As filed with the Securities and Exchange Commission on March 11, 2021

Registration No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

|

INTEGRATED VENTURES, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

82-1725385

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

73 Buck Road, Suite 2

Huntingdon Valley, PA 19006

(215) 613-1111

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

73 Buck Road, Suite 2

Huntingdon Valley, PA 19006

(215) 613-1111

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Joseph M. Lucosky, Esq.

Scott E. Linsky, Esq.

Lucosky Brookman LLP

101 Wood Avenue South, 5th Floor

Woodbridge, NJ 08830

(732) 395-4400

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

CALCULATION OF REGISTRATION FEE

|

Title of Each

Class

of Securities to

be Registered

(1)(2)

|

|

Amount to be

registered/proposed

maximum offering price

per unit/proposed

maximum aggregate

offering price (1) (2)

|

|

|

Amount of

Registration

Fee (3)

|

|

|

Offering:

|

|

|

|

|

|

|

|

Common Stock

|

|

|

|

|

|

|

|

Preferred Stock

|

|

|

|

|

|

|

|

Debt Securities (which may be senior or subordinated, convertible or non-convertible, secured or unsecured)

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

|

|

|

|

Rights

|

|

|

|

|

|

|

|

Units (4)

|

|

|

|

|

|

|

|

Total (5)

|

|

$

|

50,000,000

|

|

|

$

|

5,455

|

|

|

(1)

|

Pursuant to Rule 457(i) under the Securities Act of 1933, as amended (the “Securities Act), the securities registered hereunder include such indeterminate (a) number of shares of common stock, (b) number of shares of preferred stock, (c) debt securities, (d) warrants to purchase common stock, preferred stock or debt securities of the Registrant, (e) rights to purchase common stock or preferred stock and (f) units, consisting of some or all of these securities, as may be sold from time to time by the Registrant. Any securities registered hereunder may be sold separately or as units with other securities registered hereunder. There are also being registered hereunder an indeterminate number of shares of common stock, preferred stock and debt securities as shall be issuable upon conversion, exchange or exercise of any securities that provide for such issuance. In no event will the aggregate offering price of all types of securities issued by the Registrant pursuant to this registration statement exceed $50,000,000. Pursuant to Rule 416(a), this registration statement also covers any additional securities that may be offered or issued in connection with any stock split, stock dividend or similar transaction.

|

|

(2)

|

The proposed maximum offering price per unit and aggregate offering prices per class of securities will be determined from time to time by the Registrant in connection with the issuance by the Registrant of the securities registered under this registration statement and is not specified as to each class of security pursuant to General Instruction II.D of Form S-3 under the Securities Act.

|

|

(3)

|

Calculated pursuant to Rule 457(o) under the Securities Act.

|

|

(4)

|

Consisting of some or all of the securities listed above, in any combination, including common stock, preferred stock, debt securities, and warrants.

|

|

(5)

|

Any securities registered hereunder may be sold separately or as units with other securities registered hereunder. The proposed maximum offering price per unit will be determined by the Registrant in connection with the issuance of the securities. In no event will the aggregate offering price of all securities issued by the Registrant from time to time pursuant to this Registration Statement exceed $50,000,000 or the equivalent thereof in one or more foreign currencies, foreign currency units or composite currencies.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated March 11, 2021.

PROSPECTUS

INTEGRATED VENTURES, INC.

$50,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

We may offer and sell up to $50 million in the aggregate of the securities identified above from time to time in one or more offerings. This prospectus provides you with a general description of the securities.

Each time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering and the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 4 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

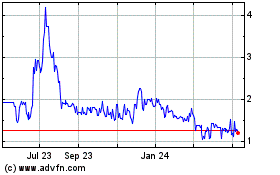

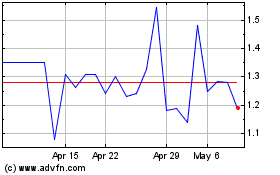

Our common stock is currently quoted on the OTCQB Marketplace operated by OTC Markets Group Inc. (the “OTCQB”) under the trading symbol “INTV”. On March 10, 2021, the last reported sale price of our common stock on OTC QB Market was $0.64 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is March 11, 2021.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC, using a “shelf” registration process. By using a shelf registration statement, we may sell securities from time to time and in one or more offerings up to a total dollar amount of $50 million as described in this prospectus. Each time that we offer and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described under the heading “Where You Can Find More Information; Incorporation by Reference.”

We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

When we refer to “Integrated,” “we,” “our,” “us” and the “Company” in this prospectus, we mean Integrated Ventures, Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series of securities.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available Information

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our website address is https://www.integratedventuresinc.com. The information on our website, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms of the documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may view a copy of the registration statement through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus modifies or replaces that statement.

We incorporate by reference our documents listed below and any future filings made by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, between the date of this prospectus and the termination of the offering of the securities described in this prospectus. We are not, however, incorporating by reference any documents or portions thereof, whether specifically listed below or filed in the future, that are not deemed “filed” with the SEC, including any information furnished pursuant to Items 2.02 or 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

|

|

●

|

Our Annual Report on Form 10-K for the year ended June 30, 2020, filed with the SEC on September 23, 2020.

|

|

|

|

|

|

|

●

|

Our Quarterly Reports on Form 10-Q for the quarters ended September 30, 2020, and December 31, 2020, filed with the SEC on November 13, 2020, and February 12, 2021, respectively.

|

|

|

|

|

|

|

●

|

Our Current Reports on Form 8-K and/or amendments on Form 8-K/A filed with the SEC on November 18, 2020, January 28, 2021, January 29, 2021, and February 25, 2021.

|

|

|

|

|

|

|

●

|

The description of our common stock contained in our Registration Statement on Form 8-A, filed with the SEC on August 9, 2016, and any amendment or report filed with the SEC for the purpose of updating such description.

|

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination of this Offering, including all such documents we may file with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits, unless they are specifically incorporated by reference in the documents) by writing or telephoning us at the following address:

Integrated Ventures, Inc.

73 Buck Road, Suite 2

Huntingdon Valley, PA 19006

(215) 613-1111

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus and any accompanying prospectus supplement.

THE COMPANY

Our Business

On November 22, 2017, we successfully launched our cryptocurrency operations, and revenues commenced from cryptocurrency mining operations and from sales of cryptocurrency mining equipment. As of December 31, 2020, the Company owned and operated approximately 598 miners that mine Bitcoin (BTC), Litecoin (LTC) and Ethereum (ETH).

The Company will continue to (1) raise capital to purchase new mining equipment and (2) retire older and no longer profitable models.

