false

0001083522

0001083522

2024-08-16

2024-08-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 16, 2024

Jones Soda Co.

(Exact Name of Registrant as Specified in Its Charter)

Washington

(State or Other Jurisdiction of Incorporation)

|

0-28820

|

52-2336602

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

4786 1st Avenue South, Suite 103, Seattle, Washington

|

98134

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(206) 624-3357

(Registrant's Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

None

|

|

N/A

|

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 1.01.

|

Entry into a Material Definitive Agreement.

|

On August 21, 2024, Jones Soda Co. (the “Company”) issued 1,875,000 units (the “Units”) at $0.40 per Unit, for aggregate gross proceeds of $750,000, of which $500,000 was cash (the “Current Offering Tranche”), with each Unit being composed of: (i) one (1) common share in the capital of the Company (each, a “Common Share”); and (ii) one‐half (1/2) of one detachable share purchase warrant (each whole warrant, a “Warrant”). Each whole Warrant will be exercisable into one Common Share (each, a “Warrant Share”) at a price of $0.50 per Warrant Share for a period of 24 months from the date of issuance, subject to the Company having the right at its option to accelerate the expiry date of the Warrants to the date that is 30 days following delivery of a notice of acceleration to holders of Warrants if at any time the closing price of the Common Shares on the OTCQB or other stock exchange or over-the-counter market in the United States or on the Canadian Securities Exchange (the “CSE”) exceeds $0.80 (for the purposes of the CSE, the equivalent in Canadian dollars based on the daily exchange rate published by the Bank of Canada) for a period of five (5) consecutive trading days (the “Warrant Exercise Period”). Each whole Warrant may be exercised anytime during the Warrant Exercise Period upon the voluntary election to exercise by the Warrant holder.

The Company previous issued 7,535,000 Units and 1,600,000 Units on July 26, 2024 and July 31, 2024, respectively, for gross cash proceeds of $3,013,960 and $640,000, respectively (collectively, the “Previous Offering Tranches” and together with the Current Offering Tranche, the “Offering”).

In connection with the Offering, the Company paid Dominari Securities LLC (“Dominari”), who acted as exclusive placement agent for the Offering, an aggregate of $166,158.40 in cash commission, representing 4.0% of the aggregate gross proceeds raised in the Offering, and issued to Dominari an aggregate of 440,400 Warrants as compensation for Dominari’s services.

The Units were offered and sold in the Offering: (i) in the United States to accredited investors in reliance on Rule 506(b) of Regulation D under the Securities Act of 1933, as amended (the “Securities Act”); and (ii) outside the United States to non-U.S. persons in reliance on Regulation S under the Securities Act.

In connection with the issuance of the Units in the Current Offering Tranche, the Company signed on August 21, 2024, a registration rights agreement with each of the purchasers of the Units in the Current Offering Tranche (the “Current Registration Rights Agreement”). Pursuant to the terms of the Current Registration Rights Agreement, the Company is required to file a registration statement with the United States Securities and Exchange Commission (the “SEC”) within 30 days from the closing of the Current Offering Tranche that registers for resale the Common Shares issued in the Current Offering Tranche as well as the Common Shares issuable of upon the exercise of the Warrants. The failure on the part of the Company to file the registration statement with the SEC within this timeframe may subject the Company to payment of certain monetary penalties. In connection with the closing of the Previous Offering Tranches on July 26, 2024 and July 31, 2024, the Company entered into registration rights agreements with the purchasers of the Units in the each of the Previous Offering Tranches that contained almost identical terms to the Current Registration Rights Agreement.

The foregoing description of the Warrants and the Current Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the forms of warrant and registration rights agreement, which were filed as Exhibits 4.1 and 10.1, respectively, to the Current Report on Form 8-K filed with the SEC on August 1, 2024, and are incorporated into this Item 1.01 by reference.

|

ITEM 3.02.

|

Unregistered Sales of Equity Securities.

|

The information contained or incorporated in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

On August 16, 2024, the Company issued a press release announcing an extension of the Offering. Pursuant to Rule 135c under the Securities Act, the Company is filing herewith this press release as Exhibit 99.1 hereto.

On August 22, 2024, the Company issued a press release announcing the closing of the Current Offering Tranche. A copy of such press release is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

|

ITEM 9.01

|

Financial Statements and Exhibits

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

JONES SODA CO.

