Sintana Energy Inc. (TSXV: SEI) (the “

Company” or

“

Sintana”) is pleased to announce that it has

closed its previously announced marketed public offering (the

“

Offering”) conducted by Echelon Capital Markets

(the “

Agent”) as lead agent and sole bookrunner,

pursuant to which it issued an aggregate of 88,550,000 units (the

“

Units”) of the Company, at a price of $0.15 per

Unit, to raise aggregate gross proceeds of $13,282,500 (including

full exercise of an over-allotment option). The Offering was

effected pursuant to a final short form prospectus of the Company

dated February 24, 2022 (the “

Final Prospectus”),

and was upsized from the originally announced maximum base offering

of $10 million due to strong demand. Each Unit consisted of one

common share of the Company (each a “

Common

Share”) and one Common Share purchase warrant (each a

“

Warrant”). Each Warrant entitles the holder

thereof to acquire one Common Share for an exercise price of $0.25

until March 8, 2024, and will be listed for trading on the TSX

Venture Exchange (“

TSXV”) under the symbol SEI.WT

at the open of trading on or about Friday, March 11, 2022.

Immediately following the closing of the

Offering, the Company completed its previously announced proposed

acquisition (the “Acquisition”) of 49% of the

outstanding shares of Inter Oil (Pty) Ltd. (“Inter

Oil”) from Grisham Assets Corp., as initially announced in

the Company’s press release dated September 15, 2021 available on

SEDAR at www.sedar.com. Inter Oil indirectly holds a strategic

portfolio of offshore petroleum exploration license interests as

well as an indirect 30% interest in onshore Block 1918B. In

connection with the closing of the Acquisition, Mr. Knowledge Katti

has been appointed to the board of directors of Sintana. Mr. Katti

is a pioneer in the Namibian oil and gas industry with more than 15

years of experience in a diversified portfolio of industries in

Namibia including oil and gas, mining and healthcare. He is

responsible for attracting investment of more than US$400 million

into Namibia over his career. He previously served as a director

and founding shareholder of UNX Energy Corp. and was business

development manager of Brazilian oil and gas company HRT. He holds

a Bachelor of Commerce in Accounting/Economics and Auditing from

the University of Namibia.

We appreciate the support of our shareholders,

new and old, in our upsized financing and are very pleased to

complete our acquisition in Namibia.” said Doug Manner, CEO,

further adding “The multi-billion barrel discoveries announced by

Shell (Graff-1) and Total (Venus-1) over the past month sit

directly beside a number of our newly acquired offshore blocks in

Namibia. Our exposure to this emerging world class basin coupled

with our cornerstone asset in Colombia position Sintana for

significant continuing success going forward.”

Consideration for the Acquisition consisted of

an aggregate of 34,933,333 Common Shares of the Company (the

“Consideration Shares”) and a cash payment in the

amount of US$4,000,000 (the “Cash Payment”), in

connection with which the Company had previously paid a deposit in

the amount of US$500,000. The balance of the Cash Payment was

funded by the Company at closing out of the net proceeds of the

Offering. The Consideration Shares are subject to a statutory hold

period expiring on July 9, 2022.

The Company intends to use the balance of the

net proceeds of the Offering to fund certain future obligations of

the Company in connection with the Namibian property interests

acquired pursuant to the Acquisition, future obligations of the

Company in connection with Namibian property interests to be

acquired pursuant thereto, to satisfy existing indebtedness, future

strategic acquisitions, working capital, general corporate

purposes, investor relations and marketing services.

The Company paid a cash commission of $649,775

to the Agent as partial consideration for its services in

connection with the Offering, together with a corporate finance fee

of $25,000. The Company also issued an aggregate of 4,331,833

broker warrants (“Broker Warrants”) to the Agent.

Each Broker Warrant entitles the holder to acquire one Unit at an

exercise price of $0.15 until March 8, 2024.