We have consolidated our cryptocurrency operations in one facility, located in Carthage, New York. The power supply and purchase agreement was entered into on May 10, 2019 for an initial term of 90 days, with an option to continue for a subsequent 36 months, which option the Company has exercised. The Company’s sole obligation under the Agreement is to pay the PetaWatt Properties, LLC, a contractual rate per kilowatt hour of electricity, consumed by the Company’s cryptocurrency mining operations.

Cryptocurrency Mining

Digital tokens are built on a distributed ledger infrastructure often referred to as a “blockchain”. These tokens can provide various rights, and cryptocurrency is a type of digital token, designed a a medium of exchange. Other digital tokens provide rights to use assets or services, or in some cases represent ownership interests. Cryptocurrencies, for example Bitcoin, are digital software that run on a blockchain platform, which is a decentralized, immutable ledger of transactions, and essentially function as a digital form of money. Cryptocurrencies such as Bitcoin are not sponsored by any government or a single entity. A bitcoin is one type of an intangible digital asset that is issued by, and transmitted through, an open source, math-based protocol platform using cryptographic security (the “Bitcoin Network”). The Bitcoin Network, for example, is an online, peer-to-peer user network that hosts the public transaction ledger, known as the “Blockchain,” and the source code that comprises the basis for the cryptography and math-based protocols governing the Bitcoin Network. No single entity owns or operates the Bitcoin Network, the infrastructure of which is collectively maintained by a decentralized user base. Bitcoins can be used to pay for goods and services or can be converted to fiat currencies, such as the US Dollar, at rates determined on bitcoin exchanges or in individual end-user-to-end-user transactions under a barter system.

Bitcoins are “stored” or reflected on the digital transaction ledger known as the “blockchain,” which is a digital file stored in a decentralized manner on the computers of each Bitcoin Network or as applicable to other cryptocurrency users. A blockchain records the transaction history of all bitcoins in existence and, through the transparent reporting of transactions, allows the cryptocurrency network to verify the association of each bitcoin with the digital wallet that owns them. The network and software programs can interpret the blockchain to determine the exact balance, if any, of any digital wallet listed in the blockchain as having taken part in a transaction on the cryptocurrency network.

Mining is the process by which bitcoins, for example, are created resulting in new blocks being added to the blockchain and new bitcoins being issued to the miners. Miners engage in a set of prescribed complex mathematical calculations in order to add a block to the blockchain and thereby confirm cryptocurrency transactions included in that block’s data. Miners that are successful in adding a block to the blockchain are automatically awarded a fixed number of bitcoins for their effort. To begin mining, a user can download and run the network mining software, which turns the user’s computer into a node on the network that validates blocks.

All bitcoin transactions are recorded in blocks added to the blockchain. Each block contains the details of some or all of the most recent transactions that are not memorialized in prior blocks, a reference to the most recent prior block, and a record of the award of bitcoins to the miner who added the new block. Each unique block can only be solved and added to the blockchain by one miner; therefore, all individual miners and mining pools on the cryptocurrency network are engaged in a competitive process and are incentivized to increase their computing power to improve their likelihood of solving for new blocks.

The method for creating new bitcoins is mathematically controlled in a manner so that the supply of bitcoins grows at a limited rate pursuant to a pre-set schedule. Less than a year ago, Bitcoin moved to a price around $20,000 in December 2017, and is trading in the range of $10,000 currently. Mining economics have also been much more pressured by the Difficulty Rate – a computation used by miners to determine the amount of computing power required to mine bitcoin. The Difficulty Rate is directly influenced by the total size of the entire Bitcoin network. The Bitcoin network has grown six-fold in the past year, resulting in a six-fold increase in difficulty. Today, the network requires the computing power of approximately 1,800 Bitmain S9 miners to mine one Bitcoin per day, using approximately 2.5 MegaWatt of power supply. Meanwhile, demand from miners also drove up hardware and power prices, the largest costs of production. This deliberately controlled rate of bitcoin creation means that the number of bitcoins in existence will never exceed 21 million and that bitcoins cannot be devalued through excessive production unless the Bitcoin Network’s source code (and the underlying protocol for bitcoin issuance) is altered.

Mining pools have developed in which multiple miners act cohesively and combine their processing power to solve blocks. When a pool solves a new block, the participating mining pool members split the resulting reward based on the processing power they each contributed to solve for such block. The mining pool operator provides a service that coordinates the workers. Fees are paid to the mining pool operator to cover the costs of maintaining the pool. The pool uses software that coordinates the pool members’ hashing power, identifies new block rewards, records how much work all the participants are doing, and assigns block rewards in-proportion to the participants’ efforts. While we do not pay pool fees directly, pool fees (approximately 2% to 5%) are deducted from amounts we may otherwise earn. Participation in such pools is essential for our mining business.

Our Cryptocurrency Operations

We utilize and rely on cryptocurrency pools to mine cryptocurrencies and generate a mixed selection of digital cryptocurrencies, including BTC, LTC and ETH. Cryptocurrency payouts are paid to us by the pool operator, and the digital currency produced is either stored in a wallet (Coinbase) or sold in open market. Payout proceeds are automatically deposited in our corporate bank accounts.

In our digital currency mining operations, various models of miners are owned and deployed by the Company.

When funds are available and market conditions allow, we also invest in certain denominations of cryptocurrencies to complement our mining operations. We consider these investments similar to marketable securities where we purchase and hold the cryptocurrencies for sale. We report realized gains and losses on the sales of cryptocurrencies and mark our portfolio of cryptocurrencies to market at the end of each quarterly reporting period, reporting unrealized gains or losses on the investments. We held digital currencies with a total market value of $123,980 and $82,855 as of December 31, 2020 and June 30, 2020, respectively, comprised primarily of LINK (Chainlink), with a smaller portfolio of BTC, LTC and ETH.

The Digital Currency Markets

The value of bitcoins is determined by the supply and demand of bitcoins in the bitcoin exchange market (and in private end-user-to-end-user transactions), as well as the number of merchants that accept them. However, merchant adoption is very low according to a Morgan Stanley note from the summer of 2018.As bitcoin transactions can be broadcast to the Bitcoin Network by any user’s bitcoin software and bitcoins can be transferred without the involvement of intermediaries or third parties, there are little or no transaction costs in direct peer-to-peer transactions on the Bitcoin Network. Third party service providers such as crypto currency exchanges and bitcoin third party payment processing services may charge significant fees for processing transactions and for converting, or facilitating the conversion of, bitcoins to or from fiat currency.

Under the peer-to-peer framework of the Bitcoin Network, transferors and recipients of bitcoins are able to determine the value of the bitcoins transferred by mutual agreement, the most common means of determining the value of a bitcoin being by surveying one or more bitcoin exchanges where bitcoins are publicly bought, sold and traded, i.e., the Bitcoin Exchange Market (“Bitcoin Exchange”).

