Regulatory News:

Sodexo (NYSE Euronext Paris FR 0000121220-OTC:

SDXAY)(Paris:SW)(OTCBB:SDXAY): at the Board of Directors meeting on

April 16, 2013, chaired by Pierre Bellon, Chief Executive Officer

Michel Landel presented the Group’s performance for the first half

of Fiscal 2013.

Financial performance for first half Fiscal 2013:

millions of euros

First HalfFiscal 2013(ended

February28, 2013)

First HalfFiscal 2012(ended

February29, 2012)

Changeat currentexchange rates

Changeat constantexchange rates

3

Revenues 9 463 9 069

+ 4.3% + 2.8% Organic

growth + 2.1% + 6.4%

Operating profitbefore exceptional

items2

528 533

- 0.9% - 1.1%

Exceptional items4

(50) 26

Operating

profit - reported

478

559 - 14.5% -

14.7% Tax rate

39%

35.6%

Group net income5

236 297

- 20.5% - 20.9%

Gearing

33%

38%

Feb. 28, 2013

Feb. 29, 2012

1 Excluding positive impact of Rugby World Cup in Fiscal 2012.2

Before expenses in first half Fiscal 2013 related to operational

efficiency improvement program announced in November 2012 and

favorable impact from UK pensions in first half Fiscal 2012.3 The

currency impact is determined by applying the average exchange rate

for the first half of the previous year to the figures for the

first half of the current year.4 Expenses related to operational

efficiency improvement program in first half Fiscal 2013 and

favorable impact from UK pensions in first half Fiscal 2012.5 After

exceptional items and effects of new tax measures, particularly in

France (tax on dividends and non-deductibility of interest

expenses).

Commenting on these figures, Sodexo CEO Michel Landel

said:

"In a more difficult economic environment, Sodexo is showing

good resilience. Our Quality of Life services offer continues to be

successful. Our clients are increasingly interested in our wide

range of integrated services. Our leading position in emerging

markets is also a driver of future growth. The operational

efficiency improvement and cost reduction program, already

underway, will be further enlarged. We are confident in the future

and are maintaining our objectives for Fiscal 2015."

Revenue growth of + 4.3%

Consolidated revenues for the first half of Fiscal 2013 were 9.5

billion euro, an increase of + 4.3%, including + 0.7% from

acquisitions and changes in scope and + 1.5% from currency

impacts.

Organic growth

Organic revenue growth in the first half of Fiscal 2013 was +

2.1%, or + 2.7% excluding the positive impact from the Rugby World

Cup on the first quarter of Fiscal 2012.

Organic growth for On-site Services was + 2% and + 2.7%,

excluding Rugby World Cup. The first half of Fiscal 2012 had

benefited from the 53 million euro in revenue generated by the 2011

Rugby World Cup.

Facilities management services accounted for over one quarter of

consolidated revenue. As was the case in the last two fiscal years,

revenues from these services are continuing to grow three times

faster than foodservices revenues, providing renewed confirmation

of the relevance of the Group’s strategic positioning.

Organic growth in Benefits and Rewards Services6

was +4.3%, reflecting:

- continued dynamism in Latin America,

and

- slightly higher performance than in the

second half of Fiscal 2012 (adjusted for the decrease in activity

in Hungary resulting from unfavorable legislation introduced in

that country on January 1, 2012) .

1 Formerly Motivation Solutions

Changes in scope

Acquisitions contributed + 0.7% to the Group's growth in the

first half and include the following acquisitions completed since

the beginning of the fiscal year:

- Servi-Bonos (Benefits and

Rewards Services in Mexico) in November 2012, a leader in Mexico’s

checks and vouchers market.

- MacLellan (Technical Services,

in India) in December 2012; a major Indian facilities management

services company with specific expertise in air conditioning,

heating, maintenance and energy management services.

Acquisitions made during the prior year, including Roth

Bros (facilities management, U.S., November 2011) and

Lenôtre (France in September 2011) also contributed to a

lesser extent.

Operating profit

Reported operating profit was 478 million euro, a decline of -

14.5% at current exchange rates and - 14.7% at constant rates.

Responding to the current macro-economic environment, the Group

Chief Executive Officer launched an operational efficiency

improvement and cost reduction program at the start of the fiscal

year. This program should allow Sodexo to reduce site operating

costs by the equivalent of 0.6% of revenue and overheads by the

equivalent of 0.4% of revenue, using Fiscal 2012 as the baseline,

over the period to Fiscal 2015. Exceptional costs of 50 million

euro have been recorded in the first half of Fiscal 2013 in

relation to this program.

millions of euro

First HalfFiscal 2013

First HalfFiscal 2012

Change

At currentexchange rates

At constantexchange rates

Operating profitbefore exceptional items

528 533

- 0.9% - 1.1%

Exceptional items

Included in gross profit (30)

-

Included in overheads (20)

-

Accounting adjustment to pension

liabilities

- 26

TOTAL exceptional items

(50) 26

Reported operating profit

478 559

-14.5% -14.7%

Operating profit before exceptional expenses was 528 million

euro in the first half of Fiscal 2013 compared with 533 million

euro in the prior year period (excluding exceptional income), a

decline of - 0.9% at current exchange rates and - 1.1% at constant

rates.

