UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended

March 31, 2018

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission File Number

001-10346

GALENFEHA, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

46-2283393

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

420 Throckmorton Street, Suite 200

Fort Worth,

Texas 76102

(Address of principal executive offices) (Zip code)

(800) 280-2404

(Registrant’s telephone

number, including area code)

N/A

(Former name, former address and former

fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant submitted

electronically and posted on its corporate web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (section 232.405 of this chapter) during the preceding 12 months (or for

such shorter period that the registrant was required to submit and post such

files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large Accelerated Filer [ ]

|

Accelerated

Filer [

]

|

|

|

Non-Accelerated Filer [ ]

|

Smaller Reporting Company [X]

|

Emerging Growth Company [ ]

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to

Section 7(a)(2)(B) of the Securities Act. [ ]

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No

[X]

As of May 24, 2018, there were 72,300,000 shares of the

registrant’s common stock outstanding, each with a par value of $0.001.

TABLE OF CONTENTS

FORM 10-Q

FOR THE

QUARTERLY PERIOD ENDED MARCH 31, 2018

Galenfeha, Inc.

INDEX TO CONSOLIDATED FINANCIAL

STATEMENTS

(Unaudited)

|

|

|

|

|

Page

|

|

|

|

|

Consolidated

Balance Sheets as of March 31, 2018 (Successor) and December 31, 2017 (

Predecessor) (Unaudited)

|

F-2

|

|

|

|

|

Consolidated

Statements of Operations for the period from January 29, 2018 through

March 31, 2018 (Successor) and January 1, 2018 through January 28, 2018

(Predecessor) and the three month period ended March 31, 2017(Predecessor)

(Unaudited)

|

F-3

|

|

|

|

|

Consolidated

Statements of Cash Flows for the period from January 29, 2018 through

March 31, 2018 (Successor) and January 1, 2018 through January 28, 2018

(Predecessor) and the three month periods ended March 31, 2017

(Predecessor) (Unaudited)

|

F-4

|

|

|

|

|

Notes

to Consolidated Financial Statements (Unaudited)

|

F-5

|

Galenfeha, Inc.

CONSOLIDATED

BALANCE

SHEETS

(Unaudited)

|

|

March 31, 2018

(Successor)

|

|

|

|

December 31, 2017

(Predecessor)

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

356,995

|

|

|

$

|

348

|

|

|

Marketable securities

|

|

26,160

|

|

|

|

-

|

|

|

Accounts receivable

|

|

759,538

|

|

|

|

537,337

|

|

|

Supplies

|

|

90,000

|

|

|

|

30,000

|

|

|

Prepaid supplies

|

|

62,769

|

|

|

|

-

|

|

|

Due from related parties

|

|

1,000

|

|

|

|

12,000

|

|

|

Total current assets

|

|

1,296,462

|

|

|

|

579,685

|

|

|

Property and equipment, net of accumulated

depreciation

|

|

878,127

|

|

|

|

887,340

|

|

|

Goodwill

|

|

212,279

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

$

|

2,386,868

|

|

|

$

|

1,467,025

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’

EQUITY(DEFICIT)

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

Accounts payable and accrued

liabilities

|

$

|

379,726

|

|

|

$

|

237,613

|

|

|

Lines of credit payable

|

|

529,841

|

|

|

|

173,561

|

|

|

Note payable

|

|

332,662

|

|

|

|

482,983

|

|

|

Short-term non-secured debt

|

|

565,600

|

|

|

|

404,509

|

|

|

Due to officer and related parties

|

|

88,367

|

|

|

|

36,867

|

|

|

Total current liabilities

|

|

1,896,196

|

|

|

|

1,335,533

|

|

|

|

|

|

|

|

|

|

|

|

Long term notes payable

|

|

428,068

|

|

|

|

471,924

|

|

|

Total liabilities

|

|

2,324,264

|

|

|

|

1,807,457

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

|

|

|

|

|

Preferred A shares: Authorized: 20,000,000 shares, $0.001

par value, 7,300,000 issued and outstanding

|

|

7,300

|

|

|

|

-

|

|

Preferred B shares: Authorized: 30,000,000 shares, $0.001

Par value, 27,347,563 issued and outstanding

|

|

27,348

|

|

|

|

-

|

|

|

Common stock

|

|

|

|

|

|

|

|

|

Authorized: 150,000,000 common shares, $0.001 par

value,

|

|

|

|

|

|

|

|

|

72,300,000 issued and outstanding

|

|

72,300

|

|

|

|

-

|

|

|

Additional paid-in capital

|

|

3,709,081

|

|

|

|

-

|

|

|

Member contributions (draws)

|

|

-

|

|

|

|

(70,040

|

)

|

|

Accumulated deficit

|

|

(3,753,425

|

)

|

|

|

(270,392

|

)

|

|

Total stockholders’ equity (deficit)

|

|

62,604

|

|

|

|

(340,432

|

)

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

(DEFICIT)

|

$

|

2,386,868

|

|

|

$

|

1,467,025

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

Galenfeha, Inc.

CONSOLIDATED

STATEMENTS OF

OPERATIONS

(Unaudited)

|

|

|

January 29, 2018 -

March 31, 2018

(Successor)

|

|

|

|

January 1, 2018 –

January 28, 2018

(Predecessor)

|

|

|

Three Months Ended

March 31, 2017

(

Predecessor)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

$

|

708,126

|

|

|

$

|

412,416

|

|

$

|

96,750

|

|

|

Less: Cost of Sales

|

|

219,423

|

|

|

|

45,626

|

|

|

9,187

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

92,464

|

|

|

|

146,273

|

|

|

147,050

|

|

|

Payroll expenses

|

|

197,939

|

|

|

|

67,285

|

|

|

-

|

|

|

Professional fees

|

|

29,320

|

|

|

|

-

|

|

|

-

|

|

|

Depreciation and amortization expense

|

|

40,710

|

|

|

|

20,355

|

|

|

64,367

|

|

|

Total operating expenses

|

|

360,433

|

|

|

|

233,913

|

|

|

211,417

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) from operations

|

|

128,270

|

|

|

|

132,877

|

|

|

(123,854

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (expense) income:

|

|

|

|

|

|

|

|

|

|

|

|

Miscellaneous income

|

|

36

|

|

|

|

-

|

|

|

32,511

|

|

|

Rental income- related party

|

|

6,000

|

|

|

|

3,000

|

|

|

-

|

|

|

Realized gain (loss) on sale of investments

|

|

(762

|

)

|

|

|

-

|

|

|

-

|

|

|

Unrealized gain (loss) on trading securities

|

|

(3,030

|

)

|

|

|

-

|

|

|

-

|

|

|

Interest expense

|

|

(63,836

|

)

|

|

|

(7,725

|

)

|

|

(3,399

|

)

|

|

Loss on derivative instruments

|

|

(105,284

|

)

|

|

|

-

|

|

|

-

|

|

|

Total other (expense)

|

|

(166,876

|

)

|

|

|

(4,725

|

)

|

|

29,112

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

$

|

(38,606

|

)

|

|

$

|

128,152

|

|

$

|

(94,742

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

loss per share, basis and diluted

|

$

|

(0.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares

|

|

|

|

|

|

|

|

|

|

|

|

outstanding, basic and diluted

|

|

69,937,803

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

Galenfeha, Inc.