The Offering was completed on a commercially

reasonable “best efforts” basis (i) by way of the Final Prospectus

in each of the Provinces of Canada other than Quebec; (ii) on a

private placement basis in the United States pursuant to exemptions

from the registration requirements of the United States Securities

Act of 1933, as amended (the “U.S. Securities

Act”); and (iii) outside Canada and the United States on a

basis which did not require the qualification or registration of

any of the Company’s securities under domestic or foreign

securities laws.

The Acquisition and Offering remain subject to

the final approval of the TSXV. For further details, please refer

to the press releases of Sintana dated September 15, 2021, November

15, 2021, November 26, 2021, January 20, 2022, February 1, 2022 and

February 22, 2022, and the Final Prospectus, all available on SEDAR

at www.sedar.com.

This news release does not constitute an offer

to sell or a solicitation of an offer to sell any of the securities

in the United States. The securities have not been and will not be

registered under the U.S. Securities Act or any state securities

laws and may not be offered or sold within the United States or to

U.S. Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

The disclosure contained in this release

concerning the neighbouring discoveries announced by Shell

(Graff-1) and Total (Venus-1) constitutes analogous information

under National Instrument 51-101. This information is based upon

recent news releases dated February 4, 2022 and February 24, 2022

by Shell and Total, respectively, each of which are independent of

the Company. The Company is unable to confirm that the analogous

information was prepared by a qualified reserves evaluator or

auditor or in accordance with the COGE Handbook, but is of the view

that the information is relevant to the Company given the proximity

of such properties to Sintana’s newly acquired Namibian interests

pursuant to the Acquisition.

About Sintana

The Company is currently engaged in hydrocarbons

exploration and development activities in Colombia’s Magdalena

Basin, and holds interests in a strategic portfolio of onshore and

offshore petroleum exploration license interests in Namibia.

Sintana’s business strategy is to acquire, explore, develop and

produce superior quality assets with significant reserves

potential.

On behalf of Sintana Energy Inc.,

“Douglas G. Manner” Chief Executive Officer

For additional information regarding Sintana and

ongoing corporate activities, please visit the Company’s website at

www.sintanaenergy.com.

| Corporate

Contact: |

Corporate

Contact: |

| Douglas G. Manner |

Sean J. Austin |

| Chief Executive Officer |

Vice President |

| Tel: 832.279.4913 |

Tel: 713.825.9591 |

Neither the TSX Venture Exchange nor its

regulation services provider has reviewed or accepted

responsibility for the adequacy or accuracy of this press

release.

Forward Looking Statements – Certain information

set forth in this news release may contain forward-looking

statements, as such terms are defined under applicable securities

law, regarding the Company’s business and operations.

Forward-looking statements are statements that relate to future,

not past, events. In this context, forward-looking statements often

address expected future business and financial performance and

often contain words such as "intend" or other similar expressions.

Forward-looking statements involve substantial known and unknown

risks and uncertainties, including risks related to the receipt of

final TSX Venture Exchange approval of each of the Acquisition

and/or Offering, the prospective nature of the Company’s property

interests, the anticipated timing of trading of the Warrants,

currency risk, political and security risks relating to operations

in Namibia, availability of capital, permitting and land title

issues, the risks inherent in oil and gas exploration and

development activities, and such other risk factors as are set

forth in the Company’s continuous disclosure documents available on

SEDAR from time to time. In this news release, forward-looking

statements relate to, among other things, information regarding:

the use of proceeds of the Offering. While such forward-looking

statements are expressed by the Company, as stated in this release,

in good faith and believed by the Company to have a reasonable

basis, they are subject to numerous risks and uncertainties,

certain of which are beyond the control of the Company. Readers are

cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements. The Company

disclaims any obligation to update the forward looking statements

contained herein other than as required under applicable securities

laws.

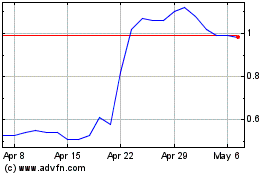

Sintana Energy (TSXV:SEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sintana Energy (TSXV:SEI)

Historical Stock Chart

From Apr 2023 to Apr 2024