The On-site Services activities in North America, the UK and

Ireland and the Rest of the World (Latin America, Africa, Middle

East, Asia, Australia and Remote Sites) all increased their

contribution to operating profit (excluding currency effects).

Operating profit from the Benefits and Rewards Services activity

was also higher. However, the contribution from On-site Services in

Europe deteriorated as compared to the prior year period.

Consolidated operating margin1 stood at 5.6% versus 5.9% in the

first half of Fiscal 2012.

1 Operating margin before exceptional expenses related to the

operational efficiency improvement program in first half Fiscal

2013 and favorable impact from UK pensions in first half Fiscal

2012.

Group net income

Group net income was 236 million euro compared with 297

million euro in the prior year period. This result includes the

impact of exceptional expenses generated by the operational

efficiency improvement program as well as the effects of new fiscal

measures, particularly in France (tax on dividends and

non-deductibility of interest expense borrowing).

Debt levels and cash flows

- As of February 28, 2013, net debt was

961 million euro and gearing was 33% (compared to 38% as of

February 29, 2012). The Group's financial ratios are very

strong.

- Net cash provided by operating

activities was 37 million euro, a decline of 278 million euro

compared to the same period last year. Three main factors explain

this variation:

- Benefits and Rewards Services

investments for the period in higher-return financial instruments

with longer maturities (100 million euro impact).

- Changes in exceptional items included

in operating profit for the two periods (76 million euro

impact).

- A slight deterioration in the days

sales outstanding ratio.

- By contrast, net cash used in investing

activities reduced in the first half of Fiscal 2013. The first half

of Fiscal 2012 included 576 million euro related to acquisitions

(mainly Puras do Brasil, Roth Bros in the United States and Lenôtre

in France).

- Investments for the first half of

Fiscal 2013 included:

- Net capital expenditure and client

investments for 113 million euro, representing approximately 1.2%

of revenues.

- Acquisitions for 81 million euro,

mainly Servi-Bonos in Mexico.

Awards

- In March 2013, Sodexo was again listed

among the "Most Admired Companies" in FORTUNE magazine,

which evaluates the reputation of the largest companies in the

world. Sodexo was ranked number one in its industry category,

"Diversified outsourced services."

- For the sixth consecutive year, Sodexo

was recognized in January 2013 by Sustainable Asset Management

(SAM) in its prestigious "2013 Sustainability Yearbook"

report for its commitment in terms of economic, social and

environmental responsibility and was awarded three prizes:

Sector Leader, Gold Class and Sector Mover.

Outlook

At the April 16, 2013 Board of Directors’ meeting, Michel Landel

reminded the Board of the relevance of the Group’s long-term

strategy, founded on a unique Quality of Life services offer, an

unsurpassed global network for its activities and uncontested

leadership in emerging economies.

During this meeting he confirmed his confidence in the Group’s

medium-term objectives. He noted that between Fiscal 2005 and

Fiscal 2012, revenues grew by an average 6.7% per year. The

initiatives undertaken by Sodexo over several years will allow the

Group to continue its growth, improve its competitiveness and

continue to invest in its transformation.

Michel Landel noted that the operational efficiency

improvement and cost reduction program announced in November

2012 is well underway. In this regard, he confirmed that all teams

are fully mobilized around specific actions to reinforce the

Group’s competitiveness. This program will be reinforced, given

the economic context. At present, the Group considers that the

implementation of this program will result in exceptional charges

of between 180 and 200 million euro over a period of 18 months,

beginning September 2012, and will have a favorable effect for the

same amount in Fiscal 2015 and subsequent years.

Given the first half performance and current trends in the

economic environment, Michel Landel provided the following

objectives for Fiscal 2013:

- Organic revenue growth between 1% and

2%

- Stable operating profit1 compared with

Fiscal 2012

Sodexo confirms its confidence in achieving its objective of a

consolidated operating margin of 6.3% by the end of Fiscal

2015.

In addition, the Group maintains its medium-term objective of

+ 7% average annual consolidated revenue growth.

Michel Landel noted Sodexo’s numerous strengths:

- Its integrated services offer;

- Its choices for development which

capitalize on the experience and competence of its teams in each

client segment and sub-segment;

- Its solid growth dynamic in emerging

economies, where the Group continues to reinforce its

positions;

- The engagement and motivation of its

teams.

1 Excluding currency impacts and before exception items in

Fiscal 2012 and Fiscal 2013.

Analyst briefing

Sodexo will hold a conference call (in English) today at 8:30

a.m. (Paris time), to comment on the first half results for

Fiscal 2013. The presentation can be followed via webcast at

www.sodexo.com. The press release and the presentation will be

available on the Group website: www.sodexo.com under the "latest

news" section beginning at 7:00 a.m. A recording of the conference

will be available until May 1 by dialing +44 (0) 1452 550

000, followed by the pass code 25 63 74 95.