CONSOLIDATED

STATEMENTS OF

CASH FLOWS

(Unaudited)

|

|

January 29,

2018 –

March

31, 2018

|

|

|

|

January 1, 2018

–

January 28,

2018

|

|

|

Three Months

Ended

March 31, 2017

|

|

|

|

|

(Successor)

|

|

|

|

(Predecessor)

|

|

|

(Predecessor)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING

ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

$

|

(38,606

|

)

|

|

$

|

128,152

|

|

$

|

(94,742

|

)

|

|

Adjustments to reconcile net loss to net cash used in

|

|

|

|

|

|

|

|

|

|

|

|

operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

40,710

|

|

|

|

20,355

|

|

|

64,367

|

|

|

Loss on derivative instruments

|

|

105,284

|

|

|

|

-

|

|

|

-

|

|

|

Amortization of debt discounts on convertible notes

|

|

30,925

|

|

|

|

-

|

|

|

-

|

|

|

Realized losses on investments

|

|

762

|

|

|

|

-

|

|

|

-

|

|

|

Unrealized losses on investments

|

|

3,030

|

|

|

|

-

|

|

|

-

|

|

|

Changes in Operating Assets and Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

(Increase) Decrease in accounts receivable

|

|

57,391

|

|

|

|

(284,592

|

)

|

|

(96,750

|

)

|

|

(Increase) Decrease in due from

related party

|

|

(1,000

|

)

|

|

|

17,000

|

|

|

-

|

|

|

(Increase) in supplies

|

|

(60,000

|

)

|

|

|

-

|

|

|

|

|

|

(Increase) Decrease in prepaid

supplies and other assets

|

|

(62,769

|

)

|

|

|

-

|

|

|

-

|

|

|

Increase (Decrease) in

accounts payable and accrued liabilities

|

|

(30,225

|

)

|

|

|

78,565

|

|

|

44,062

|

|

|

Net cash (used in)/provided by operating activities

|

|

45,502

|

|

|

|

(40,520

|

)

|

|

(83,063

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

Sales and

purchases of investments, net

|

|

36,765

|

|

|

|

-

|

|

|

-

|

|

|

Repurchase and cancellation of shares

|

|

(913

|

)

|

|

|

-

|

|

|

-

|

|

|

Purchase of

fixed assets

|

|

-

|

|

|

|

-

|

|

|

(301,727

|

)

|

|

Cash assumed in acquisition of subsidiary

|

|

171,703

|

|

|

|

-

|

|

|

-

|

|

|

Net cash (used in)

provided by financing activities

|

|

207,555

|

|

|

|

-

|

|

|

(301,727

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FINANCING

ACTIVITIES

|

|

|

|

|

|

|

|

|

-

|

|

|

Proceeds from lines of credit

|

|

108,030

|

|

|

|

627,147

|

|

|

78,141

|

|

|

Payments on

lines of credit

|

|

-

|

|

|

|

(378,897

|

)

|

|

-

|

|

|

Proceeds from other loans payable

|

|

300,000

|

|

|

|

|

|

|

100,000

|

|

|

Payments on

other loans payable

|

|

(100,348

|

)

|

|

|

(38,561

|

)

|

|

-

|

|

|

Proceeds from notes payable

|

|

-

|

|

|

|

-

|

|

|

221,855

|

|

|

Payments on

notes payable

|

|

(161,363

|

)

|

|

|

(32,814

|

)

|

|

(18,477

|

)

|

|

Proceeds on liabilities due to officer and related

parties

|

|

-

|

|

|

|

35,000

|

|

|

34,693

|

|

|

Payments on

liabilities due to officer and related parties

|

|

(28,500

|

)

|

|

|

-

|

|

|

(28,092

|

)

|

|

Principal payments on convertible debenture

contracts

|

|

(21,840

|

)

|

|

|

-

|

|

|

-

|

|

|

Payments on

margin loan

|

|

(14,203

|

)

|

|

|

-

|

|

|

-

|

|

|

Member draws

|

|

-

|

|

|

|

-

|

|

|

(77,540

|

)

|

|

Net cash provided

by financing activities

|

|

81,776

|

|

|

|

211,875

|

|

|

310,580

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCREASE

(DECREASE) IN CASH

|

|

334,833

|

|

|

|

171,355

|

|

|

(74,210

|

)

|

|

CASH AT BEGINNING OF PERIOD

|

|

22,162

|

|

|

|

348

|

|

|

88,321

|

|

|

CASH AT END OF

PERIOD

|

$

|

356,995

|

|

|

|

171,703

|

|

$

|

14,111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL

INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for:

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

$

|

69,238

|

|

|

|

7,725

|

|

$

|

3,399

|

|

|

Income taxes

|

|

-

|

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONCASH INVESTING

AND FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for debt conversion

|

|

12,240

|

|

|

|

-

|

|

|

-

|

|

|

Derivative

liability extinguished on conversion

|

|

55,938

|

|

|

|

-

|

|

|

-

|

|

|

Fixed assets purchased through accounts payable

|

|

-

|

|

|

|

51,853

|

|

|

-

|

|

|

Fixed assets purchased through notes payable

|

|

|

|

|

|

|

|

|

516,051

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

Galenfeha, Inc.

Notes to Unaudited Consolidated

Financial Statements

March 31, 2018

NOTE 1 - BASIS OF PRESENTATION

The accompanying financial statements have been prepared by the

Company without audit. In the opinion of management, all adjustments (which

include only normal recurring adjustments) necessary to present fairly the

financial position, results of operations, and cash flows at March 31, 2018, and

for all periods presented herein, have been made.

Certain information and footnote disclosures normally included

in financial statements prepared in accordance with accounting principles

generally accepted in the United States of America have been omitted. It is

suggested that these unaudited interim financial statements be read in

conjunction with the financial statements and notes thereto included in the

Company’s December 31, 2017 audited financial statements included in its Form

10-K filed with the Securities and Exchange Commission. The results of

operations for the period ended March 31, 2018 and the same period last year are

not necessarily indicative of the operating results for the full years.

On January 29, 2018, the Company acquired substantially all of

the operating assets of Fleaux Solutions, LLC, a Louisiana Limited Liability

Company (the "Acquisition") a Company with common officers and directors. There

was no common majority ownership between the Company and Fleaux Solutions, LLC.

Fleaux Solutions, LLC is engaged in the business of water, utility, and sewage

construction. Upon the closing of the Acquisition, the Company received

substantially all of the operating assets of Fleaux Solutions, LLC, consisting

of cash on hand, inventory, accounts receivable, and fixed assets. There are

common directors/officers of Fleaux Solutions, LLC with Galenfeha, Inc. and no

common majority control.

