PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this Prospectus. This summary does not contain all of the information you should

consider before investing in our Class B common stock. You should read this entire prospectus carefully, especially the “Risk Factors”

section of this Prospectus and the financial statements and related notes appearing at the end of this Prospectus before making an investment

decision.

Unless

the context provides otherwise, all references in this Prospectus to “IDW” “we,” “us,” “our,”

“our company,” the “Company,” or similar terms, refer to IDW Media Holdings, Inc. and its wholly owned subsidiaries

on a consolidated basis.

Overview

IDW

Media Holdings, Inc., a Delaware corporation, is a holding company consisting of the following principal businesses:

|

|

●

|

IDW

Publishing, or IDWP, creates comic books, graphic novels, digital content and games through its imprints IDW Publishing, IDW Games

and Top Shelf; and

|

|

|

●

|

IDW

Entertainment, or IDWE, leverages properties, primarily from IDWP, into television series developing, producing and distributing

original content worldwide.

|

IDWP

is an award-winning publisher of comic books, original graphic novels, and art books as well as board and tabletop games. Founded in

1999, IDWP has a long tradition of supporting original, creator-driven titles. In 2002, IDWP published 30 Days of Night by Steve

Niles and Ben Templesmith followed by other horror titles that kickstarted a resurgence in horror-comic publishing across the industry.

Since then, IDWP has significantly diversified its publications. Joe Hill and Gabriel Rodríguez’s Locke & Key,

Jonathan Maberry’s V Wars, Stan Sakai’s Usagi Yojimbo, Walter Simonson’s Ragnarök, Beau Smith’s

Wynonna Earp, Chris Ryall and Ashley Wood’s Zombies vs Robots, Joe Hill and Martin Simmonds’ Dying is Easy

are among the hundreds of award-winning titles published since IDWP’s inception.

IDWE

is a production company and studio that develops and produces content and formats for global platforms and services.

IDW

Publishing

In

January 2020, IDWP and the Smithsonian Institution announced a multi-year global publishing program, which will create

a library of graphic novels built on the cultural and scientific knowledge of the world’s largest museum, educational, and research

complex. The first product in the Smithsonian line was released in late November 2020 with an additional five titles scheduled for release

in 2021.

In

2020, IDWP also announced a Spanish language initiative to bring graphic novels to Spanish speakers throughout North America. To launch

the initiative, in June 2020 IDWP released a Spanish translation of George Takei’s best-selling memoir, They Called Us Enemy,

which had been named the best graphic novel of 2019 by the Publisher’s Weekly Critics Poll, and which also won

a 2020 Will Eisner Comic Industry Award for best reality-based work. 2020 Spanish translations included Sonic the Hedgehog and

Redbone, with Locke & Key and additional Sonic the Hedgehog translations scheduled for 2021.

In

March 2020, IDW Games, a division of IDWP, closed a Kickstarter campaign for Batman: The Animated Series Adventures at over $1.6

million. The game is scheduled for release in Summer 2021.

In

October 2020, IDWP released the first issue of the long-anticipated Teenage Mutant Ninja Turtles: The Last Ronin series

by creator Kevin Eastman. The second issue and a Director’s Cut were released in February and March 2021, respectively, with issues

three through five scheduled for release later in 2021.

IDWP

has also announced the Star Wars: The High Republic Adventures series with the first issue released in February 2021 and

additional issues released monthly throughout 2021.

IDW

Entertainment

IDWE

has developed and/or produced four series for television that premiered in 2019 and 2020:

|

|

●

|

Wynonna

Earp season four aired in two parts due to worldwide COVID-19 related production shutdowns. The first six episodes

of season four premiered July 26, 2020 and the second half of season four began airing on March 5, 2021. The show was created

by Emily Andras and stars Melanie Scrofano and is based on the IDWP comics of Beau Smith. Season four’s twelve episodes are

being produced by Seven24 Films and distributed by IDWE, in partnership with Syfy and CTV Sci-Fi. Cineflix Studios is the co-producer

and global distributor for the series. Season one’s thirteen episodes aired in fiscal 2016. Season two’s twelve episodes

aired in fiscal 2017, and Season three’s twelve episodes aired in fiscal 2018.

|

|

|

●

|

V

Wars, debuted on Netflix on December 5, 2019. The 10-episode vampire thriller stars Ian Somerhalder and was produced by High

Park Entertainment. The series is based upon Jonathan Maberry’s IDWP comic book series of the same name.

|

|

|

●

|

October

Faction premiered on Netflix January 23, 2020. The 10-episode show is based on the IDWP comic books of Steve Niles and Damien

Worm and was adapted by showrunner Damian Kindler and starred Tamara Taylor and J.C. MacKenzie. It was also produced by High Park

Entertainment.

|

|

|

●

|

Locke

& Key premiered on Netflix on February 7, 2020. The show is based on the critically acclaimed graphic novels of Joe

Hill and Gabriel Rodriguez that are published by IDWP. Seasons two and three have been ordered by Netflix and production began in

September 2020.

|

CTM

As

a result of the economic downturn related to the COVID-19 pandemic, and the impact it had on the travel and tourist markets, we decided

to make a strategic shift to sell our CTM Media Group, Inc., or CTM, subsidiary and focus on our entertainment and publishing business.

In February 2021, we consummated the sale of CTM to The Brochure Distribution Trust, a South Dakota trust (the assignee of Howard S.

Jonas, our Chairman of the Board). The purchase price was (i) the cancelation of $3.75 million of indebtedness owed to Mr. Jonas (and

assigned by Mr. Jonas to the trust) by us, (ii) a contingent payment of up to $3.25 million based upon a recovery of quarterly revenues

of CTM to 90% of its fiscal 2019 levels during the 18-month period following the closing of the CTM Sale, and (iii) a contingent payment

if CTM is sold within 36 months from closing of the CTM Sale for more than $4.5 million.

Our

Strategy

We

seek to improve our financial performance primarily by focusing on development of entertainment that can generate value across our intellectual

property (“IP”) holdings and to increase coordination between IDWP and IDWE to enhance our development pipeline. IDWP and

IDWE intend to jointly and synergistically develop and produce books and entertainment to allow us to capitalize on the global demand

for original content from streaming services as well as traditional broadcast and other networks and other content services. To date,

we have sold projects to Hulu, Syfy, BBC America, Netflix and Endeavor Content, while others are in active discussion. We believe that

our potential projects would be attractive to a broad range of potential distribution channels and participants.

IDW’s

IP, where we own “all rights”, affords the Company significant production-based fees supplemented by merchandising, games,

video and other fandom-driven revenue opportunities.

As

we have a diverse slate of content, we plan to develop new editorial directives to better suit the ever-changing needs of the publishing

world. We have spent considerable time and financial resources in identifying and cultivating new audiences, additional markets, and

interesting new channels of distribution. We plan to expand and implement our mission of creating, marketing, and releasing captivating

new comic books and graphic novels to the world.

