Bluewater Acquisition Corp. (NEX:BAQ.H,

"

Bluewater") and AlphaDelta Management Corp.

("

ADM") are pleased to announce that they have

entered into a non-binding letter of intent dated April 20, 2022

(the "

Letter of Intent"), that sets out the terms

under which Bluewater would be prepared to acquire all of the

issued and outstanding securities of ADM (the "

Proposed

Transaction").

Bluewater intends the Proposed Transaction to constitute its

"Qualifying Transaction", as defined by the policies of TSX Venture

Exchange Inc. (the "Exchange"). After the

completion of the Proposed Transaction, Bluewater expects to be

classified as a "Tier 2" issuer in the "Industrial/Investment/

Technology" industry segment of the Exchange and carry on the

business of ADM.

ADM

ADM is a creator, marketer and promoter of actively-managed

investment funds and other investment products which are sold to

Canadian investors through the broker-dealer distribution channel.

The AlphaDelta Funds are distinguished by their fulfilling of

un-met client needs and their high degree of differentiation from

index and closet-index funds. All of the AlphaDelta Funds have, at

one time or another, been at or near the top of their respective

investment categories over their five-year performance history.

ADM was incorporated under the federal laws of Canada in

Vancouver, British Columbia on May 4, 2014, and carries on the

business of distribution of financial investment products through

IIROC and MFDA financial advisors throughout Canada.

ADM has 66,902,186 common shares (the "ADM

Shares") and 5,500,000 stock options (the "ADM

Options") issued and outstanding. The directors of ADM are

Maurice Levesque of Edmonton, Alberta; Victor Therrien of

Vancouver, British Columbia; and Peter Van Dyke of Vancouver,

British Columbia. No individual or group of individuals acting in

concert has beneficial ownership of, or control or direction over,

directly or indirectly, more than 20% of the outstanding ADM Shares

on a non-diluted or fully-diluted basis.

ADM intends to disclose certain historical financial information

in a subsequent press release.

Bluewater

Bluewater is a Capital Pool Company (as that term is defined in

the policies of the Exchange). Bluewater has not commenced

operations and has no assets other than cash. The principal

business of Bluewater is the identification and evaluation of

assets or businesses with a view to completing a Qualifying

Transaction.

Bluewater has 7,716,500 common shares (the "Bluewater

Shares") issued and outstanding and 771,650 stock options

(the "Bluewater Options") issued and outstanding.

No individual or group of individuals acting in concert has

beneficial ownership of, or control or direction over, directly or

indirectly, more than 20% of the outstanding Bluewater Shares.

Certain historical financial information about Bluewater is

available at www.sedar.com.

Proposed Transaction

The Proposed Transaction involves several steps. Under the

Proposed Transaction: (a) Bluewater will incorporate a wholly-owned

subsidiary; (b) the wholly-owned subsidiary and ADM will amalgamate

(the "Amalgamation") and, pursuant to the

Amalgamation, the ADM shareholders will receive Bluewater Shares in

exchange for their ADM Shares, and the ADM option holders will

receive Bluewater Options in exchange for their ADM options, in

accordance with the Exchange Ratio (as defined below).

Private Placements

Shortly after the dissemination of this press release, ADM

intends to conduct a non-brokered private placement of a maximum of

20,000,000 ADM Shares, at a price of $0.05 per ADM Share, for

maximum gross proceeds of $1,000,000 (the "Initial Private

Placement"). The proceeds of the Initial Private Placement

will be used for working capital purposes.

Immediately prior to the completion of the Proposed Transaction,

ADM expects to conduct a brokered private placement (the

"Concurrent Private Placement" and, together with

the Initial Private Placement, the "Private

Placements") of ADM subscription receipts, for minimum

gross proceeds of $2,000,000. Each ADM subscription receipt will

entitle the holder to receive, without payment of additional

consideration and without any further action, one AlphaDelta Share

upon satisfaction of all the conditions to the completion of the

Proposed Transaction. The proceeds of the Concurrent Private

Placement will be used for working capital purposes.

Conditions Precedent to Closing

The Proposed Transaction is subject to a number of significant

conditions, including that: (a) the Exchange has conditionally

accepted the Proposed Transaction; (b) ADM has closed the Private

Placements; and (c) ADM shareholders have approved the

Amalgamation.

Post-Closing Capitalization of Bluewater

Under the Proposed Transaction, the parties will establish the

number of Bluewater Shares to be issued for each ADM Share, and the

number of Bluewater Options to be issued for each ADM Option, based

on an exchange ratio that will result in former AlphaDelta

shareholders owning approximately 97.00% of the common shares of

the resulting issuer, on a fully-diluted basis, and former

Bluewater shareholders owning approximately 3.00% of the common

shares of the resulting issuer, on a fully-diluted basis,

immediately after the completion of the Proposed Transaction.