On each Bitcoin Exchange, bitcoins are traded with publicly disclosed valuations for each transaction, measured by one or more fiat currencies. Bitcoin Exchanges report publicly on their site the valuation of each transaction and bid and ask prices for the purchase or sale of bitcoins. Market participants can choose the Bitcoin Exchange on which to buy or sell bitcoins. To date, the SEC has rejected the proposals for bitcoin ETF’s, citing that lack of enough transparency in the cryptocurrency markets to be sure that prices are not being manipulated. The Wall Street Journal has recently reported on how bots are manipulating the prices of bitcoin on the crypto exchanges. However, on November 8, 2018, the SEC announced in an order (the "Order") that it had settled charges against Zachary Coburn, the founder of the digital token exchange EtherDelta, marking the first time that the SEC has brought an enforcement action against an online digital token platform for operating as an unregistered national securities exchange.

Although the cryptocurrency markets have been historically volatile and have weathered several up and down cycles over the past few years, recently these markets have been in a selloff phase for the past several months, possibly reflecting doubts as to the applicability of digital currencies in commercial applications and other factors. In this selloff, prices of digital currencies other than Bitcoin have experienced deeper percentage declines than Bitcoin. On December 31, 2017, Bitcoin was trading in the range of $18,000, and as of November 30, 2018 had declined to a $4,000 trading range. The trading range has recently increased to approximately $10,200. Other cryptocurrencies have experienced more substantial declines, than Bitcoin’s recent decline.Our revenues are directly affected by the Bitcoin market price specifically, which is the market leader for prices of all cryptocurrencies. In recent weeks, regulatory crackdowns have also weighed on prices. The Securities and Exchange Commission recently announced its first civil penalties against cryptocurrency founders as part of a wide regulatory and legal crackdown on fraud and abuses in the industry. In addition, Bloomberg News recently reported that regulators are investigating whether bitcoin's rally to almost $20,000 last year was the result of market manipulation. The U.S. Justice Department is investigating whether tether, a controversial cryptocurrency that founders say is backed 1:1 by the U.S. dollar, was used by traders to prop up bitcoin, according to the report, which cited three unnamed sources familiar with the matter.

Competition

In cryptocurrency mining, companies, individuals and groups generate units of cryptocurrency through mining. Miners can range from individual enthusiasts to professional mining operations with dedicated data centers, with all of which we compete. Miners may organize themselves in mining pools, with which we would compete. The Company currently participates in mining pools and may decide to invest or initiate operations in mining pools. At present, the information concerning the activities of these enterprises is not readily available as the vast majority of the participants in this sector do not publish information publicly or the information may be unreliable.

Government Regulation

Government regulation of blockchain and cryptocurrency under review with a number of government agencies, the Securities and Exchange Commission, the Commodity Futures Trading Commission, the Federal Trade Commission and the Financial Crimes Enforcement Network of the U.S. Department of the Treasury, and in other countries. State government regulations also may apply to certain activities such as cryptocurrency exchanges (bitlicense, banking and money transmission regulations) and other activities. Other bodies which may have an interest in regulating or investigating companies engaged in the blockchain or cryptocurrency business include the national securities exchanges and the Financial Industry Regulatory Authority. As the regulatory and legal environment evolves, the Company may in its mining activities become subject to new laws, and further regulation by the SEC and other agencies. On November 16, 2018, the SEC issued a Statement on Digital Asset Securities Issuance and Trading, in which it emphasized that market participants must still adhere to the SEC’s well-established and well-functioning federal securities law framework when dealing with technological innovations, regardless of whether the securities are issued in certificated form or using new technologies, such as blockchain.

Blockchain and cryptocurrency regulations are in a nascent state with agencies investigating businesses and their practices, gathering information, and generally trying to understand the risks and uncertainties in order to protect investors in these businesses and in cryptocurrencies generally. Various bills have also been proposed in Congress for adoption related to our business which may be adopted and have an impact on us. The offer and sale of digital assets in initial coin offerings, which is not an activity we expect to pursue, has been a central focus of recent regulatory inquiries. On November 16, 2018 the SEC settled with two cryptocurrency startups, and reportedly has more than 100 investigations into cryptocurrency related ventures, according to a codirector of the SEC’s enforcement division (Wall Street Journal, November 17-18, 2018). An annual report by the SEC shows that digital currency scams are among the agency’s top enforcement priorities. The SEC is focused in particular on Initial Coin Offerings (ICOs), which involve the sale of digital tokens related to blockchain projects. Many such projects have failed to deliver on their promises or turned out to be outright scams. In the past year, the enforcement division has opened dozens of investigations involving ICOs and digital assets, many of which were ongoing at the close of FY 2018,” the SEC states in a section of the report titled “ICOs and Digital Assets.”

Financial

For the year ended June 30, 2020, we recognized revenues totaling $454,170 from cryptocurrency operations (consisting of both mining and equipment sales transactions). For the six months ended December 31, 2020, we recognized revenues from cryptocurrency operations totaling $264,347. In the current fiscal year, we have significantly increased our investing efforts in digital currencies when funds are available and held digital currencies with a total market value of $123,980 and $82,855 as of December 31, 2020 and June 30, 2020, respectively.

At December 31, 2020, the Company owned 598 mining rigs, with a net book value of $511,512. This number is directly related to the availability of the electric power for the mining rigs, which is currently at maximum utilization capacity. For financial accounting purposes, we record our mining rigs at the lower of cost or estimated net realizable value.

Through December 31, 2020, we purchased mining machines and funded our operations primarily with proceeds provided primarily from the issuance of convertible notes payable. During the year ended June 30, 2020, we received net proceeds from convertible notes payable totaling $534,000.

Additional Capital Requirements

To continue to operate, complete and successfully operate our digital currency mining facilities and to fund future operations, we may need to raise additional capital for expansion or other expenses of operations. The amount and timing of future funding requirements will depend on many factors, including the timing and results of our ongoing mining operations, and potential new development and administrative support expenses. We anticipate that we will seek to fund our operations through our cryptocurrency mining operations, further liquidation of our marketable securities, public or private equity or debt financings or other sources, such as potential collaboration agreements. If additional financing is required, we cannot be certain that it will be available to us on favorable terms, or at all.

Employees and Employment Agreements

At present time, we have one full time employee, Steve Rubakh, our sole officer and director, who devotes 100% of his time to our operations. In addition, we rely on a group of subcontractors to build, install, manage, monitor and service our mining equipment. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt such plans in the future. There are presently no personal benefits available to any officers, directors or employees; however, we at times do reimburse Mr. Rubakh for certain health insurance and medical costs.