The purchase price of the operating assets of Fleaux Solutions,

LLC was a cash payment of $1.00

The Company accounted for its acquisition of the operating

assets of Fleaux Solutions, LLC using the acquisition method of accounting.

Fleaux Solutions cash on hand, inventories, accounts receivable, and fixed

assets acquired and liabilities assumed were recorded based upon their estimated

fair values as of the closing date of the Acquisition. The excess of purchase

price over the value of the net assets acquired was recorded as goodwill. (See

footnote #4)

The basis of presentation is not consistent between the

successor and predecessor entities and the financial statements are not

presented on a comparable basis. As a result, the accompanying consolidated

statements of operations, cash flows and comprehensive income (loss) are

presented for two different reporting entities:

Successor — relates to the combined entities financial periods

and balance sheets succeeding the Acquisition; and Predecessor — relates to the

financial of Fleaux Solutions, LLC periods preceding the Acquisition (prior to

January 29, 2018).

Unless otherwise indicated, the “Company” as used throughout

the remainder of the notes, refers to both the Successor and Predecessor.

NOTE 2 - GOING CONCERN

The accompanying consolidated financial statements have been

prepared assuming that the Company will continue as a going concern. The Company

has incurred reoccurring net losses and has an accumulated deficit. These

conditions raise substantial doubt about the Company’s ability to continue as a

going concern. The Company’s ability to continue as a going concern is dependent

upon the Company’s ability to achieve a level of profitability. The Company

intends on financing its future development activities and its working capital

needs largely from the sale of public equity securities with some additional

funding from other traditional financing sources, including term notes until

such time that funds provided by operations are sufficient to fund working

capital requirements. The financial statements of the Company do not include any

adjustments relating to the recoverability and classification of recorded

assets, or the amounts and classifications of liabilities that might be

necessary should the Company be unable to continue as a going concern.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The Financial Statements and related disclosures have been

prepared pursuant to the rules and regulations of the Securities and Exchange

Commission (“SEC”). The Financial Statements have been prepared using the

accrual basis of accounting in accordance with Generally Accepted Accounting

Principles (“GAAP”) of the United States (See Note 2 regarding the assumption

that the Company is a “going concern”). Certain prior period amounts

have been reclassified to conform to current period presentation.

The accompanying financial statements have been presented on a

comparative basis. For periods after the acquisition of Fleaux Solutions, LLC

(see Note 4), the Company is referred to as the Successor and its results of

operations combines the operations of Fleaux Solutions, LLC and those of

Galenfeha, Inc. For periods prior to the acquisition of Fleaux Solutions, the

Company is referred to as the Predecessor and its results of operations include

only the Fleaux Solutions, LLC operations. A black line separates the

Predecessor and Successor financial statements to highlight the lack of

comparability between these two periods.

PRINCIPLES OF CONSOLIDATION

The consolidated financial statements include the accounts of

the Company and its wholly owned subsidiary, Fleaux Solutions, LLC. All

significant inter-company accounts and transactions have been eliminated.

USE OF ESTIMATES

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of America

requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. These estimates and

assumptions also affect the reported amounts of revenues, costs, and expenses

during the reporting period. Management evaluates these estimates and

assumptions on a regular basis. Actual results could differ from those

estimates.

REVENUE RECOGNITION

Revenues are recognized when control of the promised goods or

services is transferred to the Company’s customers, in an amount that reflects

the consideration the Company expects to be entitled to in exchange for those

goods or services, pursuant to the guidance provided by Accounting Standards

Codification (“ASC”) Topic 606.

Services revenues are generated from sub-contractor services

provided to contractors for infrastructure water-line repair. The Company

recognizes revenue for these services at a point in time as the customer

receives and consumes the benefits of the service as they are being performed

and the Company has a right to payment for performance completed to date. The

Company recognizes revenue upon invoicing and completion of service for the

contractor and recognizes expenses as incurred.

Successor: For the period from January 29, 2018 through March

31, 2018; $642,507 and 91% of our total revenue came from one customer.

Predecessor: For the period from January 1, 2018 through

January 29, 2018; $256,334 or 62% of our total revenue came from one customer

and $136,937 or 33% came from one other customer.

Predecessor- For the three months ending March 31, 2017;

$96,750 and 100% of our total revenue came from one customer.

The following table presents our revenues disaggregated by

revenue source.

Sources of Revenue

|

For the Period from

January

29, 2018

through March 31,

2018 (Successor)

|

For the Period

from January

1,

2018 through

January 29, 2018

(Predecessor)

|

Three Months Ending

March 31,

2017

(Predecessor)

|

|

Pre and Post CCTV

|

163,699

|

26,816

|

51,978

|

|

Point Repairs

|

44,060

|

-

|

-

|

|

Manhole Rehabilitation

|

157,941

|

256,300

|

44,772

|

|

Service Lateral Reconnect

|

82,001

|

31,700

|

-

|

|

Cosmic Service Lateral Lining

|

260,425

|

97,600

|

-

|

Pre and Post CCTV consists of cleaning wastewater lines.

Manhole Rehabilitation consists of lining the manhole

interiors, internal sealing of the joint area, and reconstructing manhole

benches and channels.

Point Repairs consists of an excavator used to fid at a marked deviated in existing wastewater pipe and repairs and then made to the line.

Service Lateral Reconnect consists of an excavator used to dig where a service needs reconnecting to the main pipe and the repairs are then made to that line.

Cosmic Service Lateral Lining uses our exclusive material to robotically insert into an existing service line where UV light then cures the material creating a bonded connection between the mainline and the service line.

CASH AND CASH EQUIVALENTS

All cash, other than held in escrow, is maintained with a major financial institution in the United States. Deposits with this bank may exceed the amount of insurance provided on such deposits. Temporary cash investments with an original maturity of

three months or less are considered to be cash equivalents. Cash at March 31, 2018 (Successor) and December 31, 2017 (Predecessor) was $356,995 and $348, respectively.

ACCOUNTS RECEIVABLE

Accounts receivable represents the uncollected portion of amounts recorded as revenues. Management performs periodic analyses to evaluate all outstanding accounts receivable to estimate an allowance for doubtful accounts that may not be collectible,

based on the best facts available to management. Management considers historical collection patterns, accounts receivable aging trends and specific identification of disputed invoices in its analyses. After all reasonable attempts to collect a

receivable have failed, the receivable is directly written off. As of March 31, 2018 and December 31, 2017, the balance of the allowance for doubtful accounts was $0 (Successor) and $0 (Predecessor), respectively.

As of December 31, 2017; $119,201 or 22% of our Accounts Receivable was from one customer and another $359,474 or 67% was from another single customer. As of March 31, 2018; $652,852 or 86% of our total accounts receivable was from a

single customer.