Post-Closing Directors and Officers

Immediately after the Proposed Transaction, the parties expect

the directors or officers of the resulting issuer to be as

follows:

Victor J Therrien, Director, Chief Executive

Officer. Mr. Therrien is the CEO / Founder of ADM and over

the past 30 years served in the following executive roles;

Vice-President, Director for AGF Management Ltd., an investment

management firm, Executive Vice-President, Director (Canada),

Executive Director / Global Institutional Group at Brandes

Investment Partners Ltd., an investment management firm, President

and CEO at Therrien Woods & Co., an investment management firm,

Vice-President (Ontario) of Richardson GMP Limited, a wealth

management firm, and CEO / Founder of ADM. As well, Mr. Therrien

serves on the board of directors of a publicly- traded company, a

registered investment fund manager and two private companies.

Brad Farquhar, Director. Mr. Farquhar is

Executive Vice-President and Chief Financial Officer of SSC

Security Services Corp. (TSXV: SECU; OTCQX: SECUF) and its

predecessor companies. He previously co-founded Assiniboia Capital

Corp., which built Canada’s largest farmland fund before selling it

to the Canada Pension Plan Investment Board in 2014. Mr. Farquhar

is a trained financial planner and spent over 10 years as a senior

advisor to senior political leaders in Saskatchewan and Canada

prior to founding Assiniboia. He received a MPA in Electoral

Governance from Griffith University in Australia, studied political

science at Carleton University, and completed a BA at Providence

College. He previously served as Executive in Residence in

Agribusiness at the University of Regina. Mr. Farquhar has

extensive public company and board experience as a Director of SSC

Security Services Corp. (TSXV: SECU), Mongolia Growth Group Inc.

(TSXV: YAK), LUXXFOLIO Holdings Inc. (CSE: LUXX), Radicle Group

Inc., SIM Canada, Prairie College, and the advisory board of

AgFunder.

Maurice Levesque, Director. Mr. Maurice

Levesque is a founder, Chairman, and Chief Executive Officer of

Qwest Investment Management Corp. (“QIM”). Mr. Levesque is the

Chairman, CEO and Chief Compliance Officer of Qwest Investment Fund

Management Ltd., and Chairman, President and director of Heritage

Bancorp Ltd., Chairman of Qwest Fund Advisory and Back Officer

Services Ltd. (all three companies a subsidiary of QIM). Mr.

Levesque has over 35 years of experience in the Canadian financial

industry and is recognized for his broad knowledge, skills and

experience in the venture capital industry, financial services

industry and for his leadership skills in new business formation

and development. Mr. Levesque is a founder and/or a director of

several private and publicly traded companies which operate in a

variety of industries. Mr. Levesque graduated from The Northern

Alberta Institute of Technology with a diploma in Administration

Management.

Dave Malone, Director. For the last 20 years,

Mr. Malone has served as VP Business Initiatives at RBC Wealth

Management (reporting to CEO and COO) where he was responsible for

business technology strategy, prioritization, funding and

implementation of advisor desktop and client facing technologies

across $4 billion annual revenue business, supporting 1900 Advisor

teams and 450,000 HNW clients. For the past 5 years, Mr. Malone has

been the President and Director of a 360 unit Condominium Board in

the GTA Humber Bay Shores area. Graduated from University of

Toronto in 1983, Canadian Chartered Accountant (CA) designation

(1986), Canadian Securities Course (1987), CSI Derivatives Course

(2010), and Masters Trust Institute (MTI) in 2011.

Michail Sapountzoglou, Director. Mr.

Sapountzoglou's is currently co-founder and CEO of Bluewater. Mr.

Sapountzoglou began his career with a private family office in

Monaco running proprietary trading and asset management. In 1994,

he moved to London and helped establish the family office of the

Angelopoulos Group, leading M&A transactions within its core

investments in shipping, off-shore drilling, and private equity

until his departure in 2015. He established Angelopoulos Group's

joint venture with Odfjell Drilling Ltd. and led a series of bond

transactions trading on the Oslo Stock Exchange, raising over $1.6

billion for the off-shore projects. For the Angelopoulos Group's

shipping arm, Metrostar Management Corp., he led capital markets

strategy and business development. He directed the Angelopoulos

Group's initial seed investment in PuriCore, focused on developing

its HOCl, where he was also a founding Director from 1999-2013. He

assisted in taking PuriCore public on the Main List of the London

Stock Exchange and chaired its Remuneration and Nomination

committees.

Peter Van Dyke, Director. Mr. Van Dyke is a

seasoned finance professional, having worked in the finance and

investment industry for most of his 35-year career. He held

positions in banking (Royal Bank: Administrative Management and

Lloyds Bank: Commercial/Corporate Credit), real estate market

analysis (CMHC), operational finance and investment and for the

last four years has been working in the family office space,

managing an institutional-sized investment portfolio. Peter is a

Director of Junior Achievement BC and Chair of its Risk Management

Committee. He is also Director and Treasurer of the Vancouver

Community College Foundation. Peter is a Chartered Professional

Accountant (CPA, CMA), a graduate of Simon Fraser University (BBA –

Finance), and University of British Columbia (Urban Land Economics

Diploma). He has successfully completed the Canadian Securities

Course and completed the first year of the CFA Institute’s

Certificate in Investment Performance Measurement.

