SÃ O PAULO—Shares of Brazil's largest bank took a hit Tuesday, a

day after telephone company Oi SA filed the nation's largest

request ever for bankruptcy protection and raised the likelihood of

steep losses for creditors owed nearly $19 billion by the troubled

carrier.

State-controlled Banco do Brasil SA, the country's biggest bank

by assets, finished down 4.5%. Oi's shares fell 18%.

Private-sector lenders Itau Unibanco Holding SA and Banco

Bradesco SA opened lower, then recovered over the course of the

day. Itau ended at 29.39 reais, from 29.40 on Monday, after falling

as much as 2.6% during the day, and Banco Bradesco SA fell as much

as 1.8% before turning positive before the close of trading.

Oi's debt to Banco do Brasil is estimated at more than 5 billion

Brazilian reais, while Itau and Bradesco are said to be owed some

1.5 billion reais each by the telecommunications company, according

to Joã o Pedro Brugger, an analyst at investment company Leme

Investimentos. The three banks declined to comment.

At the end of March, about one-quarter of the roughly 50 billion

reais ($14.75 billion) Oi owed to lenders was in the hands of

commercial banks. Oi owes billions more to Brazil's tax agency, the

country's telecoms regulator and others. Monday's filing by Oi and

six subsidiaries lists 65.4 billion reais ($19.26 billion) in total

debt.

A brutal recession has sent bankruptcy filings soaring in

Brazil, forcing banks to boost their reserves. Oi´ s bankruptcy

protection request will further weigh on the financial sector, said

Luis Miguel Santacreu, an analyst with credit-ratings firm Austin

Rating.

"This happens at a difficult time [for Brazil] and requests for

bankruptcy protection will probably continue to increase," he

said.

Oi's shares were suspended several times on Tuesday as the price

of its preferred shares plunged as much as 30% soon after they

started trading. The shares fell as much as 31% during the day and

closed down 18.2%, while the benchmark Ibovespa index finished up

1%.

Fitch Ratings, Standard & Poor's and Moody's Investors

Service all said Tuesday they downgraded their ratings for Oi.

Fitch, which had downgraded Oi just last Friday as well, cited the

phone company's "debt-laden precarious capital structure" and

negative free cash flow generation.

Oi, Brazil's fourth-largest telecom firm, blamed its financial

collapse on a series of factors, including heavy borrowing to

complete mergers and acquisitions that have not helped the firm

close the technology gap with its main competitors.

Telecoms clients now favor mobile telephones and broadband

internet access, and Oi has had less success than its competitors

in penetrating those two markets. Oi's two mergers, with Brasil

Telecom SA and Portugal Telecom SGPS SA, failed to have the desired

effect of improving its balance sheet.

"Oi has financial and operations problems, competition is hard,

the market is very regulated and technology becomes obsolete fast,"

said Alexandre Furtado Montes, a telecommunications analyst at Rio

de Janeiro-based consulting firm Lopes Filho.

The company posted a net loss of 1.64 billion reais (about $476

million) in the first quarter, compared with a loss of 447 million

reais in the prior-year period. Net revenue dropped 4% over the

same period.

Oi, which has a 34.4% share of Brazil's fixed-line market and

about 70 million clients, asked a Rio de Janeiro court late Monday

for protection from creditors, the equivalent to a chapter 11

filing in the U.S., after debt restructuring talks with creditors

recently.

Earlier this month, Chief Executive Officer Bayard Gontijo

resigned while the talks were still open. The company gave no

specific reason for his departure, but people close to him said he

backed a proposal to convert debt into equity and give bondholders

a controlling stake in the restructured company.

The plan, however, was opposed by the firm´ s main shareholder,

Bratel BV, which was created by former shareholders of Portugal

Telecom using the official name Pharol SGPS. Pharol controls 27.2%

of Oi shares directly and indirectly through its subsidiaries.

"The main reason for Oi´ s bankruptcy protection request is

Pharol," Mr. Montes said, noting Oi has a market capitalization of

only about 1 billion reais, and owes more than 30 times its value

to international creditors. Shareholders "lost the company a long

time ago, it's no longer theirs," he added.

Pharol supported Oi's bankruptcy filing plan, and rejected the

deal favored by Mr. Gontijo, because it didn't want to dilute its

stake so sharply, according to people familiar with the situation.

Pharol on Tuesday said it reaffirms its "determination to continue

to defend the value of its main asset."

Shareholders including Pharol had been negotiating with

creditors represented by investment bank Moelis & Co, which

will continue working with international investors such as Pacific

Investment Management and Co., Citadel LLC and Wellington

Management Co, according to a person close to the negotiations.

The indebted company could also be sold or merge with a local or

international telecommunications player, some analysts said.

Oi could also sell only a specific business or one of its

subsidiaries, said Arthur Almeida, a Sã o Paulo-based legal analyst

at Debtwire Analytics. Its large base of fixed-line clients could

be helpful to a competitor wanting to expand its businesses in

other segments as well, Mr. Almeida noted.

"It's possible one of the larger telecommunications companies

operating in Brazil may show interest in Oi. It's also viable that

an international candidate could come up, as Brazil is cheap for

outsiders, " said Leme's Mr. Brugger.

Oi has been roiled by management instability and failed attempts

to find new sources of capital. Marco Schroeder, who replaced Mr.

Gontijo earlier in this month, is the company's sixth chief

executive since 2011. A potential deal with Russian billionaire

Mikhail Fridman to help Oi finance a merger with Telecom Italia

SpA's Brazilian unit fell through in February.

Local news media have reported that Egyptian billionaire Naguib

Sawiris, owner of Global Telecom, is considering purchasing part of

Oi.

Write to Luciana Magalhaes at Luciana.Magalhaes@dowjones.com,

Rogerio Jelmayer at rogerio.jelmayer@wsj.com and Patricia Kowsmann

at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

June 21, 2016 21:25 ET (01:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

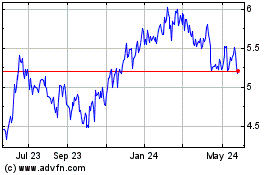

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Oct 2024 to Nov 2024

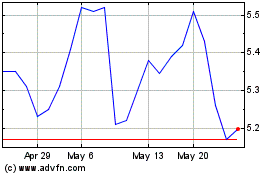

Banco Do Brasil (PK) (USOTC:BDORY)

Historical Stock Chart

From Nov 2023 to Nov 2024