(Registrant)

|

| |

|

|

|

|

August 22, 2024

|

|

By:

|

/s/ David Knight

|

| |

|

|

David Knight

President and Chief Executive Officer

|

Exhibit 99.1

FOR IMMEDIATE RELEASE:

JONES SODA CO. PROVIDES UPDATE ON PRIVATE PLACEMENT

SEATTLE, Washington, August 16, 2024 – Jones Soda Co. (“Jones Soda” or the “Company”) (CSE: JSDA, OTCQB: JSDA) wishes to provide an update on the private placement financing of units consisting of (i) one (1) common share in the capital of the Company and (ii) one‐half (1/2) of one detachable share purchase warrant for gross proceeds of up to US$5,000,000 initially announced in the Company’s news release dated August 1, 2024 (the “Offering”). The Company has currently completed two tranches of the Offering for aggregate proceeds of US$3,653,960. The Company intends to complete a third and final tranche of the Offering no later than August 21, 2024.

None of the securities being offered and sold in the Offering were registered under the United States Securities Act of 1933, as amended, (the “U.S. Securities Act”) at the time of the Offering, however, such securities include registration rights. None of the securities issued in the Offering or any underlying securities may be offered or sold in the United States absent registration under the U.S. Securities Act and all applicable state securities laws or an applicable exemption from such registration requirements.

This news release shall not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States, and shall not constitute an offer, solicitation or sale of any securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful. This news release is being issued pursuant to and in accordance with Rule 135c under the U.S. Securities Act.

About Jones Soda

Jones Soda Co.® (CSE: JSDA, OTCQB: JSDA) is a leading developer of sodas and cannabis-infused beverages known for their premium taste, unique flavors and unconventional brand personality. Launched in 1996 as the original craft soda brand, the Company today markets a diverse portfolio of sodas, mixers and wellness beverages under the Jones® Soda brand as well as a line of award-winning cannabis beverages and edibles leveraging Jones’ trademark flavors under the Mary Jones brand. For more information, visit www.jonessoda.com, www.myjones.com, or https://gomaryjones.com.

Contacts

David Knight, President and Chief Executive Officer

1-206-624-3357

Investor Relations

Cody Cree

Gateway Group, Inc.

1-949-574-3860

JSDA@gateway-grp.com

The CSE does not accept responsibility for the adequacy or accuracy of this release.

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATIONS SERVICES PROVIDER HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Statements Regarding Forward‐Looking Information

This news release may contain forward‐looking information within the meaning of applicable securities legislation in both Canada and the United States, which reflect management's current expectations regarding future events. Such information includes, without limitation, information regarding the completion and timing of a third tranche of the Offering. Although the Company believes that such information is reasonable, it can give no assurance that such expectations will prove to be correct.

Forward‐looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "postulate" and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward‐looking information provided by the Company is not a guarantee of future results or performance and that such forward‐looking information is based upon a number of estimates and assumptions of management in light of management's experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this news release including, without limitation, that the Company will be able to complete a third tranche of the Offering or utilize the net proceeds of the Offering in the manner intended; that general business and economic conditions will not change in a material adverse manner; and assumptions regarding political and regulatory stability and stability in financial and capital markets.

Forward‐looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward‐looking statements. Such risks and other factors include, among others: the risk that the Company is unable to complete a third tranche of the Offering; the risk that the Company may not be able to use the proceeds of the Offering as intended; the state of the financial markets for the Company's securities; the Company's ability to raise the necessary capital or to be fully able to implement its business strategies; and other risks and factors that the Company is unaware of at this time.

The forward‐looking statements contained in this news release are made as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward‐ looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Exhibit 99.2

FOR IMMEDIATE RELEASE:

JONES SODA CO. ANNOUNCES CLOSING OF THIRD AND FINAL TRANCHE OF PRIVATE PLACEMENT OF UNITS

SEATTLE, Washington, August 22, 2024 – Jones Soda Co. (“Jones Soda” or the “Company”) (CSE: JSDA, OTCQB: JSDA) is pleased to announce that it has closed the third and final tranche of its previously announced private placement offering of units of the Company (the “Offering”) composed of: (i) one (1) common share in the capital of the Company (each, a “Common Share”); and (ii) one‐half (1/2) of one detachable share purchase warrant (each whole warrant, a “Warrant”, and together with a Common Share, a “Unit”) for aggregate gross proceeds of $750,000, of which $500,000 was cash, in the third tranche of the Offering, and $4,403,960 in total gross proceeds for the entire Offering.

In connection with the Offering, the Company paid Dominari Securities LLC (“Dominari”), who acted as exclusive placement agent for the Offering, an aggregate of $166,158.40 in cash commission, representing 4.0% of the aggregate gross proceeds raised in the Offering, and issued to Dominari an aggregate of 440,400 Warrants as compensation for Dominari’s services.

