Current Report Filing (8-k)

January 03 2023 - 7:23AM

Edgar (US Regulatory)

0000895665

false

0000895665

2023-01-03

2023-01-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event Reported): January 3, 2023 (December 30, 2022)

Clearday,

Inc.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

0-21074 |

|

77-0158076 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

8800

Village Drive, Suite 106, San Antonio, TX 78217

(Address

of Principal Executive Offices) (Zip Code)

(210)

451-0839

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 |

|

CLRD |

|

OTCQX |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

December 30, 2022, Clearday, Inc. (the “Company” or “we”) entered into a Restricted Stock

Award and Issuance Agreement (the “Stock Issuance Agreement”) to issue to James T. Walesa, the Company’s

Chief Executive Officer (“Walesa”) shares of common stock, par value $0.001 per share, of the Company (“Common

Stock”). The shares of Common Stock were issued upon the conversion of $1,000,000 of accrued obligations of the Company

and as compensation to Walesa for the 2022 year of $200,000 in lieu of cash compensation of such amount during 2022.

The

price per share used for the issuance of Common Stock was $0.67551 (the “Issuance Price”), subject to adjustment as

described below. The Issuance Price is greater than the 20 day volume average price per share of the Common Stock or the closing

price per share of the Common Stock as of December 31, 2022 (which closing price was $0.56). Accordingly, the Company has issued 1,776,436

shares of Common Stock under the Stock Issuance of Agreement, subject to reduction as described below.

Walesa

has agreed to provide price protection to the Company. In the event that the Company enters into a transaction or agreement that is material

to the Company during January 2023 (a “Specified Transaction”) and the closing price per share of Common Stock, on

the first full trading day after the disclosure of such Specified Transaction by the Company, is greater than the Issuance Price,

then the Issuance Price will be adjusted to such greater price. To effect such adjustment, Walesa will promptly transfer and assign shares

of Common Stock to the Company.

The

foregoing description of the Stock Issuance Agreement is not complete and is qualified in its entirety by reference to the full

text of such agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

The

disclosures set forth in Item 1.01 to this Current Report on Form 8-K is incorporated by reference in this Item 3.02.

Forward

Looking Statements

This

communication contains forward-looking statements (including within the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and Section 27A of the Securities Act of 1933, as amended) concerning the Company. These statements may discuss goals, intentions

and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs

of the management of the Company, as well as assumptions made by, and information currently available to, management. Forward-looking

statements generally include statements that are predictive in nature and depend upon or refer to future events or conditions, and include

words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,”

“plan,” “likely,” “believe,” “estimate,” “project,” “intend,”

and other similar expressions. Statements that are not historical facts are forward-looking statements. Forward-looking statements are

based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual

results could differ materially from those contained in any forward-looking statement as a result of various factors, including, without

limitation: the risks regarding the Company and its business, generally; risks related to the Company’s ability to correctly estimate

and manage its operating expenses and develop its innovate non-acute care businesses and the acceptance of its proposed products and

services, including with respect to future financial and operating results; the ability of the Company to protect its intellectual property

rights; competitive responses to the Company’s businesses including its innovative non-acute care business; unexpected costs, charges

or expenses; regulatory requirements or developments; changes in capital resource requirements; and legislative, regulatory, political

and economic developments. The foregoing review of important factors that could cause actual events to differ from expectations should

not be construed as exhaustive and should be read in conjunction with statements that are included herein and elsewhere, including the

risk factors included in the Company’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K filed with the SEC and the registration statement regarding the Company’s previously announced merger, that was filed

and declared effective. The Company can give no assurance that the actual results will not be materially different than those based on

the forward looking statements. Except as required by applicable law, the Company undertakes no obligation to revise or update any forward-looking

statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Item

9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CLEARDAY,

INC. |

| |

|

| |

By: |

/s/

James Walesa |

| |

Name:

|

James

Walesa |

| |

Title: |

Chief

Executive Officer |

| Dated

January 3, 2023 |

|

|

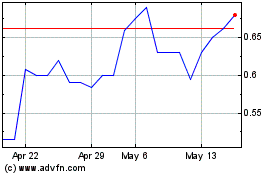

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Oct 2024 to Nov 2024

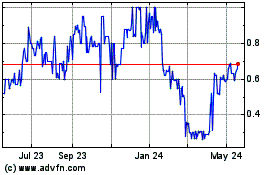

Clearday (CE) (USOTC:CLRD)

Historical Stock Chart

From Nov 2023 to Nov 2024