Current Report Filing (8-k)

January 14 2019 - 7:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act 1934

Date of Report (Date of earliest event reported): January 8, 2019

|

Merion, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

333-173681

|

|

45-2898504

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

9550 Flair Dr, Suite 302, El Monte CA

|

|

91731

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including areas code:

(626) 448-3737

None

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Definitive Agreement

On January 8, 2019, Merion, Inc. a Nevada Corporation (the “Company”), entered into a Strategic Cooperation Agreement (the “Agreement”) with Alitaitai Industrial Holding Group (the “Alitaitai”), a company incorporated in Hong Kong, pursuant to which the parties agreed to cooperate with the each other in connection with the sales of the Company’s products through Alitaitai’s sales platform, and the Company agreed to provide awards to Alitaitai with ten percent (10%) of the total sale revenues generated by Alitaitai in the form of the Company’s shares of common stock at a price of $2.00 per share. The Company also agreed to provide Alitaitai with a one-time award of 60,000 shares of common stock of the Company, to be issued upon Alitaitai making the first deposit payment of $300,000 for the purchase of the Company’s products. The shares contemplated in the Agreement will be issued pursuant to the exemption from registration provided by Regulation S promulgated under the Securities Act of 1933, as amended.

The Company’s other duties under the Agreement include (i) providing the products list and introduction of the Company’s high-tech small molecules and carriers and providing FDA qualified analysis test reports, FDA free sales certificates, and other qualification documents; (ii) providing the Company’s disclosure information on the SEC website, as well as Chinese translations for the relevant requirements of the US stock market and the procedures and required information to open a stock account in the U.S.; (iii) providing a list of service items and service procedures for the Company’s e-hospital as well as discussion and consultations with Alitaitai regarding a specific cooperation plan in this area; (iv) providing a stock award incentive arrangement based upon Alitaitai’s product sales performance; (v) providing Alitaitai with the latest FDA anti-cancer drug supply channels and other high-tech functional food and nutrition supplements intended to help prevent cancer; (vi) providing recommendations of financial institutions and investment banks in North America to Alitaitai based on its capital operations, and jointly exploring asset securitization and digital certification; (vii) providing various high-tech functional products and overseas services after Alitaitai’s establishment of the new retail company in Ankang City, China; (viii) providing compliance consulting services for FDA-certified GMP factories for Alitaitai’s affiliated companies and developing OEM business in China; (ix) providing the Company’s e-hospital qualifications and American doctor team, connecting American doctors and Chinese hospitals and patients via internet platforms and video calls, providing overseas treatment and drug prescriptions in compliance with relevant laws and regulations, and providing medicine price inquiries, medicine payment, medicine delivery and other services to meet the needs of domestic and overseas customers.

The representations, warranties and covenants contained in the Agreement were made solely for the benefit of the parties to the Agreement. In addition, such representations, warranties and covenants (i) are intended as a way of allocating the risk between the parties to the Agreement and not as statements of fact, and (ii) may apply standards of materiality in a way that is different from what may be viewed as material by shareholders of, or other investors in, the Company. Accordingly, the Agreement is filed with this report only to provide investors with information regarding the terms of transactions, and not to provide investors with any other factual information regarding the Company. Shareholders should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Agreement, which subsequent information may or may not be fully reflected in public disclosures.

The Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K. The foregoing summary of the terms of the Agreement is subject to, and qualified in its entirety by, the Agreement, which is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities

Please see the disclosure set forth under Item 1.01, which is incorporated by reference into this Item 3.02.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Merion, Inc.

|

|

|

|

|

|

|

Dated: January 14, 2019

|

By:

|

/s/ Ding Hua Wang

|

|

|

|

|

Ding Hua Wang

|

|

|

|

|

Chief Executive Officer and Chief Financial Officer

|

|

Merion (CE) (USOTC:EWLU)

Historical Stock Chart

From Oct 2024 to Nov 2024

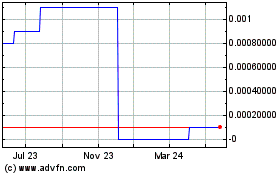

Merion (CE) (USOTC:EWLU)

Historical Stock Chart

From Nov 2023 to Nov 2024