Financial communications schedule

Nine months revenues July 10, 2013 Annual

results November 14, 2013

Key figures (as of August 31, 2012)18.2 billion

euro consolidated revenue420,000 employees20th

largest employer worldwide80 countries34,300

sites75 million consumers served daily11.1 billion

euros market capitalization (as of April 17, 2013)

About Sodexo

Founded in 1966 by Pierre Bellon, Sodexo is the global leader in

services that improve Quality of Life, an essential factor in

individual and organizational performance. Operating in 80

countries, Sodexo serves 75 million consumers each day through its

unique combination of On-site Services, Benefits and Rewards

Services and Personal and Home Services. Through its more than 100

services, Sodexo provides clients an integrated offering developed

over more than 45 years of experience: from reception, safety,

maintenance and cleaning, to foodservices and facilities and

equipment management; from Meal Pass, Gift Pass and Mobility Pass

benefits for employees to in-home assistance and concierge

services. Sodexo’s success and performance are founded on its

independence, its sustainable business model and its ability to

continuously develop and engage its 420,000 employees throughout

the world.

Principal risks and uncertainties

There were no significant changes to the principal risks and

uncertainties identified by the Group in the "Risk Factors" section

of the Fiscal 2012 Registration Document filed with the AMF

November 12, 2012.

This press release contains statements that may be considered as

forward-looking statements and as such may not relate strictly to

historical or current facts. These statements represent

management's views as of the date they are made and Sodexo assumes

no obligation to update them. The reader is cautioned not to place

undue reliance on these forward-looking statements.

APPENDIX 1

Comments by activity and geographical area

All of the following data in this document relating to operating

profit do not include exceptional items1

1. On-site Services

Revenues

(millions of euro)

First HalfFiscal 2013

First HalfFiscal 2012

Organicgrowth

Currencyeffect

Acquisitions

Change at currentexchange

rates

On-site Services North America

3,602 3,420

+

1.3% + 3.2% + 0.8%

+ 5.3% Continental Europe

2,949 2,892

+

0.9% + 0.6% + 0.5%

+ 2.0% Rest of the World

1,838 1,708

+

7.2% + 0.2% + 0.2%

+ 7.6% United Kingdomand Ireland

700 680

- 2.6% + 3.9% +

1.6% + 2.9%

Total

9,089 8,700

+

2% + 1.8% + 0.7%

+ 4.5%

On-site Services revenue was 9.1 billion euro, up + 4.5%

compared with the first half of Fiscal 2012. Organic revenue growth

was + 2%, or + 2.7% excluding the positive impact on revenue for

the prior year period from the 2011 Rugby World Cup.

(millions of euro)

First HalfFiscal 2013

First HalfFiscal 2012

Organicgrowth

Acquisitions

Currencyeffects

Total growth Corporate

4,719 4,444

+ 3.9%

Healthcare and Seniors

2,177 2,134

- 0.4%

Education

2,193 2,122

+ 0.6%

Total 9,089

8,700

+ 2.0%

+ 0.7% +

1.8% + 4.5%

- Organic growth in the Corporate

segment was + 3.9% for the first half of Fiscal 2013, or +

5.1% excluding the impact of the 2011 Rugby World Cup.

Growth was mainly driven by:

- Increased demand from companies in

North America and Europe for integrated service contracts.

- A healthy rate of growth for Sodexo in

Asia, Africa, Middle East, Remote Sites and, in particular, Latin

America, despite the economic slowdown observed since last

summer.

Concerning foodservices, notably in Europe, the slowdown has

intensified since the start of the fiscal year. Efforts by clients

to find additional cost savings and to reduce employee numbers,

along with lower consumer spending, weighed on revenue growth in

several countries.

- The - 0.4% decline in

Healthcare and Seniors was due to the lower client retention

rate in North America in Fiscal 2012. Since the start of Fiscal

2013, Sodexo’s teams in the United States have won a number of

contracts that should lead to a gradual return to growth in this

client segment in the coming months.

- In Education organic revenue

growth was + 0.6%, reflecting a more selective approach to

new contracts in the public school sector.

1 Expenses related to operational efficiency improvement program

in first half Fiscal 2013 and favorable impact from UK pensions in

first half Fiscal 2012.

Operating profit

Operating profit of 427 million euro reflected a slight

decrease (- 0.7%) compared to the prior year period. The On-Site

Services activities in North America, the United Kingdom, Ireland

and the Rest of the World region (Latin America, Africa, Middle

East, Asia, Australia and Remote Sites) all increased their

contribution to operating profit (excluding currency effects).

However, the contribution from Continental Europe deteriorated

compared to the prior year period due to the region’s unfavorable

economic environment.

Analysis by geographic region, On-site Services

1.1 North America

Revenues

(millions of euro)

First HalfFiscal 2013

First HalfFiscal 2012

Organicgrowth

Acquisitions

Currencyeffects

Totalgrowth

Corporate 792 700

+ 6.3%

Healthcare and Seniors

1,253 1,234

- 1.6%

Education

1,557 1,486 + 1.4%

Total 3,602

3,420 + 1.3%

+ 0.8% +

3.2% + 5.3%

Revenues in North America were 3.6 billion euro, up + 5.3%

compared with the first half of Fiscal 2012, and included organic

growth of + 1.3%.