We

continue to seek prospective upside from potential renewals of IDWE’s current line-up, from previously announced deals with Cineflix

and SyFy for distribution of Wynonna Earp and renewal of seasons 2 and 3 of Locke & Key to new deals that IDWE is developing

from IDWP’s growing library of content, where we have media and ancillary rights. We believe that our focus on monetization through

merchandising, games, video on demand, and other fandom-driven channels coupled with the demand from streaming networks for fresh, innovative

shows provides us with a tremendous market opportunity. We believe that our IP portfolio, strong relationships with renowned creators

and holistic approach to development strategically positions us for both near and long-term growth.

Our

Capital Stock

Holders

of shares of Class B common stock are entitled to one-tenth of one vote for each share on all matters to be voted on by the stockholders.

Holders of Class B common stock are entitled to share ratably in dividends, if any, as may be declared from time to time by the Board

of Directors in its discretion from funds legally available therefor. There are no conversion or redemption rights or sinking fund provisions

with respect to the Class B common stock.

The

Company also has issued and outstanding shares of Class C common stock. Holders of shares of Class C common stock are entitled to three

votes for each share on all matters to be voted on by the stockholders. Holders of Class C common stock are entitled to share ratably

in dividends, if any, as may be declared from time to time by the Board of Directors in its discretion from funds legally available therefor.

Each share of Class C common stock may be converted, at any time and at the option of the holder thereof, into one fully paid and non-assessable

share of Class B common stock, which would cause dilution to the holders of Class B common stock. There are no mandatory conversion rights

for our Class C common stock. There are no sunset provisions or intra-family transfers that would require the conversion of our Class

C common stock.

SUMMARY

OF THE OFFERING

The

following summary of the offering contains basic information about the offering and our Class B common stock and is not intended to be

complete. It does not contain all the information that may be is important to you. For a more complete understanding of our Class B common

stock, please refer to the section of this Prospectus entitled “Description of Capital Stock” on page 60.

|

Issuer:

|

|

IDW Media Holdings, Inc.

|

|

|

|

|

|

Securities Offered:

|

|

_______ shares of Class B common stock, at an assumed public offering price of $_____ per share of Class B common stock.

|

|

|

|

|

|

Over-allotment option:

|

|

We have granted to the representative of the underwriters a 45-day option to purchase up to _______ additional shares of our Class B common stock at the per share public offering price, less the underwriting discounts payable by us, in any combination solely to cover over-allotments, if any (the “Over-Allotment Option”).

|

|

|

|

|

|

Class B common stock outstanding before this offering:

|

|

9,514,080

|

|

|

|

|

|

Class B common stock to be outstanding immediately after this offering:

|

|

_______

|

|

|

|

|

|

The above does not include, as of June 30, 2021, the following:

|

|

|

|

|

|

●

|

up to 327,737 shares of Class B common stock issuable upon the exercise of outstanding options under our 2009 Stock Option and Incentive Plan and our 2019 Stock Option and Incentive Plan (the “2019 Plan”), with a weighted average exercise price of $6.44 per share;

|

|

|

|

|

|

|

|

●

|

up to 89,243 shares of Class B common stock at a price per share of $42.02 and up to 98,336 shares of Class B common stock at a price per share of $26.44 issuable upon exercise of outstanding warrants;

|

|

|

|

|

|

|

|

●

|

261,483 shares of Class B common stock reserved for future issuance under the 2019 Plan;

|

|

|

|

|

|

|

|

●

|

up to 545,360 shares of Class B common stock upon conversion of the outstanding shares of Class C common stock, which are convertible into shares of our Class B common stock on a 1-for-1 basis; and

|

|

|

|

|

|

|

|

●

|

up to _________ shares of Class B common stock issued pursuant to the Over-Allotment Option.

|

|

|

|

|

|

|

Use of proceeds:

|

|

We estimate that the net proceeds to us from this offering will be approximately $_____ million, or approximately $_____ million if the underwriters exercise their over-allotment option in full, assuming an offering price of $____ per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

|

|

|

|

|

|

|

|

|

We intend to use the net proceeds of this offering primarily for general corporate purposes, including development of original IP, talent and technology investments, as well as potential acquisitions.

|

|

Risk Factors:

|

|

Investing in

our Class B common stock is highly speculative and involves a high degree of risk. You should carefully consider the information

set forth in this Prospectus and, in particular, the specific factors set forth in the “Risk Factors” section

beginning on page 6 of this Prospectus before deciding whether or not to invest in our common stock.

|

|

|

|

|

|

|

OTC Ticker Symbol:

|

|

IDWM

|

|

|

|

|

|

|

Proposed NYSE American Listing:

|

|

We intend to

apply for listing of our Class B common stock on the NYSE American and have reserved the symbol “IDW.”

|

|

|

|

|

|

Lock-Up:

|

|

We, our directors,

executive officers, and certain of our stockholders affiliated with our directors and executive officers will agree with the underwriters

not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Common Stock or securities convertible

into Common Stock, subject to certain exceptions, for a period of 180 days, commencing on the date of this prospectus. See “Underwriting”

for additional information.

|

Business

Address and Telephone Number

Our

address is 520 Broad Street, Newark, New Jersey 07102, and our telephone number at such address is (973) 438-3385.

RISK

FACTORS

Investing

in our Class B common stock involves a high degree of risk. You should carefully consider the following information about these risks,

together with the other information appearing elsewhere in this Prospectus, including our consolidated financial statements, the notes

thereto and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

before deciding to invest in our Class B common stock. The occurrence of any of the following risks could have a material and adverse

effect on our business, reputation, financial condition, results of operations and future growth prospects, as well as our ability to

accomplish our strategic objectives. As a result, the trading price of our Class B common stock could decline and you could lose all

or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also

impair our business operations and the trading price of our Class B common stock. Certain statements contained in this section constitute

forward-looking statements. See the information included in “Cautionary Note Regarding Forward-Looking Statements.”

Risks

Associated with Our Business

Public

health threats could have an adverse effect on the Company’s operations and financial results.

In

early 2020, the spread of the COVID-19 virus resulted in a worldwide pandemic. We are actively monitoring the COVID-19 pandemic, the

restrictive measures imposed to combat its spread and their potential and actual impact on each of our operating segments. While we believe

that, in 2021, there has been significant improvement due to global and domestic vaccination efforts, we cannot predict the ongoing impact,

if any, of COVID-19 related to both known and unknown risks, including future quarantines, closures and other restrictions resulting

from the outbreak, and our operations and our customers and partners may continue to be impacted.

