Data Call Technologies Announces Year End Financials for 2012

March 27 2013 - 2:37PM

Marketwired

Data Call Technologies, Inc. (OTCBB: DCLT) (the "

Company" or "

Data Call"), listed

on the OTC Bulletin Board (the "

Exchange"),

announced today its financial results for the fiscal year ended

December 31, 2012.

The year ended with a promising forecast of the direction the

company is to travel into 2013. Extreme focus was placed in 2012 on

the company's path to profitability as Data Call pressed to

navigate through an anticipated difficult year. As the company

continued to maintain its current core business, the DataCallQ

mobile product was launched with unfavorable results. As a result

of the poor acceptance of this product, the company quickly

terminated the DataCallQ product, eliminating the recurring expense

of supporting the product. With efforts quickly redirected to the

expansion of the company's core products, the company was able to

grow its customer base in the last half of 2012 creating a

refreshing change in the company's momentum.

The audited financial results are quite bold in 2012 compared to

the audited results of the previous year. One must note, the year's

results are also significantly impacted by the mobile project

development cost overruns, combined with the expenses relative to

that product launch.

Summary of significant events of the

quarter

- Termination/Suspension of DataCallQ mobile project

- Maintaining and upselling services with regular clients

- Significant new clients being added.

The Company had $556,363 of sales revenue for the year ended

December 31, 2012, compared to sales revenue of $548,689 for the

year ended December 31, 2011, an increase in sales revenue of

$7,674 or 1.3% from the prior period.

The Company had total costs of sales for the year ended December

31, 2012 of $116,045 compared to total costs of sales of $121,297

for the year ended December 31, 2011, which resulted in a gross

margin of $440,318 for the year ended December 31, 2012, compared

to a gross margin of $427,392 for the year ended December 31, 2011,

an increase in gross margin of $12,925 from the prior year.

Cost of sales as a percentage of sales was 20.9% for the year

ended December 31, 2012, compared to 22.1% for the year ended

December 31, 2011. As the company gains more customers and enter

into more service agreements, they anticipate the cost of sales

will decrease further as they expect to take advantage of

applicable economies of scale which reduced their expenses of

$431,923 for the year ended December 31, 2012, compared to total

expenses of $536,701 for the year ended December 31, 2011, a

decrease in expenses of $104,778 or 19.5% from the prior period.

The decrease in expenses was mainly due to decrease in employee

compensation, decrease in deferred stock based compensation and

decrease in advertising and marketing expenses.

Data Call had a net profit of $8,395 for the year ended December

31, 2012, compared to a net loss of $109,309 for the year ended

December 31, 2011.

"With the last few years being probably some of the company's

most challenging, I am proud to put them behind us with the latest

changes that Data Call has weathered. We have continued the

commitment to not only put in place cost cutting measures to

increase our bottom line, but to adhere to and enforce these

measures consistently. The knowledge this company has acquired

through its experiences and relationships, which were nurtured in

this still young and ever growing industry, are irreplaceable. Data

Call's blending of that combination is now being monetized.

Interestingly as well, we are seeing yet another convergence in the

technology, the companies, and the people that drive this industry

-- we still remain on the front of that wave of ingenuity. We will

continue to widen our customer base, while exploring new

opportunities and keeping true to our integrity. I proudly look

forward to and welcome the rest of 2013 as our stance is solid as

is our team of professionals," stated Tim Vance, the Company's CEO

and acting Chairman.

About Data Call Technologies, Inc. Data

Call's information (infotainment) feeds can be viewed throughout

digital signage networks in numerous venues from gas stations,

airports, sports arenas, banks, clinics, car dealers, manufacturing

plants, the list goes on and on -- from luxury condo information

systems and elevators, to electronic digital billboards and video

walls. Data Call provides it. These feeds range from entertainment

content such as historical factoids to relevant news items, sports

scores, weather, flight, and traffic information.

Forward-Looking Statements Statements

contained herein, which are not historical facts, including

statements about plans and expectations regarding business areas

and opportunities, demand and acceptance of new or existing

businesses, capital resources and future financial results are

"forward-looking" statements as contemplated by the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks and uncertainties, including, but

not limited to, government regulation, taxation, spending,

competition, general economic conditions and other risk factors

which could cause actual results to differ materially from those

projected or implied in the forward-looking statements. There may

be other factors not mentioned above that may cause actual results

to differ materially from any forward-looking information. The

company takes no obligation to update or correct forward-looking

statements and takes no obligation to update or correct information

prepared by third parties that are not paid for by the Company.

Add to Digg Bookmark with del.icio.us Add to Newsvine

Data Call Technologies, Inc. Email Contact

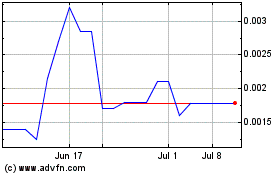

Data Call Technologies (PK) (USOTC:DCLT)

Historical Stock Chart

From Oct 2024 to Nov 2024

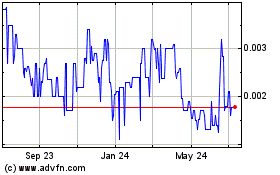

Data Call Technologies (PK) (USOTC:DCLT)

Historical Stock Chart

From Nov 2023 to Nov 2024