UBS Expands Range of ESG ETFs in Europe

August 06 2019 - 7:47AM

Dow Jones News

By Dieter Holger

-UBS has three new ESG ETFs on the Frankfurt stock exchange,

with two focused on emerging markets

-One ETF is the first to track the new ESG version of the Euro

STOXX 50 Index

UBS Group AG (UBS) has expanded its range of exchange-traded

funds aimed at Europeans seeking to invest in emerging markets and

the Eurozone with an environmental, social and governance focus,

further cementing the Swiss bank as a market leader in the ESG

sector.

The bank said on Tuesday that the three new ETFs are now trading

on the Frankfurt exchange, including one fund that tracks a

newly-launched ESG version of the bellwether Euro Stoxx 50

index.

The UBS ETF (LU) EURO STOXX 50 ESG UCITS ETF (UET5) tracks the

Euro Stoxx 50 ESG Index, the latest in a series of ESG indexes that

Stoxx, the index arm of Deutsche Boerse AG (DB1.XE), has launched

this year.

It excludes one-tenth of the least sustainable companies from

the parent blue-chip benchmark using ESG scores from data provider

Sustainalytics, Stoxx said. The index screens out corporations that

don't follow the United Nations Global Compact principles on human

and labor rights, the environment, ethics and corruption. It also

bars companies involved in controversial weapons, tobacco and

coal.

UBS's Euro Stoxx ESG-tracker fund charges fees of 0.15%

annually, the lowest among the bank's new funds.

"It is a highly liquid solution for asset owners who are looking

for cost-effective ways to integrate sustainable factors in the

core of their investments," said Willem Keogh, head of ESG,

thematic and factor solutions at Stoxx.

The launch of the funds comes as UBS positions itself as the top

supplier of values-based investing products in Europe, the world's

largest market for sustainable investing. UBS said it currently

holds around 34% of the European ESG ETF market, offering 141 ETFS

in the region and 64 globally.

UBS's other two new ETFs invest in emerging markets, but one

invests in bonds and the other in Chinese equities.

The expanded lineup will help UBS tap into new markets and

segments, said Clemens Reuter, head of ETF and passive investment

specialists at UBS Asset Management.

"The demand for sustainable investments is accelerating," Mr.

Reuter said.

The bond ETF tracks the J.P. Morgan EM IG ESG Diversified Bond

Index. JPMorgan Chase & Co. (JPM) partnered with BlackRock Inc.

(BLK) in 2018 to launch a series of fixed-income ESG indexes, which

score more than 170 countries and 650 issuers via data from

Sustainalytics, RepRisk and the Climate Bonds Initiative.

The dollar version of the bond ETF has fees of 0.45% annually,

compared with the euro version which charges 0.50%.

UBS also debuted an ETF that invests in China; the UBS ETF (LU)

MSCI China ESG Universal UCITS ETF (UETC). It tracks an benchmark

from indexing giant MSCI Inc. (MSCI), which invests in high

ESG-scoring corporations but caps the maximum holding of a company

at 5%. It charges 0.65% annually, the highest among the new

ETFs.

Write to Dieter Holger at dieter.holger@dowjones.com;

@dieterholger

(END) Dow Jones Newswires

August 06, 2019 08:32 ET (12:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

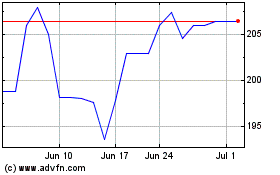

Deutsche Boerse Ag Namen... (PK) (USOTC:DBOEF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Deutsche Boerse Ag Namen... (PK) (USOTC:DBOEF)

Historical Stock Chart

From Nov 2023 to Nov 2024