Organic growth in Corporate was a high + 6.3%. This

performance was mainly attributable to the increase in facilities

management services for clients such as General Electric, the

contribution of new contracts such as the prestigious Circuit of

the Americas, home to the United States Formula 1 Grand Prix, and

growth in the Remote Sites business in Canada.

Sodexo won several new contracts during the first half,

including with Siemens in Canada (44 sites, integrated services),

Harley Davidson, Inc. (Wisconsin) and General Electric Aero &

Healthcare Systems (South Carolina and New Jersey).

Healthcare and Seniors revenues decreased by -

1.6%, due to weak growth in Fiscal 2012 and a decline in the

client retention rate, with first half of Fiscal 2013 revenue

bearing the full brunt of the lost Ascension Health System

contract. Since the start of Fiscal 2013, Sodexo’s teams have

achieved several major contract wins that should help drive a

return to growth in the coming months, notably with the gradual

ramp-up of the major contract with HCR ManorCare, one of the United

States’ largest retirement home operators with 290 homes in 32

states and some 40,000 residents. When services under the contract

are fully deployed, annual revenues are expected to reach 220

million US dollars.

Other contracts won during the period included the signature of

contracts with Health Corporation of America (HCA) East Florida (9

hospitals), LA County (two UCLA Medical Center sites in

California), Ochsner Medical Center (Louisiana), Saint Joseph’s

John Knox Village (Florida) and University of Arizona Medical

Center.

In Education, organic revenue growth came to +

1.4%. Growth in site revenue was tempered, as a result

of:

- A decline in the number of meals served

following implementation of the Healthy and Hunger-Free Kids Act,

which has changed schoolchildren’s eating habits.

- Lower spending by students and fewer

events at the sports stadiums on university campuses.

New contracts signed during the period included Bethune Cookman

University (Florida), St John’s College (Maryland) and

Confederation College (Ontario, Canada).

Operating profit

Operating profit amounted to 244 million euro, up + 8.0%

or + 4.9% excluding the currency effect. Operating margin stood at

6.8% versus 6.6% in the first half of Fiscal 2012, reflecting tight

control over all operating costs and productivity gains,

particularly in the Corporate segment.

1.2 Continental Europe

Revenues

(millions of euro)

First HalfFiscal 2013

First HalfFiscal 2012

Organicgrowth

Acquisitions

Currencyeffects

Totalgrowth

Corporate 1,730 1,678

+ 1.6%

Healthcare and

Seniors 706 705

- 0.4%

Education

513 509 + 0.4%

Total 2,949

2,892 +

0.9% + 0.5%

+ 0.6% + 2,0 %

In Continental Europe, revenues totaled

2.9 billion euro, with organic growth of + 0.9%.

Performances were mixed, with more significant slowdowns in

activity on sites in several countries, particularly France, the

Netherlands, Germany and Italy, contrasting with a continued strong

dynamic in Russia and Sweden.

The + 1.6% organic growth in the Corporate segment

was led by the ramp up of contracts with a significant facilities

management services component throughout Europe. In France, revenue

was also boosted by the opening of a new site in Nantes and the

launch of additional services for the Justice Ministry. Recent

marketing successes included the signature of a new contract with

DNB (Norway) and renewal of the KLM contract in the Netherlands as

well as the Safran and Amundi contracts in France.

In Healthcare and Seniors, revenues were down -

0.4%. This was partly the result of applying a more

selective approach to new business in Southern Europe and it also

reflected soft growth in site revenues, due to clients’ strict

controls over spending. Sodexo's teams nonetheless won several

major contracts, particularly in France with Nouvelles Cliniques

Nantaises.

Education organic revenue growth came to + 0.4%,

representing an improvement on Fiscal 2012. The first half saw

continued application of a selective development policy. Growth in

site revenue was modest, particularly in Spain and Italy due to

pressure on school budgets leading to a reduction in the number of

services purchased. Contract wins included the Fonte Nuova city’s

schools in Italy, Darussafaka Okul in Istanbul, Turkey, and the

Recollets private school group in Longwy, France.

Operating profit

At 103 million euro, operating profit was down by 28

million euro excluding the currency effect. The decline was mainly

due to lower foodservices volumes and also to pricing pressure from

clients seeking to cut costs, which meant that the Group was only

able to pass on to clients a portion of the increase in wages,

payroll taxes and food prices. The Sports and Leisure activities in

France, which have high fixed costs, were also affected by the

decline in the number of tourists and unfavorable weather

conditions. As a result of these developments, operating margin

weakened to 3.5% from 4.5% in the first half of Fiscal 2012.