In

February 2021, due to the impact of the COVID-19 pandemic on the travel and tourism markets, we sold CTM. CTM had substantially

suspended operations in March 2020 as key clients closed and tourism halted in key markets and gradually resumed partial operation since

June 2020 in accordance with and as permitted by state and local COVID-19 regulations. In March 2020, CTM furloughed all non-essential

personnel, approximately 90% of its workforce, and has gradually been growing its active personnel roster as needed in its resumption

of operations.

In

April 2020, as a result of the COVID-19 pandemic, IDWP’s direct-market distributor paused the release of new product, including

IDWP’s; the direct-market distributor’s operations resumed in a limited capacity in late May 2020 and continue at an increasing

rate as of the date of this Prospectus, and IDWP’s products have resumed being distributed. Many retailers experienced closures,

reduced operations, or de-prioritization of entertainment products, such as books and games, throughout the COVID-19 pandemic resulting

in decreased sales of certain of IDWP’s products. Additional closures, restrictions, or virus spikes could have a further negative

impact on IDWP’s distribution channels and retail customers. We are unable to accurately predict the full impact that the COVID-19

pandemic will have on distributions, purchasing, sales, returns, cash receipts and overall revenue.

The

COVID-19 pandemic resulted in the production of television shows being periodically suspended depending on local governmental authorities

and regulatory requirements in place at any given time. Due to various uncertainties, including the ultimate geographic spread of

the virus, the rise of variants that may occur, the severity of the disease, the duration of the outbreak, and actions that may be taken

by governmental authorities, further production risks could arise.

For

all these reasons, the COVID-19 pandemic could have a material adverse impact on our business and financial results.

We

have a history of continued operating losses at IDWE and IDWP and cannot be certain of our future profitability.

We

had accumulated a net deficit through October 31, 2020 of approximately $92.0 million. Prior to the CTM Sale, which closed

on February 15, 2021, and until the start of the COVID-19 pandemic in April 2020, we often used cash flows from CTM to partially provide

funding for corporate overhead and for our IDWP and IDWE operations. In Fiscal 2020 IDW Media Holdings and IDWP generated positive cash

flow of $8.0 million and $795,000, respectively, while IDWE and CTM generated negative cash flow of $5.8 million and $1.0 million, respectively.

In Fiscal 2019, IDW Media Holdings and CTM generated positive cash flow of $7.2 million and $2.9 million, respectively, while IDWP and

IDWE generated negative cash flow of $1.9 million and $11.6 million, respectively.

We

expect to incur losses in the foreseeable future as we continue to seek financing for, and invest in, our IDWE and IDWP businesses and

operations. While our Chairman of the Board has previously provided us with financing on favorable terms and conditions, there is no

guarantee that we will be able to secure such financing from our Chairman of the Board in the future on favorable terms or at all. The

time required for us to become profitable is uncertain, and there can be no assurance that we will obtain the financing required or achieve

profitability on a sustained basis, if at all. We expect that our results of operations may also fluctuate significantly in the future

as a result of a variety of factors, including, without limitation: the impact of the COVID-19 pandemic, the ability to finance television

shows without great financial risks; our ability to attract, retain and motivate qualified personnel; specific economic conditions in

the entertainment and publishing markets; and general economic conditions.

Risks

Related to IDW Publishing

IDWP

depends on two main distributors for its direct market and non-direct market publications and such dependence subjects IDWP to the risk

that such distributors may be unable to perform their obligations to IDWP.

IDWP

depends on Diamond Comic Distributors, Inc., or Diamond, and Penguin Random House Publisher Services, or Penguin Random House, to distribute

the vast majority of its publications. Diamond, which handles the vast majority of all comic book publishers’ direct market (i.e.,

comic book stores) distribution, distributes all of IDWP’s products for the direct market. As a result of the COVID-19 pandemic,

IDWP offered full returns in the direct market through Diamond on comic titles through the end of February 2021 and returns are being

monitored on a month-by-month basis until the end of May 2021 when IDWP expects to return to its pre-pandemic return policy. While this

is designed to reduce inventory risk for retailers, there is a possibility the marketplace could experience an irrecoverable downward

trend that may trigger higher returns in a given month or quarter.

Penguin

Random House distributes substantially all of IDWP’s products to non-direct market account (i.e., bookstores, libraries, mass market).

Should either Diamond or Penguin Random House fail to perform under the applicable distribution agreement or if it were to experience

financial difficulties that would hinder its performance, distribution to the direct or non-direct market, respectively, would be significantly

impaired in the short term and/or long term, and IDWP’s ability to distribute and receive proceeds from its publications would

be impaired which would have a material adverse impact on our business and financial results. In the first half of 2020, due to the COVID-19

pandemic, Diamond temporarily ceased distributing IDWP’s comic books but has since resumed distribution.

The

inability or unwillingness of either Diamond or Penguin Random House to perform its distribution obligations to IDWP could have a material

adverse effect on IDWP’s business, prospects and financial condition.

The

loss of one of the two main distributors IDWP depends on for its publications could have a material adverse effect on IDWP’s business,

prospects and financial condition and the agreement with one of the two primary distributors has expired.

IDWP

depends on Diamond and Penguin Random House to distribute the vast majority of its publications. IDWP’s Supply Agreement with Diamond

has expired and the parties have been operating pursuant to the terms of the expired agreement. In the event Diamond terminates its relationship

with IDWP or the parties enter into a new agreement not on as favorable terms as the terms the parties are currently operating under,

IDWP’s business, prospects and financial condition could be materially adversely affected. The loss by IDWP of either Diamond or

Penguin Random House as a distributor of its publications could have a material adverse effect on IDWP’s business, prospects and

financial condition. The fact that the agreement with Diamond has expired may increase the risk that Diamond will cease providing distribution

services to IDWP, which could cause disruption to IDWP’s operations and have an impact on the financial and other terms under which

IDWP’s products are distributed.

IDWP

may not be able to respond to changing consumer preferences and its sales may decline.

IDWP

operates in highly competitive markets that are subject to rapid change, including changes in customer preferences. There are substantial

uncertainties associated with IDWP’s efforts to develop successful publications and products for its customers. New fads, trends,

and shifts in popular culture could affect the type of creative media consumers will purchase. Content in which IDWP has invested significant

resources may fail to attract significant consumer demand at the time it is published. IDWP regularly makes significant investments in

new products that may not be profitable, or whose profitability may be significantly lower than IDWP has experienced historically. A

loss in sales due to the foregoing could have a material adverse effect on IDWP’s business, prospects and financial condition.

Significant

returns of IDWP products sold to mass market stores may have a material impact on IDWP’s cash flow.

