Current Report Filing (8-k)

June 21 2023 - 3:19PM

Edgar (US Regulatory)

0001715611false00017156112023-06-212023-06-21iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

June 21, 2023

Date of Report (Date of earliest event reported)

BODY AND MIND INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 000-55940 | | 98-1319227 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

750 – 1095 West Pender Street Vancouver, British Columbia, Canada | | V6E 2M6 |

(Address of principal executive offices) | | (Zip Code) |

(800) 361-6312

Registrant’s telephone number, including area code

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol (s) | Name of each exchange on which registered |

N/A | N/A | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

____________

SECTION 2 – FINANCIAL INFORMATION

Item 2.02 Results of Operations and Financial Condition.

On June 21, 2023, Body and Mind Inc. (the “Company” or “BaM”) issued a news release announcing its financial results for the third quarter of fiscal year 2023 ended April 30, 2023. The information regarding the financial results for the third fiscal quarter ended April 30, 2023 of the Company contained in Item 7.01 below is responsive to this Item 2.02 and is incorporated into this Item 2.02 by reference.

The information in this Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

SECTION 7 – REGULATION FD

Item 7.01 Regulation FD Disclosure.

On June 21, 2023, the Company issued a news release to announce financial results for the third quarter of fiscal year 2023 ended April 30, 2023 and to provide shareholders with an operational update. All financial information is provided in U.S. dollars unless otherwise indicated.

Q3 FY 2023 Summary & Comparison to Q2 FY 2023 (in Millions of US$) |

| | | | | | |

| | Q3 FY 2023 | | | Q2 FY 2023 | |

Revenue | | $ | 7.3 | | | $ | 7.7 | |

Net Income/(Loss) | | $ | (3.6 | ) | | $ | (2.7 | ) |

Adjusted EBITDA* | | $ | (0.7 | ) | | $ | (1.3 | ) |

Q3 FY 2023 (ended April 30, 2023) and Subsequent Highlights:

| · | Completed construction, approvals and opened the Markham, Illinois dispensary. This is the first of two dispensary projects in the Illinois market. The Markham dispensary is located within the largest retail mall in Markham, Illinois, which has average daily traffic counts of more than 400,000 cars per day within a mile of the project location and held a Grand Opening with local and state politicians on May 27, 2023. |

| · | Advanced New Jersey state license application in conjunction with BaM Body and Mind Dispensary NJ, Inc. f/k/a CraftedPlants NJ, Inc. Received formal planning committee approval on the site plan, commenced design and architectural plans for the New Jersey location and working with state and local authorities to complete the state license. |

| · | Divested the Michigan BaM Body and Mind dispensary to focus time and energy on the Illinois and New Jersey markets. |

| · | Commenced product sales of Pretzel Bites, Turbo and vaporization cartridge products in Ohio from the Ohio processing operation. |

Management Commentary

“Our most recent quarter reflects a 46% improvement in adjusted EBITDA over last quarter as we continue to streamline our operations and expand into new markets. During the quarter, our team has focused on cost reductions and development of the new Illinois and New Jersey dispensaries,” stated Michael Mills, CEO of Body and Mind Inc. “We believe the Chicagoland market remains underserved by dispensaries and the Grand Opening of the Markham, Illinois dispensary was a significant milestone for the Company. We continue to work with state and local licensing authorities to advance current projects and also to apply for licenses in new jurisdictions.”

Q2 FY 2023 Financial Highlights:

| · | Revenues for Q3 FY 2023 were $7.3 million, a slight decrease from Q2 FY 2023 revenues of $7.7 million. |

| · | Gross profit of $2.07 million for Q3 FY 2023 as compared to $2.26 million for Q2 FY 2023. |

| · | Q3 FY 2023 net operating loss was $1.6 million as compared to net operating loss of $1.8 million in Q2 FY 2023. Net operating income was primarily impacted by continued business development expenses related to Illinois and New Jersey, new license applications and new operation startup expenses. |

| · | Q3 FY 2023 net loss was $3.6 million (or basic and diluted loss per share of $0.02) as compared to Q2 FY 2023 with a net loss of $2.7 million (or basic and diluted loss per share of $0.02). Net loss in Q3 FY 2023 included non-cash charges of $0.9 million for loss on impairment and $0.2 million for stock based compensation. |

| · | Adjusted EBITDA* loss of $0.7 million for Q3 FY 2023 compared with a $1.3 million loss for Q2 FY 2023, an adjusted EBITDA improvement of 46 % over the prior quarter. |

| · | Total Current Assets were $7.2 million, Total Assets were $32.6 million, Total Current Liabilities were $10.8 million and Total Liabilities were $31 million at April 30, 2023. |

The Company had 146,636,974 common shares outstanding as of April 30, 2023.

For further details, please see the Company’s recent Form 10-Q filing on EDGAR at www.sec.gov/edgar/search, and the interim financial statements filed on SEDAR at www.sedar.com.

*Adjusted EBITDA is a Non-GAAP metric used by management that does not have any standardized meaning prescribed by U.S. GAAP and may not be comparable to similar measures presented by other companies. Management defines the Adjusted EBITDA as the Income (loss) from operations, as reported, before interest, taxes, and adjusted for removing other non-cash items, including stock-based compensation expense, gain on settlement, loss on impairment, depreciation, and further adjustments to remove acquisition related costs or gains. Management believes Adjusted EBITDA is a useful financial metric to assess its operating performance on a cash adjusted basis before the impact of non-cash items and acquisition activities. The most comparable financial measure calculated and presented in accordance with U.S. GAAP is net income (loss), which was presented above prior to the Adjusted EBITDA figure.

Net Loss | | | -3,608,770 | |

Interest Income | | | -18,000 | |

Interest Expense | | | 484,522 | |

Tax | | | 939,028 | |

Depreciation/Amortization | | | 351,247 | |

EBITDA | | | -1,851,973 | |

| | | | |

EBITDA | | | -1,851,973 | |

Gain on settlement | | | 0 | |

Loss on impairment | | | 944,015 | |

Stock-based compensation | | | 177,642 | |

Adjusted EBITDA | | | -730,316 | |

A copy of the news release is attached as Exhibit 99.1 hereto.

The information in this Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

__________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BODY AND MIND INC. | |

| | | |

DATE: June 21, 2023 | By: | /s/ Michael Mills | |

| | Michael Mills | |

| | President, CEO and Director | |

__________

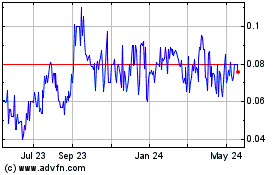

Body and Mind (CE) (USOTC:BMMJ)

Historical Stock Chart

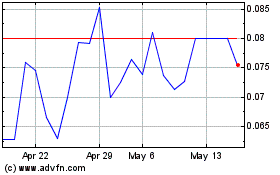

From Jan 2025 to Feb 2025

Body and Mind (CE) (USOTC:BMMJ)

Historical Stock Chart

From Feb 2024 to Feb 2025