brands by driving category, channel and geographic expansion. In

parallel, we are integrating the acquisitions of BRN/Seventh Sense

and Hervé into three growth verticals: plant-based wellness, food

and beverage, and health & beauty," says SBBC CEO, Kathy

Casey.

About Simply Better Brands

Corp.

Simply Better Brands Corp. leads an

international omni-channel platform with diversified assets in the

emerging plant-based and holistic wellness consumer product

categories. The Company’s mission is focused on leading innovation

for the informed Millennial and Generation Z generations in the

rapidly growing plant-based wellness, natural, and clean ingredient

space. The Company continues to focus on expansion into high-growth

consumer product categories including plant-based food, clean

ingredient skincare and plant-based wellness. For more information

on Simply Better Brands Corp., please visit:

https://www.simplybetterbrands.com/investor-relations.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Contact Information

Simply Better Brands Corp.Brian MeadowsChief Financial Officer+1

(855) 553-7441ir@simplybetterbrands.com

Forward-Looking Information

Certain statements contained in this news

release constitute "forward-looking information" and

"forward-looking statements" as such terms are used in applicable

Canadian securities laws. Forward-looking statements and

information are based on plans, expectations and estimates of

management at the date the information is provided and are subject

to certain factors and assumptions, including, among others, that

the Company's financial condition and development plans do not

change as a result of unforeseen events, the impact of the COVID-19

pandemic, the regulatory climate in which the Company operates, and

the Company's ability to execute on its business plans.

Specifically, this news release contains forward-looking statements

relating to, but not limited to: completion and TSXV approval of

the Common Share Offering; expansion plans for the Company’s

products; Q4 expansion into Costco Canada, receipt of TSXV and

other regulatory and third party approvals; success of PureKana's

marketing efforts; 2022 guidance and results of operations; growth

of the Company’s brands; and integration of recent acquisitions

completed by the Company.

Forward-looking statements and information are

subject to a variety of risks and uncertainties and other factors

that could cause plans, estimates and actual results to vary

materially from those projected in such forward-looking statements

and information. Factors that could cause the forward-looking

statements and information in this news release to change or to be

inaccurate include, but are not limited to, the risk that any of

the assumptions referred to prove not to be valid or reliable, that

occurrences such as those referred to above are realized and result

in delays, or cessation in planned work, that the Company's

financial condition and development plans change, ability to obtain

necessary regulatory approvals for proposed transactions, as well

as the other risks and uncertainties applicable to the CBD, broader

wellness and consumer packaged goods industries and to the Company,

and as set forth in the Company's annual information form and other

filings available under the Company's profile at www.sedar.com.

The above summary of assumptions and risks

related to forward-looking statements in this news release has been

provided in order to provide shareholders and potential investors

with a more complete perspective on the Company's current and

future operations and such information may not be appropriate for

other purposes. There is no representation by the Company that

actual results achieved will be the same in whole or in part as

those referenced in the forward-looking statements and the Company

does not undertake any obligation to update publicly or to revise

any of the included forward-looking statements, whether as a result

of new information, future events or otherwise, except as may be

required by applicable securities law.

Financial Outlook

This press release contains future-oriented

financial information and financial outlook information

(collectively, “FOFI”) about the financial results for July 2022,

year-to-date July 2022, and the quarter ended June 30, 2022, and

the year ended December 31, 2022, including net sales, gross

margin, and Adjusted EBITDA, all of which are subject to the same

assumptions, risk factors, limitations, and qualifications as set

out under the heading “Forward-Looking Information”. The actual

financial results of the Company may vary from the amounts set out

herein and such variation may be material. The Company and its

management believe that the financial outlook has been prepared on

a reasonable basis, reflecting management's best estimates and

judgments and the FOFI contained in this press release was approved

by management as of the date hereof. However, because this

information is subjective and subject to numerous risks, it should

not be relied on as necessarily indicative of future results.

Except as required by applicable securities laws, the Company

undertakes no obligation to update such FOFI. FOFI contained in

this press release was made as of the date hereof and was provided

for the purpose of providing further information about the

Company’s anticipated future business operations on a quarterly and

annual basis. Readers are cautioned that the FOFI contained in this

press release should not be used for purposes other than for which

it is disclosed herein.

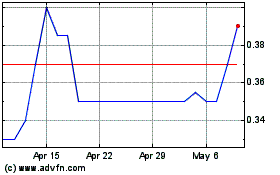

Simply Better Brands (TSXV:SBBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

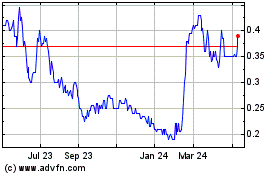

Simply Better Brands (TSXV:SBBC)

Historical Stock Chart

From Apr 2023 to Apr 2024