Property

Our corporate offices are located at 73 Buck Road, Suite 2, Huntingdon Valley, Pennsylvania 19006. Our telephone number is (215) 613-1111. We occupy 450 sq ft facility, at no cost to the Company. On May 8, 2019, the Company had consolidated all of its mining operations in Carthage, New York, by signing a three-year power supply and purchase agreement with PetaWatt Properties, LLC. We believe that our offices and data center facility are suitable and adequate and that we have sufficient capacity to meet our current and future needs.

Recent Developments

On January 14, 2021, the Company entered into a Securities Purchase Agreement (the “January Series C Agreement”) with BHP Capital NY, Inc. (“BHP”), providing for the issuance and sale by the Company and the purchase by BHP of newly designated shares of Series C Convertible Preferred Stock issued by the Company. Under the January Series C Agreement, the purchase price per share of Series C Convertible Preferred Stock is $1,000. The first closing under the Series C Agreement was held on January 22, 2021, at which the Company sold, and BHP purchased, 750 shares of Series C Preferred Stock for $750,000. The Company received net proceeds of $740,000 after payment of legal fees. The Company also on that date issued 2,000,000 shares of its common stock to BHP as equity incentive shares.

Pursuant to a second Securities Purchase Agreement effective February 5, 2021, BHP purchased a second tranche consisting of 375,000 shares of Series C Preferred Stock for $375,000. As an equity incentive to this purchase of Series C Preferred Stock, 1,000,000 shares of the Company’s common stock were issued to BHP.

On February 18, 2021, we entered into a Securities Purchase Agreement, (the “Series D Agreement”) with BHP Capital NY, Inc., providing for the issuance and sale by the Company and the purchase by such purchaser of 3,000 shares of Series D Convertible Preferred Stock (the “Series D Preferred Stock”) and a warrant to purchase common stock for a purchase price of $3,000,000, with the ability to purchase another 1,000 shares of Series D Preferred Stock on the same terms exercisable at $0.60 per share.

Using the proceeds from the Series C Agreements and the Series D Agreement, as well as amounts from operating cash flows, we purchased an additional 697 mining rigs for an aggregate purchase price of $2,910,964.

On March 8, 2021, we entered into a Master Agreement with Compute North LLC (“Compute North”) pursuant to which Compute North will provide collocation and hosting services in data centers located in Nebraska and Texas, including rack space, electrical power, utilities and physical security. Compute North will also provide managed services for the mining equipment. The monthly fees and term of the services will be determined based on the number of mining rigs placed into service and total power consumed.

Available Information

All reports of the Company filed with the SEC are available free of charge through the SEC’s website at www.sec.gov. In addition, the public may read and copy materials filed by the Company at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. The public may also obtain additional information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330.

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement before acquiring any of such securities. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

Risks Concerning our Business

BECAUSE WE ARE AN EARLY-STAGE - COMPANY WITH MINIMAL REVENUE AND A HISTORY OF LOSSES AND WE EXPECT TO CONTINUE TO INCUR SUBSTANTIAL LOSSES FOR THE FORESEEABLE FUTURE, WE CANNOT ASSURE YOU THAT WE CAN OR WILL BE ABLE TO OPERATE PROFITABLY.

We have incurred losses since our organization, and are subject to the risks common to start-up, pre-revenue enterprises, including, among other factors, undercapitalization, cash shortages, limitations with respect to personnel, financial and other resources and lack of revenues. We cannot assure you that we will be able to operate profitably or generate positive cash flow. If we cannot achieve profitability, we may be forced to cease operations and you may suffer a total loss of your investment.

AN INVESTMENT IN THE COMPANY MUST BE CONSIDERED SPECULATIVE SINCE OUR OPERATIONS ARE DEPENDENT ON THE MARKET VALUE OF BITCOIN.

Our operations are dependent on the continued viable market performance of cryptocurrencies that we market and, in particular, the market value of Bitcoin. The decision to pursue blockchain and digital currency businesses exposes the Company to risks associated with a new and untested strategic direction. Under the current accounting rules, cryptocurrency is not cash, currency or a financial asset, but an indefinite-lived intangible asset; declines in the market price of cryptocurrencies would be included in earnings, whereas increases in value beyond the original cost or recoveries of previous declines in value would not be captured. The prices of digital currencies have varied wildly in recent periods and reflects “bubble” type volatility, meaning that high prices may have little or no merit, may be subject to rapidly changing investor sentiment, and may be influenced by factors such as technology, regulatory void or changes, fraudulent actors, manipulation and media reporting.

WE DEPEND HEAVILY ON OUR CHIEF EXECUTIVE OFFICER, AND HIS DEPARTURE COULD HARM OUR BUSINESS.

The expertise and efforts of Steve Rubakh, our Chief Executive Officer, are critical to the success of our business. The loss of Mr. Rubakh’s services could significantly undermine our management expertise and our ability to operate our Company.

OUR AUDITORS’ REPORT INCLUDES A GOING CONCERN PARAGRAPH.

Our financial statements include a going-concern qualification from our auditors, which expresses doubt about our ability to continue as a going concern. We have operated at a loss since inception. Our ability to operate profitably is dependent upon, among other things, obtaining additional financing for our operations. These factors, among others, raise substantial doubt about our ability to continue as a going concern. The accompanying financial statements do not include any adjustments that take into consideration the uncertainty of our ability to continue operations.

Risks Relating Generally to Our Operations and Technology

CURRENTLY, THERE IS RELATIVELY LIMITED USE OF BITCOIN IN THE RETAIL AND COMMERCIAL MARKETPLACE IN COMPARISON TO RELATIVELY LARGE USE BY SPECULATORS, THUS CONTRIBUTING TO PRICE VOLATILITY THAT COULD ADVERSELY AFFECT OUR RESULTS OF OPERATIONS.

Bitcoin has only recently become accepted as a means of payment for goods and services by certain major retail and commercial outlets and use of Bitcoin by consumers to pay such retail and commercial outlets remains limited. Conversely, a significant portion of Bitcoin demand is generated by speculators and investors seeking to profit from the short- or long-term holding of Bitcoin. Many industry commentators believe that Bitcoin’s best use case is as a store of wealth, rather than as a currency for transactions, and that other cryptocurrencies having better scalability and faster settlement times will better serve as currency. This could limit Bitcoin’s acceptance as transactional currency. A lack of expansion by Bitcoin into retail and commercial markets, or a contraction of such use, may result in increased volatility or a reduction in the Bitcoin Index Price, either of which could adversely affect our results of operations.