Through

its distribution arrangement with Penguin Random House, IDWP sells its publications to mass market bookstores, such as Barnes & Noble,

on a fully returnable basis and IDWP Games sells its products to mass market stores, such as Target. As a result, these customers can

return publications to Penguin Random House or to game distributors for credit, which in turn is charged back to IDWP. There is no time

limit on the customers’ right to return publications distributed to them. In addition to IDWP being charged back the wholesale

cost of the publications, IDWP also incurs a return processing fee by Penguin Random House. Such returns and fees are credited against

IDWP’s current sales revenue from Penguin Random House, which reduces IDWP’s cash flow and operating capital. Product returns

are a normal part of book and games publishing and IDWP estimates and records a reserve for such returns based on its return history

and current trends that are expected to continue. A significant over-estimation of demand for a publication by the mass market bookstores,

however, could result in a larger-than-expected volume of returns that would significantly reduce IDWP’s cash flows and operating

capital. Further, a general downturn in the economy may also result in significant returns as bookstores reduce their outstanding debts

to improve their own cash flow. Any or all of these events that result in significant returns in excess of IDWP’s estimates could

have a material adverse effect on IDWP’s revenue, cash flow and operating results.

IDWP’s

publications may be less successful than anticipated.

IDWP

cannot accurately predict the commercial success of any of its publications or games because the revenue derived from the distribution

of a publication or game depends primarily upon its acceptance by the public, which cannot be accurately predicted. The commercial success

of a publication also depends upon the public’s acceptance of competing publications, critical reviews, the availability of alternative

forms of entertainment and leisure time activities, piracy and unauthorized distribution of publications, general economic conditions,

and other tangible and intangible factors, none of which can be predicted with certainty. Additionally, if the movies or television programs

that IDWP licenses are not successful, or if the characters that IDWP licenses lose some of their popularity, IDWP’s ability to

sell publications based on such characters would decline, which could have a material adverse effect on IDWP’s business, prospects

and financial condition.

If

IDWP fails to maintain positive relationships with its key licensors, authors, illustrators and other creative talent, as well as to

develop relationships with new licensors and creative talent, its business could be adversely affected.

IDWP’s

business is highly dependent on maintaining strong relationships with the entertainment companies that license their entertainment properties

to IDWP, and with authors, illustrators and other creative talent who produce the products that are sold to IDWP’s customers. Any

weakening of these relationships, or the failure to develop successful new relationships, could have an adverse impact on IDWP’s

business and financial performance. IDWP depends on freelance artists who choose how to spend their time and utilize their talents. It

is important for IDWP to maintain strong relationships with those freelance artists so they devote their time and talent to IDWP’s

projects. IDWP’s inability to maintain and secure these relationships could have a material adverse effect on IDWP’s business,

prospects and financial condition

IDWP

cannot control certain publication delays and cancellations which could adversely affect IDWP’s sales and its ability to meet delivery

obligations.

IDWP

does not control the decision to proceed with the production of publications based on characters that it licenses from others, and it

does not have full control of the timing of the releases of those publications, which are often the subject to long and inflexible schedules.

Disruptions, delays or cancellations to those schedules could cause IDWP to incur additional costs, miss an anticipated publication date,

endure long periods without publishing a publication or all of the above, which could hurt IDWP’s associated licensing programs

and business.

IDWP

depends on the internal controls of its distributors for its financial reporting and revenues.

Because

of Diamond’s and Penguin Random House’s role as distributors of IDWP’s publications and the fact that much of IDWP’s

inventory is held at its distributors’ facilities, IDWP depends on the distributors to implement internal controls over financial

reporting and to provide IDWP with information related to those internal controls. Diamond’s and Penguin Random House’s internal

controls might not be sufficient to allow IDWP to meet its internal control obligations or to allow IDWP’s management to properly

assess those controls. The distributors may fail to cure any internal control deficiencies related to the publications that it distributes.

IDWP may be unable to effectively create compensating controls to detect and prevent errors or irregularities in the distributors’

accounting to IDWP and others. Errors in properly tracking publication sales could also negatively impact IDWP’s revenues.

Any

loss of key personnel and the inability to attract and retain qualified employees could have a material adverse impact on IDWP’s

operations.

IDWP

is dependent on the continued services of key executives such as Nachie Marsham. The departure of key personnel without adequate replacement

could severely disrupt IDWP’s business operations. Additionally, IDWP needs qualified managers and skilled employees with industry

experience to operate its businesses successfully. From time to time there may be shortages of skilled labor which may make it more difficult

and expensive for IDWP to attract and retain qualified employees. If IDWP is unable to attract and retain qualified individuals or its

costs to do so increase significantly, its operations would be materially adversely affected.

IDWP

might lose sales and revenue because of piracy of publications.

With

technological advances, the piracy of publications has increased. Unauthorized and pirated copies of IDWP’s publications will reduce

the revenue generated by those publications. If consumers can obtain illegal copies of IDWP’s publications and media, IDWP’s

revenues will decline. IDWP may not be able to identify or enforce violations of its intellectual property rights and even if legal remedies

are available, they could be costly and drain its financial resources. Accordingly, illegal copying of IDWP’s content could negatively

affect its revenues and earnings.

IDWP’s

dependence on printers outside the United States subjects it to the risks of international business.

IDWP’s

publications are printed primarily outside the United States in South Korea, China and Canada. International manufacturing is subject

to a number of risks, including fluctuations and volatility in currency exchange rates, transportation delays and interruptions, political

and economic disruptions, the impositions of tariffs, import and export controls and changes in governmental policies. The impact of

changes in currency rates has been especially heightened by current global economic conditions and significant devaluations of local

currencies in comparison to the U.S. Dollar. Although to date, currency fluctuations have not materially adversely affected IDWP’s

costs, such fluctuations could materially and adversely affect IDWP in the future. Further, added tariffs may be imposed on our printing

activities outside the United States which could increase IDWP’s costs. Possible increases in costs and delays of, or interferences

with, product deliveries could result in losses of revenues, higher costs, reduced profitability and reductions in the goodwill of IDWP’s

customers. Additional factors that may adversely affect IDWP’s printing activities outside of the United States and therefore materially

and adversely affect the business and financial results of IDWP include international political situations, uncertain legal systems and

applications of law, prejudice against foreigners, corrupt practices, uncertain economic policies and potential political and economic

instability that may be exacerbated in foreign countries.

The

competitive pressures IDWP faces in its business could adversely affect its financial performance and growth prospects.

IDWP

is subject to significant competition, including from other publishers, many of which are substantially larger than IDWP and have much

greater resources than it, such as Marvel Comics and DC Comics. To the extent IDWP cannot meet the challenges from existing or new competitors

or develop new product offerings to meet customer preferences or needs, its revenues and profitability could be materially and adversely

affected.

Risks

Related to IDW Entertainment

The

public health risk of COVID-19 and its impact on productions could adversely affect IDWE’s business.

Multiple

television productions of IDWE have been delayed due to the COVD-19 pandemic. Live-action shows must be filmed and shot at locations

with a sizeable crew. Given the public health risk of COVID-19 and related possible local, state and federal guidelines limiting the

filming and production of our live-action shows, IDWE could be adversely affected and experience significant production delays or cancellations.