1.3 Rest of the World

(Latin America, Middle East, Asia, Africa, Australia and Remote

Sites)

Revenues

(millions of euro)

First HalfFiscal 2013

First HalfFiscal 2012

Organicgrowth

Acquisitions

Currencyeffects

Totalgrowth

Corporate 1,701 1,573

+ 7.9%

Healthcare and

Seniors 84 75

+ 9.3%

Education

53 60 - 13.4%

Total 1,838

1,708 +

7.2% + 0.2%

+ 0.2% + 7.6%

In the Rest of the World (Latin America, Middle East, Asia,

Africa, Australia and Remote Sites), Sodexo reaffirmed its

leadership in emerging and high potential markets. Revenues for the

first half of 2013 came to 1.8 billion euro, reflecting organic

growth of + 7.2%.

Despite a sharp decline in manufacturing activity in emerging

markets, the Corporate segment continued to enjoy robust

organic growth. This performance attested to Sodexo's expertise in

serving mining companies in Australia and Latin America. However,

completion of several construction projects in Remote Sites had a

2% negative impact on revenues.

Lastly, even though growth in revenues from existing clients

softened, particularly in India, Brazil and China, Sodexo delivered

another excellent sales performance in these markets with business

development rates topping 10%. Many contracts were signed during

the period, for example with AstraZeneca (China), Australian

Submarine Corporation (Australia), Visteon Automotive Systems and

Nestlé (India), Electrolux (Brazil), Pacific Rubiales Energy (one

of Colombia’s leading oil and gas companies) and Hyundai

Engineering and Construction Co. Ltd (Oman).

Sodexo also partnered with the French Post Office to win a

contract to provide postal support services (collection, delivery

and distribution of letters and parcels) for the 19,000 people

living on French army bases around the world. This innovative

project will leverage Sodexo’s expertise in supplying on-site

services in harsh environments.

The Healthcare and Seniors segment continued to grow in

Asia and Latin America, with contract wins including the Renmin

University Hospital Wuhan (China). The decline in Education

revenue was due to the non-renewal of a public schools contract in

Chile.

Operating profit

Operating profit amounted to 47 million euro, an increase of +

4.7% excluding the currency effect. During the first half, Puras do

Brasil, a Brazilian company acquired at the beginning of Fiscal

2012 continued to be integrated in the Group. This acquisition

doubled the On-site Services revenue base in Brazil, lifting the

Group to the no.1 position in this market, which offers

considerable medium-term growth potential. The first half also saw

significant food price inflation in several countries, particularly

Brazil. Operating margin stood at 2.6% versus 2.5% in the first

half of Fiscal 2012.

1.4 United Kingdom and Ireland

Revenues

(millions of euro)

First HalfFiscal 2013

First HalfFiscal 2012

Organicgrowth

Acquisitions

Currencyeffects

Totalgrowth

Corporate 495 493

- 4.7%

Healthcare and Seniors

135 119

+ 5.8%

Education

70 68 - 2.6%

Total 700

680 - 2.6%

+ 1.6% + 3.9%

+ 2.9%

On-site Services revenues in the United Kingdom and Ireland

totaled 700 million euro. Excluding the favorable effect of the

2011 Rugby World Cup hospitality contract in the first half of the

prior year, organic revenue growth in the first half of Fiscal 2013

was + 5.6%.

Corporate revenues for the period were up by a robust +

6.8% (excluding Rugby World Cup revenues). This performance was

attributable to the roughly 13 million euro in revenues earned

during the London Paralympic Games in early September 2012 and to

the ramp-up of several integrated service contracts including with

Unilever, AstraZeneca and Eli Lilly.

In Healthcare and Seniors, organic revenue growth

accelerated to + 5.8%, led by expanded services provided in

connection with the contract with North Staffordshire University

Hospital and the start-up of an integrated services contract at

Brighton and Sussex University Hospital.

Education revenues contracted by - 2.6% on an organic

basis, reflecting the continuing selective approach to new business

in the public schools sector. Recent contract wins included St.

Flannans College in Ennis (Ireland).

Operating profit

Operating profit amounted to 33 million euro, up 6.7% excluding

the currency effect.

On-site productivity gains, particularly in the Justice segment,

the ramp-up of integrated service contracts in the Corporate

segment, and the gain recognized following pension plan changes in

the United Kingdom and Ireland more than compensated for the high

prior period basis of comparison resulting from the 2011 Rugby

World Cup. Operating margin rose to 4.7% from 4.4% in the first

half of Fiscal 2012.

2. Benefits and Rewards Services

Issue volume

(millions of euro)

First HalfFiscal 2013

First HalfFiscal 2012

Organicgrowth

Acquisitions

Currencyeffects

Totalgrowth

Latin America 3,840 3,432

+ 18%

Europe and Asia

4,134 4,083

+ 0%

Total

7,974 7,515

+ 8.2% + 1.8%

- 3.9% + 6.1%

Benefits and Rewards Services issue volume for the first half of

Fiscal 2013 totaled 8 billion euro and organic issue volume growth

was + 8.2%. Overall growth in issue volume was + 6.1%, after

taking into account the - 3.9% negative currency effect, mainly due

to the Brazilian real’s decline against the euro, and the

contribution of Servi-Bonos in Mexico, which was acquired in

November 2012 and added + 1.8% to the growth rate.

