Sigma-Aldrich Inks Deal with Olink - Analyst Blog

February 14 2013 - 12:20PM

Zacks

Sigma Life Science, the innovative biological products and

services business unit of Sigma Aldrich

Corporation (SIAL), has entered into an agreement with

Olink Bioscience to distribute Duolink In Situ products globally.

The product contains a new protein interaction analysis technology

used for imaging and measuring protein-protein interactions in

unmodified cells.

Per the agreement, Duolink products will work in sync with Sigma

Life Science’s antibody portfolio and allow researchers to target

and analyze the precise protein of interest. The synergy between

the partners will help scientific community to access the global

support network and increase the adoption of the Duolink

Technology.

The patented PLA technologies used in Duolink products enables

rapid detection of single protein-protein interactions and

recognition of relative changes in post-translational modification

events.

This highly adaptable Duolink technology can be used along with

CompoZr Zinc Finger Nuclease-mediated gene editing to track

knocked-out or knocked-in genes. It can also be used with MISSION

RNA interference technologies to track protein expression following

gene knockdown.

Sigma-Aldrich is a leading life sciences company. A few days

ago, it released its fourth-quarter 2012 results. The company

posted adjusted earnings (excluding items) of 96 cents per share in

the quarter compared with the year-ago earnings of 91 cents per

share. The results beat the Zacks Consensus Estimate of 95

cents.

Profit, as reported, rose roughly 7% year over year to $116

million (or 96 cents per share) in the quarter from $108 million

(or 89 cents per share) a year ago. Acquisitions (including

BioReliance) and gains across overseas markets aided the results.

Revenues rose 7% year over year to $655 million in the quarter but

missed the Zacks Consensus Estimate of $660 million.

Sigma-Aldrich expects low-to-mid single digit organic sales gain

in 2013. It envisions adjusted earnings per share in the band of

$4.10 to $4.20 for the year.

Sigma-Aldrich’s BioReliance acquisition and expansion

initiatives in Asia Pacific and other high growth markets are

expected to continue to add to its growth. However, the company’s

research business is still facing economic challenges due to

uncertainties in the U.S. and Europe.

Sigma-Aldrich currently maintains a Zacks Rank #3 (Hold).

Other companies in the specialty chemical space with favorable

Zacks Rank are American Pacific Corporation

(APFC), Novozymes A/S (NVZMY) and Penford

Corporation (PENX). All of them hold a Zacks Rank #1

(Strong Buy).

AMER PAC CORP (APFC): Free Stock Analysis Report

(NVZMY): ETF Research Reports

PENFORD CORP (PENX): Free Stock Analysis Report

SIGMA ALDRICH (SIAL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

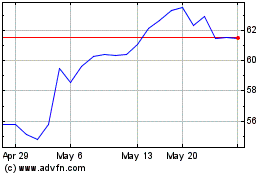

Novenesis AS (PK) (USOTC:NVZMY)

Historical Stock Chart

From Oct 2024 to Nov 2024

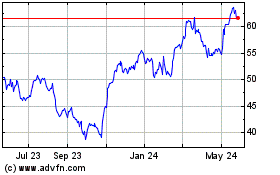

Novenesis AS (PK) (USOTC:NVZMY)

Historical Stock Chart

From Nov 2023 to Nov 2024