December 29, 2021 -- InvestorsHub NewsWire -- via Atlas

Advisors, LLC --

NexTech AR

Solutions

(OTCQB:

NEXCF) OUTLOOK

NexTech

Adds to its AR Solutions With the Acquisition of ARWAY to Pursue

the Metaverse

NexTech AR

is a technology start-up and a unique public company pure play

investment in Augmented Reality. It does not produce hardware, but

rather uses AR to improve eCommerce results for customers as well

as its company-owned sites. Its LiveX platform allows remote

learning, virtual trade shows, and high-end conferencing features

integrated with augment reality and is garnering traction. Its AR

ad network and hologram technology should begin to contribute to

revenues later this year. As one of the first movers in a

multi-billion dollar market growing at almost 300% per year,

NexTech should be able to grow rapidly as this nascent market

explodes.

Based on a

peer blended average EV to estimated EV/sales multiple of 9.4xs, we

believe NexTech stock could be worth $14.76 per

share.

Current

Price (12/28/21)

Valuation

SUMMARY

DATA

US$1.60

US$14.76

WHAT’S NEW

NexTech to Buy Spatial Computing Pioneer

ARWAY

By the end

of the month NexTech should close on the acquisition of UK- based

spatial computing company ARWAY in a US$1 million all-stock

transaction (approximately 625,000 shares.) Its key founders Baran

Korkmaz and Nikhil Sawlani will join NexTech. This acquisition will

provide NexTech with a spatial mapping platform critical to

building the Metaverse. ARway provides an Augmented Reality

Software Kit (SDK) to frame the digital world in just a few

minutes. This is achieved using Unity and AI to recognize

surroundings for hyper-accurate location

mapping,

NexTech

will offer this capability to brands and organizations that want to

create mini-metaverses like museums, corporate headquarters, theme

parks, sports stadiums, campuses and more. It can be used for

applications such as navigation, guided tours, and even treasure

hunts. ARWAY’s no-code platform has been used by over 1000

developers in 60 countries, and includes enterprise customers such

as British Telecom, Bosch, Air Asia, The City of London, the

Guildhall School of Music and Drama, HCG Hospital, and

Nomtek.

The product

is sold as SaaS with a freemium model and priced by usage amount.

NexTech is working to integrate all its AR capabilities and making

them available to all its customers through one

login.

Investors

can see how ARWAY works in a video through the following

link: Source: NexTech AR https://www.youtube.com/watch?v=VAn83Dvyx9s

NexTech will offer this capability to brands and

organizations that want to create mini-metaverses like museums,

corporate headquarters, theme parks, sports stadiums, campuses and

more. It can be used for applications such as navigation, guided

tours, and even treasure hunts. ARWAY’s no-code platform has been

used by over 1000 developers in 60 countries, and includes

enterprise customers such as British Telecom, Bosch, Air Asia, The

City of London, the Guildhall School of Music and Drama, HCG

Hospital, and Nomtek.

The product is sold as SaaS with a freemium model

and priced by usage amount. NexTech is working to integrate all its

AR capabilities and making them available to all its customers

through one login.

Investors can see how ARWAY works in a video

through the following link: Source: NexTech AR https://www.youtube.com/watch?v=VAn83Dvyx9s

Q2 Showed Weakness in eCommerce But AR Revenues

Continue to Grow

NexTech is going through a reassessment of it

business model and one of the decisions to be made is how to treat

the eCommerce business. Initially it was contributing positive cash

flow subsidizing the AR business, but in an effort to grow, it

became a cash drain. The company is taking a closer look at

returning that business back to profitability at the expense of

growth and its results may be difficult to forecast until a plan

emerges. In conjunction with a reevaluation NexTech took action in

Q2 to right size the business and expects to cut operating cost by

$6 million a year as it moves to the LiveX platform and adds the

automation capabilities of Threedy. Once the platform offers

self-serve to clients, operating costs should start to plummet.

This is expected to happen by the end of Q4. In Q3 we expect to see

a reduction of $1.5 million primarily payroll, and the benefit

should be seen across expense lines as well as gross margin. The

company has $15 million in the bank and plans to get the cash burn

to under $1.5 million a month. We expect Q3 to show sequential

revenue improvement combined with improved profitability looked at

without the one-time gain of Q2.