Dr. John Schmitz, Director. Dr. Schmitz is one

of Canada’s foremost authorities on global equities and global

derivatives. He is responsible for risk management and chairs

AlphaDelta’s Investment Oversight Committee for the AlphaDelta

Funds. Dr. Schmitz holds a BESc (Mechanical Engineering), a BA

(Economics) and a DHS (Honours Economics) from the University of

Western Ontario, a MA (Economics) from the University of Toronto,

and a PhD (Finance) from the Richard Ivey School of Business at the

University of Western Ontario. He also holds the Chartered

Financial Analyst (CFA) designation.

Glenn Warkentin, Corporate Secretary. Mr.

Warkentin is Counsel at Lindsey MacCarthy LLP, a Canadian law

firm.

Arm's Length Negotiations

The Proposed Transaction does not constitute a "Non Arm's Length

Qualifying Transaction", as defined in the policies of the

Exchange, and Bluewater is not required, therefore, to obtain

shareholder approval of the Proposed Transaction under the policies

of the Exchange.

Sponsorship

In connection with the Proposed Transaction, Bluewater intends

to apply for a waiver of the sponsorship requirements of the

Exchange. There can be no assurance that the Exchange will grant

the waiver. If the Exchange does not grant the waiver, then

Bluewater must retain a sponsor of the Proposed Transaction in

accordance with the policies of the Exchange.

Resignation of Antonios Backos

Bluewater also announces that Antonios Backos resigned as a

director of Bluewater on April 5, 2022. Bluewater wishes to thank

Mr. Backos for his service to Bluewater and wishes him well in his

future endeavours.

Exchange Advisory

Completion of the Proposed Transaction is subject to a number of

conditions, including but not limited to, Exchange acceptance and

if applicable pursuant to the requirements of the Exchange,

majority of the minority shareholder approval. Where applicable,

the Proposed Transaction cannot close until the required

shareholder approval is obtained. There can be no assurance that

the Proposed Transaction will be completed as proposed or at

all.

Investors are cautioned that, except as disclosed in the

prospectus to be prepared in connection with the Proposed

Transaction, any information released or received with respect to

the Proposed Transaction may not be accurate or complete and should

not be relied upon.

Trading in the securities of a Capital Pool Company should be

considered highly speculative.

The Exchange has in no way passed upon the merits of the

Proposed Transaction and has neither approved nor disapproved the

contents of this press release.

Neither the Exchange nor its "regulation services

provider" (as defined in the policies of the Exchange) accepts

responsibility for the adequacy or accuracy of this press

release.

Forward-Looking Information Disclaimer

This press release contains forward-looking information within

the meaning of applicable securities legislation. In general,

forward-looking information refers to disclosure about future

conditions, courses of action, and events. The use of any of the

words "anticipates", "expects", "intends", "will", "would", and

similar expressions are intended to identify forward-looking

information. More particularly and without limitation, this press

release contains forward looking information concerning the

proposed terms, and the anticipated results, of the Proposed

Transaction, Initial Private Placement, and Concurrent Private

Placement. The forward-looking information is based on certain key

expectations and assumptions made by Bluewater and ADM, including

expectations and assumptions concerning the ability of Bluewater

and ADM to complete the Proposed Transaction, Initial Private

Placement, and Concurrent Private Placement. Although Bluewater and

ADM believe that the expectations and assumptions on which such

forward-looking information is based are reasonable, undue reliance

should not be placed on the forward-looking information because

neither Bluewater nor ADM can give any assurance that they will

prove to be accurate. By its nature, forward-looking information is

subject to various risks and uncertainties, which could cause the

actual results and expectations to differ materially from the

anticipated results or expectations expressed in this press

release. These risks and uncertainties include, but are not limited

to, the inability of Bluewater and ADM to satisfy the conditions

precedent to the Proposed Transaction, Initial Private Placement,

and Concurrent Private Placement. Readers are cautioned not to

place undue reliance on this forward-looking information, which is

given as of the date of this press release, and to not use such

forward-looking information for anything other than its intended

purpose. Neither Bluewater nor ADM undertakes any obligation to

update publicly or revise any forward-looking information, whether

as a result of new information, future events or otherwise, except

as required by applicable securities legislation.

Further Information

For further information about Bluewater, please contact:

Michail SapountzoglouPresident, CEO, and CFO306945226000

For further information about ADM, please contact:

Victor TherrienCEO7789876417Victortherrien (WhatsApp)

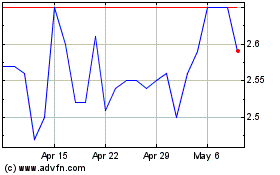

SSC Security Services (TSXV:SECU)

Historical Stock Chart

From Mar 2024 to Apr 2024

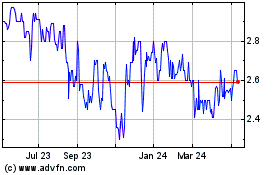

SSC Security Services (TSXV:SECU)

Historical Stock Chart

From Apr 2023 to Apr 2024