The Company intends to use the net cash proceeds of the Offering to support growth and for general corporate purposes.

The Units were offered and sold in the Offering (i) to persons in the “United States” or to “U.S. persons” (as such terms are defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”)), who qualify as accredited investors in reliance on Rule 506(b) of Regulation D under the U.S. Securities Act (the “U.S. Financing”), and (ii) outside the United States to non-U.S. persons in reliance on Regulation S under the U.S. Securities Act. The portion of the Offering that was conducted outside of the United States included an offering to eligible investors in each of the Provinces and Territories of Canada except Quebec pursuant to the listed issuer financing exemption under Part 5A of National Instrument 45-106 - Prospectus Exemptions (the “LIFE Offering”).

The securities offered and sold under the Life Offering will not be subject to a hold period in accordance with applicable Canadian securities laws but each such securities will be considered restricted securities under the U.S. Securities Act.

None of the securities that were offered and sold in the Offering were registered under the United States Securities Act of 1933, as amended, (the “U.S. Securities Act”) at the time of the Offering, however, such securities included registration rights. None of the securities issued in the Offering or any underlying securities may be offered or sold in the United States absent registration under the U.S. Securities Act and all applicable state securities laws or an applicable exemption from such registration requirements.

This press release is intended for informational purposes and shall not constitute an offer to sell, or a solicitation of an offer to purchase, these securities, and shall not constitute an offer, solicitation or sale in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

About Jones Soda

Jones Soda Co.® (CSE: JSDA, OTCQB: JSDA) is a leading developer of sodas and cannabis-infused beverages known for their premium taste, unique flavors and unconventional brand personality. Launched in 1996 as the original craft soda brand, the Company today markets a diverse portfolio of sodas, mixers and wellness beverages under the Jones® Soda brand as well as a line of award-winning cannabis beverages and edibles leveraging Jones’ trademark flavors under the Mary Jones brand. For more information, visit www.jonessoda.com, www.myjones.com, or https://gomaryjones.com.

Contacts

David Knight, President and Chief Executive Officer

1-206-624-3357

Investor Relations

Cody Cree

Gateway Group, Inc.

1-949-574-3860

JSDA@gateway-grp.com

The CSE does not accept responsibility for the adequacy or accuracy of this release.

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATIONS SERVICES PROVIDER HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Statements Regarding Forward‐Looking Information

This news release may contain forward‐looking information within the meaning of applicable securities legislation in both Canada and the United States, which reflect management's current expectations regarding future events. Such information includes, without limitation, information regarding the intended use of proceeds from the Offering and the expected closing date of a third tranche of the Offering. Although the Company believes that such information is reasonable, it can give no assurance that such expectations will prove to be correct.

Forward‐looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "postulate" and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward‐looking information provided by the Company is not a guarantee of future results or performance and that such forward‐looking information is based upon a number of estimates and assumptions of management in light of management's experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this news release including, without limitation, that the Company will be able to utilize the net cash proceeds of the Offering in the manner intended; that general business and economic conditions will not change in a material adverse manner; and assumptions regarding political and regulatory stability and stability in financial and capital markets.

Forward‐looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward‐looking statements. Such risks and other factors include, among others: the risk that the Company may not be able to use the proceeds of the Offering as intended; the state of the financial markets for the Company's securities; the Company's ability to raise the necessary capital or to be fully able to implement its business strategies; and other risks and factors that the Company is unaware of at this time.

The forward‐looking statements contained in this news release are made as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward‐ looking statements, whether as a result of new information, future events or otherwise, except as required by law.

v3.24.2.u1

Document And Entity Information

|

Aug. 16, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Jones Soda Co.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 16, 2024

|

| Entity, Incorporation, State or Country Code |

WA

|

| Entity, File Number |

0-28820

|

| Entity, Tax Identification Number |

52-2336602

|

| Entity, Address, Address Line One |

4786 1st Avenue South

|

| Entity, Address, Address Line Two |

Suite 103

|

| Entity, Address, City or Town |

Seattle

|

| Entity, Address, State or Province |

WA

|

| Entity, Address, Postal Zip Code |

98134

|

| City Area Code |

206

|

| Local Phone Number |

624-3357

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001083522

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

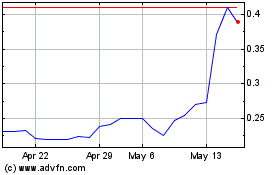

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Sep 2023 to Sep 2024