WE ARE RELIANT ON POOLS OF USERS OR MINERS THAT ARE THE SOLE OUTLET FOR SALES OF CRYPTOCURRENCIES THAT WE MINE.

We do not have the ability to sell our cryptocurrency production directly on the exchanges or markets that are currently where cryptocurrencies are purchased and traded. Pools are operated to pool the production on a daily basis of companies mining cryptocurrencies, and these pools are our sole means of selling our production of cryptocurrencies. Absent access to such pools, we would be forced to seek a different method of access to the cryptocurrency markets. There is no assurance that we could arrange any alternate access to dispose of our mining production.

WE MAY NOT BE ABLE TO RESPOND QUICKLY ENOUGH TO CHANGES IN TECHNOLOGY AND TECHNOLOGICAL RISKS, AND TO DEVELOP OUR INTELLECTUAL PROPERTY INTO COMMERCIALLY VIABLE PRODUCTS.

Changes in legislative, regulatory or industry requirements or in competitive technologies may render certain of our planned products obsolete or less attractive. Our mining equipment may become obsolete, and our ability to anticipate changes in technology and regulatory standards and to successfully develop and introduce new and enhanced products on a timely basis will be a significant factor in our ability to remain competitive. We cannot provide assurance that we will be able to achieve the technological advances that may be necessary for us to remain competitive or that certain of our products will not become obsolete.

WE ARE INCREASINGLY DEPENDENT ON INFORMATION TECHNOLOGY SYSTEMS AND INFRASTRUCTURE (CYBER SECURITY).

Our operations are potentially vulnerable to breakdown or other interruption by fire, power loss, system malfunction, unauthorized access and other events such as computer hackings, cyber-attacks, computer viruses, worms or other destructive or disruptive software. Likewise, data privacy breaches by persons with permitted access to our systems may pose a risk that sensitive data may be exposed to unauthorized persons or to the public. It is critical that our systems provide a continued and uninterrupted performance for our business to generate revenues. There can be no assurance that our efforts will prevent significant breakdowns, breaches in our systems or other cyber incidents that could have a material adverse effect upon our business, operations or financial condition of the Company.

IF WE ARE UNABLE TO ATTRACT, TRAIN AND RETAIN TECHNICAL AND FINANCIAL PERSONNEL, OUR BUSINESS MAY BE MATERIALLY AND ADVERSELY AFFECTED.

Our future success depends, to a significant extent, on our ability to attract, train and retain key management, technical, regulatory and financial personnel. Recruiting and retaining capable personnel with experience in pharmaceutical products is vital to our success. There is substantial competition for qualified personnel, and competition is likely to increase. We cannot assure you we will be able to attract or retain the technical and financial personnel we require. If we are unable to attract and retain qualified employees, our business may be materially and adversely affected.

THE SEC IS CONTINUING ITS PROBES INTO PUBLIC COMPANIES THAT APPEAR TO INCORPORATE AND SEEK TO CAPITALIZE ON THE BLOCKCHAIN TECHNOLOGY, AND MAY INCREASE THOSE EFFORTS WITH NOVEL REGULATORY REGIMES AND DETERMINE TO ISSUE ADDITIONAL REGULATIONS APPLICABLE TO THE CONDUCT OF OUR BUSINESS OR BROADENING DISCLOSURES IN OUR FILINGS UNDER THE SECURITIES EXCHANGE ACT OF 1934.

As the SEC stated previously, it is continuing to scrutinize and commence enforcement actions against companies, advisors and investors involved in the offering of cryptocurrencies and related activities. At least one Federal Court has held that cryptocurrencies are “securities” for certain purposes under the Federal Securities Laws.

According to a recent report published by Lex Machina, securities litigation in general and those that are related to blockchain, cryptocurrency or bitcoin specifically, showed a marked increase during the first two quarters of 2018 as compared to 2017. The total number of securities cases that referenced “blockchain,” “cryptocurrency” or “bitcoin” in the pleadings tripled in the first half of 2018 alone compared to 2017.On the same day, the SEC announced its first charge against unregistered broker-dealers for selling digital tokens after the SEC issued The DAO Report in 2017. The SEC charged TokenLot LLC (TokenLot), a self-described “ICO Superstore”, and its owners, Lenny Kugel and Eli L. Lewitt, with failing to register as broker-dealers. On November 16, 2018 the SEC settled with two cryptocurrency startups, and reportedly has more than 100 investigations into cryptocurrency related ventures, according to a codirector of the SEC’s enforcement. As the regulatory and legal environment evolves, the Company may in its mining activities become subject to new laws, and further regulation by the SEC and other federal and state agencies.

Recently, the SEC on February 11, 2020, filed charges against an Ohio-based businessman who allegedly orchestrated a digital asset scheme that defrauded approximately 150 investors, including many physicians. The agency alleges that Michael W. Ackerman, along with two business partners, raised at least $33 million by claiming to investors that he had developed a proprietary algorithm that allowed him to generate extraordinary profits while trading in cryptocurrencies. The SEC’s complaint alleges that Ackerman misled investors about the performance of his digital currency trading, his use of investor funds, and the safety of investor funds in the Q3 trading account. The complaint further alleges that Ackerman doctored computer screenshots taken of Q3’s trading account to create. In reality, as alleged, at no time did Q3’s trading account hold more than $6 million and Ackerman was personally enriching himself by using $7.5 million of investor funds to purchase and renovate a house, purchase high end jewelry, multiple cars, and pay for personal security services.

In another recent action filed on March 16, 2020, the SEC obtained an asset freeze and other emergency relief to halt an ongoing securities fraud perpetrated by a former state senator and two others who bilked investors in and outside the U.S. and obtained an asset freeze and other emergency relief to halt an ongoing securities fraud perpetrated by a former state senator and two others who bilked investors in and outside the U.S. The SEC’s complaint alleges that Florida residents Robert Dunlap and Nicole Bowdler worked with former Washington state senator David Schmidt to market and sell a purported digital asset called the “Meta 1 Coin” in an unregistered securities offering, conducted through the Meta 1 Coin Trust. The complaint alleges that the defendants made numerous false and misleading statements to potential and actual investors, including claims that the Meta 1 Coin was backed by a $1 billion art collection or $2 billion of gold, and that an accounting firm was auditing the gold assets. The defendants also allegedly told investors that the Meta 1 Coin was risk-free, would never lose value and could return up to 224,923%. According to the complaint, the defendants never distributed the Meta 1 Coins and instead used investor funds to pay personal expenses and for other personal purposes.