Issue volume in Latin America amounted to 3.8 billion

euro. Organic growth was a strong + 18%, reflecting a steady

increase in the number of beneficiaries as well as in voucher and

card face values.

At 4.1 billion euro, issue volume in Europe and Asia was

in line with the first half of Fiscal 2012. Unfavorable new

regulations introduced in Hungary in January 2012 reduced organic

issue volume growth by 2.4%. In Belgium, issue volume for the

Titres Emploi Service personal service vouchers remained high

during the period.

Revenues

(millions of euro)

First HalfFiscal 2013

First HalfFiscal 2012

Organicgrowth

Acquisitions

Currencyeffects

Totalgrowth

Latin America 206 203

+ 8.7%

Europe and Asia

174 174

- 0.8%

Total

380 377

+ 4.3% + 1.1%

- 4.6%

+ 0.8%

Benefits and Rewards Services revenues for the first half of

Fiscal 2013 totaled 380 million euro. Organic growth stood at +

4.3%, while reported growth was close to + 1% reflecting:

- The - 4.6% negative currency effect,

and

- The + 1.1% contribution from

Servi-Bonos, one of Mexico’s leading meal voucher and card

issuers that was acquired in November 2012. The first months of

Servi-Bonos’s integration into the Group have been

satisfactory.

Organic revenue growth in Latin America slowed to +

8.7%. This was mainly due to pressures on commission rates

with large Corporate and other clients in Brazil and it also

reflected the impact of lower interest rates.

Revenue in Europe and Asia amounted to 174 million euro.

Organic growth was a negative - 0.8% compared with the first half

of Fiscal 2012, but a positive + 3.3% excluding the impact of

Hungary.

Recent marketing successes included contracts with the Lyon

Chamber of Commerce and Industry and the Saône et Loire Conseil

Général (France), Electropaulo (São Paulo, Brazil), the Zulia State

Government (Venezuela), Sharp Electronica Mexico (Mexico) and the

Bursa City Authorities (Turkey). Other highlights of the period

included the successful launch of the Spirit of Cadeau gift card in

France, in time for the festive season. The card can be used to

purchase products and services for the home and for sporting

activities.

Operating profit

Operating profit from Benefits and Rewards Services amounted to

147 million euro, up + 6.8% excluding the currency effect compared

with the first half of Fiscal 2012. The increase reflected higher

issue volumes and the productivity gains achieved through

disciplined management, enabling continued investing in new

technologies and marketing.

Operating margin stood at 38.7% versus 39% in the year-earlier

period when operating profit benefitted from several non-recurring

items such as a litigation settlement.

APPENDIX 2

Financial statements for First Half Fiscal 2013

2.1 Consolidated income statement

(millions of euro)

First HalfFiscal 2013

Variation

First HalfFiscal 2012

% Revenues M€ % Revenues

M€

Revenues 100%

9,463 4.3%

100% 9,069 Cost of sales

- 85.1% (8,049) - 84.2% (7,634)

Gross profit

14.9% 1,414

- 1.5% 15.8%

1,435 Sales department costs - 1.4% (133) -

1.4% (129) General and administrative costs - 8.4% (798) - 8.2%

(740) Other operating income 11 10 Other operating costs - 0.2%

(16) - 0.2% (17)

Operating profit (1)

5.1% 478

- 14.4% 6.2%

559 Interest income 0.2% 23 0.4% 33 Financing

costs - 1.1% (108) - 1.4% (124)

Share of profit of companies

consolidatedby the equity method

0.1% 8 0.1% 7

Profit for the period before tax

4.2% 401

- 15.6% 5.2%

475 Income tax expense - 1.6% (153) - 1.8%

(166)

Profit for the period 2.6%

248 - 19.7%

3.4% 309 Of

which : Non-controlling interests 0.1% 12 0.1% 12

Profit attributable to equity holders

ofthe parent

2.5% 236

- 20.5%

3.3% 297

(1) Including 50 million euro in costs recognized in the first

half of Fiscal 2013 for the operational efficiency improvement and

cost reduction program.

2.2 Consolidated statement of financial position

Assets

(in millions of euro)

February 28, 2013

August 31, 2012

NON-CURRENT ASSETS

Property, plant and equipment

547 574 Goodwill 4,955 5,031 Other intangible

assets 568 563 Client investments 285 296 Companies consolidated by

the equity method 78 81 Other non-current financial assets 120 133

Derivative financial instruments 28 26 Other non-current assets 12

15 Deferred tax assets 222 169

Total non-current assets

6,815 6,888

CURRENT ASSETS

Current financial assets 5 4 Derivative financial

instruments 4 1 Inventories 288 296 Income tax receivable 163 96

Trade and other receivables 3,969 3,445

Restricted cash and financial assets

related to the Benefits andRewards Services activity

660 609 Cash and cash equivalents 1,266 1,451

Total current

assets 6,355

5,902 TOTAL ASSETS 13,170

12,790

Liabilities and Shareholders’ Equity

(in millions of euro)