Q2 2021 Results

NexTech reported a down sequential quarter, but

still up 73% year over year. ECommerce reported revenues of $4.4

million, up from $3.1 million in Q2 2020 or 43%. ECommerce cut back

its discounting and is focusing on more profitable sales in

order to return to contributing to the company’s cash

generation. By comparison, eCommerce generated $1.6 million in

fewer sales in Q2 than Q1, but that $1.6 million only contributed

$88,000 in profits.

Zacks Investment

Research Page 2 scr.zacks.com

The technology services plus renewable software

licenses revenues were essentially flat sequentially at $1.7

million, but up from $431,000 last year. In addition to a

seasonally slow summer, the hope of a return to in- person events

shifted some plans from virtual. But that trend has reversed as

certain geographies have put stricter measures in place. Jolokia

was bought April 30, 2020 so next quarter will be the first with a

full quarter of revenues in 2020 to which to

compare.

Backlog was up $249,000 sequentially to $2.3

million, while bookings were down to $1.7 million from $2.2 million

in Q1 2021.

Gross margin was 37.6% of revenues or $2.3 million

compared to 61.5% and $2.2 million a year ago and 42.9% or $3.3

million in Q1 2021. The decline in margin was due to product

discounts in eCommerce as well as compensation associated with

virtual events.

Operating expenses were $8.1 million compared to

$4.2 million last year. Of this, $1.5 million was a one-time gain

on reevaluation of contingent consideration on the purchase of

Jolokia upon its anniversary. Without that operating expenses would

have been $9.6 million, still a reduction from the $13.0 million in

Q1 2021. The company is working to reduce expenses going forward

through staff reduction, and we hope to see a full quarter of

savings by Q4 2021.

The operating loss was $5.8 million compared to

$2.0 million a year ago and $9.7 million in Q1 2021. Without the

one-time gain it was a loss of $7.3 million. The net loss was $5.9

million versus $2.0 million and EPS loss was $0.07 compared to

$0.02 a year ago. Non-IFRS loss was $6.8 million compared to $1.4

million last year. Non-IFRS loss per share was $0.08 versus

$0.02.

Primary shares outstanding were 82.3 million for

the period, up 25%. The share count as of August 11th was 85.6

million.

The company showed an operating cash flow and free

cash flow loss of $6.6 million for the quarter. The company is

working to reduce its burn.

Balance Sheet

Update

NexTech ended the June quarter with $15.4 million

in cash, working capital of $17.6 million, and no debt or

convertible debentures. On April 8, 2021, NexTech issued 2,801,500

units at $5.00 per unit and 100,000 warrants at a price of $0.5429

per warrant for gross proceeds of $14,061,790 and net of

$12,844,837. Each unit is one share of common and one-half of one

common share purchase warrant. Warrants are exercisable at $6.00

for a period of two years, subject to accelerated expiry

provisions. The Threedy acquisition,

which

th

closed on June 25 , added 3,877,551 more

shares.

During Q2

On June 25, 2021, NexTech acquired Threedy.ai, for

US$9.5 million in stock. Threedy’s proprietary AI will allow

the production of 3D models at a much quicker

pace.

Paul Duffy was appointed Chairman of the Board,

Chris Burton, Executive Vice President Head of Global Sales, and

Andrew Chan Chief Financial

Officer.

NexTech released the “LiveX” Digital

Experience Platform that enables Augmented Digital Experiences, AR

E-Commerce, AR Advertising, and AR

Products.

Zacks Investment

Research Page 3 scr.zacks.com

KEY POINTS

- NexTech AR is a

startup based in Toronto that was formed to provide services for,

and invest in, businesses using Augmented Reality (AR) and hologram

technologies. These technologies are used to improve sales and

profits for eCommerce sites, and other verticals such as

entertainment and education. This technology converts

two-dimensional images of real objects and people into three

dimensions. Using AR is a proven way to boost sales and reduce

returns in eCommerce, and provides an engaging, economic way to

provide information in the education and training

space.

- Augmented Reality (AR)

is just beginning to make its way into mainstream use and the

market is exploding. NexTech AR is the only public pure play we

know of that is providing services to allow companies to use AR in

marketing and advertising their goods. At a small price to vendors

per month per SKU, adoption of just a tiny percent of the trillions

of products sold worldwide will create a massive revenue stream for

NexTech AR.