GOODWILL

Goodwill represents the excess of the purchase price of acquired businesses over the estimated fair value of the identifiable net assets acquired. In accordance with ASC 142,

Goodwill and Other Intangible Assets

, goodwill and other

intangibles with indefinite useful lives are not amortized but tested for impairment annually or more frequently when events or circumstances indicates that the carrying value of a reporting unit more likely than not exceeds its fair value. The

goodwill impairment test is applied by performing a qualitative assessment before calculating the fair value of the reporting unit. If, on the basis of qualitative factors, it is considered not more likely than not that the fair value of the

reporting unit is less than the carrying amount, further testing of goodwill for impairment would not be required. Otherwise, goodwill impairment is tested using a two-step approach.

The first step involves comparing the fair value of a company's reporting units to their carrying amount. If the fair value of the reporting unit is determined to be greater than its carrying amount, there is no impairment. If the reporting unit's

carrying amount is determined to be greater than the fair value, the second step must be completed to measure the amount of impairment, if any. The second step involves calculating the implied fair value of goodwill by deducting the fair value of

all tangible and intangible assets, excluding goodwill, of the reporting unit from the fair value of the reporting unit as determined in step one. The implied fair value of the goodwill in this step is compared to the carrying value of goodwill. If

the implied fair value of the goodwill is less than the carrying value of the goodwill, an impairment loss equivalent to the difference is recorded. The Company performed a qualitative assessment and determined there was no impairment of goodwill

recognized during 2018.

The Company recognizes an acquired intangible asset apart from goodwill whenever the intangible asset arises from contractual or other legal rights, or when it can be separated or divided from the acquired entity and sold, transferred, licensed,

rented or exchanged, either individually or in combination with a related contract, asset or liability. Such intangibles are amortized over their useful lives. Impairment losses are recognized is the carrying amount of an intangible asset subject to

amortization is not recoverable from expected future cash flows and its carrying amount exceeds its fair value.

LONG-LIVED ASSETS

The Company's long-lived assets consisted of property and equipment and customer relationships and are reviewed for impairment in accordance with the guidance of the FASB Topic ASC 360, Property, Plant, and Equipment. The Company tests for

impairment losses on long-lived assets used in operations whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. Through March 31, 2017, the Company had not experienced impairment losses on

its long-lived assets

as management determined that there were no indicators that a carrying amount of the asset may not be recoverable.

COST OF SALES

Cost of services mainly consisted of raw material costs, direct labor and certain overhead allocated costs. Costs are recognized when the related revenue is recorded.

ADVERTISING EXPENSES

Advertising, promotional and selling expenses consisted of sales salaries, tap handles, media advertising costs, sales and marketing expenses, and promotional activity expenses and are recognized when incurred in the accompanying statement of

operations.

GENERAL AND ADMINISTRATIVE EXPENSES

General and administrative expenses consisted of office supplies, rent and utility expenses, meals, travel and entertainment expenses, and other general and administrative overhead costs. Expenses are recognized when incurred.

FAIR VALUE ACCOUNTING

As required by the Fair Value Measurements and Disclosures Topic of the FASB ASC 820, fair value is measured based on a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value as follows: (Level 1) observable

inputs such as quoted prices in active markets; (Level 2) inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and (Level 3) unobservable inputs in which there is little or no market data, which

require the reporting entity to develop its own assumptions.

The three levels of the fair value hierarchy are described below:

Level 1

Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2

Quoted prices in markets that are not active, or inputs that are observable,

either directly or indirectly, for substantially the full term of the asset or liability;

Level 3

Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by

little or no market activity).

The Company utilized level 3 inputs to estimate the fair value of its derivative instruments using the Black-Scholes Option Pricing Model. There were no outstanding assets or liabilities measured on a recurring basis at March 31, 2018 (Successor).

NOTE 4 – ACQUISITION OF FLEAUX SOLUTIONS, LLC- RELATED PARTY

On January 29, 2018, the Company acquired substantially all of the operating assets of Fleaux Solutions, LLC, a Louisiana Limited Liability Company (the "Acquisition"), a Company with common officers and directors. There was no common majority

ownership between the Company and Fleaux Solutions, LLC. Fleaux Solutions, LLC is engaged in the business of water, utility, and sewage construction. Upon the closing of the Acquisition, the Company received substantially all of the operating assets

of Fleaux Solutions, LLC, consisting of cash on hand, inventory, accounts receivable, and fixed assets. There are common directors/officers with Galenfeha, Inc. and no common “majority” control.

The purchase price of the operating assets of Fleaux Solutions, LLC was a cash payment of $1.00. In addition, the Company assumed $2,149,749 of scheduled liabilities.

The Company accounted for its acquisition of the operating assets of Fleaux Solutions, LLC using the acquisition method of accounting. Fleaux Solutions cash on hand, inventories, accountants receivable, and fixed assets acquired and liabilities

assumed were recorded based upon their estimated fair values as of the closing date of the Acquisition. The excess of purchase price over the value of the net assets acquired was recorded as goodwill.

The following table summarizes the estimated fair values of the

tangible and intangible assets acquired as of the date of acquisition:

|

Net Assets Acquired

|

|

January 29, 2018

|

|

Cash on hand

|

$

|

171,703

|

|

Inventories

|

|

30,000

|

|

Accounts receivable

|

|

816,929

|

|

Property and equipment, net

|

|

918,838

|

|

Assumption of scheduled liabilities

|

|

(2,149,749)

|

|

|

|

(212,279)

|

|

Goodwill

|

$

|

(212,279)

|

Goodwill is the excess of the purchase price over the fair

value of the underlying net tangible and identifiable intangible assets. In

accordance with applicable accounting standards, goodwill is not amortized but

instead is tested for impairment at least annually or more frequently if certain

indicators are present. The Company performed a qualitative assessment and

determined there was no impairment of goodwill.

NOTE 5 – PROPERTY AND EQUIPMENT

Property and equipment are stated at cost, less accumulated

depreciation. Depreciation is recorded using the straight-line method over the

estimated useful lives of the related assets, ranging from one to forty years. A

summary is as follows:

|

|

March 31, 2018

(Successor)

|

|

|

December 31, 2017

(Predecessor)

|

|

Manufacturing assets

|

$

|

$ 337,668

|

|

$

|

$ 285,815

|

|

Vehicles and trailers

|

|

271,686

|

|

|

271,686

|

|

Computer software

|

|

3,885

|

|

|

3,885

|

|

Capitalized leased equipment

|

|

598,119

|

|

|

598,119

|

|

|

|

1,211,358

|

|

|

1,159,505

|

|

|

|

|

|

|

|

|

Less accumulated depreciation

|

|

(333,231)

|

|

|

(272,165)

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

$

|

$ 878,127

|

|

$

|

$ 887,340

|

Depreciation expense related to property and equipment was

$40,710, $20,355 and $64,347 for the period January 29, 2018 through March 31,

2018 (Successor), January 1, 2018 through January 28, 2018 (Predecessor), and

the three months ended March 31, 2017 (Predecessor), respectively.