Production costs of IDWE shows may also rise as additional safety protocols related to the COVID-19 pandemic are necessary on the set

of these shows.

Increased

costs for programming and other rights, as well as judgments we make on the potential performance of IDWE’s content, may adversely

affect IDWE’s profits and balance sheet.

IDWE

has produced a significant amount of original programming and other content and is continuing to invest in this area. IDWE’s core

business involves the development and production of television shows, the costs of which are significant and involve complex negotiations

with numerous third parties. Network buyers and larger studios are also continuing to drive up the cost of talent and in many cases,

locking them to overall deals, which leaves IDWE with less access to high-level writers at a much higher cost of entry. These higher

costs may not be recouped when the content is broadcast or distributed, and higher costs may lead to decreased profitability, losses

or potential write-downs. Unfavorable currency rates both in the production and sale of television shows may also lead to increased costs.

Further, rapid changes in consumer behavior have increased the risk associated with acquired programming, which typically is acquired

pursuant to multi-year agreements.

We

may not have sufficient capital to pursue the most profitable revenue models and finance or co-finance future television shows.

If

IDWE continues to be successful in developing content suitable for successful television shows, it may not have sufficient capital to

finance or co-finance these shows, which usually is the deal structure that offers the greatest control and potential upside but comes

with the greatest risk. While IDWE has shifted its business model to substantially de-risk and diversify its deal structures by utilizing

guaranteed fee structures (such as production company fees, producer fees, and back-end participation) whenever possible whereby the

streaming platform cash-flows production costs, the potential requirement for financing or co-financing remains as part of the business.

As a result of the structure of its production arrangements for its television shows, IDWE may not be able to maximize the benefits of

its well-performing shows and may incur more losses of its poorly-performing shows, all of which would materially and adversely affect

its business and results of operations.

Any

loss of key personnel and the inability to attract and retain qualified employees could have a material adverse impact on IDWE’s

operations.

IDWE

is dependent on the continued services of key personnel with in-depth industry experience. The departure of key personnel without adequate

replacement or temporary skilled coverage could severely disrupt IDWE’s business operations. Additionally, IDWE needs qualified

managers and skilled employees with in-depth industry experience to operate its businesses successfully. From time to time there may

be shortages of skilled labor which may make it more difficult and expensive for IDWE to attract and retain qualified employees. If IDWE

is unable to attract and retain qualified individuals or its costs to do so increase significantly, its operations would be materially

adversely affected.

The

competitive pressures IDWE faces in its business could adversely affect its financial performance and growth prospects.

IDWE

is subject to significant competition, including from other studios/producers/distributors many of which operate with significantly larger

staffs and funding than IDWE. Competitors include (i) smaller independent studios such as Entertainment One, Blumhouse, Annapurna and

Miramax, (ii) major independent studios such as Sony TV and Warner Bros TV; and (iii) vertically integrated studios such as Twentieth

Television, Universal TV, CBS TV Studios and ABC Studios who develop, distribute and produce original television programming. To the

extent IDWE cannot meet the challenges from existing or new competitors or develop new product offerings to meet customer preferences

or needs, its revenues and profitability could be adversely affected.

The

concentration risk of IDWE’s shows currently airing primarily on Netflix and NBC Universal/SyFy could negatively affect IDWE’s

business.

IDWE

shows have primarily aired on Netflix and NBC Universal/SyFy. As such, IDWE has a concentration of customer risk related to Netflix and

NBC Universal/SyFy. While IDWE does not intend to continue to have its shows aired solely on Netflix and NBC Universal/SyFy, it cannot

control which companies may be interested to purchase and/or offer the best terms to finance its shows, nor control whether Netflix or

NBC Universal/SyFy will continue to air its shows.

Risks

Related to Our Intellectual Property

The

success of our businesses is highly dependent on the existence and maintenance of intellectual property rights in the publishing and

entertainment products and services we create.

The

value to us of our intellectual property rights is dependent on the scope and duration of our rights as defined by applicable laws in

the United States and abroad and the manner in which those laws are construed. If those laws are drafted or interpreted in ways that

limit the extent or duration of our rights, or if existing laws are changed, our ability to generate revenue from our intellectual property

may decrease, or the cost of obtaining and maintaining rights may increase.

The

unauthorized use of our intellectual property may increase the cost of protecting rights in our intellectual property or reduce our revenues.

The unauthorized distribution and access to content generally continues to be a significant challenge for intellectual property rights

holders. Inadequate laws or weak enforcement mechanisms to protect entertainment industry intellectual property in one country can adversely

affect the results of the Company’s operations worldwide, despite the Company’s efforts to protect its intellectual property

rights. COVID-19 may increase incentives and opportunities to access content in unauthorized ways, as negative economic conditions coupled

with a shift in government priorities could lead to less enforcement. These developments may require us to devote substantial resources

to protecting our intellectual property against unlicensed use and present the risk of increased losses of revenue as a result of unlicensed

distribution of our content.

With

respect to intellectual property developed by us and rights acquired by us from others, we are subject to the risk of challenges to our

copyright, trademark and patent rights by third parties. Successful challenges to our rights in intellectual property may result in increased

costs for obtaining rights or the loss of the opportunity to earn revenue from the intellectual property that is the subject of challenged

rights.

Our

intellectual property rights may not be protected, which could adversely affect our consolidated financial position and results of operations.

A

substantial portion of our publications are protected by copyright, held either in our name, in the name of the author of the work, or

in the name of a sponsoring professional society. Such copyrights protect our exclusive right to publish the work in many countries abroad

for specified periods. Our ability to continue to achieve our expected results depends, in part, upon our ability to protect our intellectual

property rights. Our consolidated financial position and results of operations may be adversely affected by lack of legal and/or technological

protections for our intellectual property in some jurisdictions and markets.

Failure

to adequately protect and enforce our intellectual property rights could substantially harm our business and operating results.

The

success of our business depends in part on our ability to protect and enforce our trademarks, copyrights, trade secrets and other intellectual

property rights. We attempt to protect our intellectual property under trademark, copyright and trade secret laws, and through a combination

of confidentiality procedures, contractual provisions and other methods, all of which offer only limited protection.

From

time to time, legal action by us may be necessary to enforce our trademarks and other intellectual property rights, to protect our trade

secrets, to determine the validity and scope of the intellectual property rights of others or to defend against claims of infringement

or invalidity. Such litigation could result in substantial costs and diversion of resources, distract management and technical personnel

and negatively affect our business, operating results and financial condition. If we are unable to protect our intellectual property

rights, we may find ourselves at a competitive disadvantage to others who need not incur the additional expense, time and effort required

to create the innovative products that have enabled us to be successful to date. Any inability on our part to protect adequately our

intellectual property may have a material adverse effect on our business, operating results and financial condition.