BANKS AND FINANCIAL INSTITUTIONS MAY NOT PROVIDE BANKING SERVICES, OR MAY CUT OFF SERVICES, TO BUSINESSES THAT PROVIDE DIGITAL CURRENCY-RELATED SERVICES OR THAT ACCEPT DIGITAL CURRENCIES AS PAYMENT, INCLUDING FINANCIAL INSTITUTIONS OF INVESTORS IN OUR SECURITIES.

A number of companies that provide bitcoin and/or other digital currency-related services have been unable to find banks or financial institutions that are willing to provide them with bank accounts and other services. Similarly, a number of companies and individuals or businesses associated with digital currencies may have had and may continue to have their existing bank accounts closed or services discontinued with financial institutions in response to government action, particularly in China, where regulatory response to digital currencies has been particularly harsh. We also may be unable to obtain or maintain these services for our business. The difficulty that many businesses that provide bitcoin and/or derivatives on other digital currency-related services have and may continue to have in finding banks and financial institutions willing to provide them services may be decreasing the usefulness of digital currencies as a payment system and harming public perception of digital currencies, and could decrease their usefulness and harm their public perception in the future.

IT MAY BE ILLEGAL NOW, OR IN THE FUTURE, TO ACQUIRE, OWN, HOLD, SELL OR USE BITCOIN, ETHEREUM, OR OTHER CRYPTOCURRENCIES, PARTICIPATE IN THE BLOCKCHAIN OR UTILIZE SIMILAR DIGITAL ASSETS IN ONE OR MORE COUNTRIES, THE RULING OF WHICH COULD ADVERSELY AFFECT THE COMPANY.

Although currently Bitcoin, Ethereum, and other cryptocurrencies, the Blockchain and digital assets generally are not regulated or are lightly regulated in most countries, including the United States, one or more countries such as China and Russia may take regulatory actions in the future that could severely restrict the right to acquire, own, hold, sell or use these digital assets or to exchange for fiat currency. Such restrictions may adversely affect the Company. Such circumstances could have a material adverse effect on the ability of the Company to continue as a going concern or to pursue this segment at all, which could have a material adverse effect on the business, prospects or operations of the Company and potentially the value of any cryptocurrencies the Company holds or expects to acquire for its own account and harm investors.

If regulatory changes or interpretations require the regulation of Bitcoin or other digital assets under the securities laws of the United States or elsewhere, including the Securities Act of 1933, the Securities Exchange Act of 1934 (the “Exchange Act”) and the Investment Company Act of 1940 or similar laws of other jurisdictions and interpretations by the SEC, the Commodity Futures Trading Commission (the “CFTC”), the Internal Revenue Service (“IRS”), Department of Treasury or other agencies or authorities, the Company may be required to register and comply with such regulations, including at a state or local level. To the extent that the Company decides to continue operations, the required registrations and regulatory compliance steps may result in extraordinary expense or burdens to the Company. The Company may also decide to cease certain operations. Any disruption of the Company’s operations in response to the changed regulatory circumstances may be at a time that is disadvantageous to the Company.

OUR DIGITAL CURRENCIES MAY BE SUBJECT TO LOSS, THEFT OR RESTRICTION ON ACCESS.

There is a risk that some or all of our digital currencies could be lost or stolen. Digital currencies are stored in digital currency sites commonly referred to as “wallets” by holders of digital currencies which may be accessed to exchange a holder’s digital currency assets. Hackers or malicious actors may launch attacks to steal, compromise or secure digital currencies, such as by attacking the digital currency network source code, exchange miners, third-party platforms, cold and hot storage locations or software, or by other means. We may be in control and possession of one of the more substantial holdings of digital currency. As we increase in size, we may become a more appealing target of hackers, malware, cyber-attacks or other security threats. Any of these events may adversely affect our operations and, consequently, our investments and profitability. The loss or destruction of a private key required to access our digital wallets may be irreversible and we may be denied access for all time to our digital currency holdings or the holdings of others held in those compromised wallets. Our loss of access to our private keys or our experience of a data loss relating to our digital wallets could adversely affect our investments and assets.

INCORRECT OR FRAUDULENT DIGITAL CURRENCY TRANSACTIONS MAY BE IRREVERSIBLE.

Once a transaction has been verified and recorded in a block that is added to a blockchain, an incorrect transfer of a digital currency or a theft thereof generally will not be reversible and we may not have sufficient recourse to recover our losses from any such transfer or theft. It is possible that, through computer or human error, or through theft or criminal action, our digital currency rewards could be transferred in incorrect amounts or to unauthorized third parties, or to uncontrolled accounts. Further, at this time, there is no specifically enumerated U.S. or foreign governmental, regulatory, investigative or prosecutorial authority or mechanism through which to bring an action or complaint regarding missing or stolen digital currency. To the extent that we are unable to recover our losses from such action, error or theft, such events could have a material adverse effect on our ability to continue as a going concern or to pursue our new strategy at all, which could have a material adverse effect on our business, prospects or operations of and potentially the value of any bitcoin or other digital currencies we mine or otherwise acquire or hold for our own account.

WE ARE SUBJECT TO RISKS ASSOCIATED WITH OUR NEED FOR SIGNIFICANT ELECTRICAL POWER. GOVERNMENT REGULATORS MAY POTENTIALLY RESTRICT THE ABILITY OF ELECTRICITY SUPPLIERS TO PROVIDE ELECTRICITY TO MINING OPERATIONS, SUCH AS OURS.

The operation of a bitcoin or other digital currency mine can require massive amounts of electrical power. We are reliant on PetaWatt Properties, LLC, located in Carthage, NY for the power supply for our mining operations. Our mining operations can only be successful and ultimately profitable if the costs, including electrical power costs, associated with mining a bitcoin are lower than the price of a bitcoin. As a result, any mine we establish can only be successful if we can obtain sufficient electrical power for that mine on a cost-effective basis with a reliable supplier, and our establishment of new mines requires us to find locations where that is the case. There may be significant competition for suitable mine locations, and government regulators may potentially restrict the ability of electricity suppliers to provide electricity to mining operations in times of electricity shortage, or may otherwise potentially restrict or prohibit the provision or electricity to mining operations. If we are unable to receive adequate power supply and are forced to reduce our operations due to the availability or cost of electrical power, our business would experience materially negative impacts.

WE HAVE INCREASED OUR INVESTMENTS IN CRYPTOCURRENCIES, THE MARKET VALUE OF WHICH MAY BE SUBJECT TO SIGNIFICANT FLUCTUATIONS

When funds are available and market conditions allow, current strategy is to invest in certain denominations of cryptocurrencies to complement our mining operations. We consider these investments similar to marketable securities where we purchase and hold the cryptocurrencies for sale. We report realized gains and losses on the sales of cryptocurrencies and mark our portfolio of cryptocurrencies to market at the end of each quarterly reporting period, reporting unrealized gains or losses on the investments. The market value of these investments may fluctuate materially, and we may be subject to investment losses on the change in market value.