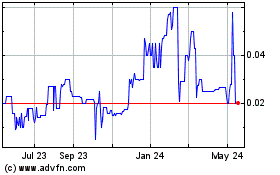

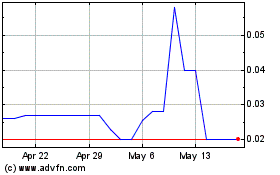

NOTE 6 – INVESTMENTS

Marketable securities are accounted for on a specific

identification basis. As of March 31, 2018, we held available for sale

marketable securities with an aggregate fair value of $26,160. As of March 31,

2018, all of our marketable securities were invested in publicly traded equity

holdings. Marketable securities were classified as current based on the

percentage of the equity controlled by the Company as well as our intended use

of the assets. The Company recognized unrealized losses of $3,030 for the period

from January 29, 2018 through March 31, 2018 (Successor). The Company recognized

realized loss of $762 for the period from January 29, 2018 through March 31,

2018.

The Company's assets measured at fair value on a recurring

basis subject to the disclosure requirements of ASC 820 at March 31, 2018, was

as follows:

|

Quoted Prices in Active

Markets for Identical

Assets and Liabilities

(Level 1)

|

Significant Other

Observable

Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

Balance as of

March 31, 2018

|

|

Assets

|

|

|

|

|

|

Marketable securities

|

$26,160

|

-

|

-

|

$26,160

|

Margin loans- (Predecessor)

During the twelve months ended December 31, 2017, the Company raised a total of $49,805 from margin loan associate with its brokerage account and repaid $49,805 during the same period. As of December 31, 2017, the company has a $0

balance in this margin loan account.

Margin loans- (Successor)

From January 29, 2018 through March 31, 2018, the Company raised a total of $18,455 from margin loan associate with its brokerage account and repaid $14,203 during the same period. As of March 31, 2018, the company has a $4,252 balance

in this margin loan account.

NOTE 7 – NOTES PAYABLE AND CAPITAL LEASES

The Company secured a line of credit with Gibsland Bank & Trust on March 22, 2017. The line of credit was secured with fixed assets financed. This line of credit was paid in full as of January 29, 2018.

The Company secured a line of credit (LOC #0221) of $500,000 on January 29, 2018 which is payable on demand. The line of credit is secured by all present and future inventory, all present and future accounts receivable, other receivables,

contract rights, instruments, documents, notes, and all other similar obligation and indebtedness that may now and in the future be owed to the Company, and all general intangibles. The loan is also secured by a personal guarantee executed by the

members of Fleaux Solutions, LLC including Michael Trey Moore, Christopher Ryan Marlowe, Ray S. Moore, Jr., and Frank Neal Richard. The Company withdrew $168,521 in funds from the line of credit on January 29, 2018 and paid loan origination and

documentation of fees of $2,540 to bring the total outstanding line of credit balance to $171,061 on January 29, 2018. On January 31, 2018, the Company withdrew an additional $250,000 in funds from the line of credit and made payments of

$100,000 on the line of credit bringing the balance due under the line of credit to $321,061. On March 22, 2018, the Company withdrew an additional $60,000 in funds from the line of credit bringing the balancer due under the line of

credit to $381,061 as of March 31, 2018 (Successor).

The Company secured a second line of credit (LOC #0248) of $150,000 on January 29, 2018 which is payable and due on February 1, 2019. The line of credit is secured by all present and future inventory, all present and future accounts receivable,

other receivables, contract rights, instruments, documents, notes, and all other similar obligation and indebtedness that may now and in the future be owed to the Company, and all general intangibles. The interest rate under this loan is the

“Prime Rate” designated in the “Money Rates” section of the Wall Street Journal (the “Index”). The index currently is 4.500% per annum. Interest on the unpaid principal balance of this line will be calculated

using a rate of 1.000 percentage points over the Index, resulting in an initial rate of 5.500% per annum. The Company withdrew $100,000 in funds from the line of credit on January 29, 2018 and paid loan origination and documentation of fees of

$750 to bring the total outstanding line of credit balance to $100,750 on January 29, 2018. The Company withdrew an additional $33,031 and $15,000 from the line of credit on February 22, 2018 and March 2, 2018, respectively, bringing

the total balance due under the line of credit to $148,781 as of March 31, 2018 (Successor).

Additionally, both lines of credit are secured by deposit accounts held at the Grantor’s institution which had cash balances of $348,726 and $0 as of March 31, 2018 (Successor) and December 31, 2017 (Predecessor) , respectively.

Notes Payable (Predecessor)

The Company assumed the debt of a loan payable executed between Fleaux Solutions, LLC and Gerald W. Norder on May 2, 2017. The proceeds received under the loan totaled $197,500. The loan is unsecured and doesn’t carry an interest rate but

does charge the Company an initial loan fee of $17,500, bringing the initial balance due under the loan to equal $215,000. The Company made principal repayments of $86,454 to this loan during the three months ending March 31, 2018,

bringing the total balance due of the loan to $128,546 and $215,000 as of March 31, 2018 and December 31, 2017, respectively.

The Company assumed the debt of a Payment Rights Purchase and Sale Agreement executed between Fleaux Solutions, LLC & Everest Business Funding on October 12, 2017. The proceeds received under the loan totaled $200,000. This loan

doesn’t carry an interest rate but does charge the Company an initial loan fee of $46,000. The loan is secured by credit card sales. Payments are drafted each business banking day from the Company’s bank account in the amount of

$807 until the entire principal balance of $246,000 is paid in full. The outstanding balance on this note was $137,054 and $189,509 as of March 31, 2018 and December 31, 2017, respectively.

The Company assumed the debt of a Cosmic Equipment loan in the amount of $142,598 between Fleaux Solutions, LLC and Business First Bank. The loan has an interest rate of 5.500% payable in thirty six payments of $4,311 with the first payment

due on January 20, 2018 and the final payment due December 20, 2020. This loan is secured with the 2016 Chevrolet DRW Express asset owned by the Company. The loan is also secured by a personal guarantee executed by the members of Fleaux Solutions,

LLC including Michael

Trey Moore, Christopher Ryan Marlowe, and Ray S. Moore, Jr. The outstanding balance on this loan was $131,568 and $142,598 as of March 31, 2018 and December 31, 2017.

The Company assumed the debt of a loan in the amount of $65,000 between Fleaux Solutions, LLC and KDC Pipeline. The loan is unsecured, non-interest bearing, and payable on demand. The outstanding balance on this loan was $65,000 as of March

31, 2018 and December 31, 2017.

The Company assumed the debt of two secured automobile loans of $53,311.01 a piece relating to the purchase of two Chevrolet Trucks executed between Fleaux Solutions, LLC & General Motors Financial on March 29, 2017. Both notes carry an

interest rate of 7.75%, payable in payments of $928 for 72 months. The outstanding balance on each note was $46,050 and $47,918 as of March 31, 2018 and December 31, 2017, respectively.