February 28, 2013

August 31, 2012

SHAREHOLDERS’EQUITY

Common stock 628 628 Additional paid-in

capital 1,109 1,109 Reserves and retained earnings 1,161 1,297

Equity attributable to equity holders of the parent

2,898 3,034

Non-controlling interests 39

35

Total shareholders’ equity 2,937

3,069 NON-CURRENT LIABILITIES

Borrowings 2,587 2,550 Derivative

financial instruments 4 2 Employee benefits 362 381 Other

liabilities 210 222 Provisions 110 105 Deferred tax liabilities 302

161

Total non-current liabilities

3,575 3,421 CURRENT

LIABILITIES

Bank overdrafts 84 15 Borrowings 232 136 Derivative

financial instruments 12 23 Income tax payable 121 130 Provisions

47 41 Trade and other payables 3,404 3,422 Vouchers payable 2,758

2,533

Total current liabilities

6,658 6,300 TOTAL LIABILITIES

AND EQUITY 13,170

12,790

2.3 Consolidated Cash Flow statement

(in millions of euro)

First HalfFiscal 2013

First HalfFiscal 2012

Operating activities

Operating profit 478

559 Elimination of non-cash and non-operating items

Depreciation and amortization of tangible and intangible assets 140

139 Provisions 17 (2) Gains and losses on disposals and other 1 8

Dividends received from companies consolidated by the equity method

8 6

Change in working capital from operating activities

(353) (178)

Change in inventories (1) 1 Change in trade and other receivables

(576) (501) Change in trade and other payables 56 76 Change in

vouchers payable 215 197

Change in financial assets related to the

Benefits and Rewards Servicesactivity

(47) 49 Interest paid (114) (101) Interest received 7 11 Income tax

paid (147) (127)

Net cash provided by operating activities

37 315

Investing activities

Acquisitions of property, plant and equipment and

intangible assets (110) (145) Disposals of property, plant and

equipment and intangible assets 5 15 Change in client investments

(3) (13) Change in financial assets 4 14 Acquisitions of

subsidiaries (81) (576) Dispositions of subsidiaries 1

Net cash

used in investing activities (185)

(704) Financing activities

Dividends paid to

parent company shareholders (240) (221) Dividends paid to

non-controlling shareholders of consolidated companies (12) (15)

Purchases of treasury shares (46) (5) Dispositions of treasury

shares 54 40 Increase in capital Decrease in capital Acquisitions

of non-controlling interests (11) Dispositions of equity

investments without loss of control Proceeds from borrowings 237

339 Repayment of borrowings (41) (100)

Net cash (used in)

provided by financing activities

(59) 38 CHANGE IN NET CASH

AND CASH EQUIVALENTS (207)

(351) Net effect of exchange rates and other

effects on cash (48) 46 Net cash and cash equivalents, beginning of

period 1,436 1,424

NET CASH AND CASH EQUIVALENTS, END OF

PERIOD 1,181

1,119

2.4 Segment information

Revenues by activity

(in millions of euro)

First

halfFiscal2013

First halfFiscal2012

Organicgrowth (1)

Currencyeffect

Acquisitions

Change

atcurrentexchangerates

On-site Services

North America

3,602 3,420

+ 1.3%

+ 3.2% + 0.8% + 5.3% Continental Europe

2,949 2,892 + 0.9% +

0.6% + 0.5% + 2.0% Rest of the World

1,838 1,708 + 7.2% +

0.2% + 0.2% + 7.6% United Kingdom and Ireland

700 680 - 2.6%

+ 3.9% + 1.6% + 2.9%

Total On-site Services

9,089 8,700

+ 2.0% + 1.8%

+ 0.7% + 4.5%

Benefits and Rewards Services 380 377 +4.3% - 4.6% +1.1%

+0.8% Elimination of intra-group revenues (6) (8)

Consolidated

Total 9,463

9,069 + 2.1%

+ 1.5 % + 0.7%

+ 4.3%

(1) Organic growth: revenue growth, at constant scope of

consolidation and excluding exchange rate effects

Operating profit by activity

(in millions of euro)

First halfFiscal 2013

(2)

First halfFiscal 2012(3)

Change atcurrentexchange rates

Change atconstantexchange rates

On-site Services

North America

244

226 + 8.0% + 4.9% Continental Europe

103 131 -

21.4% - 22.1% Rest of the World

47 43 + 9.3% + 4.7%

United Kingdom and Ireland

33 30 + 10% + 6.7%

Total On-site Services 427

430 -0.7%

- 3.3% Benefits and Rewards

Services 147 147 + 0.0% + 6.8% Corporate expenses (40) (36)

Elimination of intra-group revenues (6) (8)

Consolidated

Total 528

533 - 0.9%

- 1.1%

(2) Excluding exceptional costs related to the operational

efficiency improvement program and described on page 3.(3)

Excluding the exceptional impact of an accounting pension

adjustment to pension plans in the United Kingdom.