Risks related to the coronavirus pandemic

THE FUTURE IMPACT OF THE COVID-19 PANDEMIC ON COMPANIES IS EVOLVING AND WE ARE CURRENTLY UNABLE TO ASSESS WITH CERTAINTY THE BROAD EFFECTS OF COVID-19 ON OUR BUSINESS.

The future impact of the Covid-19 pandemic on the companies in the financial markets is evolving and we are currently unable to assess with certainty the broad effects of Covid-19 on our business, particularly on the digital currency markets. As of June 30, 2020, our investment in property and equipment of $453,342 could be subject to impairment or change in valuation due to Covid-19 if our cryptocurrency mining revenues significantly decrease or we are not able to raise capital sufficient to fund our operations. In addition, current travel restrictions and social distancing requirements make it difficult for our management to access and oversee our operations in the State of New York.

As of June 30, 2020, the reported values of the Company’s material convertible debt and derivative liabilities are based on multiple factors, including the market price of our stock, interest rates, our stock price volatility, variable conversion prices based on market prices as defined in the respective agreements and probabilities of certain outcomes based on management projections. We believe these inputs will be subject to even more significant changes due to the impact on capital markets of Covid-19, and the future estimated fair value of these liabilities may fluctuate materially from period to period.

The Covid-19 pandemic continues to have a material negative impact on capital markets, including the market prices of digital currencies. While we continue to incur operating losses, we are currently dependent on debt or equity financing to fund our operations and execute our business plan, including ongoing requirements to replace old and nonprofitable mining machines. We believe that the impact on capital markets of Covid-19 may make it more costly and more difficult for us to access these sources of funding.

Our business can potentially be impacted by the effects of the COVID-19 as follows: (1) effect our financial condition, operating results and reduce cash flows; (2) cause disruption to the activities of equipment suppliers; (3) negatively affect the Company’s mining activities due to imposition of related public health measures and travel and business restrictions; (4) create disruptions to our core operations in New York due to quarantines and self-isolations; (5) restrict the Company’s ability and that of its employees to access facilities and perform equipment maintenance, repairs, and programming which will lead to inability to monitor and service miners, resulting in reduced ability to mine cryptocurrencies due to miners being offline.

In addition, our partners such as manufacturers, suppliers and sub-contractors will be disrupted by absenteeism, quarantines and travel restrictions resulting in their employees’ ability to work. The Company’s supply chain, shipments of parts and purchases of new products may be negatively affected. Such disruptions could have a material adverse effect on our operations.

THE CORONAVIRUS PANDEMIC IS A CONTINUING SERIOUS THREAT TO HEALTH AND ECONCOMIC WELLBEING AFFECTING OUR EMPLOYEES, INVESTORS AND OUR SOURCES OF SUPPLY.

The sweeping nature of the novel Coronavirus (COVID-19) pandemic makes it extremely difficult to predict how the Company’s business and operations will be affected in the long run. However, the likely overall economic impact of the pandemic is viewed as highly negative to the general economy. To date, we have not been classified as an essential business in the New York, and we may in the future not be allowed to access our mining facilities. The duration of such impact cannot be predicted.

Risks Related to our Securities

OUR LACK OF INTERNAL CONTROLS OVER FINANCIAL REPORTING MAY AFFECT THE MARKET FOR AND PRICE OF OUR COMMON STOCK.

Pursuant to Section 404 of the Sarbanes-Oxley Act, we are required to file a report by our management on our internal control over financial reporting. Our disclosure controls and our internal controls over financial reporting are not effective. We do not have the financial resources or personnel to develop or implement systems that would provide us with the necessary information on a timely basis so as to be able to implement financial controls. The absence of internal controls over financial reporting may inhibit investors from purchasing our stock and may make it more difficult for us to raise capital or borrow money. Implementing any appropriate changes to our internal controls may require specific compliance training of our directors and employees, entail substantial costs in order to modify our existing accounting systems, take a significant period of time to complete and divert management’s attention from other business concerns. These changes may not, however, be effective in developing or maintaining internal control.

OUR COMMON STOCK IS DEEMED TO BE “PENNY STOCK,” WHICH MAY MAKE IT MORE DIFFICULT FOR INVESTORS TO SELL THEIR SHARES DUE TO DISCLOSURE AND SUITABILITY REQUIREMENTS.

Our common stock is deemed to be “penny stock” as that term is defined in Rule 3a51-1 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These requirements may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of them. This could cause our stock price to decline. Penny stocks are stock:

|

|

·

|

With a price of less than $5.00 per share;

|

|

|

|

|

|

|

·

|

That are not traded on a “recognized” national exchange;

|

|

|

|

|

|

|

·

|

Whose prices are not quoted on the NASDAQ automated quotation system (NASDAQ listed stock must still have a price of not less than $5.00 per share); or

|

|

|

|

|

|

|

·

|

In issuers with net tangible assets less than $2.0 million (if the issuer has been in continuous operation for at least three years) or $10.0 million (if in continuous operation for less than three years), or with average revenues of less than $6.0 million.

|

Broker-dealers dealing in penny stocks are required to provide potential investors with a document disclosing the risks of penny stocks. Moreover, broker-dealers are required to determine whether an investment in a penny stock is a suitable investment for a prospective investor. Many brokers have decided not to trade “penny stocks” because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. In the event that we remain subject to the “penny stock rules” for any significant period, there may develop an adverse impact on the market, if any, for our securities.

FINRA SALES PRACTICE REQUIREMENTS MAY LIMIT A STOCKHOLDER’S ABILITY TO BUY AND SELL OUR STOCK.

The Financial Industry Regulatory Authority (referred to as FINRA) has adopted rules requiring that, in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative or low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA has indicated its belief that there is a high probability that speculative or low-priced securities will not be suitable for at least some customers. If these FINRA requirements are applicable to us or our securities, they may make it more difficult for broker-dealers to recommend that at least some of their customers buy our common stock, which may limit the ability of our stockholders to buy and sell our common stock and could have an adverse effect on the market for and price of our common stock.

THE MARKET PRICE FOR OUR COMMON STOCK MAY BE VOLATILE AND YOUR INVESTMENT IN OUR COMMON STOCK COULD SUFFER A DECLINE IN VALUE.