Risk

Factors Generally Relating to Us and Our Class B Common Stock

Our

Class B common stock may not be approved for listing on the NYSE American.

We

intend to apply to have our Class B common stock traded on the NYSE American and we believe that we will satisfy all the requirements

for that listing. However, our Class B common stock may not be approved for listing on the NYSE American or any other national securities

exchange. We cannot predict how much investor interest in our Company will generate the adequate amount of liquidity in our stock to

create an active trading market for our Class B common stock. It is possible that, even if our Class B common stock is eventually listed

on the NYSE American, an active trading market will not develop or continue, and there can be no assurance as to the price at which our

Class B common stock will trade. The initial share price of our Class B common stock listed on the NYSE American may not be indicative

of prices that will prevail in any future trading market.

There

can be no assurances that our Class B common stock, once listed on the NYSE American, will not be subject to potential

delisting if we do not continue to maintain the listing requirements of the NYSE American.

We

intend to apply to list the shares of our Class B common stock on the NYSE American, under the symbol “IDW.” An approval

of our listing application by NYSE American will be subject to, among other things, our fulfilling all of the listing requirements of

NYSE American. In addition, NYSE American has rules for continued listing, including, without limitation, minimum market capitalization

and other requirements. Failure to maintain our listing (i.e., being de-listed from NYSE American), would make it more difficult for

stockholders to sell our Class B common stock and more difficult to obtain accurate price quotations on our Class B common stock. This

could have an adverse effect on the price of our Class B common stock. Our ability to issue additional securities for financing or other

purposes, or otherwise to arrange for any financing we may need in the future, may also be materially and adversely affected if our Class

B common stock is not traded on a national securities exchange.

Although

we do not intend to utilize the “controlled company” exemption that may now or in the future be afforded to us by the NYSE

American, we may do so in the future which could limit or reduce the effectiveness of our corporate governance.

The

Trusts (as defined below) collectively hold shares that represent approximately 67.9% of the combined voting power of our outstanding

stock as of June 30, 2021. See “Eight trusts for the benefit of sons and daughters of Howard S. Jonas, our Chairman of the Board

of Directors, hold shares that, in the aggregate, represent more than a majority of the combined voting power of our outstanding capital

stock, which may limit the ability of other stockholders to affect our management”, below, and “Holders of our Class B common

stock have significantly less voting power than holders of our Class C common stock”, below.

Although

we do not believe it to be the case currently, as a result of our current ownership by the Trusts or otherwise we may now or in the future

qualify for the exceptions from the NYSE American’s corporate governance listing requirements available to us because we are a

“controlled company” as defined in section 801(a) of the NYSE American Company Guide. Among other things, a “controlled

company” may exempt itself from the requirement that (i) a majority of its directors be independent directors, (ii) its Compensation

Committee, Corporate Governance Committee and/or Nominating Committee be comprised entirely of independent directors, and (iii) the Company

not have a single Nominating/Corporate Governance Committee.

If

we currently or in the future qualify as a “controlled company,” we do not intend to rely on any applicable exceptions from

the NYSE American’s corporate governance listing requirements available to us because we are at that time a “controlled company.”

However, there can be no assurance that we will not in the future, if at that time we are a “controlled company,” rely on

any or all of the exceptions from the NYSE American’s corporate governance listing requirements available to us because we are

a “controlled company.” If we do rely on any or all of the exceptions from the NYSE American’s corporate governance

listing requirements because we are then a “controlled company,” the effectiveness of our corporate governance could be limited

or reduced.

Our

multi-class structure may render our shares ineligible for inclusion in certain stock market indices, and thus adversely affect the share

price of our Class B common stock and its liquidity.

We

have issued and outstanding shares of Class B common stock and shares of Class C common stock and intend to apply to have our Class B

common stock traded on the NYSE American. See “Our Class B common stock may not be approved for listing on the NYSE American,”

above. Our multi-class structure may render our shares ineligible for inclusion in certain stock market indices, which may adversely

affect the share price of our Class B common stock and its liquidity.

There

is a limited trading market for shares of our Class B common stock and stockholders may find it difficult to sell our shares.

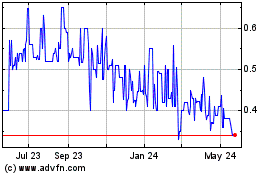

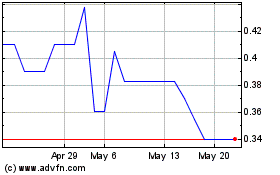

Currently,

our Class B common stock is quoted on the OTC Pink Markets. As a result, an investor may find it difficult to sell, or to obtain accurate

quotations as to the price of, shares of our Class B common stock. In addition, our Class B common stock may be subject to the penny

stock rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established

customers and accredited investors. The SEC regulations generally define a penny stock to be an equity that has a market price of less

than $5.00 per share, subject to certain exceptions. If we do not obtain or retain a listing on NYSE American and if the price of our

Class B common stock is less than $5.00, our Class B common stock will be deemed a penny stock. Unless an exception is available, those

regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock

market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons

other than established customers and accredited investors (generally institutions and high net worth individuals). In addition, the broker-dealer

must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson

in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account.

Moreover, broker-dealers who recommend such securities to persons other than established customers and accredited investors must make

a special written suitability determination for the purchaser and receive the purchaser’s written agreement to transactions prior

to sale. Regulations on penny stocks could limit the ability of broker-dealers to sell our Class B common stock and thus the ability

of purchasers of our Class B common stock to sell their shares in the secondary market.

We

cannot predict the extent to which investor interest in us and our Class B common stock will lead to the development or continuance of

an active trading market or how liquid that trading market for our Class B common stock might become. If an active trading market for

our Class B common stock does not develop or is not sustained, it may be difficult for investors to sell shares, particularly large quantities,

of our Class B common stock at a price that is attractive or at all. As a result, an investment in our Class B common stock

may be illiquid and investors may not be able to liquidate their investment readily or at all when they desire to sell.

There

is limited liquidity in our Class B common stock, which may adversely affect your ability to sell your shares of our Class B common stock.

The

market price of our Class B common stock may fluctuate significantly in response to a number of factors, some of which are beyond our

control. These factors include, but are not limited to:

|

|

●

|

developments

concerning intellectual property rights and regulatory approvals relating to us;

|

|

|

●

|

quarterly

variations in our business and financial results or the business and financial results of

our competitors;

|

|

|

●

|

the

ability or inability of us to generate increases in revenue and profit;

|

|

|

●

|

the ability or inability of us to raise capital, and the terms and conditions

associated with any such raising of capital;

|

|

|

●

|

developments

in our industry and target markets;

|

|

|

●

|

the

number of market makers who are willing to continue to make a market in our stock and the

market or exchange on which they decide to make a market in our stock;

|

|

|

●

|

our

ability to have our Class B common stock listed on the NYSE American; and

|

|

|

●

|

general

market conditions and other factors, including factors unrelated to our own operating performance.

|

In

recent years, the stock market in general has experienced extreme price and volume fluctuations. Continued market fluctuations could

result in extreme volatility in the price of shares of our Class B common stock, which could cause a decline in the value of our

shares. Price volatility may be accentuated if trading volume of our Class B common stock is low, which historically has often been

the case. The volatility in our Class B stock may be combined with low trading volume. Any or all of these above factors

could adversely affect your ability to sell your shares of our Class B common stock or, if you are able to sell your shares, to sell

your shares at a price that you determine to be fair or favorable.