2.5 Exchange rates

The main currency exchange effects for first half fiscal 2013

are:

1 EUR = Average rate H1 2013

Average rate H1 2012

Variation

U.S Dollar 1.3082

1.3484 + 3.1%

Pound

Sterling 0.8189

0.8548 + 4.4%

Brazilian Real

2.6619 2.3827

- 10.5%

APPENDIX 3

SELECTION OF NEW CLIENTS - FIRST HALF FISCAL 2013

On-site Services

Corporate

Siemens, 44 sites in Canada (2,800

people)Amundi, Paris, France (1,700

people)AstraZeneca, Shanghai, China (1,550

people)Australian Submarine Corporation, Australia (2,700

people)Banco Bradesco S.A., Osasco, Brazil (16,000

people)DNB, Oslo, Norway (3,200 people)Electrolux,

São Carlos, Brazil (12,700 people)General Electric - Aero &

Healthcare Systems, 2 sites in the U.S. (1,500

people)GlaxoSmithKline, Wavre, Belgium (1,600

people)Harley Davidson Inc., Milwaukee, Wisconsin, USA

(1,300 people)Nestlé India Ltd., Bangalore, India (1,150

people)Safran, Issy-les-Moulineaux, France (1,000

people)The Co-operative Group Ltd., 7 sites in northwest UK

(10,000 people)Visteon Automotive Systems, Chennai, India,

(1,550 people)

Defense

US Air Force, 5 bases in the U.S.US Forces, Zayed

military city, United Arab Emirates (300 people)Defense

Commissary Agency, 12 sites in the U.S.Ministère de la

Défense for the Sodexo-La Poste consortium, France (19,000

people)Healthcare and SeniorsHCR ManorCare, 290

retirement homes in 32 U.S. statesNouvelles Cliniques

Nantaises, Nantes, France (500 people)Brighton & Sussex

University Hospital, Brighton, UK (650 people)Clínica

Universidad de los Andes, Santiago, Chile (550 people)HCA

East Florida, 9 hospitals, Florida, U.S. (2,200 people)LA

County, California, U.S. (2 sites of the UCLA Medical Center,

750 people)G�teborg Municipality, Sweden (800

people)Ochsner Medical Center, Louisiana, U.S. (400

people)Renmin Hospital of Wuhan University, Wuhan, China

(4,000 people)Shands Jacksonville Medical Center, Florida,

U.S. (700 people)St. Joseph's John Knox Village, Florida,

U.S. (650 people)The University of Arizona Medical Center,

Arizona, U.S. (500 people)

Education

Al Mareefa College, Riyadh, Saudi Arabia (400

students)Bethune-Cookman University, Florida, U.S. (3,700

students)Confederation College, 4 sites, Ontario, Canada

(1,700 students)Darussafaka Okul, Istanbul,

TurkeyEnsemble Scolaire des Recollets, Longwy, France (800

students)St. Andrews College, Dublin, Ireland (1,200

students)St. Flannans College, Ennis, Ireland (1,250

students)St. John's College, Maryland, U.S. (600

students)City of Fonte Nuova, Italy (1,600 students)

Remote Sites

Pacific Rubiales Energy, Puerto Gaitan, Colombia (2,500

people)Campamento Pionero, Antofagasta, Chile (1,000

people)Compañia de Mínas Buenaventura / Tantahuatay Project,

Cajamarca, Peru (820 people)Highland Gold, Chukotka, Russia

(300 people)Hydro Quebec Mista, Quebec, Canada (1,200

people)Hyundai Engineering & Construction Co. Ltd.,

Kasha, Oman (1,000 people)Millenium Offshore Services,

Offshore, Qatar (450 people)Trepang Services – Blaydin

Village, Darwin, Australia (500 people)

Sports and Leisure

Château de Fillerval, Thury-sous-Clermont, FranceBenefits

and Rewards Services

Europe

Aldi, Belgium (3,500 beneficiaries)Bursa Buyuksehir

Municipality, Turkey (1,600 beneficiaries)Chambre de

Commerce et d'Industrie, Lyon, France (1,250

beneficiaries)Conseil Général de Saône-et-Loire,

FranceEuronics, Italy (1,000 beneficiaries)Roche

Farma, Spain (500 beneficiaries)

Latin America

Eletropaulo, Brazil (6,000 beneficiaries)Government of

the State of Zulia, Venezuela (23,000

beneficiaries)PepsiCo, Brazil (8,250

beneficiaries)Serviço Federal de Processamento de Dados

(SERPRO), Brazil (10,000 beneficiaries)Sharp Electronica

Mexico, Mexico (2,900 beneficiaries)Public University of

Campinas, Brazil (10,000 beneficiaries)

Asia

Delhi Metro Rail Corporation Ltd., India (10,000

beneficiaries)Jia Ding Telecom Bureau, China (300

beneficiaries)

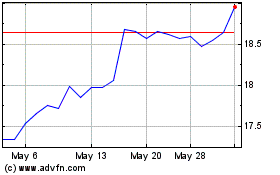

Sodexo (PK) (USOTC:SDXAY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sodexo (PK) (USOTC:SDXAY)

Historical Stock Chart

From Nov 2023 to Nov 2024