The Company assumed the debt of a secured automobile loan in the amount of $53,075 between Fleaux Solutions, LLC & TD Auto Finance executed on September 28, 2017. The note has an interest rate of 5.69%, payable in payments of $1,021 for

60 months. The outstanding balance on this note was $48,520 and $50,864 as of March 31, 2018 and December 31, 2017, respectively.

The Company assumed the debt of a secured JET trailer loan in the amount of $43,618 between Fleaux Solutions, LLC & Western Equipment Finance executed on May 4, 2017. The note has an interest rate of 0.00%, payable in payments of $1,105

for 36 months, with $3,838 payable in advance. The outstanding balance on this note was $28,730 and $32,045 as of March 31, 2018 and December 31, 2017, respectively.

The Company assumed the debt of a secured excavator equipment loan in the amount of $66,788 between Fleaux Solutions, LLC & Takeuchi Financial Services executed on August 23, 2017. The note has an interest rate of 0.00%, payable in payments

of $1,113 for 60 months. The outstanding balance on this note was $60,110 and $63,449 as of March 31, 2018 and December 31, 2017, respectively.

Obligations under Capital Leases (Predecessor)

In October of 2016, the Predecessor entered into a lease agreement for the purchase of a 1997 Ford Van, used in the day to day operation of Fleaux Solutions, LLC. The lease is for 48 months and requires monthly payments of $1,063, plus sales

tax. The Predecessor paid an advance payment on the equipment lease of $15,250. The lease is secured by the underlying leased asset. This arrangement was accounted for as a capital lease and capitalized the asset at $63,487. As of March 31,

2018 and December 31, 2017, the outstanding balance under this capital lease was $48,621 and $50,523, respectively.

In October of 2016, the Predecessor entered into a lease agreement for the purchase of a 1998 Ford Van, used in the day to day operation of Fleaux Solutions, LLC. The lease is for 48 months and requires monthly payments of $2,118, plus sales

tax. The Predecessor paid an advance payment on the equipment lease of $15,250. The lease is secured by the underlying leased asset. This arrangement was accounted for as a capital lease and capitalized the asset at $124,702. As of March 31,

2018 and December 31, 2017, the outstanding balance under this capital lease was $96,981 and $106,376, respectively.

In February of 2017, the Predecessor entered into a lease agreement for the purchase of a 2001 Sterling Tractor Truck, used in the day to day operation of Fleaux Solutions, LLC. The lease is for 36 months and requires monthly payments of $888,

plus sales tax. The Predecessor paid an advance payment on the equipment lease of $250. The lease is secured by the underlying leased asset. This arrangement was accounted for as a capital lease and capitalized the asset at $35,134. As of

March 31, 2018 and December 31, 2017, the outstanding balance under this capital lease was $25,506 and $28,758, respectively.

In February of 2017, the Predecessor entered into a lease agreement for the purchase of a 2014 Chevy Truck, used in the day to day operation of Fleaux Solutions, LLC. The lease is for 24 months and requires monthly payments of $986, plus sales

tax. The Predecessor paid an advance payment on the equipment lease of $250. The lease is secured by the underlying leased asset. This arrangement was accounted for as a capital lease and capitalized the asset at $28,258. As of March 31,

2018 and December 31, 2017, the outstanding balance under this capital lease was $16,881 and $21,571, respectively.

In March of 2017, the Predecessor entered into a lease agreement for the purchase of a 1997 Ford E350, used in the day to day operation of Fleaux Solutions, LLC. The lease is for 12 months and requires monthly payments of $17,770, plus sales

tax. The Predecessor paid an advance payment on the equipment lease of $250. The lease is secured by the underlying leased asset. This arrangement was accounted for as a capital lease and capitalized the asset at $240,433. As of March 31,

2018 and December 31, 2017, the outstanding balance under this capital lease was $66,852 and $205,977, respectively.

In March of 2017, the Predecessor entered into a lease agreement for the purchase of a Dozer, Excavator, Tractor, and Backhoe, used in the day to day operation of Fleaux Solutions, LLC. The lease is for 36 months and requires monthly payments of

2,645, plus sales tax. The Predecessor paid an advance payment on the equipment lease of $3,190. The lease is secured by the underlying leased asset.

This arrangement was accounted for as a capital lease and

capitalized the asset at $106,105. The equipment purchased under this capital

lease was acquired from Osprey Oil & Gas, a related party Company with

common ownership between the owners of Fleaux Solutions, LLC. As of March 31,

2018 and December 31, 2017, the outstanding balance under this capital lease was

$79,860 and $91,909, respectively.

The current maturities and five year debt schedule for the

notes is as follows:

|

|

|

|

|

|

2018

|

$

|

1,466,331

|

|

|

2019

|

|

184,525

|

|

|

2020

|

|

203,792

|

|

|

2021

|

|

44,028

|

|

|

2022 and thereafter

|

|

45,863

|

|

|

Total current notes payable

|

$

|

1,944,539

|

|

|

|

|

|

|

NOTE 8 – CONVERTIBLE LOANS

As of February 8, 2018, the Company had terminated and

extinguished all of the convertible notes the Company entered into during the

second and third quarters of 2017 prior to the acquisition of Fleaux Solutions,

LLC. (see Note #10)

Prior to the Acquisition date of January 29, 2018, Galenfeha

had the below unsecured convertible notes.

June 2017 Note

Effective June 8, 2017 the Company entered into a Convertible

Promissory Note (“Power Up Note One”) with Power Up Lending Group, Ltd. pursuant

to which the Company issued Power Up Lending Group, Ltd. a convertible note in

the amount of $43,000. The maturity date is March 20, 2018.

On June 8, 2017 the Company received consideration of $40,000.

In addition, the Company paid legal fees of $3,000 associated with the entering

into this agreement and thus recognized a liability of $43,000 associated with

the Power Up Note One. The Company recognized a discount of $3,000 on fees paid

upon entering into this agreement. There were no additional borrowings under the

Power Up Note One during the twelve months ended December 31, 2017 or three

months ending March 31, 2018. The Power Up Note carries an interest rate of 12%

per annum from the Issue Date until the principal amount becomes due and

payable, whether at maturity or upon acceleration or by prepayment or otherwise.

Any amount of principal or interest on the Power Up Note which is not paid when

due shall bear interest at the rate of 22% per annum from the due date thereof

until the same is paid. Interest shall commence accruing on the date that the

Note is fully paid and shall be computed on the basis of a 365-day year and the

actual number of days elapsed. Since no payments were made on this note on or

before 180 days from the effective date of the note, accrued interest due was

recorded in the amount of $4,029 on December 10, 2017. Interest paid under the

Power Up Note One totaled $0 at December 31, 2017. The note was declared in

default on November 20, 2017 with a default penalty of $21,500 added onto the

principal. The default penalty has been accounted for as interest expense as of

December 31, 2017.