- The company is

currently has four sources of

revenue:

o Its largest revenue generator is an

eCommerce business that is used as a test lab and is driven by the

use of AR and holograms in its marketing. Its main web site sells

vacuum cleaners and accessories. It recently has started to expand

the number of brands it carries. It uses these web sites primarily

for in house testing, and cash flow generation but we could see the

company ultimately reselling them or spinning them off later at

higher valuations.

o ItprovidestheplatformLiveX,thatallowsremotemeetingsintegratedwithaugmentedrealitywith

more security and features than available from mainstream video

conferencing platforms, but will work with them

seamlessly.

o It also has a SaaS offering to businesses

that places AR renderings created by NexTech AR, or by the customer

themselves, for use on their shopping websites and mobile apps, or

in ad campaigns. ECommerce customers are charged a monthly fee

based on the number of SKUs.

o In the future it will start to generate

revenues from its new AR ad network, which allow customers to place

their AR content in advertisements with one stop shopping,

holograms and spatial mapping.

With a nascent market projected to increase

by 289% per year over the next five years, NexTech as a unique

public pure play that could deserve a higher valuation. It

currently trades at an enterprise value of approximately US $122

million or 4.7xs projected 2021 calendar sales of US$26

million.

VALUATION

Since our last report, the valuation of NexTech

comps have come down, as have most of the tech names, particularly

those that benefited from work at home. We have taken a group of

companies involved in augmented reality as well as companies that

provide conferencing. At current valuations we get an average of

17.0 times EV/2021 Sales. So using US$26 million for 2021 estimated

sales, and a 17.0 multiple, NexTech could be worth an enterprise

value as high as US$425 million or a market value of $440 million.

Dividing by the current fully diluted shares of approximately 87

million, this would be a market value of US$5.07 per share. Even if

we were to split out the eCommerce revenues and give it a separate

lower

Zacks Investment

Research Page 4 scr.zacks.com

multiple we still get a blended multiple of 5.9

times or a stock price of US$1.95. By next year that could be $4.76

using revenues of $44 million and 9.4 times with a 50/50

split.

Company

Calendar Calendar

Ticker Revenue Revenue EBIDTA Enterprise Value / Sales

Included

2022E 2021E LTM Margin 2022E 2021E LTM in

Average?

FLWS AMZN

NA 2,233 581,180

490,270

2,050 443,300

9% NA 1.0 13% 2.9 3.5 8% 0.9 1.0 3% 0.8 0.9 3% 0.4

0.4 13% NA 1.6 0% 3.6 4.4

1.5 1.8

1.1 y 3.8 y 1.1 y 0.9 y 0.4 y 1.7 y 5.1

y

LE 1,760 OSTK 3,190 CNXN

2,870

1,640 1,530 2,840 2,900 2,770

2,670

PETS CHWY

NA 295 10,830 8,950

292 7,660

PRTS 614 532 539 1% W 19,040 15,840 14,850

5%

1.7 1.7 y 2.1 2.2 y

1-800 Flowers Amazon

Land's End Overstock.com PC Connection PetMed Express

Chewy

US Auto Parts Network

Wayfair

Average

Company

Ticker

Calendar Calendar Revenue

Revenue

6.2% 1.3 1.8 2.0

EBIDTA Enterprise Value /

Sales

Included

in Average?

y y y y

Enterprise Value

2,160 1,700,000 1,610 2,480 1,150 485 39,370 909

33,320

197,943

Enterprise Value

229,000 122,000 334

103,100

90,918

2022E 2021E LTM Margin

2022E

2021E LTM

8.8 10.2 31.2 36.5 2.2 2.8 26.0

31.4

17.0 20.3

Salesforce CRM 31,070 26,000 22,350 16% 7.4 Snap

SNAP 5,760 3,910 3,340 -20% 21.2 WiMi Hologram Cloud WIMI 194 153

118 -17% 1.7 Zoom ZM 4,000 3,970 3,280 30%

25.8

Average 14.0

RISKS

- NexTech is a start-up

with limited operating history. There is no assurance its will

evolve into a sustainable, profitable going

concern.

- The company is

operating at a loss and may continue to need to raise capital until

it reaches cash flow break even which could result in dilution of

current shareholders.

- To date, NexTech has

depended heavily on funding from senior

management.

- AR usage is just

beginning to be used by early adopters and it is hard to predict

how fast or even if AR will be put into use by mainstream eCommerce

sites. The company’s business with AR customers is still

very small and has yet to garner meaningful

traction.