The trading volume in our stock is low, which may result in volatility in our stock price. As a result, any reported prices may not reflect the price at which you would be able to sell shares of common stock if you want to sell any shares you own or buy if you wish to buy shares. Further, stocks with a low trading volume may be more subject to manipulation than a stock that has a significant public float and is actively traded. The price of our stock may fluctuate significantly in response to a number of factors, many of which are beyond our control. These factors include, but are not limited to, the following, in addition to the risks described above and general market and economic conditions:

|

|

●

|

the market’s reaction to our financial condition and its perception of our ability to raise necessary funding or enter into a joint venture, given the economic environment resulting from the COVID-19 pandemic, as well as its perception of the possible terms of any financing or joint venture;

|

|

|

●

|

the market’s perception as to our ability to generate positive cash flow or earnings;

|

|

|

●

|

changes in our or any securities analysts’ estimate of our financial performance;

|

|

|

●

|

the anticipated or actual results of our operations;

|

|

|

●

|

changes in market valuations of digital currencies and other companies in our industry;

|

|

|

●

|

concern that our internal controls are ineffective;

|

|

|

●

|

actions by third parties to either sell or purchase stock in quantities which would have a significant effect on our stock price; and

|

|

|

●

|

other factors not within our control.

|

RAISING FUNDS BY ISSUING EQUITY OR CONVERTIBLE DEBT SECURITIES COULD DILUTE THE NET TANGIBLE BOOK VALUE OF THE COMMON STOCK AND IMPOSE RESTRICTIONS ON OUR WORKING CAPITAL.

We anticipate that we will require funds in addition to the net proceeds from this offering for our business.

We will need to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not which is less than the market price and which may be based on a discount from market at the time of issuance. Stockholders will incur dilution upon exercise of any outstanding stock options, warrants or upon the issuance of shares of common stock under our present and future stock incentive programs. If we were to raise capital by issuing equity securities, either alone or in connection with a non-equity financing, the net tangible book value of the then outstanding common stock could decline. If the additional equity securities were issued at a per share price less than the market price, which is customary in the private placement of equity securities, the holders of the outstanding shares would suffer dilution, which could be significant. Further, if we are able to raise funds from the sale of debt securities, the lenders may impose restrictions on our operations and may impair our working capital as we service any such debt obligations. In addition, the sale of shares and any future sales of a substantial number of shares of our common stock in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those shares of common stock for sale will have on the market price of our common stock.

WE MAY ISSUE PREFERRED STOCK WHOSE TERMS COULD ADVERSELY AFFECT THE VOTING POWER OR VALUE OF OUR COMMON STOCK.

Our articles of incorporation authorize us to issue, without the approval of our stockholders, one or more classes or series of preferred stock having such designations, preferences, limitations and relative rights, including preferences over our common stock respecting dividends and distributions, as our board of directors may determine. We have outstanding shares of our Series A super-voting preferred stock and Series B convertible preferred stock, the terms of which adversely impact the voting power or value of our common stock. Similarly, the repurchase or redemption rights or liquidation preferences included in a series of preferred stock issued in the future might provide to holders of preferred stock rights that could affect the residual value of the common stock.

BECAUSE CERTAIN EXISTING STOCKHOLDERS OWN A LARGE PERCENTAGE OF OUR VOTING STOCK, OTHER STOCKHOLDERS’ VOTING POWER MAY BE LIMITED.

Steve Rubakh, our Chief Executive Officer, owns and/or controls a majority of the voting power of our common stock. As a result, Mr. Rubakh will have the ability to control all matters submitted to our stockholders for approval, including the election and removal of directors and the approval of any merger, consolidation or sale of all or substantially all of our assets. This stockholder, who is also our sole director, may make decisions that are averse to or in conflict with your interests. See our discussion under the caption “Principal Stockholders” for more information about ownership of our outstanding shares.

WE DO NOT HAVE A MAJORITY OF INDEPENDENT DIRECTORS ON OUR BOARD AND THE COMPANY HAS NOT VOLUNTARILY IMPLEMENTED VARIOUS CORPORATE GOVERNANCE MEASURES, IN THE ABSENCE OF WHICH STOCKHOLDERS MAY HAVE MORE LIMITED PROTECTIONS AGAINST INTERESTED DIRECTOR TRANSACTIONS, CONFLICTS OF INTEREST AND SIMILAR MATTERS.

Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address board of directors’ independence, audit committee oversight, and the adoption of a code of ethics. We have not yet adopted any of these other corporate governance measures and since our securities are not yet listed on a national securities exchange, we are not required to do so. If we expand our board membership in future periods to include additional independent directors, we may seek to establish an audit and other committee of our board of directors. It is possible that if our Board of Directors included a number of independent directors and if we were to adopt some or all of these corporate governance measures requiring expansion of our board of directors, stockholders would benefit from somewhat greater assurance that internal corporate decisions were being made by disinterested directors. In evaluating our Company, our current lack of corporate governance measures should be borne in mind.

OUR SHARE PRICE IS VOLATILE AND MAY BE INFLUENCED BY NUMEROUS FACTORS THAT ARE BEYOND OUR CONTROL.

Market prices for shares of technology companies such as ours are often volatile. The market price of our common stock may fluctuate significantly in response to a number of factors, most of which we cannot control, including:

|

|

•

|

fluctuations in digital currency and stock market prices and trading volumes of similar companies;

|

|

|

|

|

|

|

•

|

general market conditions and overall fluctuations in U.S. equity markets;

|

|

|

|

|

|

|

•

|

sales of large blocks of our common stock, including sales by our executive officers, directors and significant stockholders;

|

|

|

|

|

|

|

•

|

discussion of us or our stock price by the press and by online investor communities; and

|

|

|

|

|

|

|

•

|

other risks and uncertainties described in these risk factors.

|

WE HAVE NO CURRENT PLANS TO PAY DIVIDENDS ON OUR COMMON STOCK AND INVESTORS MUST LOOK SOLELY TO STOCK APPRECIATION FOR A RETURN ON THEIR INVESTMENT IN US.

We do not anticipate paying any further cash dividends on our common stock in the foreseeable future. We currently intend to retain all future earnings to fund the development and growth of our business. Any payment of future dividends will be at the discretion of our board of directors and will depend on, among other things, our earnings, financial condition, capital requirements, level of indebtedness, statutory and contractual restrictions applying to the payment of dividends and other considerations that the board of directors deems relevant. Investors may need to rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize a return on their investment. Investors seeking cash dividends should not purchase our common stock.

SPECIAL NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve risks and uncertainties, principally in the sections entitled “Risk Factors.” All statements other than statements of historical fact contained in this prospectus, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Although we do not make forward looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this prospectus, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of the times at, or by which, that performance or those results will be achieved. Forward-looking statements are based on information available at the time they are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from what is expressed in or suggested by the forward-looking statements.