The Power Up Note provides Power Up Lending Group, Ltd. the

right, to convert the outstanding balance (including accrued and unpaid

interest) into shares of the Company’s common stock at 60% of the lowest trade

price in the 15 trading days previous to the conversion, additional discounts

may apply in the case that conversion shares are not deliverable or if the

shares are ineligible. Power Up Lending Group, Ltd. shall have the right to

convert at any time during the period beginning on the date which is one hundred

eighty days following the date of this Note and ending on the later of: (i) the

Maturity Date and (ii) the date of payment of the Default Amount, each in

respect of the remaining outstanding principal amount of this Note. As a result

of the derivatives calculation (see Note 9) an additional discount of $53,471

was recorded. On December 13, 2017, Power Up Lending converted $8,000 of the

Power Up Note One into a total of 740,741 shares of Common Stock at a fair value

of $0.0108 per share. On December 20, 2017, Power Up Lending converted $13,000

of the Power Lending Note One into a total of 2,166,667 shares of Common Stock

at a fair value of $0.006 per share. On January 16, 2018, Power Up Lending

converted $15,000 of the Power Up Note One into a total of 2,500,000 shares of

Common Stock at a fair value of $0.006 per share. On January 29, 2018, Power Up

Lending converted $15,000 of the Power Lending Note One into a total of

1,923,077 shares of Common Stock at a fair value of $0.0078 per share. On

January 31, 2018, Power Up Lending converted $12,240 of the Power Up Note One

into a total of 1,569,231 shares of Common Stock at a fair value of $0.0078 per

share. On February 5, 2018, Power Up Lending converted $2,580 of the Power

Lending Note One into a total of 492,308 shares of Common Stock at a fair value

of $0.0078 per share.

Amortization of the debt discount totaled $47,351 for the three

months ended March 31, 2018 and $17,149 for the twelve months ended December 31,

2017. The principal balance due under the Power Up Lending Note One was $0 and

$43,500 at March 31, 2018 and December 31, 2017, respectively.

July 2017 Note

Effective July 5, 2017 the Company entered into a Convertible

Promissory Note (“Power Up Note Two”) with Power Up Lending Group, Ltd. pursuant

to which the Company issued Power Up Lending Group, Ltd. a convertible note in

the amount of $33,000. The maturity date is March 20, 2018.

On July 5, 2017 the Company received consideration of $30,000.

In addition, the Company paid legal fees of $3,000 associated with the entering

into this agreement and thus recognized a liability of $33,000 associated with

the Power Up Note Two. The Company recognized a discount of $3,000 on fees paid

upon entering into this agreement. There were no additional borrowings under the

Power Up Note Two during the twelve months ended December 31, 2017 or three

months ended March 31, 2018. The Power Up Note Two carries an interest rate of

12% per annum from the Issue Date until the principal amount becomes due and

payable, whether at maturity or upon acceleration or by prepayment or otherwise.

Any amount of principal or interest on the Power Up Note which is not paid when

due shall bear interest at the rate of 22% per annum from the due date thereof

until the same is paid. Interest shall commence accruing on the date that the

Note is fully paid and shall be computed on the basis of a 365-day year and the

actual number of days elapsed. The Company recognized accrued interest due under

the Power Up Note Two totaling $2,800.

The Power Up Note Two provides Power Up Lending Group, Ltd. the

right, to convert the outstanding balance (including accrued and unpaid

interest) into shares of the Company’s common stock at 60% of the lowest trade

price in the 15 trading days previous to the conversion, additional discounts

may apply in the case that conversion shares are not deliverable or if the

shares are ineligible. Power Up Lending Group, Ltd. shall have the right to

convert at any time during the period beginning on the date which is one hundred

eighty days following the date of this Note and ending on the later of: (i) the

Maturity Date and (ii) the date of payment of the Default Amount, each in

respect of the remaining outstanding principal amount of this Note. As a result

of the derivatives calculation (see Note 8) an additional discount of $27,200

was recorded. On February 5, 2018, Power Up Lending converted $11,160 of the

Power Lending Note One into a total of 1,430,769 shares of Common Stock at a

fair value of $0.0078 per share. On February 8, 2018, the Company paid Power Up

Lending $40,000 which extinguished any remaining balance due under the July 2017

note.

Amortization of the interest expense and costs associated with

this note totaled $28,976 for the three months ended March 31, 2018 and $4,024

for the twelve months ended December 31, 2017. The principal balance due under

the Power Up Note Two was $0 and $33,000 at March 31, 2018 (Successor) and

December 31, 2017, respectively.

NOTE 9 – DERIVATIVE LIABILITY

During the period from January 29, 2018 through March 31, 2018

(Successor) , the Company identified conversion features embedded within its

convertible debt. The Company has determined that the conversion feature of the

Notes represents an embedded derivative since the Notes are convertible into a

variable number of shares upon conversion. Accordingly, the embedded conversion

feature must be bifurcated from the debt host and accounted for as a derivative

liability. Therefore, the fair value of the derivative instruments have been

recorded as liabilities on the balance sheet with the corresponding amount

recorded as discounts to the Notes. Such discounts will be accreted from the

issuance date to the maturity date of the Notes. The change in the fair value of

the derivative liabilities will be recorded in other income or expenses in the

statement of operations at the end of each period, with the offset to the

derivative liabilities on the balance sheet. The fair values of the embedded

derivative liabilities were determined using the Black-Scholes valuation model

on the issuance dates with the assumptions in the table below.

The change in fair value of the Company’s derivative

liabilities for the period from January 29, 2018 through March 31, 2018 is as

follows:

|

January 29, 2018

|

$

|

49,346

|

|

|

Derivative

liability extinguished on conversion

|

|

(55,938

|

)

|

|

Loss on change in fair value of derivative

|

|

105,284

|

|

|

March 31, 2018

(Successor)

|

$

|

-

|

|

The gain (loss) on the change in fair value of derivative liabilities for the period from January 29, 2019 through March 31, 2018 and totaled $(105,284).

The fair value at the issuance and re-measurement dates for the

convertible debt treated as derivative liabilities are based upon the following

estimates and assumptions made by management for the three months ended March

31, 2018 and the year ended December 31, 2017:

|

Exercise prices

|

See Note 8

|

|

Expected dividends

|

0%

|

|

Expected volatility

|

87%-463%

|

|

Expected term

|

See Note 8

|

|

Discount rate

|

.29%-1.51%

|

NOTE 10 - SHAREHOLDERS’ EQUITY

PREFERRED STOCK

The authorized stock of the Company consists of 20,000,000

preferred A shares and 30,000,000 preferred B Shares with a par value of

$0.001.

As of March 31, 2018 and December 31, 2017; 7,300,000 shares of

the Company’s preferred stock Series A was issued and outstanding.

As of March 31, 2018 and December 31, 2017; 27,347,563 shares

of the Company’s preferred stock Series B was issued and outstanding.

COMMON STOCK

The authorized stock of the Company consists of 150,000,000

common shares with a par value of $0.001. As of March 31, 2018 72,300,000 shares

of the Company’s common stock were issued and outstanding

Prior to the Acquisition date of January 29, 2018, Galenfeha

had issued the below shares during the period January 1, 2018 through January

29, 2018.