- This industry will

attract many larger companies with much greater resources who could

compete with NexTech in the

future.

- The company has just

launched new product lines, which make take more resources and time

than expected and may not be

successful.

- With the return to

normal business operations, the need for InfernoAR’s remote

capabilities may wane.

Zacks Investment

Research Page 5 scr.zacks.com

OWNERSHIP

DISCLOSURES

The following disclosures relate to relationships

between Zacks Small-Cap Research (Zacks SCR), a division of Zacks

Investment Research (ZIR), and the issuers covered by the Zacks SCR

Analysts in the Small-Cap Universe.

ANALYST DISCLOSURES

Zacks SCR Analysts hereby certify that the view

expressed in this research report or blog article accurately

reflect the personal views of the analyst about the subject

securities and issuers. Zacks SCR also certifies that no part of

any analysts’ compensation was, is, or will be, directly or

indirectly, related to the recommendations or views expressed in

this research report or blog article. Zacks SCR believes the

information used for the creation of this report or blog article

has been obtained from sources considered reliable, but we can

neither guarantee nor represent the completeness or accuracy of the

information herewith. Such information and the opinions expressed

are subject to change without notice. The Zacks SCR Twitter is

covered herein by this disclosure.

INVESTMENT BANKING AND FEES FOR

SERVICE

Zacks SCR does not provide investment banking

services nor has it received compensation for investment banking

services from the issuers of the securities covered in this report

or article.

Zacks SCR has received compensation from the issuer

directly, from an investment manager, or from an investor relations

consulting firm engaged by the issuer for providing non-investment

banking services to this issuer and expects to receive additional

compensation for such non- investment banking services provided to

this issuer.

The non-investment banking services provided to the

issuer include the preparation of this report, investor relations

services, investment software, financial database analysis,

organization of non-deal road shows, and attendance fees for

conferences sponsored or co-sponsored by Zacks

SCR.

Each issuer has entered into an agreement with

Zacks to provide continuous independent research for a period of no

less than one year in consideration of quarterly payments totaling

a maximum fee of $40,000 annually.

POLICY DISCLOSURES

This report provides an objective valuation of the

issuer today and expected valuations of the issuer at various

future dates based on applying standard investment valuation

methodologies to the revenue and EPS forecasts made by the SCR

Analyst of the issuer’s business.

SCR Analysts are restricted from holding or trading

securities in the issuers that they cover. ZIR and Zacks SCR do not

make a market in any security followed by SCR nor do they act as

dealers in these securities. Each Zacks SCR Analyst has full

discretion over the Valuation of the issuer included in this report

based on his or her own due diligence. SCR Analysts are paid based

on the number of companies they

cover.

SCR Analyst compensation is not, was not, nor will

be, directly or indirectly, related to the specific valuations or

views expressed in any report or

article.

ADDITIONAL

INFORMATION

Additional information is available upon request.

Zacks SCR reports and articles are based on data obtained from

sources that it believes to be reliable, but are not guaranteed to

be accurate nor do they purport to be complete. Because of

individual financial or investment objectives and/or financial

circumstances, this report or article should not be construed as

advice designed to meet the particular investment needs of any

investor. Investing involves risk. Any opinions expressed by Zacks

SCR Analysts are subject to change without notice. Reports or

articles or Tweets are not to be construed as an offer or

solicitation of an offer to buy or sell the securities herein

mentioned.

CANADIAN COVERAGE

This research report is a product of Zacks SCR and

prepared by a research analyst who is employed by or is a

consultant to Zacks SCR. The research analyst preparing the

research report is resident outside of Canada, and is not an

associated person of any Canadian registered adviser and/or dealer.

Therefore, the analyst is not subject to supervision by a Canadian

registered adviser and/or dealer, and is not required to satisfy

the regulatory licensing requirements of any Canadian provincial

securities regulators, the Investment Industry Regulatory

Organization of Canada and is not required to otherwise comply with

Canadian rules or regulations.

Zacks Investment

Research Page 10 scr.zacks.com

SOURCE: Atlas Advisors, LLC

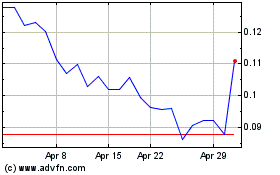

Nextech3D ai (QX) (USOTC:NEXCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nextech3D ai (QX) (USOTC:NEXCF)

Historical Stock Chart

From Apr 2023 to Apr 2024