We

have no future plans to pay dividends on our Class B common stock.

We

do not pay, and do not intend to pay, cash dividends on our Class B common stock. We currently intend to retain all available funds and

any future earnings for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable

future. In addition, the terms of our current, as well as any future, financing agreements may preclude us from paying any dividends.

As a result, capital appreciation, if any, of our Class B common stock will be investors’ sole source of potential gain for the

foreseeable future.

We

are a “smaller reporting company” and “emerging growth company” and we cannot be certain if the reduced disclosure

requirements applicable to smaller reporting companies and emerging growth companies will make our Class B common stock less attractive

to investors.

We

are a “smaller reporting company,” as defined in Rule 12b-2 under the Exchange Act, and we may take advantage of certain

exemptions from various reporting requirements that are applicable to other public companies, including “emerging growth companies”

such as, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley

Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from

the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments

not previously approved. Our status as a “smaller reporting company” is determined on an annual basis. We cannot predict

if investors will find our Class B common stock less attractive or our company less comparable to certain other public companies because

we will rely on these exemptions. For example, if we do not adopt a new or revised accounting standard, our future financial results

may not be as comparable to the financial results of certain other companies in our industry that adopted such standards. If some investors

find our Class B common stock less attractive as a result, there may be a less active trading market for our Class B common stock and

our stock price may be more volatile.

If

we fail to implement and maintain an effective system of internal controls, we may be unable to accurately report our results of operations,

meet our reporting obligations or prevent fraud.

Under

Section 404 of the Sarbanes-Oxley Act of 2002, a newly public company is not required to comply with either the management or the

auditor reporting requirements related to internal control over financial reporting until its second annual report, if applicable.

Further,

we intend to qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or the

JOBS Act. An emerging growth company may take advantage of reduced reporting and other burdens that are otherwise applicable generally

to public companies. These provisions include:

|

|

●

|

an

extended transition period to comply with new or revised accounting standards applicable to public companies; and

|

|

|

●

|

an

exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to

the Sarbanes-Oxley Act of 2002.

|

We

may take advantage of these provisions until the end of the fiscal year ending after the fifth anniversary of the filing of this registration

statement, or such earlier time that we are no longer an emerging growth company and, if we do, the information that we provide stockholders

may be different than you might receive from other public companies in which you hold equity. We would cease to be an emerging growth

company if we have more than $1.07 billion in annual revenue, have more than $700 million in market value of our shares of common stock

held by non-affiliates, or issue more than $1.0 billion of non-convertible debt over a three-year period.

In

addition, if we no longer qualify as an emerging growth company, as an accelerated filer, our independent registered public accounting

firm must attest to and report on the effectiveness of our internal control over financial reporting. Our management may conclude that

our internal control over financial reporting is not effective. Moreover, even if our management concludes that our internal control

over financial reporting is effective, our independent registered public accounting firm, after conducting its own independent testing,

may issue a report that is qualified if it is not satisfied with our internal controls or the level at which our controls are documented,

designed, operated or reviewed, or if it interprets the relevant requirements differently from us. In addition, after we become a public

company, our reporting obligations may place a significant strain on our management, operational and financial resources and systems

for the foreseeable future. We may be unable to timely complete our evaluation testing and any required remediation.

During

the course of documenting and testing our internal control procedures, in order to satisfy the requirements of Section 404, we may

identify other weaknesses and deficiencies in our internal control over financial reporting. In addition, if we fail to maintain the

adequacy of our internal control over financial reporting, as these standards are modified, supplemented or amended from time to time,

we may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with

Section 404. If we fail to achieve and maintain an effective internal control environment, we could suffer material misstatements

in our financial statements and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our

reported financial information. This could in turn limit our access to capital markets, harm our results of operations, and lead to a

decline in the trading price of our stock.

Additionally,

ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject

us to potential delisting from the stock exchange on which we list, regulatory investigations and civil or criminal sanctions. We may

also be required to restate our financial statements from prior periods.

The

requirements of being a reporting public company may strain our resources, divert management’s attention and affect our ability

to attract and retain additional executive management and qualified board members.

As

a reporting public company, we will be subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act, and the Dodd-Frank

Act, and other applicable securities rules and regulations. Compliance with these rules and regulations will increase our legal and financial

compliance costs, making some activities more difficult, time-consuming or costly. This will put increased demand on our systems and

resources, particularly after we are no longer a “smaller reporting company.” The Exchange Act requires, among other things,

that we file annual, quarterly and current reports with respect to our business and results of operations. As a “smaller reporting

company” and “emerging growth company”, as stated above, we receive certain reporting exemptions under The Sarbanes-Oxley

Act.

Changing

laws, regulations and standards relating to corporate governance and public disclosure create uncertainty for public companies, which

increases legal and financial compliance costs and time expenditures for internal personnel. These laws, regulations and standards are

subject to interpretation, which in many cases due to their lack of specificity, their application in practice may evolve over time as

regulators and governing bodies provide new guidance. These changes may result in continued uncertainty regarding compliance matters

and may necessitate higher costs due to ongoing revisions to filings, disclosures and governance practices. We intend to invest resources

to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses

and a diversion of management’s time and attention from revenue-generating activities to compliance activities. If our efforts

to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities

related to their application and practice, regulatory authorities may initiate regulatory or legal proceedings against us and our business

may be adversely affected.

As

a public company under these rules and regulations, we expect that it may make it more expensive for us to hire external auditors to

perform requisite outside audited financial statements, as well as obtain director and officer liability insurance, and we may be required

to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for

us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee

and could also make it more difficult to attract qualified executive officers.

As

a result of disclosure of information in this Prospectus and in filings required of a public company, our business and financial condition

will become more visible, which we believe may result in threatened or actual litigation, including by competitors and other third parties.

If such claims are successful, our business and results of operations could be adversely affected, and even if the claims do not result

in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources

of our management and adversely affect our business and results of operations.

General

economic conditions may negatively impact our operations.

Economic

downturns may negatively affect our operations. These conditions may be widespread or isolated to one or more geographic regions in which

we operate. Higher wages, related labor costs, printing costs, leasing costs, energy, insurance and fuel costs and the increasing cost

trends in those markets may decrease our margins. Moreover, economic downturns present an additional challenge to us because a significant

portion of our revenues are from sales through retail stores, which are more likely to close during economic downturns. In addition,

decreases in travel and entertainment spending during economic downturns could impact our businesses, and thereby negatively impact our

operations.