On January 16, 2018, Power Up Lending converted $15,000 of the

June 2017 Power Up Lending Note One into a total of 2,500,000 shares of Common

Stock at a fair value of $0.006 per share. See Note 8.

On January 29, 2018, Power Up Lending converted $15,000 of the

June 2017 Power Up Lending Note One into a total of 1,923,077 shares of Common

Stock at a fair value of $0.0078 per share. See Note 8.

The Company (Successor) issued the below shares during the

period from January 29, 2018 through March 31, 2018.

On January 31, 2018, Power Up Lending converted $12,240 of the

June 2017 Power Up Lending Note One into a total of 1,569,231 shares of Common

Stock at a fair value of $0.0078 per share. See Note 8.

On February 5, 2018, Power Up Lending converted $2,580 of the

June 2017 Power Up Lending Note One into a total of 492,308 shares of Common

Stock at a fair value of $0.0078 per share. See Note 8.

On February 5, 2018, Power Up Lending converted $11,160 of the

July 2017 Power Up Lending Note One into a total of 1,430,769 shares of Common

Stock at a fair value of $0.0078 per share See Note 8.

On February 15, 2018, the Company bought back 22,793 shares of

common stock through a brokerage account for a total price of $913. These shares

have been cancelled and are available to be issued.

NOTE 11 - COMMITMENTS AND CONTINGENCIES

The Company assumed two lease agreements with respect to the

acquisition of Fleaux Solutions, LLC for office/warehouse facilities and yard

storage in Louisiana. The office/warehouse lease is for 36 months beginning

August 1, 2017. The rent due under the office/warehouse facility lease is as

follows:

|

August 2017 – January 2018 (Months One Through Six)

|

$5,000 per month

|

|

February 2018 – July 2018 (Months Seven Through

Twelve)

|

$6,000 per month

|

|

August 2018 – January 2019 (Months Thirteen Through Eighteen)

|

$7,000 per month

|

|

February 2019 – July 2020 (Months Nineteen

Through Thirty-Six)

|

$8,000 per month

|

The yard storage lease is $1,000 per month or $12,000 per year

beginning on March 1, 2017. The terms of the yard storage lease are month to

month.

The Company leases space in Fort Worth, Texas for corporate

facilities for $99 monthly or $1,188 per year. The terms of this lease are month

to month.

|

Year Ended

|

|

Amount

|

|

|

2018

|

$

|

76,000

|

|

|

2019

|

|

95,000

|

|

|

2020

|

|

56,000

|

|

|

2021

|

|

-

|

|

|

2022

|

|

-

|

|

|

|

$

|

227,000

|

|

From time to time the Company may be a party to litigation

matters involving claims against the Company. Management believes that there are

no current matters that would have a material effect on the Company’s financial

position or results of operations.

NOTE 12 – RELATED PARTY TRANSACTIONS

On November 4, 2016, Mr. James Ketner, Galenfeha’s Chairman and

CEO made a cash contribution to the Company in the amount of $100,000 in

exchange for a note that has a fixed repayment of $110,000. The note bears no

interest, and can be repaid by the Company when the funds become available. The

note can be renegotiated between Galenfeha and Mr. Ketner if both parties agree

to the terms. Principal repayments made under the note for the twelve months

ending December 31, 2017 totaled $84,000, and the principal balance due under

the note as of December 31, 2017 (Predecessor) was $26,000. On January 29, 2018,

Mr. Ketner advanced the Company an additional $20,000 under the terms of this

note for a fixed repayment of $21,000, bringing the total balance due under the

terms of this note to $47,000 as of January 29, 2018. Principal repayments made

under the note for the three months ending March 31, 2018 totaled $17,000, and

the principal balance due under the note as of March 31, 2018 (Successor) was

$30,000.

On March 9, 2017, the Company entered into an agreement with

Fleaux Services, LLC for the sale of the Company’s Daylight Pumps division,

which includes, but in not limited to, all inventory located at 9204 Linwood

Avenue, Suite 104 and 105, Shreveport, LA 7116, as well as all usage rights for

the name “Daylight Pump.” The sale is for cash consideration of $25,000, and

Fleaux Services, LLC will assume the responsibility of a promissory note held by

Kevin L. Wilson in the amount of $350,000 and all accrued interest due since the

date of issuance on August 23, 2016. The sale will include all future pump

sales, future purchase orders resulting from previous negotiations, and all

intellectual property related to Daylight Pumps. A gain on the sale of the

Daylight Pumps division of $52,291 was recognized as a capital transaction

during 2017.

During the twelve months ending December 31, 2017 the Company

received royalty payment of $10,000 from Fleaux Services, LLC relating to the

sale of Galenfeha-style batteries. The Company didn’t receive any royalty

payments from Fleaux Services, LLC relating to the sale of Galenfeha-style

batteries during the three months ending March 31, 2018. Mr. Trey Moore is the

President/CEO of Fleaux Services, and also is a Director of Galenfeha, Inc.

On August 4, 2017, David Leimbrook, the Chief Financial Officer

of Fleaux Services, LLC, had 550,000 shares of common stock originally purchased

in the open market transferred from common stock to preferred stock Series

A.

On January 29, 2018, the CEO in a private transaction, sold

1,000,000 shares of preferred stock Series B to David Leimbrook, the Chief

Financial Officer of Fleaux Services, LLC and an additional 2,000,000 shares of

preferred stock Series B to Christopher Ryan Marlowe, the Chief Operating

Officer of Fleaux Services, LLC and an affiliate of Fleaux Solutions, LLC. The

private shares were sold for cash consideration of $30,000.

On January 29, 2018, the Company entered into a Definitive

Agreement to acquire Fleaux Solutions, LLC, a Company with common director and

shareholders for a cash purchase of $1.00. Fleaux Solutions at the time of

acquisition was owned by Director Trey Moore, President/CEO of Fleaux Services,

LLC, Christopher Ryan Marlowe, Chief Operating Officer of Fleaux Services, LLC,

and Ray Moore Jr., brother of Trey Moore. (See footnote #4)

The Company assumed a lease agreement executed on July 1, 2017

between Fleaux Solutions, LLC and Fleaux Services, LLC. The lease agreement

provides for Fleaux Services, LLC to pay Fleaux Solutions, LLC rent income of

$2,000 per month commencing on July 1, 2017 and ending on June 30, 2018 for use

of equipment and supplies owned by Fleaux Solutions, LLC. Fleaux Services, LLC

paid the Company rental income of $20,000 on January 2, 2018 relating to $12,000

of rent owed from 2017 and $8,000 as a prepayment towards rental income due for

the three months ending March 31, 2018. The remaining $1,000 due under the lease

agreement for the three months ended March 31, 2018 is shown as a receivable,

“Due from Related Parties.” Mr. Trey Moore is the

President/CEO of Fleaux Services, and also is a Director of Galenfeha, Inc.