We

could find it difficult to raise additional capital in the future.

We

may need to raise additional capital in order for stockholders to realize increased value on our securities. Given the current global

economy, there can be no assurance that we would be able to obtain funding on commercially reasonable terms in a timely fashion. Failure

to obtain additional funding, if necessary, could have a material adverse effect on our business, prospects and financial condition.

Holders

of our Class B common stock have significantly less voting power than holders of our Class C common stock.

Holders

of our Class B common stock are entitled to one-tenth of a vote per share on all matters on which our stockholders are entitled to vote,

while holders of our Class C common stock are entitled to three votes per share. Because of their voting power, the holders of our Class

C common stock will be able to control matters requiring approval by our stockholders, including the election of all of the directors,

amendment of organizational documents and the approval of significant corporate transactions, including any merger, consolidation or

sale of all or substantially all of our assets. As a result, the ability of any of the holders of our Class B common stock to influence

our management may be limited. In addition, our dual class structure has an anti-takeover effect, and accordingly, the holders of the

shares of Class C common stock have the ability to prevent any change in control transactions that may otherwise be in the best interest

of stockholders

Eight

trusts for the benefit of sons and daughters of Howard S. Jonas, our Chairman of the Board of Directors, hold shares that, in the aggregate,

represent more than a majority of the combined voting power of our outstanding capital stock, which may limit the ability of other stockholders

to affect our management.

Eight

trusts for the benefit of sons and daughters of Howard S. Jonas (the “Trusts”), our Chairman of the Board, collectively have

voting power over 1,733,750 shares of our common stock (which includes 545,360 shares of our Class C common stock (which is all the issued

and outstanding shares of the Class C common stock), which are convertible into shares of our Class B common stock on a 1-for-1 basis,

and 1,188,390 shares of our Class B common stock), representing approximately 67.9% of the combined voting power of our outstanding

capital stock, as of June 30, 2021, or __% after giving effect to this offering). In addition, as of June 30, 2021, Howard S. Jonas

beneficially holds 1,734,962 shares of our Class B common stock, warrants to purchase up to 89,243 shares of our Class B common stock

at a price per share of $42.02 and warrants to purchase up to 98,336 shares of our Class B common stock at a price per share of $26.44.

Each of the Trusts has a different, independent trustee.

Howard

S. Jonas serves as our Chairman of the Board, which is not an officer position. However, he is our founder and served as an executive

officer, including our Chief Executive Officer, for a very significant time period, and the members of the Board and management often

look to him for guidance on major financial, operational and strategic matters.

Howard

S. Jonas does not have the right to direct or control the voting of the shares of our common stock that is held by the Trusts, and the

independent trustees hold sole voting and dispositive power over the common stock held by the Trusts. However, he is the trustor of the

trusts and is the father of each of the beneficiaries of the Trusts and his views may be taken into account by the trustees and others

related to the Trusts.

We

are not aware of any voting agreement between or among any of the Trusts and/or Howard S. Jonas, but if such a voting agreement or other

similar arrangement exists or were to be consummated, if all or several or all of the Trusts were to act in concert, or if we issued

additional Class C common stock, certain or all of the Trusts and/or Howard S. Jonas along with holders of the Class C common stock would

be able to control matters requiring approval by our stockholders, including the election of all of the directors, amendment of organizational

documents and the approval of significant corporate transactions, including any merger, consolidation or sale of all or substantially

all of our assets. As a result, the ability of any of our other stockholders to influence our management may be limited. In addition,

our dual class structure has an anti-takeover effect, and accordingly, the holders of the shares of Class C common stock have the ability

to prevent any change in control transactions that may otherwise be in the best interest of stockholders.

Risks Related

to this Offering

Investors

in this offering will experience immediate and substantial dilution in net tangible book value.

The

public offering price per share is substantially higher than the net tangible book value per share of our outstanding shares of Class

B common stock. As a result, investors in this offering will incur immediate dilution of $____ per share, based on the assumed public

offering price of $_____ per share. Investors in this offering will pay a price per share that substantially exceeds the book value

of our assets after subtracting our liabilities. See “Dilution” for a more complete description of how the value of

your investment will be diluted upon the completion of this offering.

We

have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our

management will have broad discretion in the application of the net proceeds from this offering, including for any of the purposes described

in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess

whether the net proceeds will be used appropriately. Because of the number and variability of factors that will determine our use of

the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. Our management might

not apply our net proceeds in ways that ultimately increase the value of your investment. We currently intend to use the net proceeds

of this offering primarily for general corporate purposes, including development of original IP, talent and technology investments, as

well as potential acquisitions. See “Use of Proceeds” for additional information.

Our

expected use of net proceeds from this offering represents our current intentions based upon our present plans and business condition.

As of the date of this prospectus, we cannot predict with certainty all of the particular uses for the net proceeds to be received upon

the completion of this offering, or the amounts that we will actually spend on the uses set forth above. The amounts and timing of our

actual use of the net proceeds will vary depending on numerous factors, including the commercial success of our systems, as well as the

amount of cash used in our operations. As a result, our management will have broad discretion in the application of the net proceeds,

and investors will be relying on our judgment regarding the application of the net proceeds of this offering.

The

failure by our management to apply these funds effectively could harm our business. Pending their use, we may invest the net proceeds

from this offering in short-term, investment-grade, interest-bearing securities. These investments may not yield a favorable return to

our stockholders. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail

to achieve expected financial results, which could cause our stock price to decline.

If

securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price

and trading volume could decline.

The

trading market for our Class B common stock will depend in part on the research and reports that securities or industry analysts publish

about us or our business. Securities and industry analysts do not currently, and may never, publish research on our company. If no securities

or industry analysts commence coverage of our company, the trading price for our stock would likely be negatively impacted. In the event

securities or industry analysts initiate coverage, if one or more of the analysts who covers us downgrades our stock or publishes inaccurate

or unfavorable research about our business, our stock price may decline. If one or more of these analysts ceases coverage of our company

or fails to publish reports on us regularly, demand for our stock could decrease, which might cause our stock price and trading volume

to decline.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Prospectus contains forward-looking statements. All statements other than statements of historical facts contained in this Prospectus,

including statements regarding our future results of operations and financial position, business strategy, prospective products, product

approvals, timing and likelihood of success, plans and objectives of management for future operations, and future results of current

and anticipated products are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important

factors that may cause our actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements.

In

some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “could,” “intend,” “target,”

“project,” “contemplates,” “believes,” “estimates,” “predicts,” “potential”

or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Prospectus

are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future

events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking

statements speak only as of the date of this Prospectus and are subject to a number of risks, uncertainties and assumptions described